In recent times, technical analysis software has become more than just plotting lines on charts. For instance, ProRealTime has over 1 million users worldwide, supported by more than 1.9 million financial instruments. Notably, Stockgro has launched India’s first AI research platform, Stoxo, for the stock market.

As the market accelerates, with more volatility and enriched with data, technical analysis tools are providing investors with charting, scanning, and automation, along with advanced AI features.

This blog aims to help beginners and experienced traders choose the right platform by comparing how these top trading analysis platforms conduct technical analysis and what makes them unique from each other.

Best Technical Analysis Software Tools & Reviews

Stoxo by Stockgro

Stoxo is an AI financial advisor and one of the best free technical analysis software in India, providing retail investors with real-time stock market updates. It is India’s first stock market AI designed to ease technical analysis, along with over 35 million users’ insights.

Stoxo keeps a continuous track of the views of the market analysts and gives real-time updates on the strategies of the advisors registered under SEBI. It collects stock market data and observes trends, and performs comparative analysis, which guides new investors through mutual funds, sector analysis, and fundamental analysis.

TradeTime

TradeTime is a platform for journalising and analysing trades. Traders can connect more than 20 trading accounts and import or manually input trades to see automated statistical analysis.

TradeTime provides back-testing, replaying, and improving your trades over time. It helps you make better strategies, adapt to them, and gain confidence. It provides one-to-one mentoring supported by feedback and shared experience, which accelerates learning.

ProRealTime

ProRealTime, one of the best charting software for traders, offers charts, tools, and end-of-day market data directly from the stock exchanges, making it a powerful tool for investment decisions. It provides various tools for different trading styles.

It comprises almost all the necessary tools, such as trading from charts, scalping order book, decision support tools, real-time market scans, back-testing, market replay, and much more. As a trader, you can fully customise your workspace, open multiple charts, set alerts, and customize your order book for direct trading.

NinjaTrader

NinjaTraders provides advanced charting, analysis, and automated tools. This platform mostly supports futures and contracts.

It offers multiple technical indicators such as momentum, volatility, and volume, different chart types such as time-based, tick, and range bars, support and resistance, and trend identification.

NinjaTrader allows custom scripting, multiple charts or bar types, a trader community, back-testing, and simulation that give flexibility for experienced traders who want to experiment.

Trendspider

Trendspider is a trading platform that is built by traders for traders. It offers a one-step solution from recognition patterns to analysing balance sheets. It provides technical, fundamental, and economic analysis.

TrendSpider, being more inclined towards automation, automates trend line identification, patterns, and multi-factor alerts, which reduces manual analysis of charts.

Tool Comparison Table

| Tools | Primary Use | User Types | Platforms | Cost of Use | Unique Features |

| Stoxo | Stock analysis, trend identification, and technical screening suggests entry and exit points in the Indian stock market. | New to intermediate traders, looking for AI assistance for stock research. | Web, mobile app | Subscription fee ranges between ₹200–₹500(Advance, expert and influencer)The basic version is free. | Suitable for the Indian Stock market with real-time updates from SEBI-registered advisors. |

| Tradetime | Back-testing, market replay, journaling trades, and automated statistics. | Suitable for beginners and intermediate traders. | Web | For monthly plans: ₹3,965 per monthFor yearly plans: ₹26,433/-(₹2,202 per month) | Automated journaling, link and switch over 20 trading accounts. |

| ProRealTime | Deep charting, back-testing strategies, trading from charts, scalping order books, and decision support tools. | Suitable for intermediate traders looking for multiple tools in one platform. | Complete version available for PC, desktop, and mobile | Free Web-based version, for desktop ‘Complete’ and ‘Premium’ version ranges between ₹2,555 to ₹7,401 | All necessary tools required for technical analysis and trading are available. |

| NinjaTrader | Derivatives trading, back-testing strategies, and custom scripting. | Professional traders who undertake derivatives trading. | Web, desktops | Free plan: Includes ₹148 commissionMonthly: ₹8,723+commissionOne-time payment: ₹1,32,077=commission | Flexibility in chart types, third-party ecosystem, custom scripting. |

| Trendspider | Charts automation, multi-factor alerts, and pattern identification. | Intermediate to professional traders who want to reduce manual work. | Web, Windows, Mac, mobile | Ranges from ₹1,674–₹3,436(Standard, Premium, and Enhanced plans) | Automation, multi-factor alerts. |

Which Tool is Best For Which Use Case

Stoxo by Stockgro: It is best suited for beginners in the Indian stock market, looking for real-time data and simple charting without expensive fees.

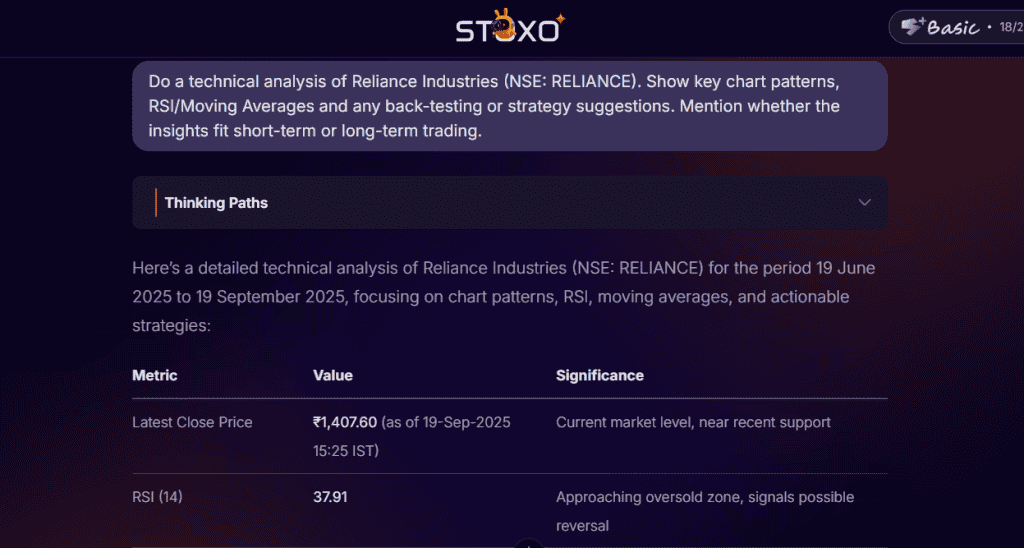

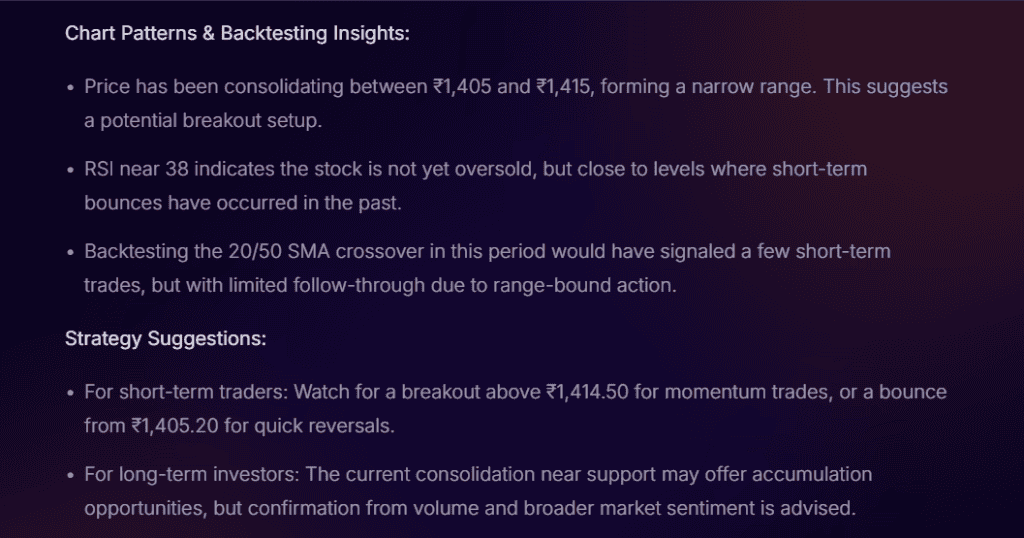

For example, a prompt was run on Stoxo for technical analysis of Reliance Industries “Do a technical analysis of Reliance Industries (NSE: RELIANCE). Show key chart patterns, RSI/Moving Averages, and any back-testing or strategy suggestions. Mention whether the insights fit short-term or long-term trading.” It generated the following technical insights:

TradeTime: It is best suited for beginners and intermediate traders who want a simple interface for journaling their trades and analysing them to improve their strategies. With its one-to-one mentorship, beginners can accelerate learning from shared experiences and feedback from their mentors.

ProRealTime: This is suitable for traders looking for full charting and access to multiple tools in one platform, as it covers most of the important tools required, such as charting, scalping order book, decision support tools, real-time market scans, back-testing, market replay, etc.

NinjaTrader: This is for professional traders who’re more into futures and derivatives and require custom scripting, alternate charts, and bar types. It provides deep back-testing and flexibility to such traders.

Trendspider: It is for those traders who highly prefer automation; it can identify patterns and trendlines and reduce the load of manual work. So, it is suitable for highly systematic or semi-systematic traders.

Pros & Cons – General Trade-offs

Pros

- Fast and Systematic Interface: Using software for technical analysis is faster and more systematic due to automated charting, scanning, and alerts.

- Performance overview: Back-test past performance to revise strategies and improve trades over time.

- Ease of Practice: AI and automation, together, reduce manual work and help beginners learn and practice with demo and simulation modes.

Cons

- Slows Analytical Skills: The learning curve for beginners slows, and mastering trading skills slows with reliance on AI and automation.

- Complex Interface: Complexity in the platform interface can confuse beginners and lead to wrong decisions.

- Heavy costs: Subscription fees for such platforms offering advanced features can be expensive.

Future Trends in Technical Analysis Software

- More platforms will incorporate AI assistance for recognising patterns or trends. For instance, Stoxo is already turning data into insights, and TrendSpider AI for trendline recognition.

- Traditional tools like moving averages and the Relative Strength Index(RSI) might be combined with AI to spot patterns quickly and more accurately.

- Tools might adapt better to the local stock market’s circumstances, like how Stoxo is built for the Indian stock market.

Conclusion

As a trader, choosing the right platform for technical analysis software depends on your trading experience and style. Stoxo and TradeTime can be beneficial for beginners as they are free and low-cost tools that provide real-time updates and boost learning. Whereas platforms such as ProRealTime, NinjaTrader, and TrendSpider offer deep analysis and automation benefits to experienced traders.

So far, it’s clear that each of these software has its own strengths, so you can try their free versions to begin with to understand what suits you better. With the right AI assistance, you shall be able to test your strategies, build skills, and improve trades over time.

FAQ

Among the above-discussed software, Stoxo by Stockgro and TradeTime are the best beginner-friendly and free options. They provide real-time market insights as well as advisors’ insights, along with basic charting.

Yes, but it can be a little overwhelming. TrendSpider automates patterns and alerts, so it is easier to use in comparison to MetaTrader, which is famous for stocks and forex, which can be complicated for beginners.

Platforms such as NinjaTrader and TrendSpider provide real-time data, and Stoxo provides live updates of the Indian stock market. However, free versions of ProRealTime often provide around 15 minutes of delayed insights.

When a trader grows, scripting becomes important. Intermediate or professional traders can benefit from custom indicators; however, beginners can rely on built-in indicators.

The incorporation of AI in platforms like TrendSpider and Stoxo actually reduces errors and saves time. However, in volatile markets, it may not be 100% accurate. Beginners should take AI as assistance instead of completely relying on it.

Stoxo, TradeTime, and TradingView are some of the best technical analysis tools for Indian traders as they collect insights in association with NSE/BSE. In the non-US market, tools like ProRealTime and MetaTrader are commonly used.

Mobile versions of these tools provide quick checks, charting, and alerts. Whereas desktop versions are more convenient to use as they allow multiple screen set-ups, which is better for in-depth analysis.

Leave a Comment