On May 17 2004, the BSE- Bombay Stock Exchange recorded its sharpest ever fall in percentage terms, falling 15.52% in a single day, and Nifty50 experienced the worst fall in the 21st century with 18.34%. This free fall came after the unexpected victory of the opposition party unsettled investors and raised doubts over future economic reforms.

This episode showed that markets react not only to earnings or macro data but also to perception and mood. When expectations are defied, collective psychology can overwhelm fundamentals. That is where sentiment analysis stock market becomes relevant. It offers a structured way to capture such shifts, helping investors interpret how news, commentary, and public conversation translate into market action.

What Is Sentiment Analysis in the Stock Market?

Sentiment analysis in the stock market is one of the web scraping methods for finance to understand public views on the stocks to make informed business. Market sentiment analysis explores how participants interpret developments shaping equities, indices, or the broader bourse. It means tracking narratives from media, conversations on social platforms, and the signals embedded in trading patterns to understand whether market players feel confident, cautious, or outright negative.

Unlike traditional analysis, which relies on financial statements, this approach focuses on the psychology and perception that drive buying and selling decisions.This helps capture the psychology of moving demand and supply, something traditional financial data alone cannot reveal.

For instance, when Ola Electric filed a claim of about ₹400 crore under the government’s production-linked incentive scheme on September 15, 2025. The update was read as strengthening future prospects, and within hours, the counter climbed over 3% on the NSE- National Stock Exchange. That reaction illustrates how quickly your perception can set the tone for price action within a single trading session.

Sources of Sentiment Data

Sentiment analysis stock market draws from multiple sources that capture investor mood, media tone, and broader economic signals. Together, these stock market sentiment indicators help explain short-term swings and long-term trends.

Social media:

Digital platforms now act as accelerators of sentiment in Indian markets. It amplifies narratives quickly, often shaping investor mood before formal data is available.

Take Zomato’s listing in July 2021. When it came out with its IPO Twitter, Instagram, Reddit, and YouTube were saturated with memes and short commentary that drew in a new wave of retail investors.

Zomato itself leaned into the moment with a tongue-in-cheek tweet about nerves. Brands from Kotak Securities to Urban Company joined in. This interplay blurred boundaries between marketing and market mood.

Such speculation stirred herd behaviour and magnified participation. Shares began trading at ₹115 on the BSE, 51% above the issue price of ₹76. On the NSE, they touched ₹116, a gain close to 53%.

News and RSS feeds:

Dedicated finance apps and portals play a key role in spreading updates. Platforms like StockGro highlight policy changes, earnings results, and market views, often triggering visible moves in investor sentiment.

Company disclosures:

Annual filings, quarterly statements, and management briefings reveal more than numbers. Subtle shifts in tone signal outlook. For example, in June 2025, profit growth for 38 of the Nifty 50 companies slowed to 7.5%, far below the double-digit pace of earlier years. The weak results weighed on benchmarks, with the Nifty 50 staying largely rangebound despite a 10% rise earlier in the fiscal year.

Economic indicators:

Official statistics on growth, inflation, and employment frame the broader climate. India’s Q1 FY26 GDP results published in August 2025 surpassed projections with 7.8%. The upbeat figure lifted sentiment, with the Sensex closing at 80,364.49, up 554.84 points, while the Nifty advanced 198.20 points to finish at 24,625.05, reflecting strong buying interest across banking and infrastructure stocks.

Podcasts and alternative media:

Investor-focused podcasts and YouTube finance channels like StockGro and other analysts are increasingly shaping retail sentiment. Their discussions on stocks often trend during results season, adding to informal sentiment data.

How Sentiment Data Is Processed & Models Used

Stock market sentiment indicators move through several steps before it becomes useful for traders and analysts. The aim is to convert scattered opinions into measurable signals that can be aligned with price movements.

Preprocessing: Text Cleaning, Tokenization, Noise Removal

The initial step focuses on raw input. Social commentary, press releases, and articles often arrive cluttered with emojis, symbols, and formats. Cleaning removes these intrusions, leaving a more coherent corpus.

Tokenization divides language into smaller linguistic segments, allowing algorithms to recognise meaning at a finer scale. Noise reduction follows, eliminating filler expressions, duplicate entries, and advertising scraps that obscure interpretation.

A well-prepared dataset ensures later frameworks can function with precision. Imagine thousands of remarks about a new banking IPO, many filled with slang and emojis. Once processed, only significant terms remain, showing whether reactions convey optimism, restraint, or scepticism.

Model Types: Lexicon-based, Machine Learning, Deep Learning

With preparation complete using sentiment data for stocks, classification begins. Several approaches exist to interpret this labelled material. Rule-based frameworks lean on fixed word sets.

- Lexicon-driven frameworks rely on dictionaries of emotionally weighted terms. They are straightforward yet struggle with irony or subtle shifts in tone.

- Machine learning strategies extend further by studying labelled corpora. They detect hidden structures, adapt to fresh vocabulary, and refine results. A phrase such as growth slowing but stable, for example, may be judged neutral here, while a basic lexicon system could misinterpret it.

- Deep learning architectures add another dimension by mapping complex relationships across long passages. They capture nuance, detect changing orientation, and manage large, noisy datasets. Consider extended reviews about a fintech platform. A deep learning model can uncover recurring themes of trust, usability, or dissatisfaction that escape simpler systems.

Together, these techniques identify polarity, optimistic, pessimistic, or balanced, offering market participants a clearer view of collective orientation. This reading does not replace traditional measures but sits alongside them, offering market participants a closer view of the psychology guiding behaviour.

Applications & Use Cases

Sentiment analysis extends across diverse fields, each drawing meaning from collective opinion. It highlights attitudes in areas where perception can alter behaviour and outcomes.

Customer experience

Companies study online reactions, survey responses, and product reviews to gauge satisfaction. The findings expose recurring shortcomings, inform product refinements, and shape outreach initiatives. Detecting early frustration with a new service feature enables rapid correction before reputational damage escalates.

Financial markets

As we discussed earlier, traders and investors examine analyst notes, corporate briefings, and online chatter to judge outlook. Strong optimism or deep pessimism often precede turning points, while balanced commentary indicates steadier ground. Integrated into forecasting systems, these insights help participants refine strategies and manage exposure.

Political environment

Assessment of speeches, debate transcripts, and civic commentary uncovers voter orientation towards leaders and policies. Election teams use these insights to adjust messaging across constituencies and demographics. At the same time, scrutiny of digital discourse helps detect propaganda and misinformation.

Brand perception

Firms observe digital mentions of products to protect reputation. Evaluations of advertising drives and competitor performance offer early signals of possible crises. Tracking conversation shifts also allows measurement of loyalty and long-term brand health.

Healthcare services

Hospitals and pharmaceutical companies analyse patient commentary and societal discussions to strengthen care delivery. Public health authorities rely on these insights to track wellbeing, spot rising challenges, and measure the effectiveness of awareness programmes.

Workplace culture

Employers review staff evaluations, surveys, and internal exchanges to identify morale trends. The results highlight risks of attrition and point to areas needing attention. Observing changes over time reveals whether organisational policies foster or weaken engagement.

Customer support

Analysis of chat logs and call transcripts highlights recurring grievances. It also provides intelligence on staff performance and efficiency of service structures. Common themes identified this way often signal systemic weaknesses that demand resolution.

Building a Sentiment-Based Strategy: Step-by-Step

Using sentiment data for stocks allows individual investors to translate raw opinion into actionable insights. Follow these steps to generate actionable insights:

Data Acquisition & Sample Datasets

Your first step is to decide what information to follow. News portals, company announcements, and social media can all provide valuable signals.

Keep your own dataset simple but structured. Save articles, tweets, or forum posts related to the stocks you track. Record dates, tickers, and short notes on context, such as earnings results or policy changes. This way you build a personal archive that you can revisit when analysing trends.

Feature Engineering & Sentiment Signals

Once you gather material, look for patterns in language. Words like growth or beat expectations usually reflect optimism, while phrases such as downgrade or weak demand suggest caution. You can assign basic polarity scores or even use free tools to extract sentiment automatically.

Think beyond single words. Notice the frequency of posts, the speed at which opinions spread, and whether views differ across sources. These features give you more context than a simple positive or negative label. For practical use, you might translate them into signals such as “sentiment turning more negative” or “sentiment volume spiking unusually high.”

Backtesting & Validation

Before you act on signals, test them on past data. Compare sentiment trends around earlier earnings releases or policy announcements with how the stock price moved. This will tell you whether the approach would have added value in the past.

Be realistic about costs. Factor in brokerage charges, taxes, and slippage when testing your strategy. Track metrics such as win rate, drawdown, and consistency rather than only headline returns. Start with paper trading or small allocations, and refine your process as you gather more evidence.

Now you can fast-track this process with Stoxo AI, India’s first stock market AI research engine. It is a first-of-its-kind research desk built for retail investors, delivering credible, relevant, accurate, and real-time intelligence.

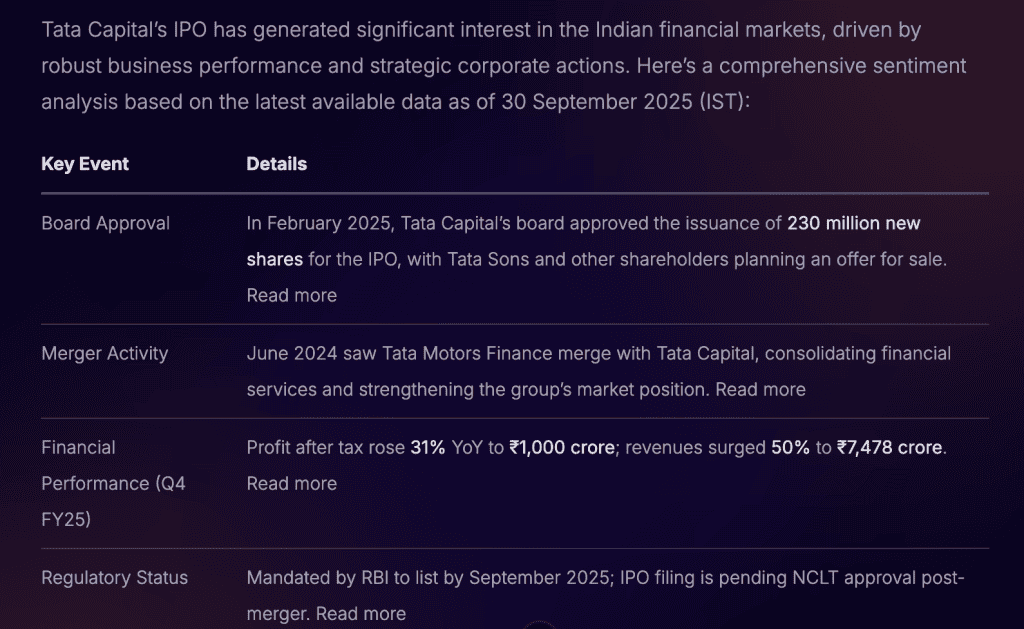

For your next sentiment analysis, you only need to add a simple prompt. For example, you can ask for sentiment analysis on Tata Capital IPO. Stoxo instantly generates a summarised view with all the important data points that matter.

Challenges & Limitations

Applying sentiment techniques in markets reveals patterns, yet several barriers remain that can distort interpretation. Recognising these barriers allows for more careful use.

- Dependence on immediate reactions: Relying too heavily on momentary sentiment-based signals risks short-sighted behaviour. Rapid swings in perception may encourage impulsive trades that weaken long-term objectives.

- Distortion during turbulent phases: Periods of heightened fluctuation generate clutter and exaggerate tone. In such settings, systems often capture distorted impressions that do not align with underlying direction.

- Accuracy of data inputs: News feeds, online commentary, and social platforms mix relevant details with distractions. Extracting meaningful information demands advanced filtering, yet errors still creep in. Poor input quality weakens the strength of any conclusions drawn.

- Nuance in language: Phrases carry different meanings in different contexts. Sarcasm, irony, or cultural nuance often mislead systems. Natural language processing tools struggle with these subtleties, which lowers the consistency of results.

- Behavioural unpredictability: Investor moods can reverse suddenly due to policy decisions, geopolitical events, or economic shocks. These factors limit the validity of forecasts built purely on sentiment.

Best Practices & Tips for Using Sentiment Analysis

If you are using sentiment insights to guide your decisions, you need more than just tools. You need structure, context, and discipline. Let’s walk through what works in practice.

- Blend approaches carefully: You may be tempted to rely only on machine learning systems because they adapt quickly. Yet they depend on strong inputs. Lexicon methods, on the other hand, require no training but often miss irony. If you combine both, you reduce blind spots and improve reliability.

- Place findings alongside other studies: Do not treat sentiment signals as the full story. When you pair them with fundamental analysis and technical charts, you gain a clearer picture of where markets are heading. This layered view lowers the risk of acting on noise that fades within hours.

For Indian retail participants, platforms such as Stoxo, the country’s first stock market AI research desk, provide credible real-time intelligence. By linking sentiment with financial metrics and trading trends, it helps users form decisions grounded in evidence rather than instinct.

FAQs

It looks at opinions, reactions, and emotions that influence trading behaviour. Analysts use this to sense whether the overall mood leans positive, negative, or neutral in the market.

It can highlight shifts in mood that often precede market moves. The insights work best when combined with fundamentals and technical indicators.

Stoxo is an AI built to read market chatter and financial headlines with high contextual awareness. It works well alongside NLTK, TextBlob, spaCy, VADER, and Hugging Face models for wider language processing.

Lexicon methods depend on predefined word lists that assign polarity. Machine learning systems learn from labelled data and adapt to context with greater flexibility.

Misreading sarcasm or cultural nuance often affects accuracy. Bias can also arise from unbalanced training data or selective information sources.

Social platforms capture raw opinion but can be noisy or manipulated. News sources undergo editorial checks, though they may carry their own framing.

It works best as a complement, not in isolation. Market participants often pair it with chart-based signals or corporate fundamentals to gain a fuller perspective.

FinBERT is a language model trained on financial texts. It helps classify news, reports, and commentary into positive, negative, or neutral categories for market analysis.

Leave a Comment