Stock Recommendations for Long Term

The idea of starting to invest in the stock market begins with good intentions, but gets caught up in “hot tips,” short-term bets, and uneven results. The real challenge isn’t picking stocks, it’s finding the ones that will last through market cycles and grow wealth over time. Without a system or guidance, even experienced investors end up chasing quick gains instead of building long-term growth. A structured, research-based system for long-term stock selection solves this problem. It’s about companies with solid fundamentals, lasting advantages, and proven performance.

In fact, a 2024 study found that investors who followed systematic, fundamentals driven strategies got 12–15% higher returns than those guided by market sentiment. This guide will show you how professionals find stock recommendations for the long term, the principles behind it and how these methods can turn uncertainty into steady wealth creation. So let’s get started!

Why long-term investing matters

Long-term investing is fundamentally important because it allows investors to benefit from compounding. When investments generate earnings, those earnings are reinvested to generate their own earnings, a process that can lead to substantial wealth creation over many years. This approach also helps investors manage market volatility more effectively.

- By focusing on a multi-year horizon, it lets you ride out short-term market fluctuations.

- The strategy is based on giving quality investments ample time to grow.

By avoiding reactive decisions based on temporary price swings, investors can benefit from the general upward trend of the market over decades, allowing their investments to mature through various economic cycles.

Key criteria for long-term stock picks

Choosing long-term investment picks for your portfolio involves a thorough study of a company’s fundamentals which include:

- Competitive advantage (moat)

A company’s “moat” refers to its ability to maintain a competitive advantage over its rivals, protecting its long-term profits and market share. This could be derived from a strong brand, unique technology, significant cost advantages, or high barriers to entry in its industry. A wide and sustainable moat is a crucial characteristic for a long-term investment, as it suggests the company can weather competition and economic challenges.

- Growth potential

Assessing a company’s potential for future growth is crucial. This involves analysing its historical performance, the growth rate of its industry, its market share, and its plans for future expansion. A company with a consistent track record of revenue and profit growth is often a strong candidate for long-term investment.

- Dividends

A consistent history of paying and increasing dividends can indicate a company’s financial health and stability. Dividend-paying stocks can provide a regular income stream and are often mature, well-established businesses with stable cash flows.

Top sources and expert picks

Investors often look to various sources for reliable market info and investment recommendations. The following table provides some well-known experts and platforms to use.

| Platform/expert | Description/philosophy |

| Stoxo AI | An AI-powered stock market research engine by StockGro. Designed for retail investors, it offers a unified platform for market analysis, sector insights, and sentiment tracking. It allows users to ask contextual questions and receive structured, research-backed answers. |

| Warren Buffett | Known for his long-term, value investing philosophy. He focuses on buying high-quality companies with durable competitive advantages (“moats”) at fair prices and holding them for the long haul. |

| Motilal Oswal | A financial services firm in India that emphasises a “QGLP” (Quality, Growth, Longevity, and Price) investment philosophy. It focuses on identifying quality companies with strong growth prospects and long-term potential, purchased at a reasonable price. |

| Barron’s | A financial news publication that provides in-depth analysis, market data, and investment ideas. It is known for its detailed research and coverage of a wide range of companies and market trends. |

Note: Remember to always check an analyst’s transparency by reviewing their reasoning, past picks, reports, and risk disclosures, and verify their SEBI registration on the official website to ensure both legal compliance and credibility.

Growth vs. value vs. dividend strategies

Investors may adopt different strategies based on their monetary objectives, risk appetite, and time suitability. The table below compares three common long-term approaches.

| Criteria | Growth investing | Value investing | Dividend investing |

| Primary goal | Capital appreciation | Buying undervalued assets | Generating regular income |

| Investor profile | Higher risk tolerance, focused on long-term wealth creation | Patient, contrarian, seeks discounted stocks | Steady income seekers, retirees, or conservative investors |

| Characteristics | Above-average earnings growth, reinvesting profits, higher P/E ratios, focus on scalability and innovation | Low P/E ratios, low price-to-book ratios, high dividend yields, stable cash flows, often temporarily out of favor | Mature, stable companies with consistent dividends, moderate growth, strong cash flows, large-cap, low volatility |

| Valuation | Often expensive relative to current earnings; high growth expectations priced in | Stocks priced below intrinsic value; considered “bargains” | Moderate valuation, stable earnings support regular dividends |

| Volatility | High, prices fluctuate based on growth expectations | Medium, prices influenced by market sentiment and fundamentals | Low–Medium, more stable due to mature business models |

| Dividend policy | Usually minimal or no dividends; focus on reinvestment | Variable; some may pay dividends if financially healthy | Consistent dividend payouts, often growing over time |

| Tax treatment | Primarily taxed on capital gains. STCG (held ≤1 year) is taxed at 20%. LTCG (held >1 year) is taxed at 12.5% on gains above the annual exemption of ₹1.25 lakh. | A mix of capital gains tax and dividend tax. Capital gains are taxed like growth investing (20% STCG; 12.5% LTCG over ₹1.25 lakh). Any dividends received are added to total income and taxed at the investor’s slab rate. | Primary tax is on dividend income, which is added to total income and taxed at the investor’s personal slab rate. If the investment is sold, capital gains are taxed separately (20% STCG; 12.5% LTCG over ₹1.25 lakh). |

AI-enhanced long-term stock recommendations

For decades, investors have relied on recommendations from experts at major financial firms and publications, valuable sources like the ones we’ve discussed. However, accessing this information can involve sifting through long reports, waiting for periodic updates, and trying to apply generalised advice to your specific goals.

This is where stock recommendations by AI create a significant advantage. AI-powered tools like Stoxo AI are designed to cut through that hassle and give you personalised, data-backed insights instantly. Instead of waiting for an expert report, you can get answers on demand.

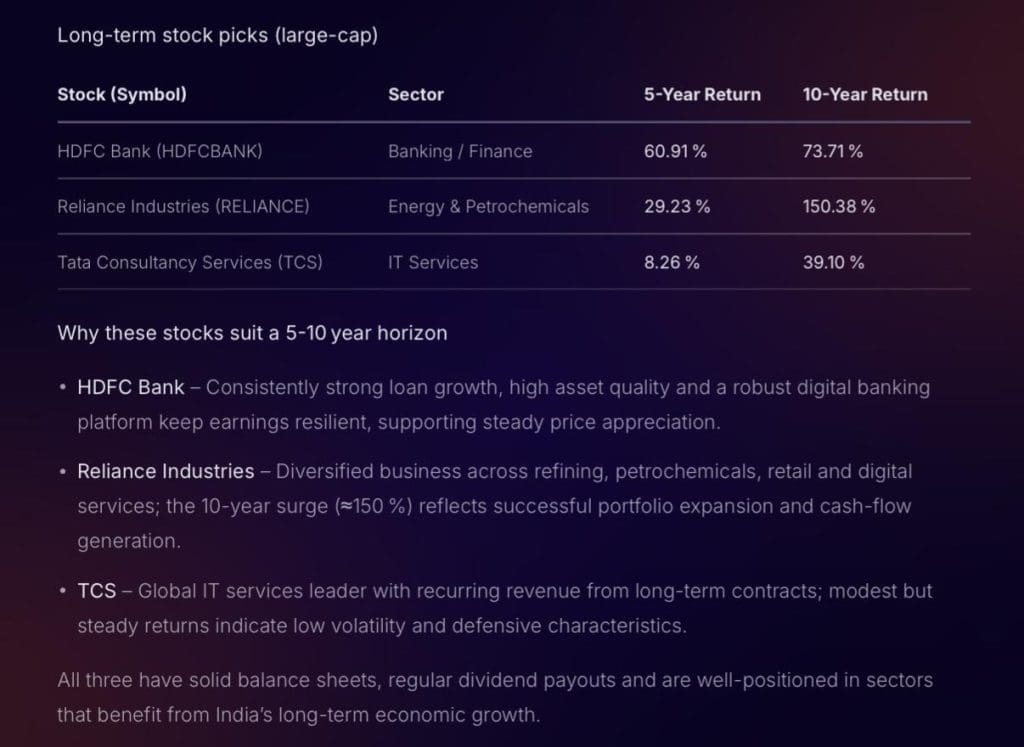

The platform is built for simplicity, removing the complexity of traditional research. You can ask for exactly what you want in plain English, just like talking to a personal research analyst. For example, when asked to “recommend three stocks to buy for the long term. For each stock, provide the returns over 5 years and 10 years and reason for their suitability over long term”

In seconds, it does the complex work of scanning and analysing the market for you. And provides a clear, actionable list of potential stocks that fit your criteria, complete with past performance and a solid rationale. It provides the same kind of quality insights you’d expect from an expert, but it’s faster, easier, and tailored directly to your questions.

How to evaluate recommendations

When considering expert stock recommendations, it’s essential to assess both credibility and reasoning before acting.

- Track record: Look at the historical accuracy of the analyst or platform issuing the recommendation. Review multiple past calls to see if they consistently picked winners or avoided major losses. A strong track record over the years signals reliability, while sporadic or highly variable results suggest guesswork rather than informed analysis.

- Methodology: Understand the analytical approach behind the recommendations. This includes whether it’s based on fundamental analysis (looking at financial health and intrinsic value), technical analysis (price patterns and market signals), or quantitative analysis (statistical modelling). Transparent methodology that uses credible data and incorporates risk management ensures better reliability.

Case studies: historical long-term outperformers

Analysing companies that have delivered strong historical returns can offer valuable insights, though it’s important to remember that past performance is not an indicator of future results.

Below is a selection of five best stocks to hold long term as on 9th October, 2025 are as follows:

| Company | 10-year return (%) | 5-year return(%) | 3-year return (%) |

| Authum Invest | 127.39 | 239.05 | 135.36 |

| Waaree Renewables | 80.06 | 212.94 | 119.17 |

| Lloyds Metals | 80.34 | 163.39 | 94.09 |

| Integ. Industries | 73.39 | 268.07 | 404.84 |

| Algoquant Fin | 73.00 | 153.89 | 88.54 |

Risks and considerations

Long-term investing can reward patience, but it also exposes investors to broader economic and structural changes. Understanding how these forces play out over time helps contextualise performance swings and industry realignments:

- Market cycles

Stock markets tend to go through cycles (expansion, peak, contraction, recovery). Even high-quality companies can underperform during adverse phases.

- A company doing well during an economic boom may struggle when demand contracts or credit tightens.

- Valuations that look reasonable in a growth phase may become stretched, and corrections can be steep.

- Sectoral shifts

Over decades, industries can lose relevance or face disruption. What is dominant today may decline tomorrow as technology, regulation, consumer behavior, or resource constraints change.

- A sector might fall out of favor; capital may flow to emerging sectors.

- Regulatory changes, climate imperatives, or shifts in consumer preferences (e.g. digitalisation) can erode the competitive moat of existing players.

How to integrate long-term picks with your portfolio strategy

Identifying great long-term stock recommendations is only half the battle, integrating them wisely into your portfolio is what truly manages risk and drives success.

- Diversification is nonnegotiable: Never put all your eggs in one basket. Even the most promising stock carries risk. A well-diversified portfolio holds stocks across various sectors (e.g., tech, healthcare, financials, consumer goods) to protect against a downturn in any single industry.

- Asset allocation: Your stock picks should be part of a broader asset allocation strategy that includes other classes like bonds, gold, and real estate. The right mix depends on your age, risk tolerance, and financial goals, providing a cushion during stock market volatility.

- Position sizing: Determine how much of your portfolio you will allocate to a single stock. A common rule of thumb is not to let any single position grow to more than 5-10% of your total portfolio value. This prevents one poor performer from sinking your overall returns.

- Review and rebalance: “Long-term” doesn’t mean “buy and forget.” It’s wise to review your portfolio at least once a year. Rebalancing selling some assets that have grown significantly and buying more of those that have lagged helps you maintain your desired asset allocation and lock in gains.

Conclusion

In the end, the most suitable stock recommendations for the long term are the starting point, not the finish line. True success is born from combining quality insights with your own research and conviction. This guide equips you with the tools to move beyond simply following tips, empowering you to build a portfolio that reflects a clear, confident, and personalised strategy.

FAQ’s

Reliable long-term stocks include well-known companies like Authum Invest, Waaree Renewables, Lloyds Metals, Integrated Industries, and Algoquant Fin. These firms have shown strong 5- and 10-year returns, sustained growth, competitive moats, consistent dividends, and strong management, making them suitable for steady wealth building.

Expert stock picks tend to be more accurate when based on thorough fundamental analysis and disciplined strategies. However, predictions involve uncertainty, and no expert is always right. Consistency over many calls is key; following recommendations with proven track records improves chances of success.

Evaluate recommendations by checking the expert’s past record for consistency, understanding their analytical methods, and reviewing the company’s financials and growth potential. Look for transparency in reasoning and alignment with your investment goals and risk tolerance before acting on any advice.

Growth investing targets companies with high earnings growth potential, often at higher valuations. Value investing seeks undervalued stocks trading below intrinsic worth. Dividend investing focuses on steady income from dividend-paying firms, favoring stability and cash flow over rapid growth.

AI-based recommendations can aid long-term investing by analysing large datasets, detecting emerging trends, and offering objective, data-driven insights. They reduce emotional bias and complement expert analysis. However, AI should be one tool among many and used alongside fundamental research.

Good long-term stocks have competitive advantages, strong growth prospects, prudent management, financial stability, healthy cash flows, and reasonable valuations. They often pay or increase dividends and demonstrate resilience to economic cycles, making them suitable for wealth creation over extended periods.

Combine expert and AI advice by using expert guidance for qualitative insights and AI for quantitative data analysis. Use AI tools to screen and shortlist stocks, then apply expert judgment for deeper assessment. This hybrid approach enhances decision-making and portfolio diversification.

Leave a Comment