Feeling hesitant about where to begin when it comes to investing, because all you see online is conflicting tips and endless charts? That’s the reality for most new traders; the “research” often amounts to Googling terms, deciphering jargon, or joining WhatsApp groups. A trading account is simply a gateway that allows you to buy and sell shares, but having an account doesn’t guarantee you know what or why to trade. A SEBI study reveals that 93% of individual traders in the equity futures and options segment incurred losses between FY22 and FY24, with aggregate losses exceeding ₹1.8 lakh crores over these three years. This shows what a common struggle it is to maintain conviction and consistency. Stoxo offers a solution: a dedicated tool to power your investments. In this beginner’s guide to using Stoxo for stock market research, we’ll show you how to turn confusion into conviction.

What is Stoxo?

Stoxo, by StockGro, is an AI-powered tool for stock market research, built for everyday investors. It was developed using insights from StockGro’s large community of over 35 million users. Instead of using complex financial tools, users can ask questions in plain English. Stoxo then gathers and analyses real-time market data, identifies trends, and checks the general market feeling (sentiment). It provides answers that are reviewed for accuracy by registered financial analysts, presenting all the information in one convenient place.

How Stoxo Helps With Stock Market Research

Stoxo offers several features designed to help with stock market research, which include:

- AI-Powered Query System

The platform uses a generative AI interface, allowing users to input research questions in simple, conversational language. It can function as a stock screener using natural language commands.

- Integrated Research Tools

It brings together different kinds of financial information, such as a stock’s price history and performance trends, so users can find data in one location instead of searching multiple sources.

- Real-Time Data and Sentiment Analysis

The platform provides current market data. It also scans news and social media to understand the general feeling whether positive or negative about a particular stock.

- Personalised Learning Flow

The tool adapts to a user’s questions, suggesting follow-up topics and helping them explore information more deeply based on their interests.

- Verified Insights & Analyst-Backed Validation

The AI-generated insights are cross-verified with data from multiple sources and are validated by SEBI-registered research analysts and investment advisors to ensure the information is fact-checked. This includes providing analyst ratings and summarising reports.

Step-by-Step Guide for Beginners to Using Stoxo for Stock Market Research

For individuals new to the platform, a general process for conducting research includes the following main steps:

Step 1: Decide on your investment goals & your risk tolerance

Before beginning any research, it is important to define personal financial objectives. This involves clarifying what you aim to achieve (e.g., long-term growth, regular income) and determining your individual risk tolerance, the level of market fluctuation and potential loss you are comfortable with. Establishing these personal guidelines provides a necessary framework for all subsequent research.

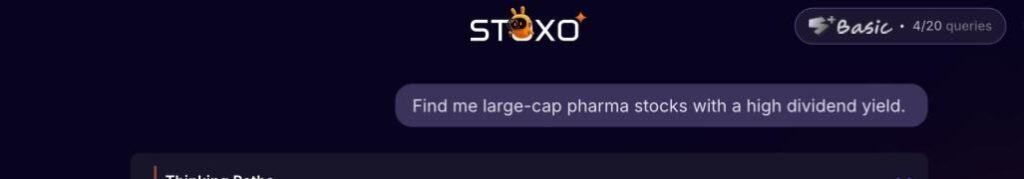

Step 2: Enter your question in simple language or use Use natural language as a stock screener

With clear goals, users can interact with Stoxo by typing their research questions in plain English, just as they would ask a person. This natural language approach also works as a powerful stock screener. For example, instead of using complex filters, a user can simply ask “Find me large-cap pharma stocks with a high dividend yield.”

Step 3: Review the detailed response

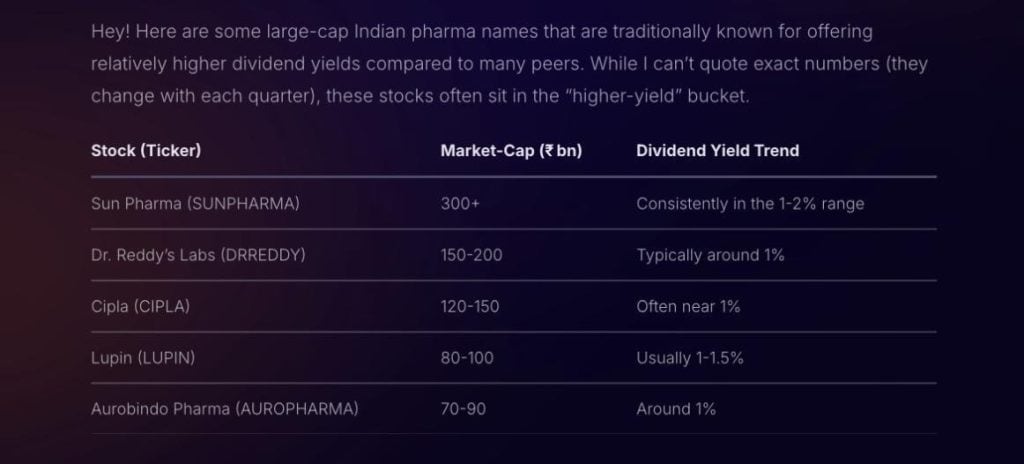

Stoxo processes the query and provides a comprehensive, consolidated response, breaking down the topic in an easy-to-understand manner. For the “pharma stock” query, it gave the following response, covering the following aspects:

- List of stocks: A list of relevant stocks (like Sun Pharma, Cipla, Dr. Reddy’s) with their market cap and typical dividend yield trends.

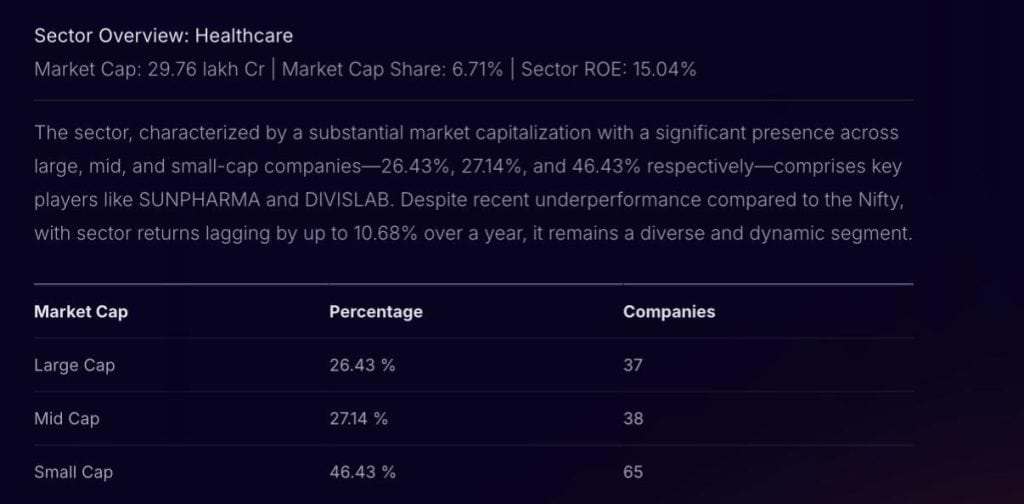

- Sector overview: Details on the Healthcare sector, including its total market cap, its mix of large-cap, mid-cap, and small-cap companies, and key players.

- Peer comparison: A table of the “Top companies by Market Cap” (like SUNPHARMA, DIVISLAB) showing metrics like Revenue, P/E ratio, and ROE (%).

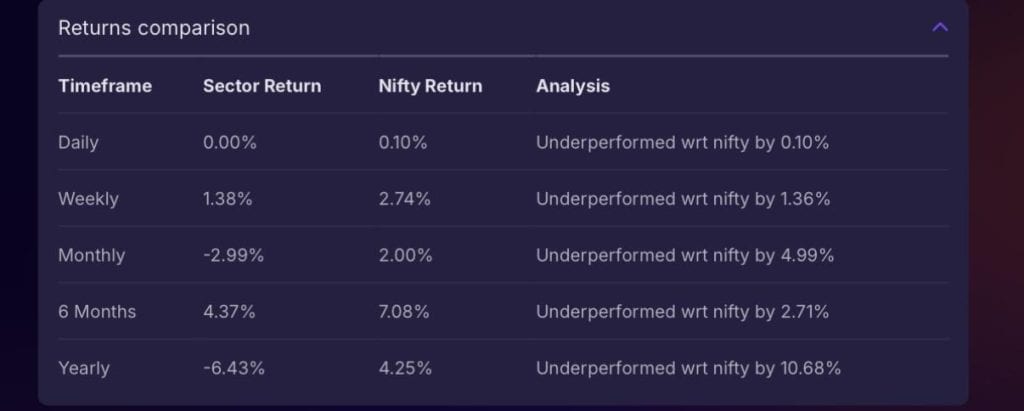

- Performance analysis: A “Returns comparison” chart showing the sector’s performance against the Nifty’s return over daily, weekly, monthly, and yearly timeframes.

Step 4: Ask follow up questions to learn more

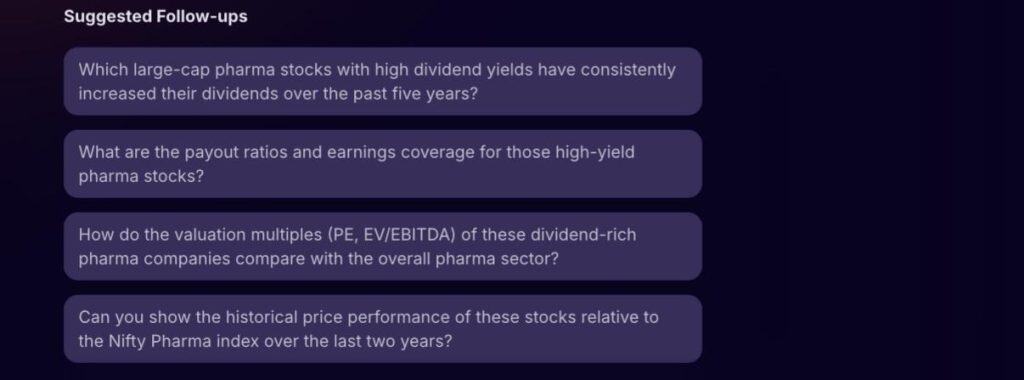

Research is often an iterative process. After reviewing the initial data, users can delve deeper. Stoxo facilitates this by providing “Suggested Follow-ups.” as shown in the image below. These are contextual prompts to guide the next phase of your research.

Step 5: Build a watchlist to monitor stocks

After thoroughly analysing and understanding the information Stoxo has given. Users can take this information and apply it to their personal investment strategy. The platform is focused on providing the research, which can then be used to make decisions while day-to-day trading orders.

Conclusion

This beginner’s guide to using Stoxo for stock market research shows the path forward. The market’s complexity doesn’t mean your research has to be. By leveraging conversational AI for clear, verified insights, you can move from confusion to conviction. Let Stoxo be your tool for building a smarter, more confident investment strategy, starting from your very first query.

FAQs

Stoxo is not entirely free. It offers a limited trial period, which includes 20 free queries for new users. After the trial queries are used, continued access to the platform requires a paid subscription, with various plans available.

Stoxo aggregates its information from a wide variety of sources. This includes real-time market data feeds, financial news publications, company reports, and social media platforms (which are scanned to analyse market sentiment).

Stixo employs a two-step validation process. First, the AI-generated insights are cross-checked against multiple data sources. Second, this information is reviewed and validated by SEBI-registered research analysts and investment advisors to ensure it is fact-checked and accurate.

No, Stoxo is a dedicated research and analysis platform, not a trading or portfolio-tracking tool. It does not have features to buy, sell, or create watchlists. Users can apply the insights from Stoxo to inform their strategies on a separate brokerage account or their StockGro platform.

Stoxo’s primary focus is on the Indian stock market. This is indicated by its description as “India’s first stock market AI” and its reliance on validation from “SEBI-registered” analysts (Securities and Exchange Board of India).

Leave a Comment