Investing wisely means using the right resources for stock research. This blog covers the best five stock analysis websites for smart investing in 2025, highlighting platforms with advanced data, user-friendly screening, and AI insights. Explore further to find solutions that suit your investment style, whether you focus on Indian stocks or global markets.

Best 5 Stock Analysis Websites

Five stock analysis web resources closely connected to the modern stock market and AI-based trading are Stockgro Stoxo, Perplexity Finance, TradingView, WallStreetZen, and Investing.com.

These platforms comprise numerous user interfaces and research tools that enable users to access a wide range of data and insights. The mentioned websites are capable of handling a wide range of areas that include AI-powered analytics, charting functions, expert summaries, and broad market information, thus playing an important role in today’s technology-supported investment activities.

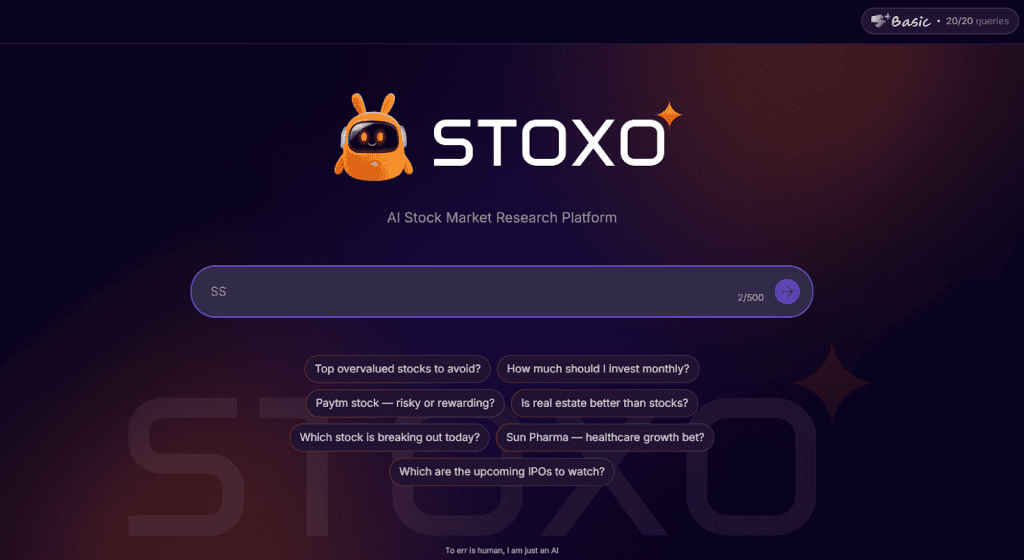

1. Stockgro Stoxo

Stockgro Stoxo is an AI-driven stock research platform that focuses on Indian equities. It gathers market data, trends, and comparative analysis, making it easier for users to navigate through mutual funds, ETFs, sector overviews, and company details. The platform offers the supply of market movements and expert portfolios, along with tools for benchmarking, which help in stock comparison within sectors or against the market.

Stoxo features support from the scores that are generated by an automated system and the continual tracking of the views of the analysts, as well as the live updates on the strategies of the SEBI-registered advisors.

The goal of the interface is to present simple navigation and accurate reports to users of varying levels, which in turn guides them in making their decisions. Timely and accurate deliveries, as well as the explanation of particular questions, are the results of AI algorithms that identify market trends and user preferences. Stoxo is a one-stop solution for both the general market scenario and the specific data-driven information.

Best for: Market research, actionable insights, and AI-powered analysis tailored to Indian equities, mutual funds, and sector comparisons.2. Perplexity Finance

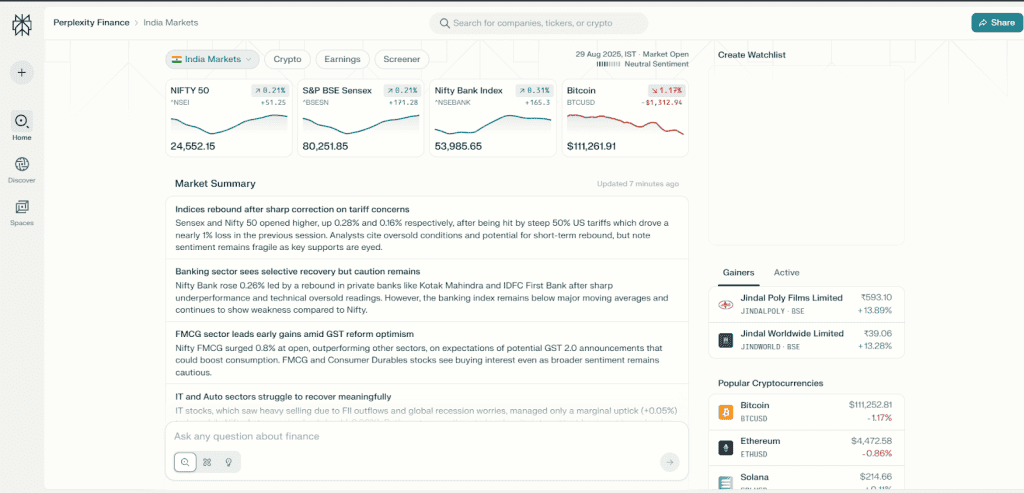

Perplexity Finance is a financial research platform of Perplexity AI, aiming to deliver live stock quotes, earnings updates, company disclosures, and peer comparisons for global and Indian equities.

It offers an ad-free, minimalistic interface and natural-language search, which provides context-rich answers with transparent and clickable citations from user-trusted financial sources. Customers get the advantage of market data, historical charts, fundamentals, earnings call schedules, and event transcriptions, covering BSE and NSE stocks.

The available analytic tools include ratio analysis, news synthesis, revenue and profit breakdowns, and summaries of both bull and bear cases. Perplexity Finance is freely accessible, with Pro and Enterprise plans allowing more significant limits, advanced analysis, and the provision of dedicated support.

Best for: Quick financial fact-checking, live data synthesis, and AI-powered answers for global and Indian markets.3. Trading View

TradingView is a cross-platform charting and technical analysis website for individual traders and professionals, accessible via web, desktop, and mobile devices. Forex, stocks, ETFs, bonds, options, futures, and cryptocurrencies are all financial instruments with which it interacts, and it deals with more than 150 global exchanges.

There are subscription options ranging from completely free plans with some restrictions in use, to paid plans that fall between Essential and Ultimate and cost from about ₹1,295 to ₹20,799 per month, with lower pricing available for annual subscriptions. Free accounts provide basic integration and paper trading, while higher tiers add advanced charting tools, more indicators, expanded alert capacity, and multi-monitor support.

The platform features over 400 indicators, 110+ drawing tools, Pine Script for custom studies, market screeners, real-time data, economic calendars, and a social network for sharing trading ideas. Customer support, security, and device synchronisation are standard across all plans.

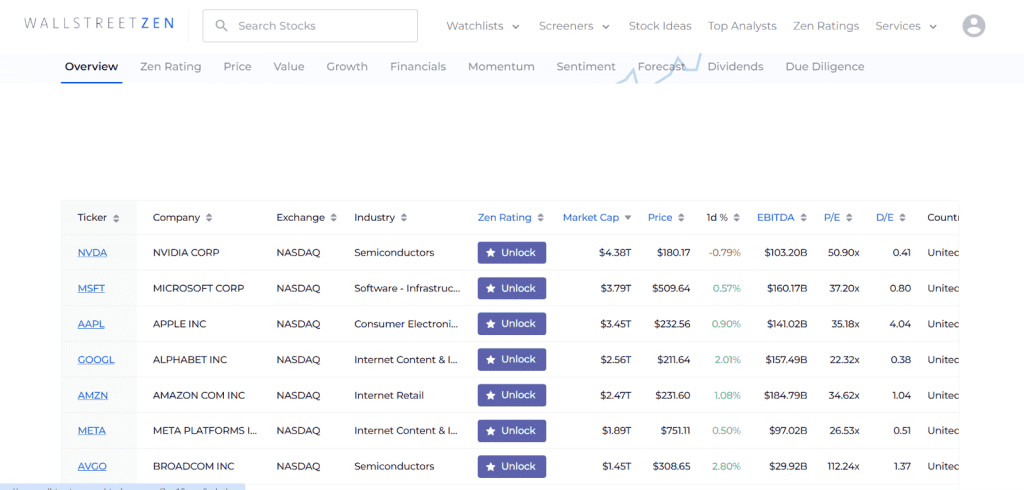

Best for: Technical analysis, interactive charting, and active trading across diverse financial instruments.4. WallStreetZen

WallStreetZen is an internet-based stock evaluation tool, the main goal of which is supplying well-organised, context-rich research through visual financial dashboards and automated due diligence instruments. It condenses more than 115 financial and qualitative factors into one proprietary Zen Score, briefly explaining the strengths and the weaknesses of the company.

The visuals represent the historical and the comparative ratio data, e.g. price-to-earnings and liquidity, thereby allowing the users to evaluate the valuations against the industry and the market benchmarks.

Some features are analyst forecasts, fundamental data, news feeds, performance and ratings metrics, watchlists, alerts, and SEC filings. WallStreetZen collects all the analyst recommendations and gives advice based on the score, employing a very easy-to-understand interface for beginners and part-time investors who want accessible fundamental analysis. There is a free basic research plan, while advanced plans provide unlimited reports and expert recommendation tools. Brokerage integration is also available.

Best for: Easy-to-understand fundamental analysis, analyst recommendations, and visual company evaluations for beginners and casual investors.5. Investing.com

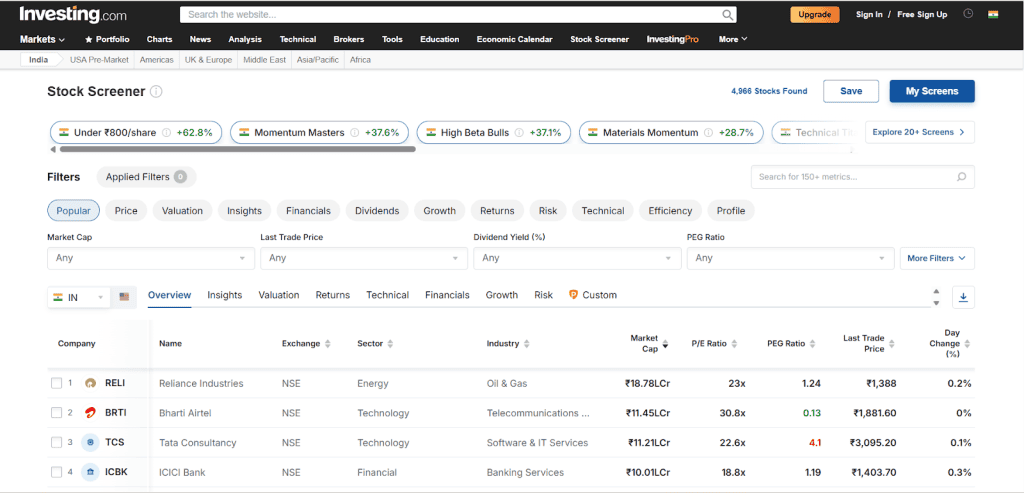

Investing.com is a global financial information platform that provides coverage for more than 250 stock, index, commodity, forex, bond, cryptocurrency, ETF, and futures exchanges. The Indian version is essentially the same but tailored to the local users. It provides real-time quotes and interactive charts for a broad spectrum of financial instruments, along with breaking news, local and global market analysis, fundamental and technical data tools, and economic calendars. Users are allowed to make their own watchlists and portfolios. They also get price, volume, and news alerts that help them sync up different devices.

Additionally, there are market screeners, calculators, downloadable market data, and notifications set up by the user for particular events or price changes. The platform is available in 44 languages and also offers a mobile app, which is highly rated for both iOS and Android devices. Most of the data and tools available on Investing.com are free, while the premium tier, InvestingPro, comes as a separate subscription that enables users to access advanced analytics and deeper insights. Having launched in 2007, Investing.com now reaches millions of users monthly from its global offices.

Best for: Real-time global market coverage, comprehensive financial data, screeners, and portfolio management across multiple asset classes.AI-Powered Platforms to Watch

Intelligent platforms that use AI are transforming stock research in a big way. They enable easy access to up-to-the-minute market insights and prompt data analysis. In detail, they are handling the live market info, keeping the sentiment of the news, benchmarking stocks, and also analysing macroeconomic factors for users’ specific queries.

Stoxo, powered by AI from StockGro, is one such example that uses artificial intelligence to make complicated financial data understandable and available to retail investors. Typical functionalities also include automation of future expectations, ratio analysis, anomaly detection, and risk management, with all of this presented through visual and user-friendly dashboards or digital tools.

These platforms cater to a large number of users and hence, democratise the provision of quality research.

Why Stock Analysis Websites Matter

Investors face many problems while researching stocks. They have to go through the financial reports, get the market data that is accurate and timely, and try to make sense of the huge amount of information that is often contradictory and comes from different places.

It is not easy to compare companies in an efficient way to keep up with the industry or to find the opinion of the most trusted analysts without investing a lot of time and effort. For new investors, this could be intimidating.

Stock analysis websites were created to address these challenges by aggregating financial data from various sources and presenting them in user-friendly formats. These sites simplify the investigation process, provide a one-stop for data in the form of visual charts and summarised expert insights, and open the door for investors of all levels to watch the stocks, run their investment models, and make decisions confidently by using the resources that are reliable and up-to-date.

How to Choose the Right Website for You

While deciding on a stock analysis website, it is advisable to consider some important questions reflecting your requirements as your decision’s framework:

Evaluation of Data – Does it cover just the basics, or can you dig into sector comparisons, balance sheets, and historical charts?

Tools for research – Can one find in such a platform the easy-to-use screeners, technical charts, analyst ratings, and live news feeds for more profound research?

Interface for users – Does the website have a simple structure and is easy for users to find what they are looking for, or maybe you will have to spend some time searching for the relevant information?

Pricing policy – Are there enough free features that you can use for your needs, or would the paid tiers give you more value?

Market coverage – Is the website allowing the exchanges and asset classes you are interested in, such as Indian equities or the global market?

Trust and Help – Is your data maintained? Is your privacy maintained, and can you access a quick-resolving customer service to sort out your queries?

Device Compatibility – Can you use your mobile and desktop easily to access key features, or is it limited to one?

Summary & Final Recommendation

Several prominent stock market research websites are available, and each of them offers unique features, different screening tools, and various types of data. The best option mainly depends on the necessities, the experience of the investor, and his/her preferred way of research. By visiting these sites, one can find the resources most suitable for different sets of objectives.

FAQs

The selection of a stock evaluation website is based on the user’s personal requirements; that is, each service, such as Stockgro Stoxo, TradingView, WallStreetZen, Perplexity Finance, and Investing.com, comes with unique features and data that meet the needs and habits of different investors.

Among the most popular free stock research websites are Stockgro Stoxo, Investing.com, TradingView (basic plan), WallStreetZen (basic plan), and Yahoo Finance.Every platform has a comprehensive data, research, and charting feature set that can be employed to meet the varied research needs.

Stoxo from Stockgro, WallStreetZen and Yahoo Finance are the best options for beginners in stock analysis as they provide simple and easy-to-understand designs, easily accessible tools, and summarised financial information, which makes the process of market research for new users much simpler.

Stockgro Stoxo, TradingView, Investing.com, and Screener are websites with stock screeners that are widely recognised, offering adjustable filters and a multitude of standards to help users find stocks that align with their particular interests and requirements.

AI-powered stock analysis tools and traditional sites each have different approaches and features. The choice between them depends on individual requirements, preferred research methods, and familiarity with technology, as both types of platforms serve distinct investor needs

Different options are available in India, such as Stockgro Stoxo, Investing.com, and TradingView. Every website offers a unique combination of features and data which caters to a wide range of investor preferences and research practices.

Leave a Comment