ChatGPT for the Stock Market

The revolution of AI has taken the world by storm, and stock trading is no exception. ChatGPT, developed by OpenAI, is the most renowned and commonly used AI tool. Its use cases vary from generating images, making content, education, research and even entertainment. But the investors are looking for in-depth information that goes beyond the capabilities of ChatGPTIn this blog, we’ll explore how ChatGPT is useful for trading, its limitations, and compare it with Stoxo, an Indian-developed AI tool built specifically for market research.

Can ChatGPT Help You Trade Better?

Yes, ChatGPT can help you trade better. It can help the investors in the following ways:

- Summarisation of Data: ChatGPT can be used to generate short summaries of large datasets such as quarterly reports, annual reports, and/ or concalls, which are easier to interpret.

- Sentiment Analysis: Based on current trends, news, and events, it provides a general tone of the market.

- Knowledge: ChatGPT can help you understand financial concepts and economic terminology.

- What-If Analysis: Investors can test out hypothetical situations based on their investment idea and act them out with different factors in ChatGPT.

Limitations of Using ChatGPT for Stock Market Analysis

- Lack of real-time data:ChatGPT relies on the data already fed to its models. It can not keep track of market movements and price changes.

- Generic Domain:As ChatGPT is designed for generic research, it doesn’t have the efficiency of AI tools built specifically for market research.

- Limited Data Processing:Although ChatGPT does a good job at processing texts, its efficiency goes down when it comes to quantitative data such as charts, models, or statistics.

Meet Stoxo: The AI Built for Stock Market Insights

As ChatGPT struggled with accessing real-time market data and monitoring, there was a need for a market-specific AI tool. So, StockGro launched Stoxo, India’s first AI-powered market research engine. The Aim of Stoxo is to provide investors with accurate and reliable information that can help them make data-backed decisions.

The key features are:

- Behavioral Intelligence: Stoxo is developed by analysing the behavioral patterns of the 35million+ users of StockGro.

- Real-Time Insights: It makes use of real-time changes in stock prices and trading volume to give more accurate, up-to-date results.

- Focused Design: It is developed for the use of stock market research, not general use

- User-friendly interface: Users can put in simple, natural language instructions and get well-structured answers, making it accessible and useful even for amateur investors.

Stoxo vs ChatGPT: Which Is Better for Traders?

Stoxo and ChatGPT differ from each other in the following aspects:

| Basis | Stoxo | ChatGPT |

| Data | Makes use of real-time market data | Relies on already fed data in its models |

| Model Training | Specialised training focusing on the stock market | General training based on text and previous models |

| Scope | Narrow, limited to market research | Wider, useful for broader searches in different domAIns |

| Applicability | Information-backed investment decision-making | Education, research or any other general queries |

| Target User | Investors | General public |

While ChatGPT remains the king in generic AI, Stoxo users have a clear advantage for market-specific insights.

How Stoxo Understands Market Data

Stoxo develops an understanding of market data by integrating various channels of information in the following manner:

Real-Time Processing: Stoxo maintains live access to changes in stock prices, trading volumes, and indices to better predict the market momentum.

User Data: Stoxo already has possession of investor behaviour patterns from StockGro’s data, which it uses in addition to market data.

Data Integration: The quantitative data derived from the market is integrated with the behavioural patterns of the users to develop a holistic overview of the market.

Sentimental Analysis: The financial news, information from social media and market data are integrated. They are run through a natural language processor to assess the tone i.e. whether the market is looking bullish, bearish or neutral.

Final Output: A real-time market data integrated with pre-existing user patterns, along with the underlying market tone, works to give out the best results to the Stoxo users.

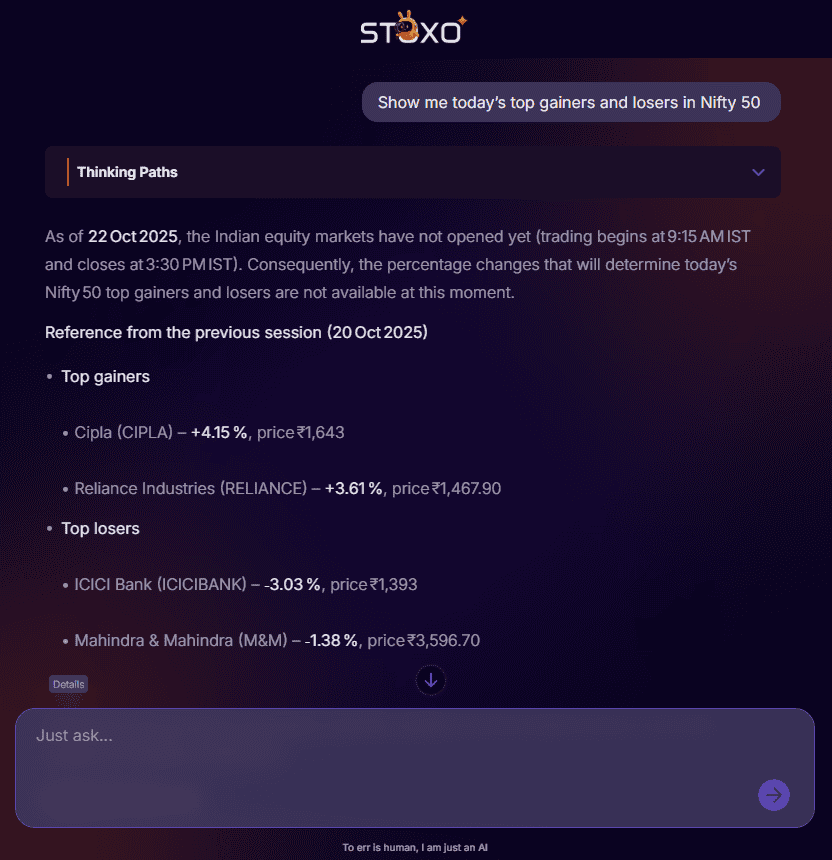

Prompt Examples You Can Try in Stoxo

These are some of the prompts users can try on Stoxo AI:

- “Gold at an all-time high. Still buy or wait?”

- “Give me a list of top gainers and losers in the market today.”

- “Suggest 3 IT sector stocks giving more than 15% returns over the past 5 years.”

- “How the tariffs imposed by the USA are affecting the global economy.”

- “Devise an investment strategy for capital appreciation and retirement after 30 years.”

These kinds of prompts help the users get crisp answers, and then they can use their own judgment to make decisions.

AI Trading Use Cases Powered by Stoxo

Market research platforms such as Stoxo can be used for many different purposes:

1. Stock Screening and Selection:

Different parameters, such as P/E, P/B, RoE(Return on Equity), etc., can be used to filter and select stocks among a list of thousands.

2. Automated Portfolio Management:

It can act as a portfolio manager for the users. The users can set up their goals along with upper and lower limits, which the AI uses to keep track of investments and rebalance them if anything goes astray.

3. Data-Driven Trend Detection:

Stoxo makes use of real-time data and also assesses the macroeconomic events to understand the current market sentiment. This helps in early trend detection and making strategies for it.

4. Scenario-Testing:

The users can experiment with Stoxo to play out hypothetical scenarios, which can help them better understand the impact of different factors and the course of action to be taken for the different scenarios.

Why specialised AI Outperforms Generic Chatbots

Generic models such as ChatGPT are good for processing text and natural language, but they often struggle with fast-paced quantitative data and its interpretation. Specialised AI outperforms Generic Chatbots because:

1. Specialisation over generalisation: While generic chatbots are made to cater variety of purposes, a specialised AI solely designed for a particular use case will outperform a generic one

2. Access to real-time data:Specialised AIs can fetch live data and use it to provide more accurate outputs, but a generic chatbot would be confined to data stored with it.

3. Customisation: Generic chatbots only give out plain text answers, but the results from specialised AI can be tailored to provide charts, ratios, quantitative models, or a plan of action as per the needs of the user.

Conclusion: Future of AI in the Stock Market

The future of AI seems very promising in the stock market. Although the focus is shifting from manual analysis to quick AI results, we must remember that AI is a tool, not a replacement.

Already established names like ChatGPT have proved their mettle, but the future brings the rise of specifically designed, purpose-built tools such as Stoxo.

FAQ’s

No, AI can’t guarantee returns. AI can provide analysis and suggestions, but it is the investor’s judgement and his decision-making ability that earns him a return in the market.

While ChatGPT is a general model, Stoxo is a market-specific model trained on real-time data and behavioral patterns of the users.

Stoxo has an interactive and simple interface that breaks down complex market terminology into easily understandable language, making it accessible to both beginners and experienced users.

Yes, both can be used in a well-synchronised harmony. Stoxo can provide real-time analytics, while ChatGPT can be used for summarising and understanding the data, making the two a perfect combination.

Leave a Comment