In the week leading up to Diwali 2025,, the Indian stock market saw a positive start, with Sensex and Nifty 50 observing high optimism due to the India-US trade deal and support from Gift Nifty. However, interpreting these shifts can be overwhelming for new traders as it involves too much data with little clarity.

In such cases, Stoxo, a stock market AI platform, makes it easier by turning real-time market movements into clear, structured insights that help investors to understand what truly drives these trends and make faster, informed decisions.

This blog provides a comprehensive overview of how Stoxo helps traders to make better investment decisions and outlines the benefits it offers.

How Stoxo helps traders?

Stoxo is a stock market research platform developed by StockGro, which helps traders make effective trading decisions by providing validated data-driven insights. It analyses real-time and historical market data and aims to eliminate trading based on emotions and guesswork.

Converts complex data into actionable insights

Stoxo allows users to ask natural-language questions by writing a prompt about the market, specific stocks, or sectors, and receive responses intuitively with a conversational interface. Instead of manually moving across complex charts and articles, Stoxo provides users with clear, concise, and credible answers to their queries.

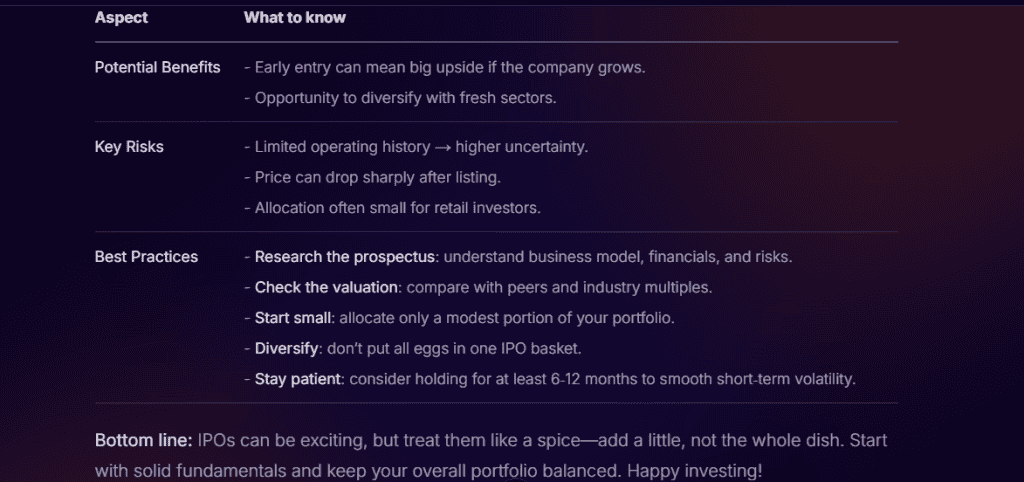

For example, a user may ask, “I’m a beginner, should I invest in IPOs?” and receive a structured, well-researched, and verified answer.

Stoxo breaks down the answer into potential benefits, key risks, and best practices. It helps users see both sides clearly, from growth opportunities to risk management.

Augments analysis with AI and machine learning

The platform uses powerful AI algorithms that deliver market analysis and forecasting models that go beyond traditional methods. Stoxo is also able to track news and market sentiment to provide an analysis of the market mood, which is a key indicator of trend shifts.

Stoxo incorporates a wide range of advanced tools and indicators, such as technical indicators, fundamental analysis, backtesting capabilities, and option chain analysis, to deliver its outputs.

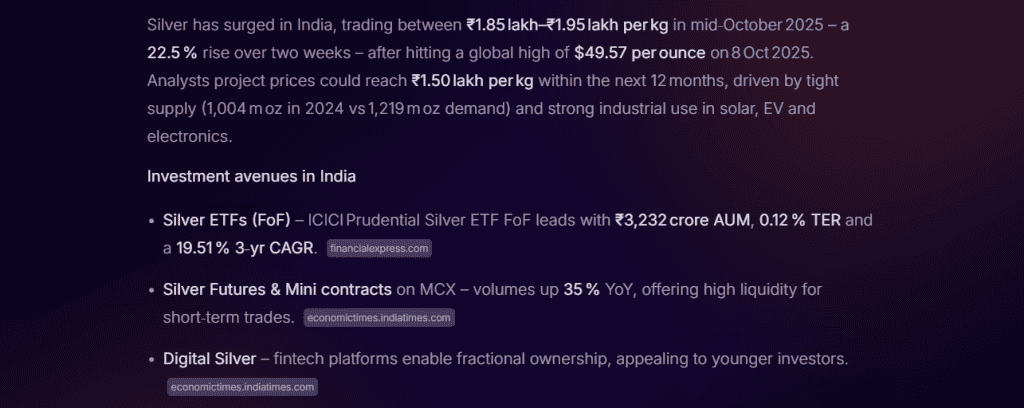

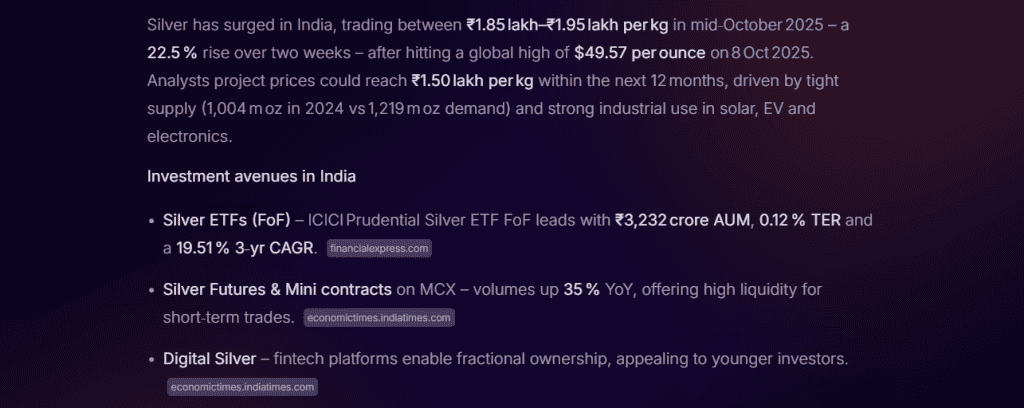

For example, an investor asked Stoxo for insights regarding the rising demand for silver and its usage, and what impact it will have on its price. It delivered the following results:

Stoxo provided a detailed market overview, which includes current price trends, growth projections, and top investment options such as Silver ETFs, futures, and physical silver. It also highlighted the recent actions by fund houses like UTI and Kotak Mahindra, which will help investors understand the opportunity and risk before making any decision.

Accelerates the research and trading process

Stoxo automates chart scanning, filters, and backtesting for users to spend only a few minutes on research that may take hours.

It quickly screens and filters thousands of stocks in seconds based on specific criteria, such as strong earnings or high trading volume, saving countless hours of research. The platform processes real-time data, which helps traders detect and confirm market trends.

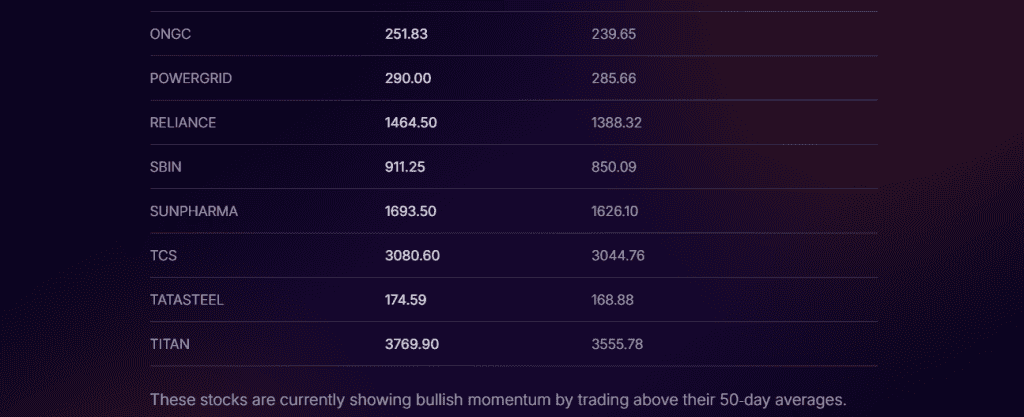

For example, an investor wanted to know which Nifty 50 stocks are currently trading above their 50-day moving average. Stoxo lists down all the stocks as below:

Provides a low-risk practice environment

Stoxo offers a sandbox environment with virtual capital that lets traders test strategies without using real money. It allows traders to backtest strategies based on historical data to analyse how they have performed, which helps investors to improve and build confidence in their trading approach.

Manages risk and automates tasks

Stoxo sets stop loss, trailing stop, position sizing rules, and trigger orders automatically based on predefined criteria to help traders manage their risk effectively by simulating outcomes and setting risk limits.

Investors can set targets for their portfolio, and Stoxo will track it and issue alerts or automatically rebalance if it drifts outside the set zone.

Benefits of using AI for trading

- Faster data analysis and predictive power: AI platforms analyse complicated and huge datasets, which include years of historical prices, economic reports, and market indicators, in a few seconds. They also reveal patterns and forecast future stock price movements with a higher degree of accuracy.

- Automated, high-speed execution: AI supports automated trading systems that execute buy and sell orders based on preset conditions and market criteria. Moreover, trading bots can monitor markets 24/7 and ensure that trading opportunities are captured instantly when they arise, even if the investor is offline or occupied.

- Emotionless and disciplined trading: AI eliminates emotional bias and operates purely on data and logic, removing emotions, unlike human traders who indulge in fear and greed during decision-making. The AI algorithms strictly comply with predetermined strategies, which ensure a disciplined and consistent trading approach that is key during volatile conditions.

Real-World Use Case

Let’s take an example to see how Stoxo works to help traders or investors make effective decisions.

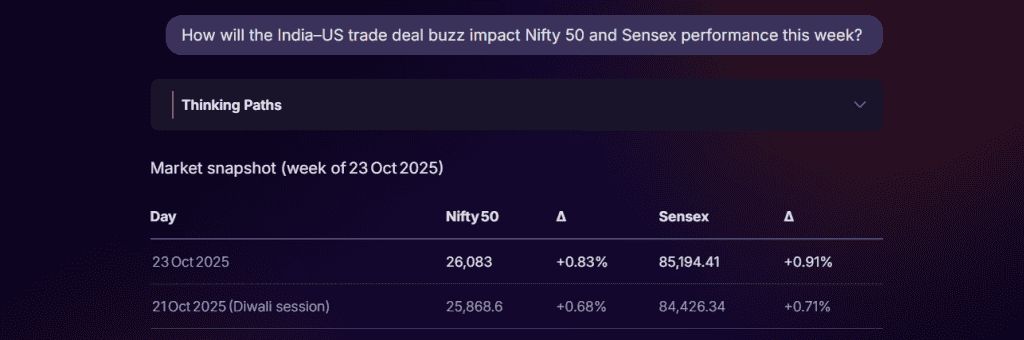

An investor asked on Stoxo, “How will the India–US trade deal buzz impact Nifty 50 and Sensex performance this week?”, to which it provided the following results:

This image shows the week’s performance summary for Nifty 50 and Sensex (20th-23rd October 2025).

- Nifty 50 went up by 0.83% to 26,083.

- Sensex went up by 0.91% to 85,194.

- In the Diwali session, both indices had already risen about 0.7%

It means momentum was already positive before this week. It points to continued investor confidence, not a one-day reaction.

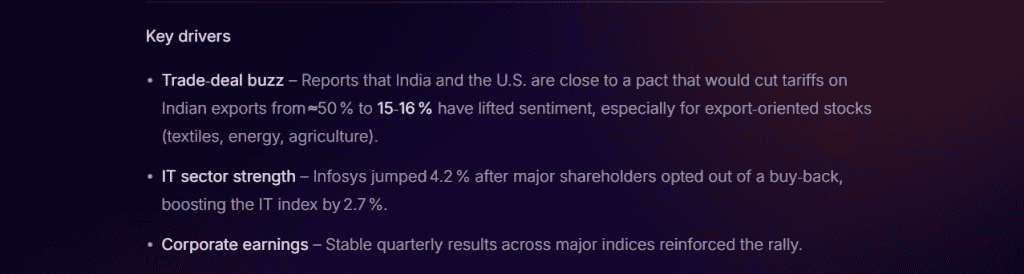

This represents the three main drivers of the market that are both macro, that is, the trade news, and micro, which are earnings and sector performance. It is considered a healthy mix.

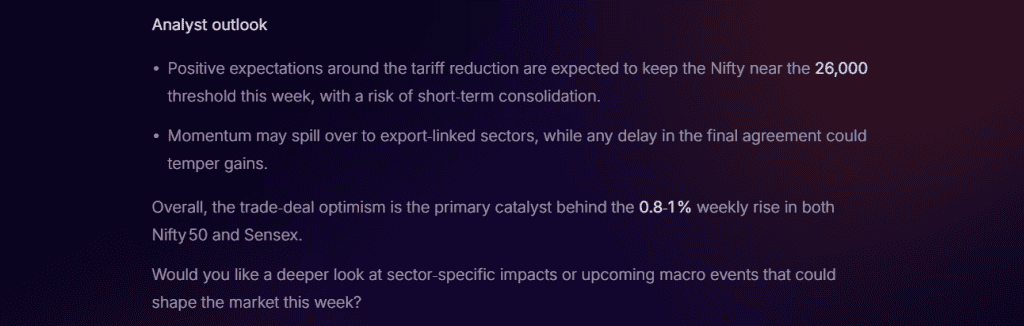

This image states the analyst’s outlook on the overall situation.

From the above result, it is clear that instead of manually tracking indices, news, and company data, Stoxo automated the process by showing not just numbers, but why those numbers moved. It also added a forward view by analysing analyst sentiment, giving context, not just data.

Conclusion

Stoxo brings speed, clarity, and structure to investment research by combining real-time data, expert validation, and intuitive design. It helps traders to focus on building a strategy rather than endless data checks.

Whether it’s understanding market trends, testing new ideas, or managing risks, Stoxo can simplify the process from research to execution. It serves as a single, reliable platform where traders can learn, analyse, and make confident investment decisions.

FAQs

Stoxo is a stock market AI that provides verified and structured insights based on live market data. It helps traders to understand trends, test strategies, and make informed trading decisions.

Yes, Stoxo offers paper trading, which allows beginners to learn and test their strategies to gain confidence before investing with real money.

Stoxo automates data collection and analysis by scanning charts, filtering stocks, and backtesting in a few seconds, so that the traders can spend more time making decisions and less time searching for information.

Yes, the insights delivered by Stoxo are validated through multiple sources, including SEBI-registered analysts and real-time market data, which ensures the information is accurate and reliable.

Yes, traders can simply ask questions like “What is the trade outlook on Zomato?” and Stoxo will provide a structured and data-backed analysis in a few seconds.

Yes, Stoxo provides personalised insights based on each user’s query and risk preference. Whether it’s long-term investing, short-term trading, or sector-specific research, it helps traders to get answers that fit their individual goals.

Leave a Comment