India’s stock market is gearing up for a significant IPO wave, with listings expected to raise nearly USD 8 billion by the end of 2025. For investors, it means endless choices as well as information overload.

Here, Stoxo steps in to simplify this noise. With data aggregation, AI-backed analysis, and personalised insights, it can help users to evaluate these new listings, compare performance, and make effective investment decisions without getting lost in the hype.

This blog aims to provide a complete overview of how Stoxo works, its key features, and user interface of the platform.

Introduction to Stoxo

Stoxo is an AI-backed stock market research platform, which is developed by StockGro for Indian retail investors. It provides real-time and data-based results directly from SEBI-registered analysts for making effective investment decisions.

It addresses common investor challenges by moving beyond market noise and hyped information to offer verifiable analysis of trends, market performance, and investment strategies, with a focus on technical, fundamental as well as sentiment analysis.

Key features

Key features of Stoxo are,

- Data-driven insights: Stoxo uses historical patterns and live market trends to generate accurate forecasts and help investors identify opportunities and make better investment decisions.

- Real-time stock data: It continuously stays updated on the market movement, driven by insights from registered analysts, and ensures investors’ accuracy with the latest prices, volume, and stock movements.

- Comprehensive market analysis: Stoxo blends technical indicators and fundamental metrics to evaluate the strengths, risks, performance, and long-term growth prospects of companies to provide clear and actionable insights.

- Portfolio tracking and risk management: Stoxo can also analyse the portfolio holdings of investors to track profit or loss and identify risk, which helps investors to stay balanced and make timely adjustments.

How does Stoxo work?

Here’s an overview of how Stoxo works to provide data-driven, accurate, and validated insights.

Efficient Data Collection

Stoxo collects real-time stock data from the market and aggregates market sentiment based on news and information on social media platforms. The data are a combination of inputs and insights from SEBI-registered analysts.

The system further incorporates conversational insights from over 35 million users of StockGro, stating their observation of behavioral patterns.

Stoxo can collect live stock prices, market cap data, and social sentiment to generate sector overviews, for example, an analysis of PSU banks.

AI Analysis Engine

Stoxo is an AI engine that is built specifically for capital markets, unlike generic AI platforms. The engine processes huge amounts of data to perform comprehensive stock market analysis, which includes pattern recognition, trend forecasting, technical analysis and fundamental analysis, and predictive modeling.

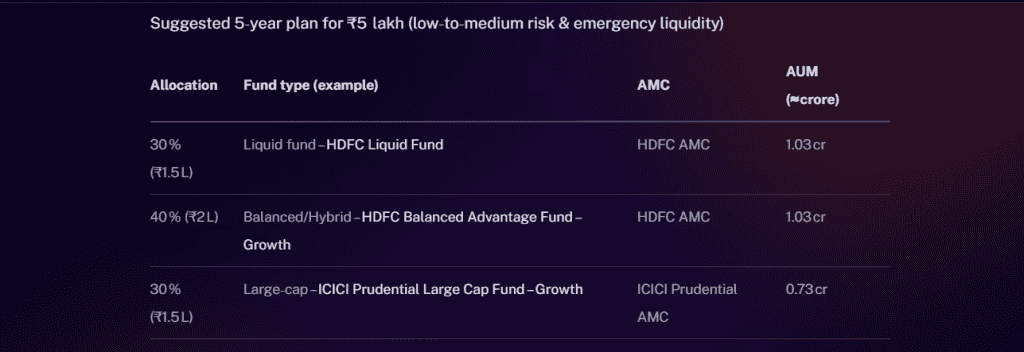

Stoxo processes queries such as how to invest ₹5 lakh for 5 years and create a personalised allocation across fund types using risk and liquidity data.

Multi-Layer Validation

The analysis provided by Stoxo is validated through multiple sources to ensure reliability and credibility, including verification by SEBI-registered analysts.

The validation process minimises the risk of misinformation and helps to prevent common issues with general-purpose AI platforms, such as generating non-existent information.

Continuing the above ₹5 lakh 5-year example, Stoxo suggests mutual funds and market insights are verified with SEBI-registered analyst inputs and real market data before display.

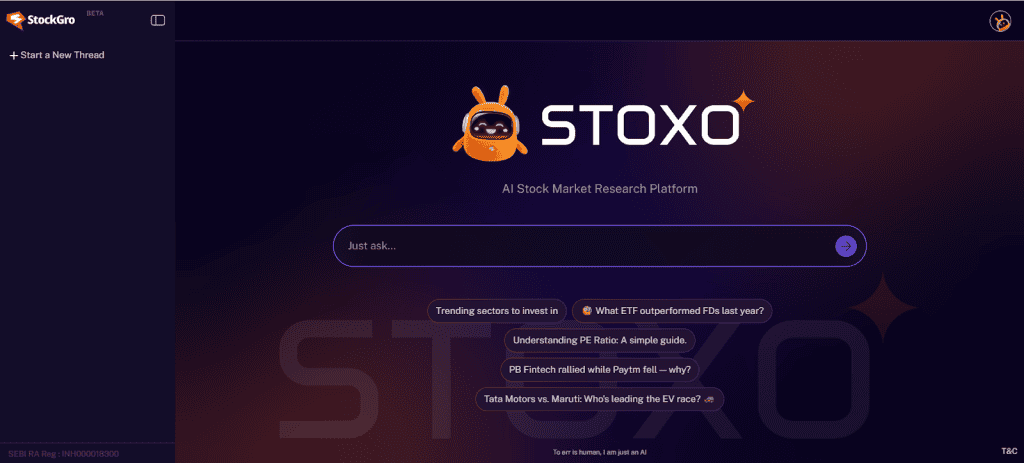

Interactive Chat Interface

Stoxo is a chat-based robo interface that allows users to ask simple, contextual questions in their natural language. It eliminates the need for users to have expertise or sift through multiple sources to find necessary information. The conversational format of the platform is more intuitive, which supports new investors.

For example, users can simply ask “Which sectors are performing well in this quarter?” and get structured and comparable insights in a few seconds.

Safety guardrails

Stoxo is equipped with guardrails. These are safeguards that ensure the AI operates within an ethical boundary. These are a must-have for any financial tool to prevent it from generating false or misleading outputs.

For example, the guardrails prevent Stoxo from showing outdated or unverified stock data by cross-checking every output with credible market sources and SEBI-verified information. If a query involves speculative or misleading content, the system filters it out and only displays data backed by official or publicly available records.

Tailored, Context-Aware Insights

Stoxo leverages its knowledge base to offer specific, relevant, and actionable insights, instead of providing generic advice. The personalised approach gives investors clearer information to make informed decisions and build conviction.

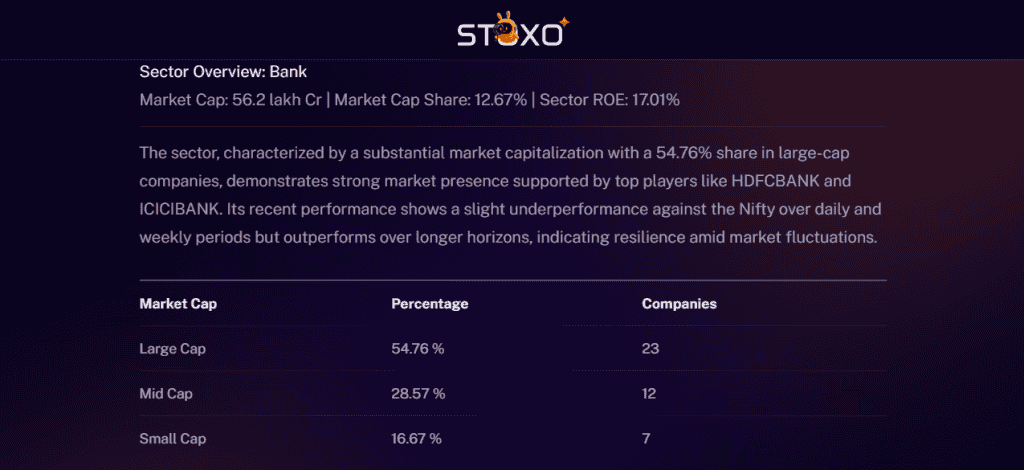

By understanding the context of a user’s query, such as “Is this a good time to invest in PSU banks?” Stoxo can deliver a structured answer. For example, it presents a sector overview showing market cap distribution, number and percentage of companies within the segment, followed by top performers by market cap and a return comparison to help users assess opportunities more clearly.

A representation of how Stoxo breaks down the PSU banking sector with real-time data, showing market cap distribution, top performers, and return comparisons to guide investment decisions.

User interface: Step by step (Login → Dashboard → Insights)

Here’s a quick walkthrough of how Stoxo guides investors from login to actionable insights.

The first step is to sign in to your Stoxo account to access personalised insights.

Next, investors can simply ask anything, for example, “I’m new to the stock market, and I have about ₹5 lakhs of capital to invest. How do I invest, ensuring a low to medium risk? Also, I hope to stay invested for at least 5 years, but I also want to have some highly liquid options for emergencies”. This is what Stoxo represents.

It breaks down how the amount can be divided among different types of mutual funds, depending on the risk tolerance and objectives.

It shows how much of the total amount goes into each type of fund. The type of mutual fund to invest in and the scheme name. The Asset Management Company that manages the fund. The size of the fund shows how large and stable it is.

This helps investors understand where the money would go and why.

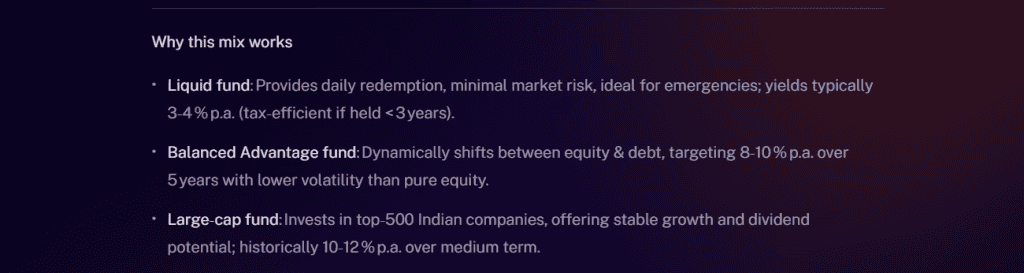

This part explains the reasoning behind the suggested portfolio.

The Liquid Fund gives easy access to money for emergencies with low risk. The Balanced Advantage Fund balances equity and debt for moderate growth and stability. The Large-Cap Fund invests in top companies to provide steady, long-term growth.

It helps the investors see how each fund plays a different role for safety, balance, and growth.

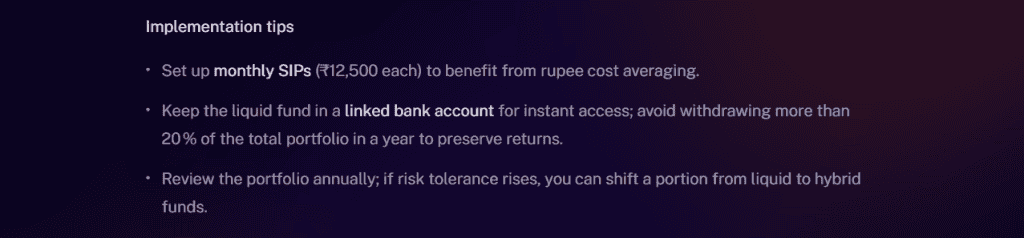

Here, Stoxo provides the practical steps to put the plan into action.

It suggests setting up monthly SIPs of ₹12,500 each to benefit from rupee cost averaging. It recommends linking liquid funds to bank accounts for quick access in case of any emergencies. It also advises reviewing the portfolio every year and making adjustments if the goals or risk levels change.

This makes the plan not just theoretical, but something the investors can follow in real life.

Conclusion

Stoxo is built to simplify the way investors understand the stock market. It aims to help investors by providing real-time data, expert validation, and interactive insights to make informed investment decisions.

Stoxo provides safeguarded, accurate, and reliable information in an easy and conversational tone. Whether it is sector analysis, portfolio management, or performance overview, it bridges the gap between market research and investment.

FAQs

Stoxo is an AI-backed stock market research platform, developed by StockGro, for Indian retail investors. Its primary aim is to provide real-time, data-driven insights directly from SEBI-registered analysts for effective investment decisions.

It gathers live market information, company performance metrics, and market sentiment from verified sources to maintain accuracy and reliability.

Yes, Stoxo’s natural language interface allows new investors to ask simple questions and receive clear, structured answers without needing deep market knowledge.

Yes, Stoxo insights are reliable as all the insights go through multiple layers of validation, including expert review and verified market data, which ensures accuracy and credibility.

Stoxo does not provide personal investment advice, but it offers personalised investment advice based on queries from investors. It helps investors to make independent and data-backed decisions.

Stoxo stands out with its chat-based feature that understands natural language, letting investors ask questions just like a conversation. It handles the research, analysis, and comparison in one place by offering multiple solutions through a single, easy-to-use tool.

Leave a Comment