Penny stocks, being low-priced stocks with high possibilities of profit, can lure investors in. But knowing how to choose penny stocks is a much tougher task than just buying what looks cheap. In fact, from September 2024 to July 2025, more than 50 penny and microcap stocks in India delivered returns above 200%, with a few over 5,000%, even as broader markets faced pressure.

These sharp moves show both the possible gains and the extreme risks, making it clear why having a thoughtful approach to selection matters. In this blog, we’ll discuss how to choose penny stocks in detail.

How to Choose Penny Stocks

Penny stocks tempt with multi-bagger potential, yet history shows their fragility. Their volatility makes careful research essential. Tools like Stoxo, StockGro’s stock market AI research engine with real-time analysis and sentiment tracking, help simplify this process by helping investors see past the hype and focus on the right factors when choosing penny stocks, such as:

- Know the Risks of Penny Stock Investing

Investing in penny stocks comes with distinctive risks compared to established large-cap companies. By definition, penny stocks trade at low prices, often under ₹10 in India, and belong to small-cap or micro-cap firms. Their inherent characteristics, such as thin liquidity and scarce reliable public information, make them highly susceptible to market manipulation. Penny stocks’ low price and trading volume facilitate price volatility and speculative trading, which, combined with frequent lack of consistent earnings, contribute to a higher probability of capital erosion.

- Fundamentals First: Financial Health Matters

Penny stocks may deliver exciting short-term gains, but those moves can easily mask deeper problems like weak revenues, inconsistent profits, or high debt. That’s why looking at financial health is essential before investing. With Stoxo’s fundamental analysis by going beneath the surface, investors can see whether a company’s financials truly support its growth story.

- Debt, Cash Flow & Profitability

Strong financials are rare among penny stocks. High debt levels can overwhelm small companies that don’t have steady revenues, while erratic cash flows make it difficult for them to scale operations. Profitability, too, is inconsistent, some firms report temporary profits, only to reverse them later. By tracking balance sheets, operating cash flows, and profit margins through structured tools, investors can avoid companies whose financial base is too fragile to survive downturns

- Management & Governance Quality

Numbers alone don’t determine long-term success. The quality of management and governance is just as crucial, especially in penny stocks where regulatory oversight tends to be weaker. As reported in June, 2023, SEBI received 4,085 complaints of corporate governance violations across 1,551 companies over the preceding 4-5 years, showing how lapses are widespread even outside penny-stock space.

This suggests that the risk of weak governance ranging from delayed disclosures and insider manipulation to promoter pledging is even higher in small and micro-cap firms. By assessing leadership credibility, board independence, and promoter behavior, investors can separate businesses with genuine potential from those built on fragile foundations.

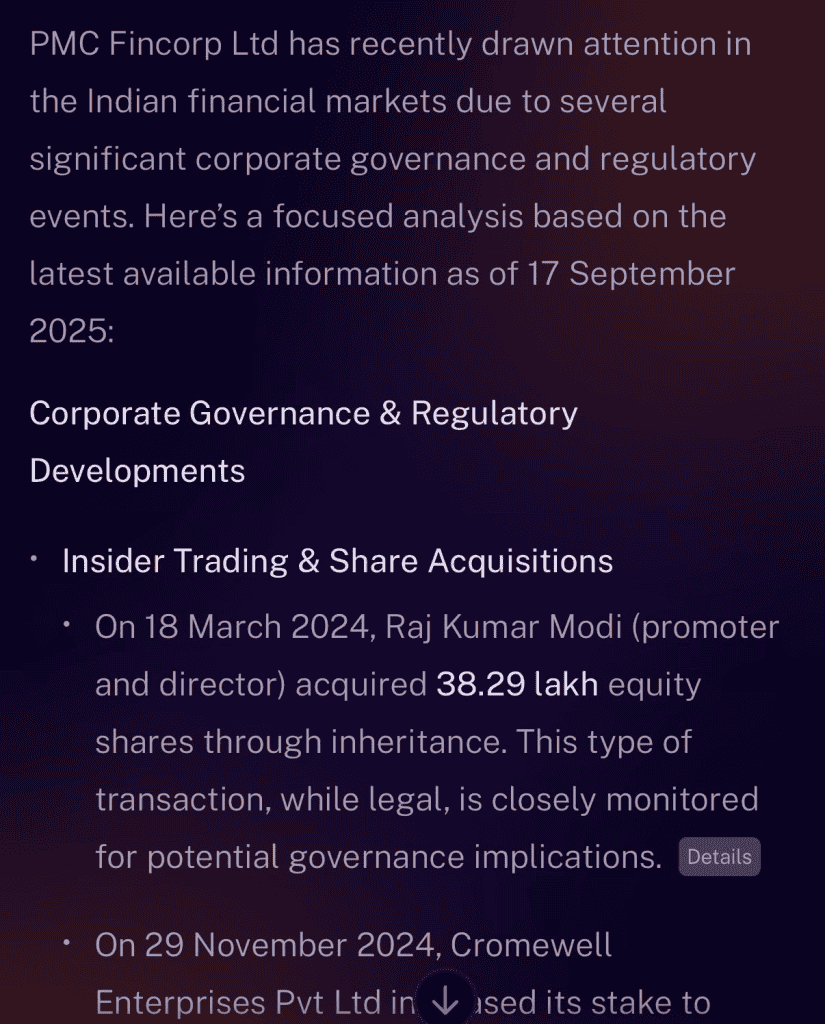

To make such checks easier, Stoxo AI can pull together financial health and governance insights in one place. For example, when asked to “analyse PMC Fincorp Ltd penny stock for me. Check its fundamentals like debt and revenue, look at cash flow and profitability trends, and also tell me if there are any governance red flags such as promoter pledging or insider trading”. The response it gave was:

The analysis showed recent insider acquisitions, SEBI scrutiny, and compliance reports alongside profitability trends, showcasing how governance red flags and weak fundamentals can significantly raise the risks of holding such penny stocks.

- Liquidity & Trading Volume

Liquidity is a key factor when selecting penny stocks. Because these stocks trade at low prices, they often face wide bid-ask spreads, making it harder to buy or sell without affecting the price. For example, a study published in the International Journal of Finance and Management Research found that a large proportion of penny stocks in the Indian market traded at very low daily volumes, suggesting poor liquidity and heightened price volatility.

Low liquidity increases price swings and can make existing positions at desired levels difficult. Investors should therefore focus on penny stocks with consistent daily trading volumes rather than sudden, short-lived spikes. Stocks with steady liquidity allow smoother price discovery, reduced volatility, and safer entry and exit points.

- Technical Patterns & Chart Analysis

Chart analysis plays a central role in the penny stock segment, where fundamentals often lack depth. Price patterns can highlight momentum shifts and help assess whether spikes are genuine or speculative.

- Volume spikes: Abnormal volumes without any corresponding news may indicate pump-and-dump schemes. Sustained increases linked with sectoral news or business announcements are more reliable.

- Trends: Identifying consistent uptrends with higher highs and higher lows is more credible than sudden one-day rallies.

- Moving average: Short-term averages crossing above long-term averages often indicate trend reversals. In penny stocks, 20-day and 50-day moving averages are commonly used to detect sustained momentum.

- Beware Pump-and-Dump & Fraud

The biggest danger of penny stock investing is manipulation. In a prominent case, SEBI issued a confirmatory order in March 2023 against operators involved with Sadhna Broadcast Ltd. The investigation found that misleading YouTube videos containing false positive news were used to artificially inflate the stock price (the “pump”), after which the operators sold their shares at a high price (the “dump”), trapping retail investors. This is a classic example of the schemes SEBI actively prosecutes.

Safeguards include verifying whether rallies coincide with audited financial improvements or industry trends, rather than baseless hype.

- Pick the Right Industry & Catalysts

Penny stocks can exhibit improved performance if aligned with industries undergoing structural growth supported by strong macroeconomic tailwinds and government policies. For example:

- Renewable energy and electric mobility sectors in India have seen rapid growth driven by national EV incentives and clean energy targets.

- Export-oriented textile small-cap firms benefit from favorable foreign exchange movements and rising global demand.

- Digital and fintech microcaps have grown post-pandemic thanks to accelerated adoption of online financial services and digital payments.

Choosing penny stocks focused on such industries with credible growth catalysts provides relatively better chances of capturing positive returns amid the broader high risk.

- Risk Management & Position Sizing

Penny stocks can offer big rewards, but they come with high risks. A 2016 study of 167 penny stocks listed on the National Stock Exchange of India found that smaller, low-priced stocks often provide higher returns than their pricier peers but they also experience far greater volatility and risk of loss. In fact, only a small fraction of penny stocks deliver significant gains, while most underperform or lose value over time. This highly skewed risk-return distribution necessitates disciplined risk management approaches such as:

- Setting strict stop-loss levels.

- Diversification across 4–5 penny stocks rather than concentrating on one.

- Linking entry to fundamental or technical triggers instead of speculation.

- Use Stoxo AI to Screen and Validate Picks

To understand how AI makes penny stock screening easier, let’s look at how Stoxo AI by StockGro works.

- Open Stoxo: Visit StockGro’s AI research engine.

- Type in your query: Type something simple like “List penny stocks with good returns and steady growth.”

- Get insights: Stoxo instantly shows a filtered list along with clear takeaways.

It first provides a detailed list of stocks trading under ₹50 that have shown positive monthly and yearly returns as of September 16, 2025 such as:

More importantly, it summarises this data into actionable key insights as follows:

- Top performers: Mentions stocks showing strong yearly returns, like one that gained over 80% after turning profitable.

- Risk alerts: Flags names with sudden price spikes and warns investors to review fundamentals.

- Sector spread: Covers multiple industries (finance, IT, infrastructure, metals, trading), avoiding over-concentration.

- Health checks: Points out cases where returns look good but profits are weak or unstable.

In short, Stoxo doesn’t just list stocks, it adds context, balances opportunity with risk, and helps investors approach penny stocks in a more structured way.

Conclusion

Penny stocks continue to draw attention because of their affordability and potential, but understanding them requires careful consideration. Factors such as cash flow, profitability, governance standards, and trading levels provide useful signals about a company’s position. Bringing these elements together showcase patterns that can separate stronger companies from weaker ones. In this way, a methodical approach defines how to choose penny stocks, creating a clearer path through a complex market space.

FAQs

Penny stocks are risky due to low liquidity, high volatility, limited financial information, weak governance, and susceptibility to manipulation like pump-and-dump schemes. Many lack solid business fundamentals, increasing the chances of significant losses or capital erosion.

Assess liquidity by examining consistent daily trading volumes and bid-ask spreads. Avoid penny stocks with sporadic volume spikes or extremely low turnover, as these can cause price manipulation and difficulty entering or exiting positions at desired prices.

Beware of sudden, unjustified price or volume spikes, false positive news, frequent promoter pledging, weak or delayed corporate disclosures, and overly optimistic social media hype, which indicate possible pump-and-dump schemes designed to inflate and dump stock prices.

Focus on debt levels, free cash flow, profitability consistency, governance quality, management credibility, and growth prospects. Prefer penny stocks with healthier balance sheets, transparent management, and alignment with growing sectors rather than those with erratic financials.

Technical analysis helps identify genuine momentum through volume spikes, consistent trends with higher highs/lows, and moving average crossovers (20-day/50-day) signaling sustained price moves. It aids spotting manipulative spikes and timing entry/exit points more reliably.

Limit penny stocks to a small portion of your portfolio, typically 5–10%, because of their high risk. Diversify across multiple penny stocks rather than concentrating on one to manage volatility and preserve capital.

Yes, AI tools analyse fundamentals, technicals, and sentiment to filter penny stocks more objectively. They help separate hype from value, improving decision-making while minimising risk. However, caution and further research are essential given penny stocks’ high volatility and risk.

Leave a Comment