According to a SEBI study, over 93% of individual investors trading in Futures & Options (F&O) incurred average losses of more than ₹2 lakh per trader, during FY22 to FY24. Derivatives, in general, are considered complex tools that seem confusing for beginners and novice traders alike.

Futures trading is gaining momentum as SEBI is taking steps to safeguard individual investors from suffering losses in this segment. Effective 1st October, 2025, these new regulations aim to enhance transparency and liquidity in the derivatives market.

Are you also among the investors who find futures trading a complicated investment tool? Don’t worry, this blog is here to help you with a step-by-step guide on how to trade futures.

How to Trade Futures: Step-by-Step Guide for Beginners

Futures trading for beginners can be a daunting task. Look no further, as these eight steps get you one step closer to your futures trading journey.

Step 1: Understand Futures Contracts

The first step is to understand futures as a trading instrument. So, what is a futures contract? A future is a form of a derivative agreement that allows you to buy or sell an underlying asset/commodity at an agreed price and time. The rate of the futures contract remains fixed, irrespective of the underlying price at the time of the settlement.

For a proper understanding of futures, it’s vital to learn these futures contract basics:

- Expiry date is the date of settlement of the contract. On this date, both the buyer and seller fulfill their obligations.

- The Futures price is the agreed-upon price for the underlying at the time of entering into the contract. This price is used to settle the trades on the expiry date.

- Spot price is the current price of the underlying.

- Futures premium is the difference between the futures price and its expected spot price that the buyer is willing to pay to acquire the asset in the future.

- Futures margin is the amount, typically a fraction of the underlying’s value, that a trader must deposit to participate in the futures market.

- Lot size is the minimum quantity of shares supposed to be traded in a futures contract. For example, one lot of a futures contract on stock X could be of 100 units.

- Mark-to-market is the process of settling the futures trading account daily to determine the day’s profits/losses.

Step 2: Learn How Futures Trading Works

These terms don’t make sense until you really understand how futures trading works.

Here, it is crucial to understand that futures are contracts that obligate both buyers and sellers to trade at predetermined rates and timelines. Now, why would traders enter into a futures contract instead of buying or selling the underlying today? To benefit from price fluctuations and secure a profit. Additionally, traders can enter the contract at a fraction of the price before buying the underlying asset.

Imagine a trader who wants to enter into a futures contract with gold as the underlying asset. The trader expects the gold price to rise in the next 6 months. They plan to enter into a futures contract today to lock in the price for buying 200g of gold in the future.

Suppose the gold price today is ₹5,000 per gram. Now, the trader may enter into a futures contract to buy 200g of gold with an expiry date of 6 months, at a futures price of ₹5,050 per gram. At the time of the delivery, the gold price reached ₹5,800 per gram. This means the trader gained ₹750 per gram, equivalent to ₹150,000 for 200 grams. The best part? He just had to pay a small initial margin, which is usually just a fraction of the total value.

However, if the price of gold had fallen, the trader could have lost money.

The trader can take two positions in a futures contract:

- Long position: The trader is obligated to buy the underlying instrument in the future.

- Short position: The trader is obligated to sell the underlying instrument in the future.

In both positions, a margin amount is required. At the end of each trading day, accounts are settled by calculating the difference between the contract price and the prevailing price of the underlying. Any difference between these is immediately settled using the margin money in the trader’s accounts.

Step 3: Open an Account & Choose a Broker

Futures trading in India requires a trading account with a SEBI-registered broker. Ideally, choose a broker that specialises in the underlying asset that you want to trade in. Research through different broker platforms and select one with suitable fees, research tools, and guidance.

Step 4: Margin, Leverage & Costs in Futures

As discussed above, trading in futures does not require full payment. An initial small payment is taken as a deposit, called the margin in futures. This margin is mandatory to open any long or short futures position. Two types of margin exist:

- Initial margin is the minimum amount that you must deposit into your trading account before initiating a futures trade. This is typically a percentage of the underlying security. For example, initial margin requirements for a stock future are around 50% of the stock’s value. Thus, a futures contract for 200 units of a stock trading at ₹ 1,200 will have an initial margin of ₹ 240,000 (50% of the total contract value of ₹ 480,000). This is to be deposited before entering into a futures trade.

- Maintenance margin is the minimum balance you must maintain in your account throughout the trading period. Market fluctuations impact your account balance. To ensure that the account margin balance does not fall below a threshold, a maintenance margin is required.

Leverage is the use of a small fraction of an amount in the trading of an underlying asset that is of a larger value. The use of leverage escalates both potential losses and gains. Futures trading is based on the use of leverage. Traders gain exposure using a small amount and are at risk of losing or gaining a lot.

There are associated costs to holding a futures contract as well. Traders need to bear these additional costs to maintain their position. Associated costs include interest charges, storage costs, and other costs involved in holding the underlying asset.

Let’s dig into an example to understand these concepts better.

Suppose you want to enter into a futures contract for 500 units of Alpha Private Ltd shares. Their shares are currently trading at ₹1200 per share. This means the contract value is (500 units * ₹1200 per share) = ₹6,00,000.

A trader must keep a 25% initial margin before entering into the trade. This means the initial margin amount should be = ₹1,50,000.

Now, the maintenance margin is 15% = ₹90,000. This means any drop in the account balance below ₹90,000 could trigger a ‘margin call’, i.e, a call to deposit money to maintain the margin position.

Step 5: Place Your First Futures Trade

Before placing your first futures trade, decide on the underlying asset and determine whether you are bullish or bearish on its future price movements. If you are bullish, you expect its price to rise in the future. This indicates that you should take a long position in the futures contract. However, if you feel the price of the underlying asset may go down, take a short position in its futures contract.

Through your trading account, search for the underlying futures that you want to trade in. Read through the contract details, including the lot size, expiry, and others. Ensure you have sufficient balance for the initial margin, and place the buy or sell order.

Step 6: Futures Trading Strategies for Beginners

You thought the price of Alpha Private Ltd shares would go up, but instead it went down? Yes, that’s how most people lose money in futures. To protect yourself, you can follow these simple trading strategies that are useful in managing the risk involved in futures trading.

- Trend following: This strategy suggests you buy or go long on the future when there is an uptrend, i.e, when prices of the underlying asset are going up in the market. The logic behind this strategy is that once a trend is set, it will be followed for a long time.

For example, if the underlying asset’s price is facing an uptrend, you should go long in it, expecting the price to go up in the future. If, however, the prices are in a downtrend, you should go short on the future.

To effectively use this strategy, it is important to identify uptrends and downtrends. For example, looking at the Nifty50 chart, we can see that it has been in an uptrend for the last 6 months. - Spread Trading: This strategy takes place when you simultaneously go long and short on the underlying security to take advantage of the price differential across different expiry dates.

For example, you can buy a future contract on an underlying asset that expires in 1 month, and sell a future contract on the same asset expiring in 3 months. The aim is to generate a profit from the price differential.

Suppose you buy a Nifty August future at 14,000 and sell the Nifty September future at 14,100. If the price difference between the two contracts reduces to 80, you stand to gain irrespective of the market movements.

- Breakout Trading: This strategy is applied when the underlying assets break past a support or resistance level, exhibiting a strong direction. For instance, if Bank Nifty futures move above a long-held ceiling price and volume surges, the trader buys, expecting prices to rise further. Stop-loss orders can help manage risk if the breakout fails. This strategy targets sharp moves when markets shift out of consolidation phases.

Step 7: Risk Management in Futures Trading

Financial markets are unpredictable. Sometimes, you can’t even predict what’s going to happen in the next minute. There are different kinds of risk in futures trading. To avoid losing money, proper risk management tools should be in place for futures trading. Some effective components of risk management in futures trading include:

- Position sizing: To avoid over-exposure in any underlying asset, positions should be determined and set. Position sizing predefines the amount of capital, the number of units to be bought or sold, and the total value of the trade. This allows traders to limit losses by staying within the predetermined position.

- Stop-loss orders: include setting up exit points where the order to exit the trade will take place. These work as ultimate trigger points that, once reached, have to be ‘exited’. These are placed to avoid significant losses on any individual trade.

- Risk-reward ratios: compare the possible risk of the trade with possible gains. Traders ideally aim to attain a risk-reward ratio of 1:2, which means for every ₹1 at risk, aim to generate a ₹2 profit.

Step 8: Closing or Rolling Over a Contract

When investors trade, they open or close positions. Buying a stock creates a long position, while selling borrowed stock creates a short position. To exit, they do the opposite- sell to close a long, or buy to close a short.

However, a trader could also carry the futures contract forward. This means he could close his position in one contract and enter into another futures contract of the same underlying asset that expires later. This is called a rollover of the contract.

Let’s illustrate this with an example.

Suppose a trader buys 1 lot of Nifty futures at ₹14,000, expecting prices to rise. After some time, if the price goes up to ₹14,200 and the trader wants to block the profits, they ‘close’ the position by selling 1 lot of the same Nifty futures contract. The difference between buy and sell prices is their profit.

If, however, the contract is nearing expiry but the trader wants to stay invested, they ‘roll over’ by closing the current contract and simultaneously buying a futures contract with a later expiry date, maintaining the same market exposure without taking physical delivery.

How Stoxo AI Helps You Trade Futures Smarter

Stoxo is a newly launched AI tool by the Stockgro family. It is India’s first AI-based stock research platform. Using AI in stock market futures analysis is a helpful way to understand the ongoing developments in the futures market in India.

Let’s help you understand how you can use Stoxo AI for futures analysis in the simplest way. Suppose you want to trade in Nifty50 futures in India. You can use the following prompt on Stoxo. For any custom requirements, please feel free to customise the prompt.

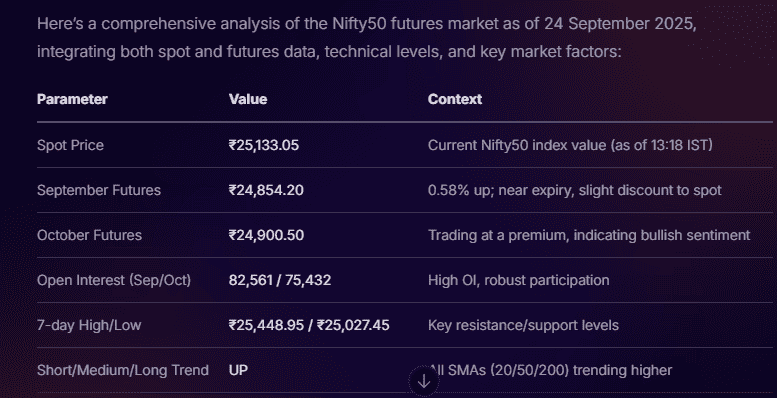

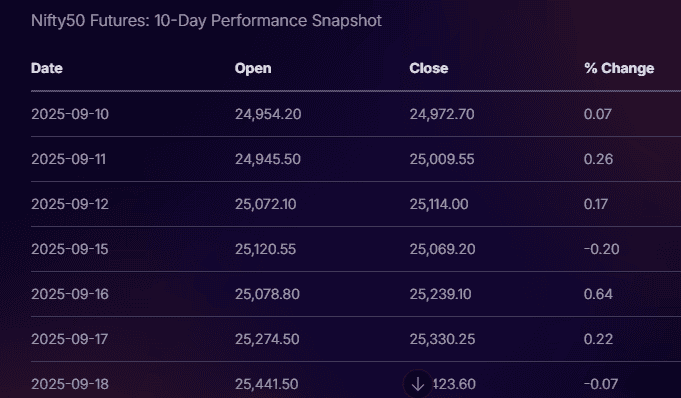

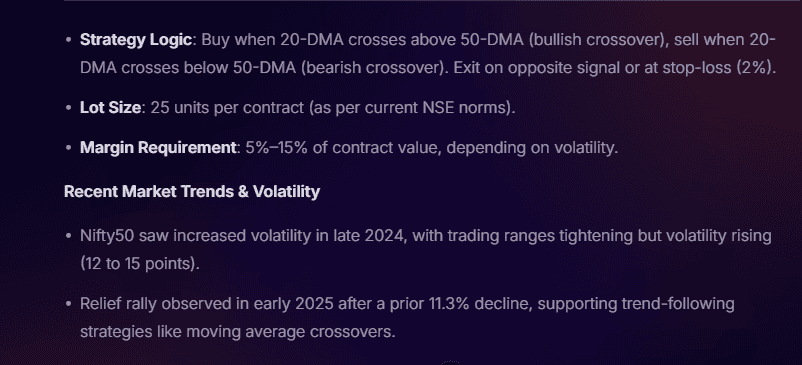

Stoxo provides the following results:

This provides users with a comprehensive view of the Nifty50 futures market. You can take your trading decision based on these insights.

However, if you are looking for specifics, then check out the sections below:

AI-driven contract analysis (entry/exit signals, volume trends)

Stoxo is a great AI stock predictions tool available in the market. You can also use the tool to conduct AI-driven contract analysis, including analysing potential entry and exit points, estimating price trends, etc. Let’s check out how you can use Stoxo for this.

First, give a prompt as shown below.

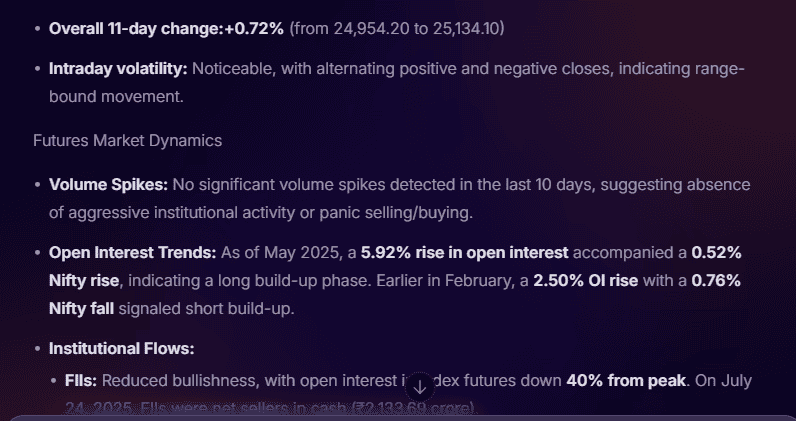

Stoxo then gives the following results:

Here, Stoxo has successfully provided a range of the Nifty50 price movements. These could be potential entry and exit points for a futures trade. Alongside, it provides updates on the volume trends, volatility, market dynamics, etc.

Built-in risk management insights

Risk management using AI is a simple and accurate way of protecting traders from significant losses in the futures market. Here’s how Stoxo can be helpful:

First, give a prompt:

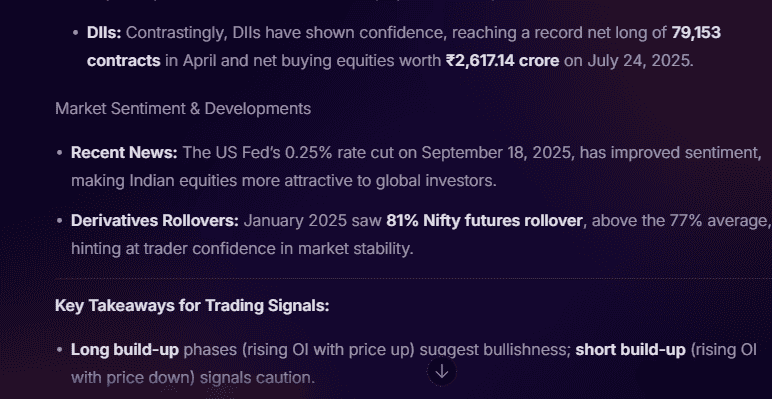

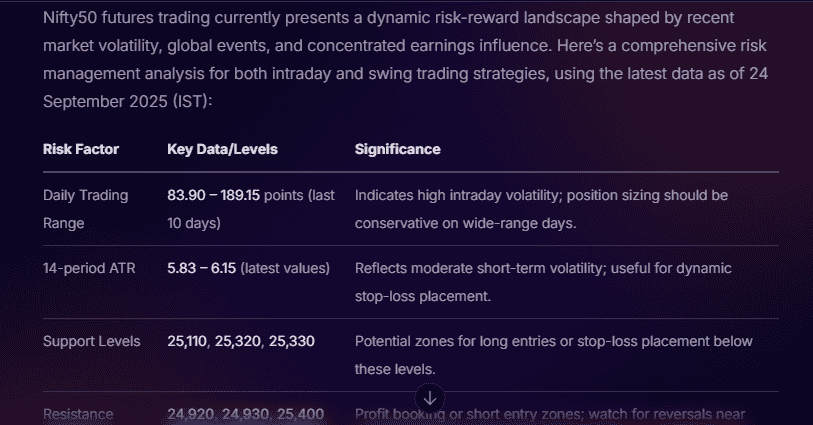

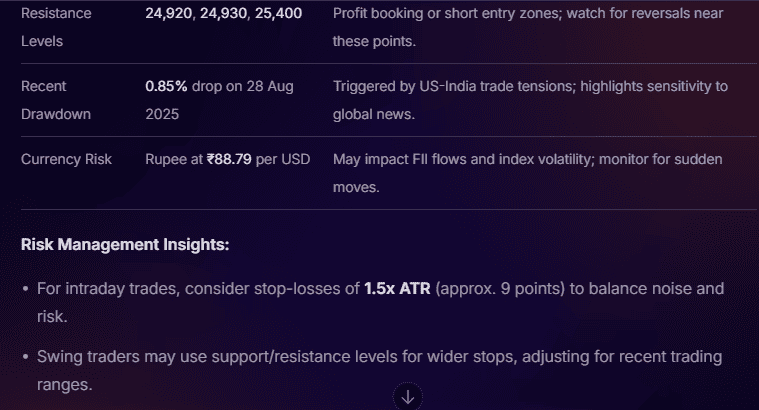

This is how Stoxo reacts:

Impressively, it provides a full-fledged breakdown of key points such as the daily trading range, recent drawdowns, resistance levels, estimated stop-loss points, and much more. You have your research in a few seconds.

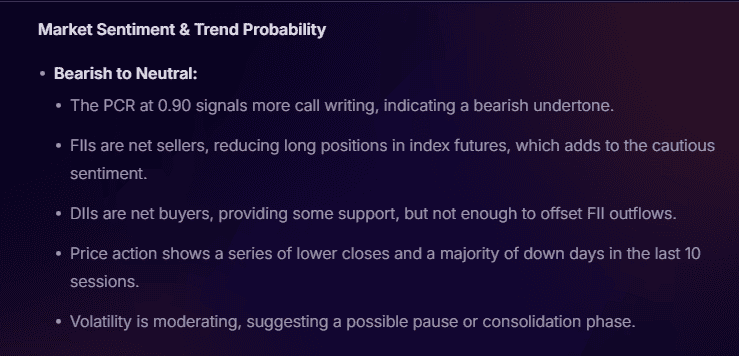

Market sentiment & trend detection

Understanding the overall market sentiment and trend detection is now simple with the help of Stoxo. Let’s see how.

First, give a prompt like below:

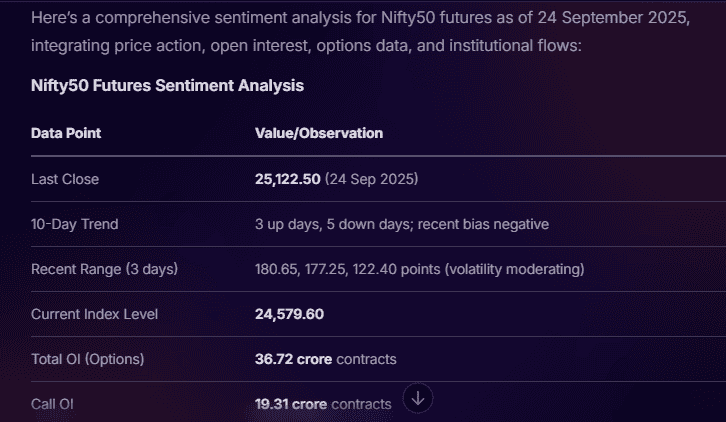

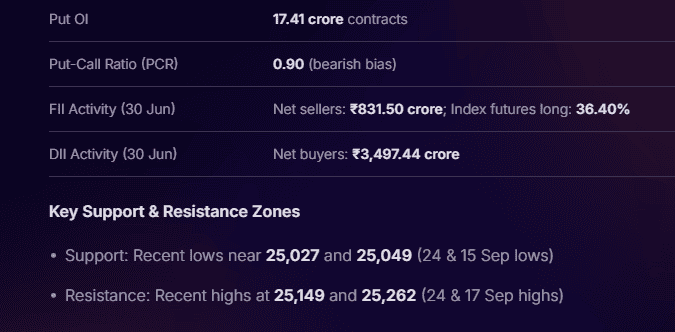

Let’s look at Stoxo’s output:

Stoxo reports the major sentiment analysis factor points and overall bearish or bullish signal trends.

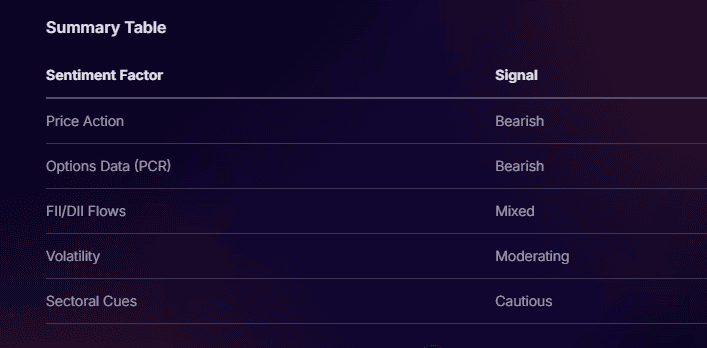

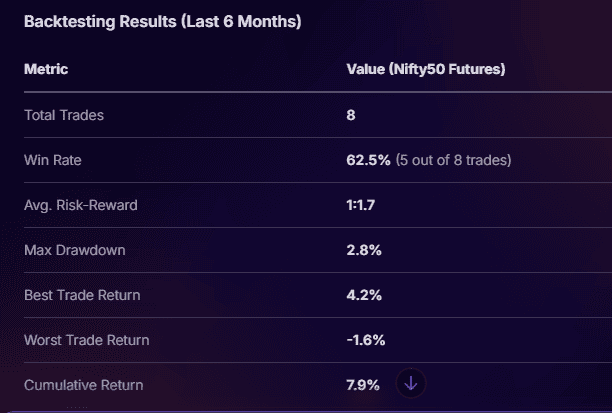

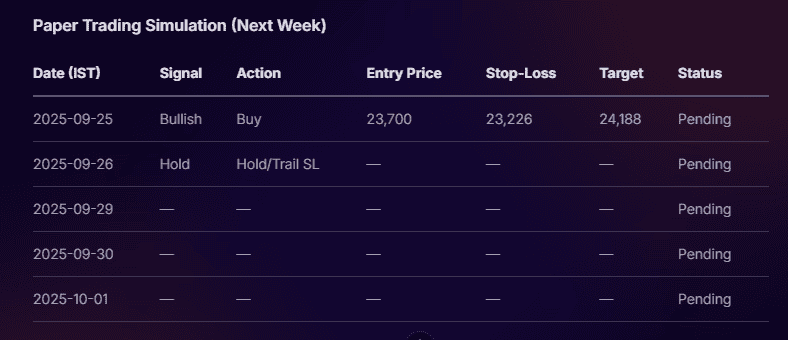

Paper trading & backtesting with AI support

Paper trading involves a simulated trading environment where buying and selling of futures can be done using artificial money. How can you use AI to conduct paper trading and backtesting of futures?

Check out how to use Stoxo for this.

Stoxo helps investors get a perspective on historical strategy performance and also a forward-looking simulation that shows the effectiveness of the futures trading strategy.

Conclusion

Trading in futures can be confusing for beginners. The use of leverage, margin, and market analysis makes it even more complicated. However, with effective trading strategies such as trend following, spread trading, and breakout trading, you can trade with the right plan in mind. With technology upgrades, using AI tools such as Stoxo can facilitate accurate, time-saving, and extensive futures trading.

FAQs

The process of trading futures is simple. First, open a trading account with a SEBI-registered broker, deposit margin money, choose your asset, and place a buy (long) or sell (short) futures order. Monitor, manage risks with stop-loss, and close or roll over the contract before expiry.

To trade in futures, you do not need the full contract value. A fraction of it, called the margin (usually 10–50% of contract value), is required. The exact amount depends on the asset, lot size, and broker.

Yes. AI tools like Stoxo provide entry/exit signals, risk levels, sentiment trends, and backtesting results, helping traders make faster and more informed decisions.

Futures carry high risk due to leverage, market volatility, and margin calls. Losses can exceed the initial margin if not managed carefully.

Select based on market conditions and risk appetite. Choose trend following for strong trends, spread trading for expiry differences, and breakout trading for sharp moves.

Margin is the deposit required to enter a trade. Leverage allows you to control large positions with smaller capital, amplifying both profits and losses.

Yes, but only with proper education, small position sizes, strict risk management, and practice through paper trading before risking real money.

Leave a Comment