Feeling lost while researching stocks, even with a trading account in hand? Having one only lets you buy and sell shares, it doesn’t guide you on what to research or how to interpret data. In fact, India now has over 192 million demat accounts as of FY25, yet millions of investors still struggle to make sense of market information and trends. That’s where Stoxo, India’s first AI-powered stock market research tool by StockGro, comes in. It helps you ask clear, natural-language questions and get real-time, verified insights instantly. With millions of users already relying on StockGro’s stock market research tools, learning how to prompt in Stoxo effectively can turn scattered information into structured analysis, helping you make sense of the market from your very first query. So, let’s learn in detail about it in this blog.

Why Effective Prompting Matters

Prompting is how you “talk” to Stoxo. A clear prompt tells the AI what you want, how you want it, and for which stock or sector. Stoxo is a conversational AI research engine; the quality of its output is directly dependent on the quality of the user’s input. Effective prompting is the skill of asking clear, specific, and well-defined questions to get the most relevant and actionable answers.

Vague prompts, such as “Is this stock good?” or “Tell me about the market,” are too broad. The AI cannot determine the user’s specific intent and will likely provide a very general overview.

In contrast, an effective prompt, such as “What are the primary drivers of Company X’s revenue growth last quarter?” or “Compare the debt-to-equity ratios of the top 3 steel companies,” provides clear direction. It narrows the AI’s focus, allowing it to sift through real-time data, analyst reports, and market sentiment analysis to retrieve the exact data points needed. Effective prompts save time, eliminate irrelevant data, and ensure that your responses are accurate, analyst-backed, and easy to understand.

How Stoxo Understands Prompts

Stoxo is built on an advanced generative AI model that uses Natural Language Processing (NLP). This model has been specifically trained on a massive and specialised dataset encompassing financial terminology, market concepts, and the behavioral insights from StockGro’s community of over 35 million users.

When a user enters a prompt, Stoxo doesn’t just look for keywords. It analyses the intent and context of the sentence. The engine:

- Identifies entities: It recognises company names, sectors, and market indices.

- Understands financial metrics: It comprehends jargon and acronyms like P/E ratio, ROE,market cap, and dividend yield.

- Deciphers intent: It determines the user’s goal, whether they are asking to compare, find (screen), explain (define), or analyse (assess trends or sentiment).

This financial-specific training allows Stoxo to differentiate between a simple definition request and a complex, multi-criteria screening command, ensuring the response is appropriate.

Types of Prompts You Can Use in Stoxo

The main types of prompts are as follows:

- Descriptive prompts

These are “what is” questions designed to retrieve specific data points or simple facts. They are ideal for quickly gathering foundational information about a company or concept. For example, “What is Sun Pharma’s current market capitalisation?” or “Show me the latest quarterly revenue for Tata Motors.”

- Comparative prompts

These prompts are used to examine two or more companies or assets side-by-side based on specific metrics. This is useful for benchmarking a company against its competitors. Examples of such prompts include “Compare the financial health of Infosys and TCS based on P/E ratio and ROE.” or “HDFC Bank vs. ICICI Bank on Q2 net profit growth.”

- Screening prompts

These prompts use Stoxo’s natural language capabilities as an intuitive stock screener. Instead of navigating complex filter menus, you simply describe the characteristics of the stocks you are looking for in plain English. Try prompts like “Find me large-cap pharma stocks with a high dividend yield.” or “List IT stocks with a P/E ratio below the sector average and a positive ROE.”

- Analytical prompts

These are open-ended “why” or “how” questions that ask the AI to identify trends, summarise sentiment, or provide causal analysis. They are useful for understanding the reasons behind a company’s performance or market behaviour. Common examples of analytical prompts include: “What is the current market sentiment for Zomato?” or “Analyse the revenue growth trend for Bajaj Finance over the past 3 years.”

- Learning prompts

These prompts are educational, designed to help users understand financial concepts, sector-wide issues, or implications of specific data points. They are often used as follow-ups to initial queries. Prompts of this type goes something like: “What are the main risks associated with the Indian EV sector?” or “Explain what a ‘payout ratio’ means in the context of high-dividend stocks.”

Essential Steps: How to Prompt in Stoxo Effectively

Stoxo’s power as a research engine lies in its conversational AI. The quality of your research depends directly on the quality of the questions you ask. Here’s an effective step-by-step process to get precise, actionable insights from the platform.

Step 1: Decide on your motive

Before you type, know what you’re looking for. Are you screening for new ideas? Comparing two specific stocks? Evaluating a sector’s health? Or just trying to understand a financial concept? A clear goal prevents unclear answers and is the foundation of a good prompt.

Step 2: Type in your prompt

Type your question as if you were asking a human analyst. You don’t need technical jargon. Be specific. Instead of an ambiguous prompt like “good pharma stocks,” ask a like, “List large-cap pharma stocks with a high dividend yield”.

Step 3: Review the detailed response

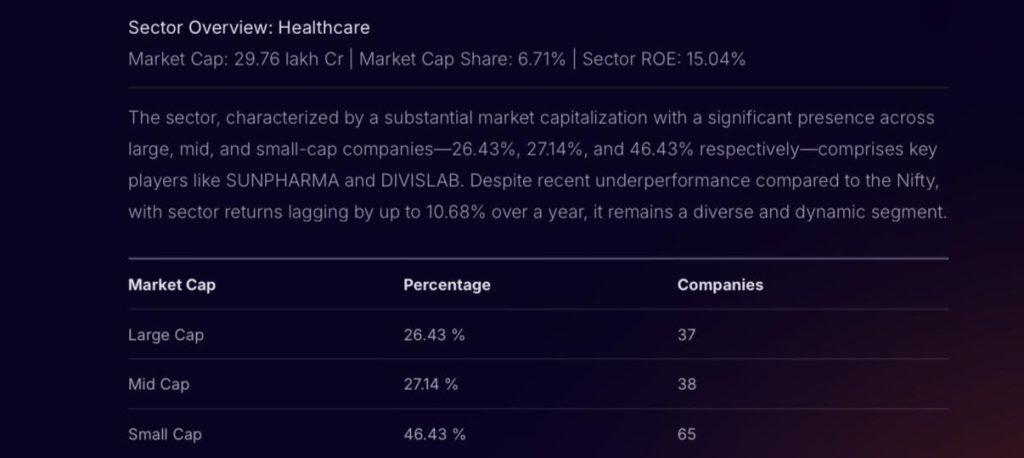

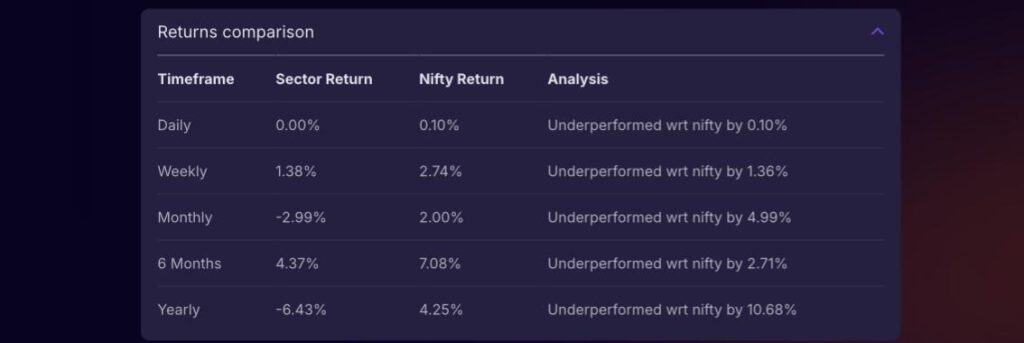

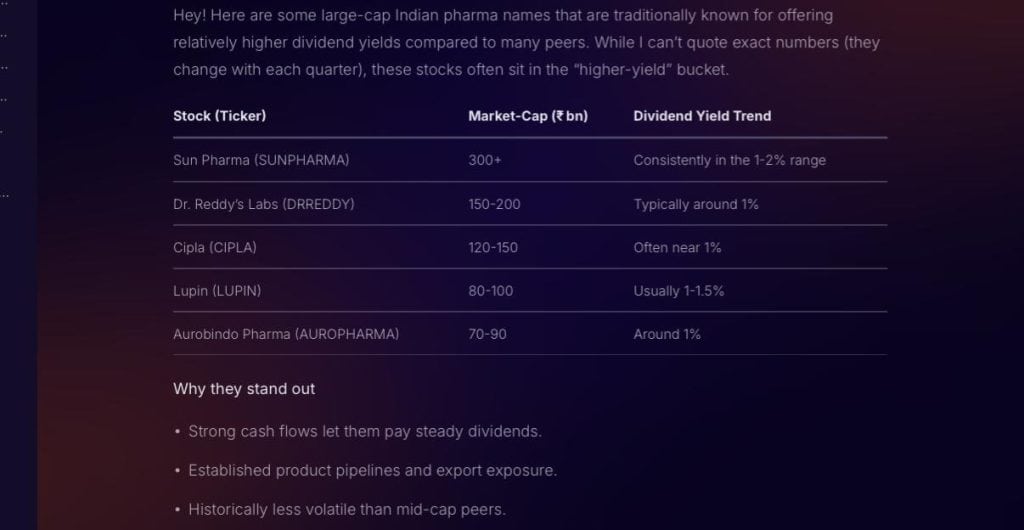

Stoxo will provide a detailed, structured reply, not just a link. Review all the modules it provides. For the “large-cap pharma stocks” prompt, this comprehensive response (which will be shown in the screenshots) typically includes:

- A direct answer listing relevant stocks with their market cap and dividend trends.

- A “Sector Overview” detailing the sector’s total market cap, its composition (large, mid, small-cap), and key metrics like sector ROE.

- A “Top companies by Market Cap” table, which acts as a peer comparison with metrics like Revenue, P/E ratio, and ROE.

- A “Returns comparison” chart, showing the sector’s performance against the Nifty’s return over various timeframes.

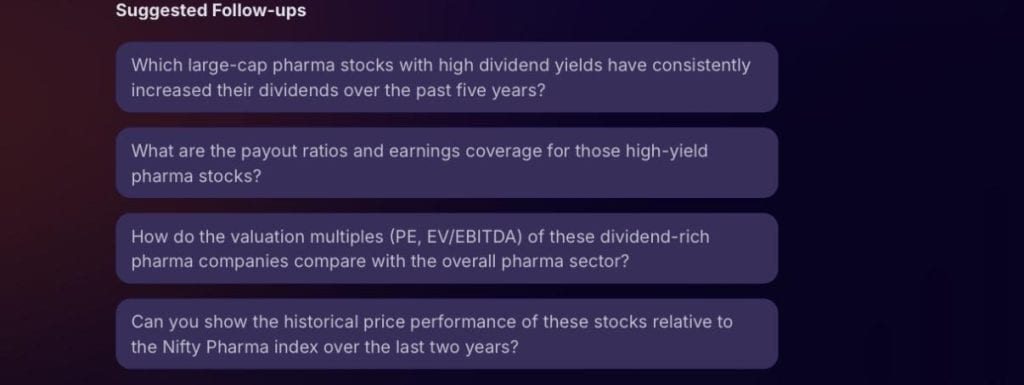

Step 4: Use “Suggested follow-ups” to dig deeper

After the first response, Stoxo predicts your next question. Look for the “Suggested Follow-ups” section. These are contextual prompts, based on your original query, that allow you to explore related topics (like payout ratios or valuation multiples) with a single click.

Step 5: Optimise your prompt

If the first answer isn’t specific enough, refine it yourself. You can add timeframes such as “over the last two years” , ask for different metrics like asking to show P/E ratios or look over qualitative factors by asking “What is the market sentiment for Sun Pharma?”. This helps you find the exact data you need.

Conclusion

This guide on how to prompt in Stoxo effectively is just the beginning. The real value isn’t just in the answers you get, but in the skill you build. By learning to ask better questions, you develop a sharper analytical mindset, turning Stoxo from a simple tool into a true research partner.

FAQs

If the answer isn’t what you expected, try rephrasing your prompt. Be more specific with your terms. For example, instead of “show me big stocks,” try “list stocks with a market cap over ₹1,00,000 crore.” Being more precise almost always clarifies your intent for the AI.

No. Stoxo is a research and analysis tool, not a financial advisor. It will not provide personal advice or tell you to buy or sell. Instead, ask for the data to help you decide, such as, “What are the latest analyst ratings for TCS?” or “Analyse the key risks for TCS.”

Stoxo is designed for a continuous, conversational research flow. You can continue to ask iterative follow-up questions to dig deeper and refine your search. The “Suggested follow-ups” are just a starting point; you are encouraged to ask your own as well.

No. Stoxo is a research and analysis tool, not a predictive oracle. It analyses historical data, trends, and market sentiment to provide a factual, data-driven overview. It does not provide personal financial advice, price targets, or guarantees of future performance.

Leave a Comment