Traders today face an overwhelming problem, information overload. Market data floods in every second, from price charts to breaking news, making it nearly impossible to identify what truly matters. As a result, major opportunities often slip away in the noise. Stoxo AI solves this by using artificial intelligence to analyse massive data streams and highlight only meaningful trading signals. In fact, reports show that by the end of 2025 AI will handle almost 89% of the world’s trading volume, changing everything from high-frequency equity trading to decentralised crypto ecosystems showcasing why platforms like this matter. In this guide on Stoxo features explained, we’ll look at how Stoxo makes trading simpler and smarter.

What is Stoxo?

Stoxo, developed by StockGro, is an AI-powered stock market research tool designed for everyday investors based on data of over 35 million users of StockGro. It simplifies market research by allowing users to ask questions in plain English. Stoxo collects real-time data, tracks trends, and examines market sentiment, with insights reviewed by SEBI-registered analysts to ensure accuracy.

Stoxo Features Explained: Top 10 Must-Know

Some of the top Stoxo features explained have been given below:

- Conversational AI research

The platform operates on a natural language interface. Users can input queries (writing a prompts) in plain English to ask complex questions about market trends, specific stocks, or economic indicators. This replaces the need for traditional, complex stock screening tools or filters. Users can ask for specific data points or broad analytical summaries.

- In-depth stock analysis

The tool provides detailed, multi-faceted reports on specific stocks. When prompted, Stoxo gathers and assess data to present fundamental analysis (reviewing financial statements, P/E ratios, debt-to-equity ratios) and technical analysis (evaluating chart patterns, support/resistance levels, and moving averages). It often aggregates this into digestible formats like SWOT (Strengths, Weaknesses, Opportunities, Threats) analysis for a holistic view.

- Comparative analysis

Stoxo allows users to benchmark multiple stocks directly against each other. A user can input a prompt to evaluate two or more companies, even across different sectors, against various metrics. This comparison can include financial health, growth projections, dividend yields, or valuation multiples, offering a relative perspective.

- Market and sectoral insights

Beyond individual equities, the platform can go through broader market trends, major indices (like Nifty 50 or Sensex), or specific industries. Users can query the AI about the outlook for a sector (e.g., pharmaceuticals, IT, or renewable energy), identifying key drivers, regulatory changes, or potential headwinds affecting that industry.

- Simplified data interpretation

A major function of the platform is the translation of complex, raw financial data into understandable insights. The platform processes large volumes of market data, dense quarterly reports, and breaking news, summarising the critical points into concise, simple language. This feature is aimed specifically at retail investors who may lack specialised financial training.

- Integration with extensive data feeds

The AI is connected to extensive financial datasets, including real-time market data, historical performance records, and corporate filings. This allows it to pull relevant, current figures when formulating its answers, providing a data-backed basis for its analysis rather than relying on static information.

- Handling complex queries

The underlying large language models (LLMs) are trained on financial data to deconstruct and answer multi-part or complex financial questions. This allows the tool to handle queries that might traditionally require significant manual research across multiple sources, such as “What is the impact of the new RBI guidelines on NBFC stocks?”

- Educational function

For investors seeking to understand concepts rather than just stock specifics, Stoxo can act as an informational tool. It can define and explain complex financial ratios, break down market terminologies, or detail the implications of economic indicators, helping users build their financial literacy.

- Retail investor focus

The tool was developed with the specific needs of the growing retail investor base in mind. The design and accessibility aim to democratise access to high-level, data-intensive research tools that were historically more accessible to institutional investors or professional financial analysts.

- Component of the Stockgro ecosystem

Stoxo operates as the stock market research tool within the larger Stockgro platform. This integrates the AI tool into a broader environment that includes social investing features, expert communities, and virtual trading (paper trading) functionalities, positioning it as a research component supporting these other activities.

Using Stoxo: Simple Steps to Follow

Here are the simple steps to use Stoxo:

Step 1 Form your query: Start by defining what you need to know. This can be a specific query about a stock, a comparative question, or a broader market trend inquiry.

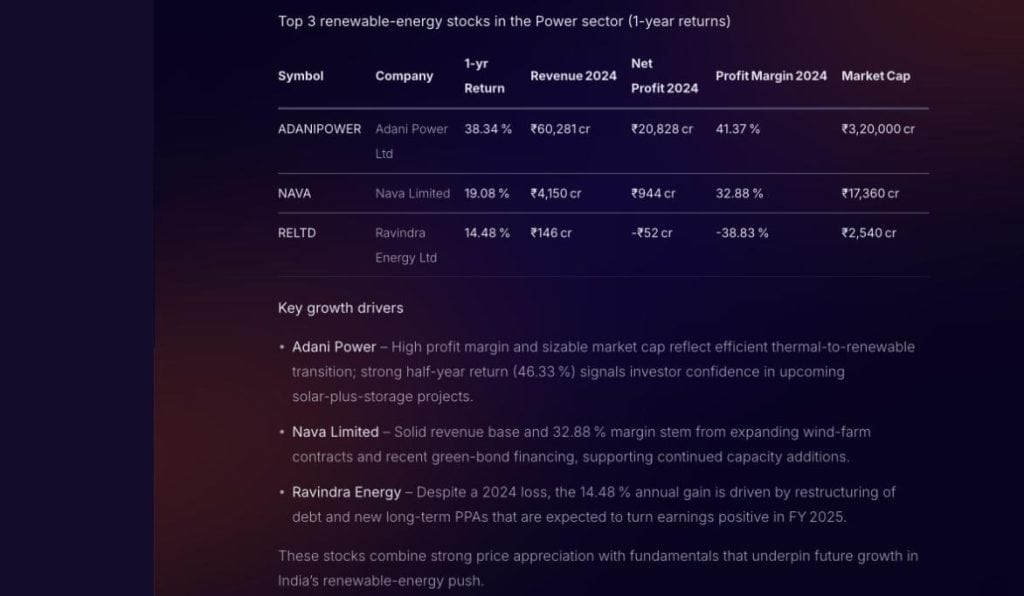

Step 2 Input your prompt: Type your question directly into the Stoxo chat interface using simple, plain English. You don’t need to know any special commands or financial codes. For example, instead of just “renewable energy best stocks” be specific to get a better answer, such as: “Identify the top 3 performing stocks in the Indian renewable energy sector based on their 1-year returns and summarise their key growth drivers.”

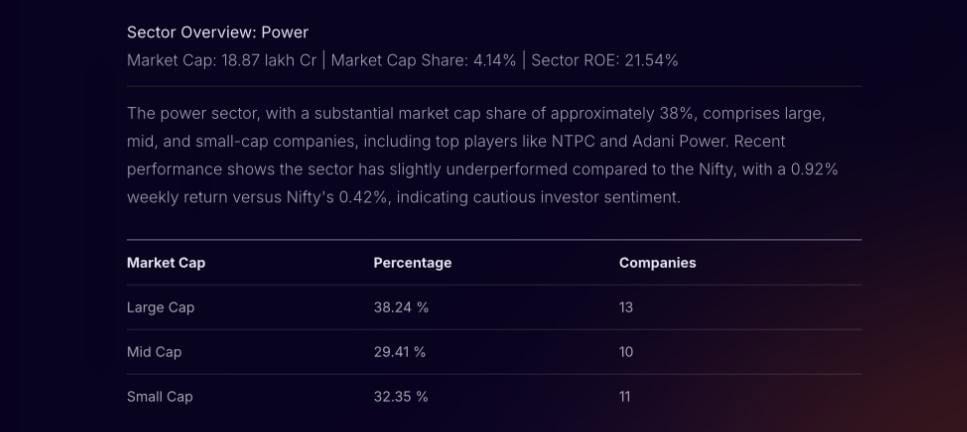

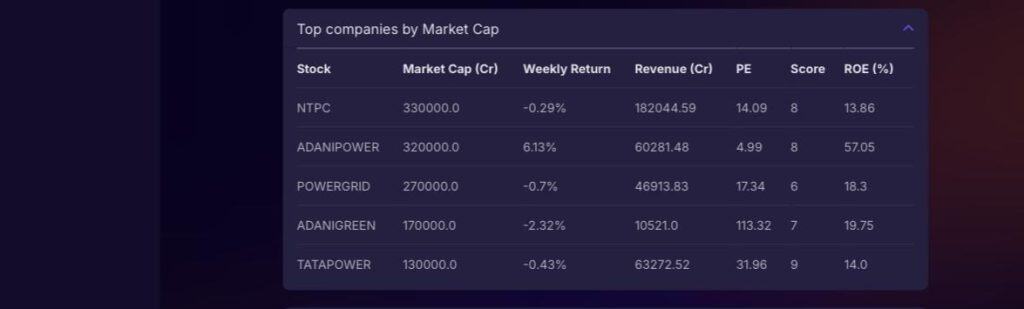

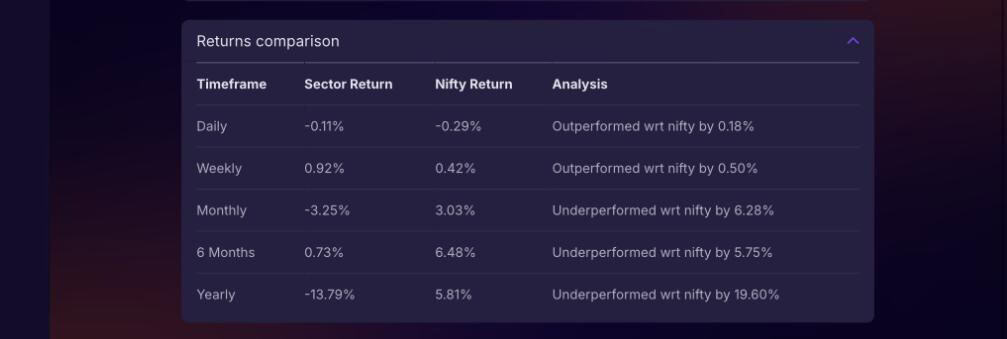

Step 3 Receive the analysis: The moment you hit enter, Stoxo’s AI begins its work. It doesn’t just search a static database. It actively queries live market data feeds for the latest prices, scans official company filings (like quarterly reports) for fundamental numbers, and breaks news and market sentiment related to your query. It synthesises all this important data, pulling everything from high-level sector overviews (like market cap share and sector ROE) to specific company fundamentals (like Revenue, P/E ratios, and Net Profit) and performance metrics (like 1-year returns and weekly returns).

Step 4 Review the response: It translates the thorough data into a simply laid down, concise, and easy-to-understand answer. For the prompt above, the platform doesn’t just list three names. It presents a comprehensive dashboard:

- It gives broader context with a sector overview.

- A returns comparison showing how the sector has performed against the Nifty over various timeframes (Daily, Weekly, Monthly, etc.).

- It delivers qualitative insights by explaining the key growth drivers for each of those top stocks.

- It provides a Top 3 table showing key metrics like 1-yr return, revenue, and profit margin.

Conclusion

As markets evolve, so must investors. Having had the core Stoxo features explained, it’s clear AI research isn’t just an option, it’s the new standard. Adapt to this change. Let intelligent automation sharpen your every investment decision and unlock your true trading potential, moving from information overload to operational insights.

FAQs

Stoxo ensures accuracy by integrating live, real-time market data, verified company reports, and insights from SEBI-registered analysts. Its AI continuously updates information, processes vast data volumes, and is designed to deliver precise, trustworthy, and timely market analysis, reducing misinformation risks.

No expertise is required to use Stoxo. Built as a retail-friendly, conversational AI, it allows users to ask questions in plain language. It simplifies technical analysis, market trends, and valuation into actionable insights, making advanced stock research accessible to beginners and experts alike.

Yes, Stoxo supports day trading by providing real-time market updates, intraday price movement analysis, and high-frequency data insights. It helps traders spot volatility-driven opportunities quickly while maintaining analytical accuracy, making it ideal for short-term and intraday trading decisions.

Analyst-backed validation means all Stoxo insights undergo review and verification by SEBI-registered market analysts. This dual-layer approach, combining AI-generated intelligence with expert validation ensures each insight is accurate, credible, and compliant with regulatory standards before reaching users for decision-making support.

Unlike general AIs, Stoxo specialises in financial data, directly integrating with live market feeds, stock metrics, and regulatory data. It offers SEBI-verified, context-specific insights, built for investor decision-making, while ChatGPT provides general information without real-time or compliance-based validation.

Leave a Comment