An investor’s life involves multiple critical decisions, such as how to build a balanced portfolio, choose between stocks and other assets, manage risk, and decide which shares to buy, sell, or hold. With numerous publicly traded companies, choosing the right one is equivalent to searching for a needle in a haystack.

That is where stock recommendations by experts come into play, providing a guiding light amidst the confusing universe of the stock market. But what are these expert recommendations, exactly, and who are the experts providing them, and how can you leverage them to your gain? This definitive guide will take you through everything you need to know about expert stock recommendations.

What are stock recommendations by experts?

Stock recommendations by experts are suggestions and analyses from investment advisors about a stock’s potential future performance. Professional investment advisors give actionable “buy,” “sell,” or “hold” recommendations on particular stocks, based on extensive analysis and research.

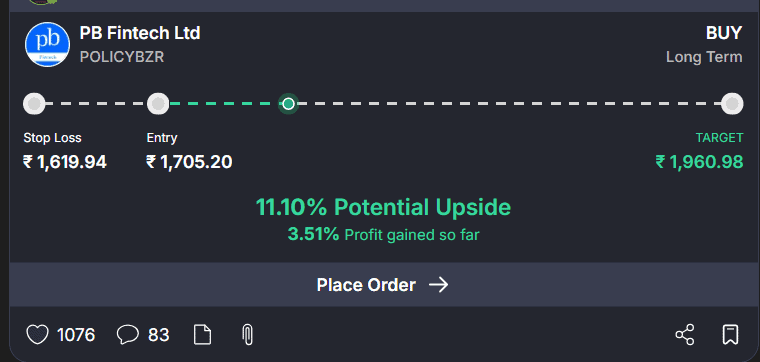

Let’s look at an example of stock recommendations by experts. As per the image above, a SEBI-registered research analyst on the Stockgro platform has given a BUY signal on PB Fintech Ltd for long term.

Who are the experts issuing recommendations?

As per SEBI regulations, only qualified and registered professionals can issue buy, sell, or hold stock recommendations. The two main types of entities/individuals authorised to give stock recommendations are SEBI Registered Investment Advisers (RIAs) and Research Analysts (RAs). This includes investment advisers, equity research analysts, brokerage houses, financial media, and independent newsletter analysts who are registered with SEBI

These organisations are known for rigorous research, using both fundamental and technical tools. Importantly, SEBI’s registration assures that recommendations are based on formal qualifications, stringent ethical standards, and a clean track record, not just popularity or commission.

How Are Buy/Sell/Hold Recommendations Created?

Experts make their recommendations based on:

- Fundamental analysis: Examine the company’s latest quarter results, conference calls, annual reports, valuation, and other fundamental variables that potentially affect the stock price.

- Technical analysis: Analyses market action (price and volume) to forecast future prices.Makes use of tools such as candlestick charts and technical indicators to spot patterns, trends, and signals

- Macro analysis: It involves assessing broad economic and political trends, such as inflation, interest rates, unemployment, and government policies, to understand their overall impact on the stock market

Top sources: brokers, platforms & newsletters

Some trusted sources of recommendations are:

| Platform | What they offer | SEBI registered? |

| Stoxo by Stockgro | AI-driven trading research, analysis, and investment services | Yes |

| StockGro | SEBI registered research analyst trading/investment advice, market reports, Technical analysis, etc | Yes |

| Motilal Oswal | Sector picks, quarterly reports, etc | Yes |

| ICICI Direct | Daily/Weekly outlooks, sector calls, etc | Yes |

| Economic Times | Fundamental and technical research, sector research, etc | Yes |

Key models of recommendations: daily picks, weekly outlooks, sectoral calls

There are several formats of expert recommendations:

- Daily picks: Intra-day quick calls on momentum stocks or news-based ideas.

- Weekly outlooks: Broader views on industries and market indices, suitable for short-term portfolios.

- Sectoral calls: In-depth exploration of high-conviction sector trends based on quarterly reports or policy shifts. For example, recently, due to GST rate cuts, a lot of brokerages/analysts have given a BUY signal on the Consumption & FMCG stocks.

Each model fulfills a distinct investor requirement. Daily picks are appropriate for active traders, whereas sectoral and weekly picks are more suitable for those creating portfolios of medium to longer duration.

Risks and limitations of expert stock picks

Even seasoned investment advisor recommendations have limitations because of:

- Unexpected market events: Policy changes, international crises, or black swan events.

- Optimistic projections: At times, analysts overestimate management commitments or overlook competition.

- Conflicting interests: Recommendations may benefit the broker’s business or commissions, in spite of SEBI’s prohibition.

- No “guarantees”: The Stock market continues to be volatile, and loss is always likely, even if there is expert advice.

Always view expert recommendations as educated guesses.

How to evaluate analyst credibility (TipRanks, consensus, track record)

Reliability is key. The following factors will help you evaluate an analyst’s credibility:

- Track record: Sites such as TipRanks compile and use artificial intelligence to analyse and rank investment advice from financial experts.

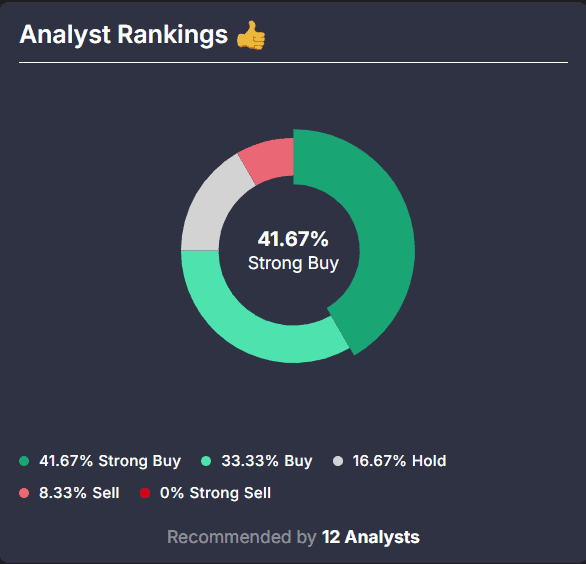

- Consensus ratings: Consensus refers to the majority view among multiple experts. High consensus indicates idea strength. You can also check the consensus ratings on a stock in the StockGro platform by selecting a stock. For example, below we have selected Ajanta Pharma Ltd stock, and the majority of analysts are giving it a BUY signal(6th Oct 2025).

- Transparency: Compare analysts’ reasoning, past picks, published reports, and risk disclosures.

- SEBI registration: Double-check analyst registration using SEBI’s website for legal compliance.

Case Studies: Recent Expert Picks

Let’s look at some real expert picks available on the StockGro platform.

| Stock Name | Entry Price (₹) | Target Price (₹) | Stop Loss (₹) | Time Frame | Potential Upside (%) |

| Va Tech Wabag Ltd | 1,406 | 1,476.30 | – | Short Term | 4.93 |

| Sun TV Network Ltd | 583.5 | 643.37 | – | Medium Term | 10.21 |

| Ajanta Pharma Ltd | 2,468 | 2,714.80 | 2,369.28 | Medium Term | 10.39 |

How to use expert picks in your portfolio (strategy & caution)

Here’s how amateur investors can efficiently take advantage of expert picks

- Never blindly copy: Use picks as research starting points, but always check original reports and reasons.

- Diversify: Choose stocks in different industries to minimise risk. Don’t place all your eggs in the same basket.

- Match to goals: Coordinate buys/sells along your time frame and appetite for risk.

- Quarterly portfolio monitoring: Rebalance positions according to fresh expert recommendations, firm announcements, and industry developments.

Seek SEBI-registered advisors/platforms for additional safety.

Stock Recommendations by AI vs. Experts – What’s the Difference?

AI takes advantage of massive databases and algorithms for real-time indications, usually free from human prejudice. Human specialists introduce context through company interactions, management calls, and sector experience.

Most brokers employ stock market AI complemented with human research teams, presenting hybrid models. AI tools are excellent for screening, pattern recognition, and quick updates. Expert advisors are still useful for reading grey areas, e.g., new products or regulation changes. Use both ideally for well-informed decision-making

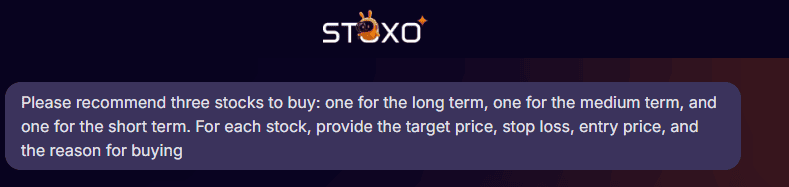

Stoxo by Stockgro offers an AI-based platform where you can connect & grow along with SEBI-registered investment advisors & analysts. Here you can also use stock market AI to do research & investing. A single platform for learning, receiving legitimate advice, and creating real-life strategies. In the previous section, let’s look at an example of stock recommendations by Stock market AI. We use a customised prompt to ask the AI for stocks to invest in short, medium & long term.

The following are the results. You can refine the result by asking more logical & in-depth questions. Stoxo provides details of different stock recommendations based on its own AI-driven research and analysis.

Conclusion

Expert stock recommendations can be a helpful guide when filtering stocks & deciding which stocks to buy/sell, or hold. But remember, these tips aren’t magic. It’s important to use them as a starting point, do your own research, and make sure they fit your goals and risk comfort. Use expert advice, an AI research tool & other information to make decisions, keep your portfolio spread across different sectors, and don’t be afraid to ask questions.

FAQs

Buy indicates that analysts think the price of the stock will increase. Sell indicates the price will decrease, and you should sell. Hold indicates hold your existing position, don’t buy more, don’t sell, because the stock should behave in line with the market.

Analyst forecasts get modified whenever fresh data comes out, usually after quarterly earnings, significant announcements, or market fluctuations. Some analysts update monthly, quarterly, while others update only after major events.

Major risks are conflicts of interest (analysts favor their firm’s clients), herd behavior causing identical recommendations, timing risk (recommendations being delayed versus market movement), and overconfidence. SEBI cautions that retail investors lose money by following tips blindly without knowledge of underlying risks or by doing independent research.

Key platforms are StockXo, Stockgro, TipRanks, Bloomberg Terminal, Reuters-Refinitiv, Economic Times recommendations page, and brokerage websites.

Expert advice must complement, but not substitute, your own research. Utilize them as points of departure for research. Always cross-check the analyst’s record, figure out the reasoning behind recommendations, and do your own research.

Verify their SEBI status, analyse past track record through sites such as TipRanks, review the rationale behind recommendations (in-depth reports vs general tips), ensure independence from conflicts of interest, search for a consistent approach, and compare success rates with peers. Disclosures must be transparent.

Leave a Comment