What are short-term stock recommendations?

Short-term stock recommendations can help capture quick opportunities driven by price momentum, earnings catalysts, and strong liquidity,etc. The trick is to employ disciplined criteria (technicals, volumes, catalysts), set targets/stop-losses, limit risk per trade, and have these suggestions conform to an overall long-term strategy. This guide outlines how professionals select short-term trades, identifies top picks this week, illustrates how AI (such as Stoxo) can bring up ideas, and provides guardrails so that retail investors can act safely.

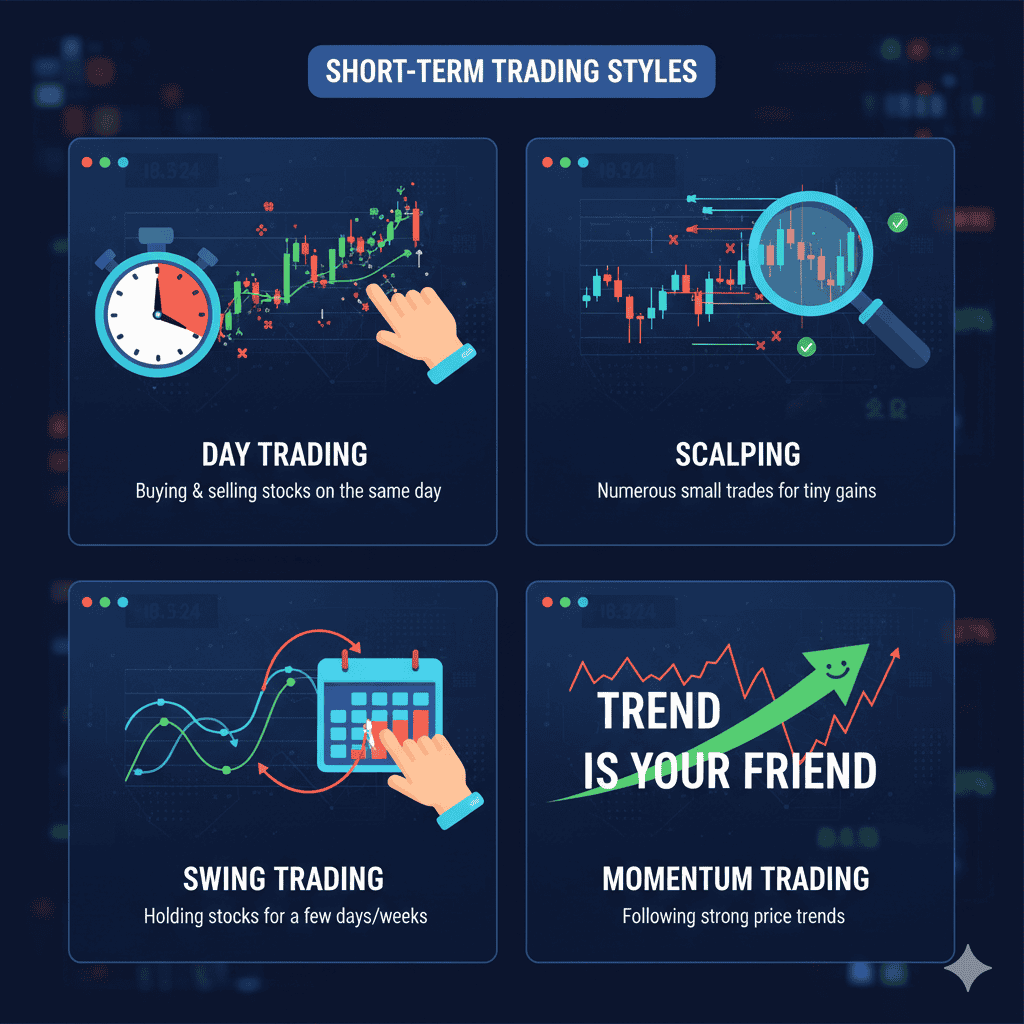

Types of short-term trades

There are various short term trading styles but major ones are listed below:

- Day Trading: It involves buying and selling stocks on the same day. This type of trading requires a lot of time, focus, and the ability to handle risks. It is also called Intraday trading.

- Scalping: This style includes holding the positions for only a few seconds or minutes and seeking to accumulate many small profits that, over time, can add up to a significant amount. It is a high-frequency trading strategy.

- Swing Trading: This method involves holding onto stocks for a few days or weeks to profit from short-term price changes.

- Momentum Trading : This trading style involves making profit from assets that are moving strongly in one direction. Here traders only follows the trend & is obedient to the famous rule “Trend is your friend”

Key criteria analysts Use

Major analysts go through various criteria for filtering short term picks.Various criteria used are mentioned below.

- Technical analysis : This forms the foundation of short term trading ideas.It is a method of studying and forecasting price movements in financial markets utilizing historical price charts and market data. It is founded on the concept that if a trader can recognize historical market trends, they may reasonably anticipate future price trajectories.

- Liquidity : It ensures execution quality through higher average daily turnover, tight bid-ask spreads, and sufficient market depth to avoid slippage during volatile sessions.

- Catalyst : Catalyst such as earnings announcements, monthly sales data, regulatory approvals,sectoral developments or any other macro/micro change can accelerate price moves within defined timeframes

- Candlestick patterns : They offer visual confirmation of market psychology and potential reversals. There are various candlestick patterns, like single candlestick patterns(like hammer, shooting star, and doji) and Multi-candlestick patterns (bullish/bearish engulfing and morning/evening star)

- Sector rotation analysis : This style identifies which industry groups are receiving capital flows. Strong sectors often see multiple stocks participating in moves, while weak sectors can drag down even fundamentally sound companies.

- Options activity : It provides additional insight into institutional sentiment and potential price targets. Unusual option volumes, especially in out-of-the-money puts or calls, may indicate informed positioning before events. Steep open interest at certain strike prices tends to function as support/resistance levels during expiry weeks.

- News sentiment analysis : It uses machine learning to gauge the tone of recent corporate announcements, media coverage, and analyst reports. Positive sentiment often precedes price appreciation, while negative sentiment can signal upcoming weakness.

- Institutional activity tracking : This style monitors bulk deals, block deals, and foreign institutional investor (FII) flows. Large institutional buying often provides price support and indicates confidence in near-term prospects, while institutional selling can create headwinds.

Popular expert picks this week

Here are the latest short-term stock picks recommended by experts this week:

- Hindustan ZInc (Buy)

- Entry: ₹490

- Target: ₹530

- Stop-loss: ₹468

- Reason: A 16 month sloping trendline breakout has been witnessed last week on the counter on daily and weekly charts. A retest has been made on the same line.Upmove for another 7-10% is possible given the sectoral strong performance.

- Amber Enterprises India (Buy)

- Entry: ₹8,239

- Target: ₹9,050

- Stop-loss: ₹7,960

- Reason: This stock has given a breakout above a cup and handle pattern on weekly charts. It has also retested the breakout levels. Fresh momentum for an 8-10% rally is expected.

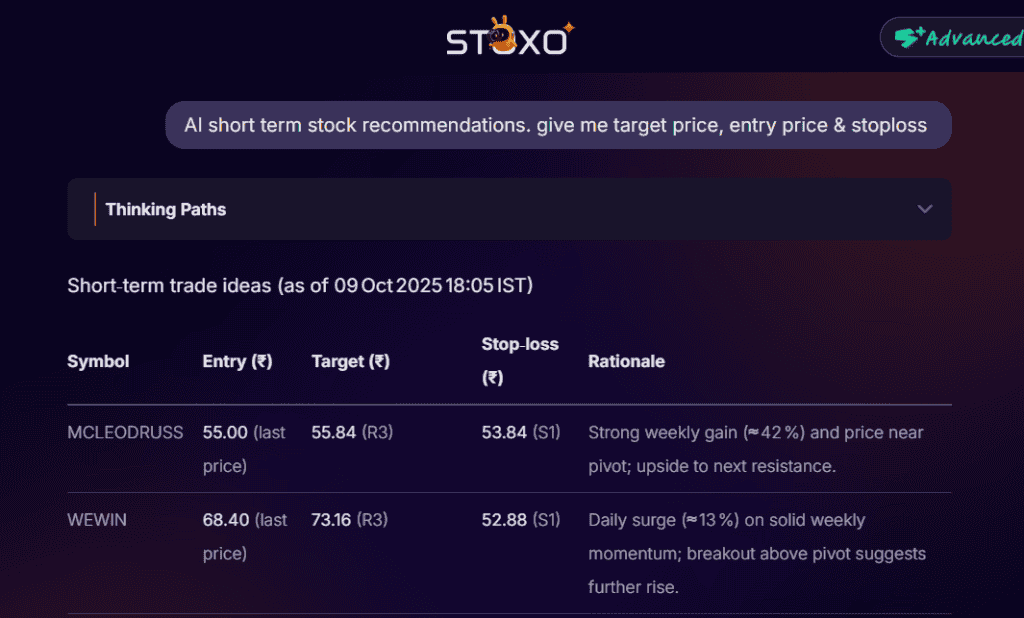

AI-driven short-term stock recommendations via Stoxo

Filtering stocks for short-term trading is a cumbersome and multi-layered process that can be very time-consuming. This is where stock recommendations by AI come in handy. AI models can scan wide market data and rank short-term opportunities faster than manual screening.

Stoxo, available on StockGro, is designed to empower short & long-term decisions through real-time trend analysis, precise stock comparisons,short-term ideas, compare short-term picks, review stock technicals, and validate with expert portfolios,etc. All of this is useful for entry & exit points along with risk monitoring.

Let’s look for some AI short term stock recommendations by asking a question to Stoxo

Stoxo AI has recommended 2 stocks as shown above in the image. This is the starting point of any analysis; you need to ask further questions & fine-tune your output.

How to evaluate short-term picks (target, stop-loss, time horizon)

First, you need to decide the time horizon to filter the short term stock picks.

- For Intraday Trades: Use VWAP (Volume-Weighted Average Price) , Today’s and previous day’s high/low, and risk-reward of at least 1:2.

- For swing/momentum trades : Track the average price of an asset over a specific period to identify overall trends. A stock consistently above its moving average suggests an uptrend, while a drop below may signal a downtrend.

Once you have decided to buy a stock based on your analysis, the major thing is to consider risk management.

- Strict Stop-Loss : Set strict stop loss orders to sell an asset, if it drops below a specified price, cutting down losses and keeping capital intact.

- Risk Tolerance: Recognize your own risk tolerance and establish maximum & minimum risk boundaries on every trade to safeguard your total capital.

- Discipline: Always follow a pre-planned trading strategy and refrain from emotional, impulsive choices, leading to avoidable losses.

Risks and limitations of short-term trading

Short-term trading faces various risks as mentioned below

- High Volatility : Short term investments are very much sensitive to market fluctation and require correct timing for entry and exits

- Leverage risk : when the position is highly leveraged, then there is very little room for error.

- Psychological stress: Short term investing/trading demands constant market monitoring and quick decision-making under pressure.

- Higher capital gains tax : Profits from short term trades are taxed higher in India as compared to long term trades.

The repeated buying and selling incur greater transaction costs. Such costs can easily erode returns and even exceed gains, making short-term trading an expensive activity compared to long-term investing. Additionally, when following short-term investment recommendations, conduct your own analysis first.

Overtrading and moving stop losses are two universal behavioral traps. Binding risk limits, following event calendars, and not trading in illiquid stocks are key to maintaining capital in bad sessions.

How to incorporate short-term picks into your broader strategy

To integrate short-term selection into a long-term investment plan, you will first need to establish distinct roles for each strategy, control risk, and diversify the portfolio. One way to do this is to employ a “core and satellite” strategy, whereby a core of long-term investments is complemented with a smaller, actively managed segment that incorporates short-term opportunities.

Conclusion

At the end of the day, short-term trading isn’t about finding a secret formula or a guaranteed hot pick. It’s a game of discipline. The expert recommendations and AI tools mentioned in this guide are excellent for finding potential opportunities, but they are just the starting point. They can’t manage the trade for you.

Your real job as a trader is to be a ruthless risk manager. The success of your strategy will be defined not by your winning trades, but by how effectively you cut your losing ones. A firm stop-loss that you actually stick to is the single most important tool you have. It’s what separates consistent traders from gamblers who eventually wipe out their accounts.

FAQ

Those stocks that show strong momentum, high liquidity,high volume, and near-term catalysts. Focus on sector leaders in weeks when their sector is outperforming, and use strict targets and stops.

Experts often use one or combine different styles as discussed above to get a short-term trading entry & exit signal.They do in-depth analysis by combining technical analysis,candlestick patterns, liquidity, earnings update, sector updates,etc

Moving averages (like 20 or 50 period Exponential Moving Average) reveal average prices within a time frame to help determine trends. RSI (Relative Strength Index) and MACD (Moving Average Convergence Divergence) reflect momentum. VWAP (Volume Weighted Average Price) is applied to the intraday price context, and ATR (Average True Range) quantifies price volatility to assist in stop-loss level sizing.

The risk involved is high. As sudden news, volatility spikes, and slippage can cause quick losses. Risk small per trade, honor stop-losses, and avoid illiquid counters.

Yes. AI can scan prices, volumes, options, and news to flag candidates. Also, it consumes less time as compared to human analysis. Use it as an assistant. still verify levels and manage risk.

Only with strict risk controls & position sizing, short-term stock picks are good for beginners. Start small, practice paper trading, focus on liquid large caps, and avoid event-heavy days until confident.

Leave a Comment