In the world of finance where everyone wants big returns without investing too much time, it’s hardly a surprise that there’s an entire trading strategy aimed at doing just that.

Swing trading is a game of intricacies, quick decisions, and of course, possibly big rewards. At its core, swing trading takes advantage of short-term to medium-term price fluctuations in the market.

While it does offer something without taking much, it’s not everyone’s cup of tea and is far from being a one-size-fits-all endeavour. Swing trading takes time, effort, and experience to master.

In this article, we’re going to delve into what is swing trading, explore what it is, how the strategies work, and whether you can actually make money from it. Whether you’re a beginner trader looking to learn new things or a professional looking to brush up on your skills, this article has something for everyone.

What is swing trading?

So, What is Swing Trading? Swing trading uses technical analysis (and sometimes fundamental analysis) to profit from short to medium-term price movements. This means that swing traders only pick stocks that they predict will show significant appreciation or dips in the next few weeks.

You may also like: What is insider trading in the stock market?

Traders lose money if they invest more than they can afford.

How Does Swing Trading Work

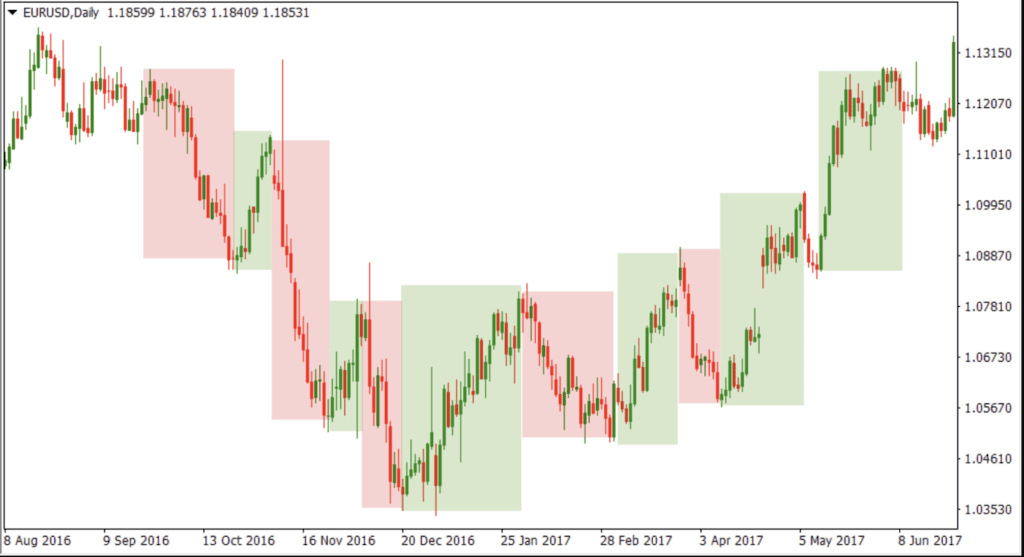

Swing trading involves entering either a long or short position typically for a few weeks or a couple of months. While this is the general time frame for such trades, some may last more in exceptional circumstances.

The objective of a swing trade is not to wait necessarily for this time period to see profits. Rather, it is to capture and profit from a bulk price movement in a stock no matter when it occurs.

This could be done in two ways – either by taking multiple trades in volatile stocks that move a lot during the time frame, or secondly, by identifying a significant movement well in advance, entering the position, and hoping that the move materialises.

Most swing experts advise traders not to stay invested in a position for too long hoping to capture the entire movement. Since it is very hard to accurately time the market, it is a good practice to use stop losses appropriately and have return goals to make sure you’re not getting greedy.

Choosing Stocks to Swing Trade

Just like with any other trading strategy, the first step is to pick the right stocks. There are mainly two metrics that experts consider when picking a stock to swing trade: volatility and liquidity.

- Volatility is how much the stock price fluctuates in a given time period. While excess volatility does no one any good, a stable stock will not provide swing opportunities. Stocks that are moderately volatile are ideal for swing trading purposes.

- Liquidity is how easily you can sell or buy a stock at a given price in the market. Liquidity is important to make sure you’re entering and exiting the position at the right prices. If your orders don’t get filled at the right time, you could be losing money.

Also Read: How safe is it to trade in the dabba market? All about dabba trading

Considering the above criteria, large-cap stocks are pretty much your best bets when trying to take a swing trade. They usually have high transaction volumes and liquidity in active markets. However, note that the larger the stock, the harder it is to move and reasonably, the less volatile it’ll be.

Choosing the right stock to swing trade is balancing the two metrics – volatility and liquidity. This means that you need to choose stocks that have enough transaction volumes to fill your orders, but also ones that have enough volatility to offer you opportunities in the first place.

Best Indicators for Swing Trading

Now you know what is swing trading, let’s see the indicators that can help you.

Swing trading is a great way to take advantage of short- to medium-term price changes in the market. In order to succeed with this strategy, It is important to utilize the appropriate indicators. We start by listing some of the indicators that are best suited for enhancing your swing trading skills:

- Moving Averages (MA): Both simple moving averages (SMA) and exponential moving averages (EMA) assist traders in trend and reversal identification. Crossovers between shorter-term and greater-term MAs can suggest possible entry or exit points.

- Relative Strength Index (RSI): RSI is used to gauge the velocity and the change in price trends. A high RSI level of 70 shows overbought conditions while a low level below 30 suggests oversold conditions thus indicating possible reversals.

- MACD (Moving Average Convergence Divergence): This indicator shows the relationship between two moving averages of a security’s price. MACD crossovers, along with divergence from price action, can provide insights into potential trend changes.

- Bollinger Bands: These consist of a middle band (SMA) and two outer bands that represent price volatility. Prices touching the upper band may indicate overbought conditions, while those hitting the lower band may suggest oversold conditions.

- Fibonacci Retracement Levels: These levels help identify potential support and resistance areas. Swing traders often look for price reactions around these levels to make informed trading decisions.

Strategies for Swing Trading

Swing trading offers a great opportunity to take advantage of price fluctuations without excessive time spent on the screen. We will now discuss some important tips that can assist you in understanding what is swing trading and and efficiently enhancing your trading capabilities:

1. Trend Following

Trend following focuses on recognizing a trend that is already in motion and trading in its direction. Use indicators such as moving averages or trendlines to help identify entry and exit points. If trades are made in the direction of the trend further success is likely.

2. Support and Resistance Levels

Support and resistance levels can be defined as the price levels on a chart that indicates price reversal zones. If you identify such levels, you are able to make decisions based on evidence. These prices should be key to your entry or exit decisions since reversals of the trend or breakouts are more likely to occur.

3. Momentum Trading

Momentum trading focuses on stocks exhibiting strong price movements. Indicators like the Relative Strength Index (RSI) or Moving Average Convergence Divergence (MACD) can help you identify stocks with significant momentum. Enter trades when momentum is strong, increasing your chances of profiting.

4. Swing Highs and Lows

Monitor swing highs and lows to identify potential reversal points. Enter trades when the price breaks above a swing high or below a swing low. This strategy helps you capture price movements while managing risk.

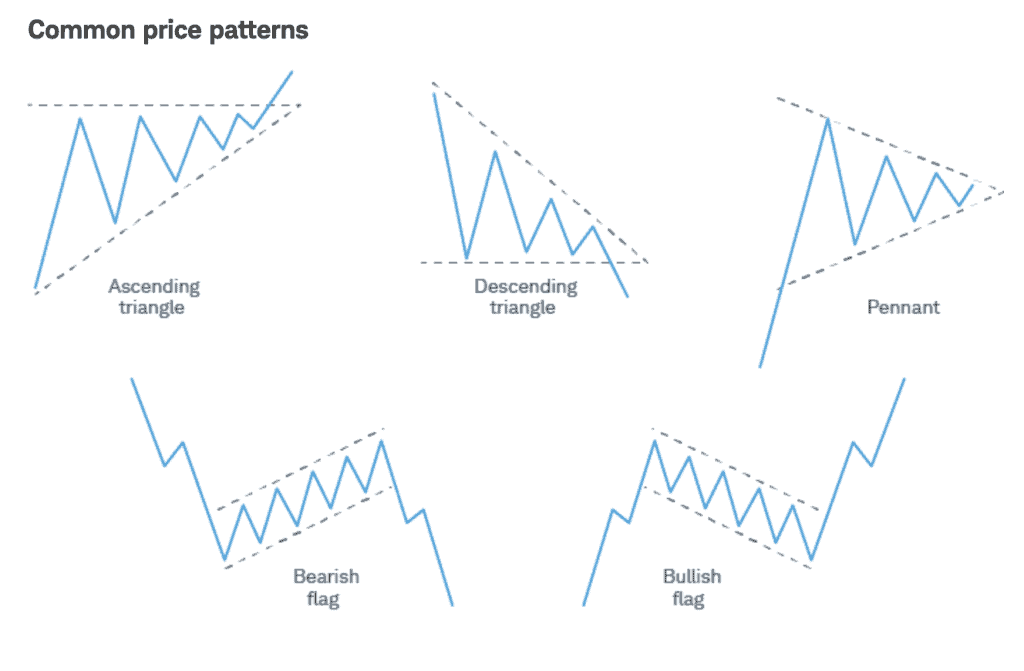

5. Chart Patterns

Familiarize yourself with common chart patterns such as head and shoulders or triangles. These patterns can signal potential price movements, providing opportunities for entering or exiting trades.

6. Risk Management

Effective risk management is crucial in swing trading. Use stop-loss orders to protect your capital and maintain a favorable risk-to-reward ratio to enhance your trading strategy.

7. Time Frame Selection

Choose a time frame that suits your trading style, whether daily, weekly, or intraday charts. This allows you to spot the best swing opportunities and align your trading approach accordingly.

The pros and cons of swing trading

Pros

- You could make decent money – Since swing trading involves capitalising on short-term trades, you could make a decent return without holding up your capital for too long.

- Reduced transaction costs and brokerage – Compared to day trading, swing trading usually involves lower transaction costs and brokerage, since traders don’t execute several trades within the same trading session.

- Time – Swing traders can work outside trading hours to research and manage their positions, which gives them more time to conduct due diligence than day traders who mostly have to analyse and place bets in real time.

- Low stress – This variety of trading is usually low stress, which means that it is suitable for full-time professionals who don’t have too much time.

Cons

- Exposed to market risks – Stocks in the short and long-term are exposed to extra market risks like price dips due to negative events, or action on the weekends.

- Low diversification – By focusing solely on one swing trade for a period of 6-8 weeks likely leads to low diversification. A portfolio consisting only of swing trades could be overexposed to market volatility.

- Limited exit potential – Since swing trades predict specific price action and account for losses only through stop loss orders, traders can oftentimes find it hard to exit without having to bear losses.

Day Trading vs Swing Trading

Are you interested in exploring different ways to trade in the stock market? You already have learned what is swing trading. If you want to take advantage of quick price changes or prefer a more relaxed approach, knowing the differences between day trading and swing trading can help you make better choices. Let’s look at the key differences to see which style might work best for you.

| Day Trading | Swing Trading | |

| Duration | Positions held for minutes to hours | Positions held for days to weeks |

| Frequency of Trades | High frequency (multiple trades daily) | Fewer trades (a few per week) |

| Time Commitment | Requires full-time attention | More flexible; can be part-time |

| Market Analysis | Relies on technical analysis | Combines technical and fundamental analysis |

| Profit Potential | Smaller profits per trade, but high volume | Larger profits per trade, less volume |

| Risk Management | Quick adjustments required | Longer-term strategies with stops |

| Tools Needed | Real-time data, advanced trading tools | Charts and broader market analysis |

Day trading involves buying and selling securities within the same trading day, aiming for quick profits. Traders capitalize on small price fluctuations, often executing multiple trades throughout the day. This approach requires a keen understanding of market trends, technical analysis, and quick decision-making skills.

In contrast, swing trading focuses on capturing price movements over several days or weeks. Swing traders analyze both technical indicators and fundamental factors, seeking to profit from more significant price swings. This method allows traders to be less reactive to market noise and gives them more time to plan and strategize their trades.

In the end, choosing between day trading and swing trading comes down to how much risk you can handle, how much time you want to spend trading, and what style suits you best. Each option has its own benefits and challenges, so it’s important to pick a strategy that matches your financial goals.

Things to keep in mind

Swing trading, like we noted above, is mostly about noticing and capitalising on upcoming price action. These analyses and predictions could be made with technical analysis by identifying common price patterns, understanding volume, and gauging market sentiment.

However, sometimes, strategies can also go haywire. Swing trading is a specialised skill. It’s not something that is suitable for every investor and their individual investing goals. You must remember that it’s one thing to know what a chart is, but it’s another to know how to read it.

Also Read: What is BTST trading?

You don’t know what you don’t know

Traders must also remember that although trading tools like buy-and-sell orders, trading volume, and other data points may provide you with information that could formulate winning strategies, there are too many unknowns and moving parts.

While you might be absolutely spot-on with your trade prediction, one piece of breaking news could ruin the impending pattern for months.

Hence, we encourage you to do your own research before you decide to indulge in swing trading. Make sure you have the risk appetite and capital to learn by doing. Until then, we wish you the best of luck!