In the rapidly evolving Indian lending landscape, agility, digitization, and retail granularity are defining winners. One company undergoing a strategic pivot in line with this vision is L&T Finance Holdings Ltd. Once a diversified lender with exposure to infrastructure and wholesale finance, L&T Finance is now on a path to becoming a pure-play, retail-focused NBFC. Backed by the brand strength of the L&T Group and a disciplined capital allocation approach, the company is reinventing itself for a high-growth, low-volatility future.

But does L&T Finance offer a compelling case for long-term investors? Let’s delve deeper.

Stock overview

| Ticker | LTF |

| Industry/Sector | Financial Services (NBFC) |

| CMP | 207.85 |

| Market Cap (₹ Cr.) | 51,915 |

| P/E | 19.41 (Vs Industry P/E of 21.67) |

| 52 W High/Low | 211.20 / 129.20 |

| EPS (TTM) | 10.59 |

| Dividend Yield | 1.32% |

About L&T Finance

Established in 1994 and headquartered in Mumbai, L&T Finance Holdings Ltd. (LTFH) is a leading NBFC in India. It operates under the umbrella of the Larsen & Toubro (L&T) Group – one of India’s most respected conglomerates.

Originally offering a wide suite of loans across infrastructure, real estate, and retail, the company announced a major strategic transformation in FY22: an exit from wholesale and infrastructure lending to focus solely on retail businesses. The result is a more focused, scalable, and sustainable financial services platform targeting underserved retail borrowers in Tier 2/3 India.

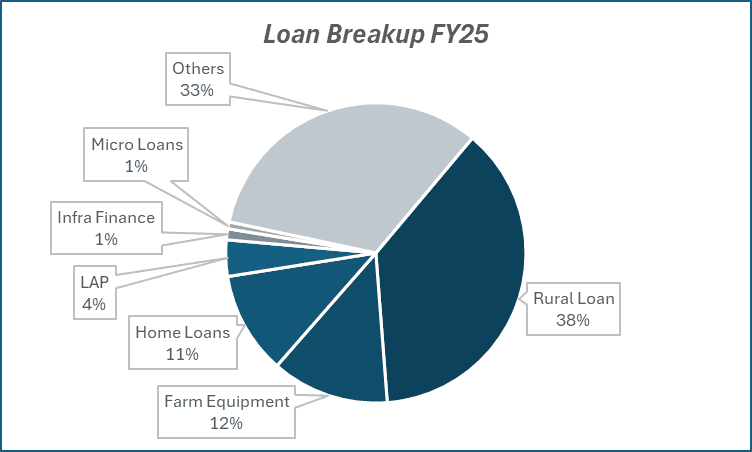

Key business segments

L&T Finance operates primarily in the following key business segments:

- Rural Finance – Two-wheeler loans, micro loans (JLG), and farm equipment finance; core to rural credit inclusion.

- Retail Housing & LAP – Affordable home loans and loans against property targeting salaried and self-employed segments.

- Consumer Loans – Personal and small-ticket loans offered digitally across segments.

- Infra & Wholesale Lending (Exiting) – Legacy book being run down as part of the portfolio rebalancing.

Primary growth factors for L&T Finance

L&T Finance key growth drivers:

- Revitalization Strategy: Shift toward retail lending (~90% of book as of FY25), driving stability and growth.

- Digital-First Lending Model: Strong tech platform supports faster disbursals, analytics-led underwriting, and better customer experience.

- Tier 2/3 Focus: Underserved and high-growth markets form the core target, helping boost penetration and yields.

- Strong Parentage & Access to Capital: Backing from L&T Group ensures funding comfort and governance trust.

- Cost Efficiency: Digitization and scale have improved opex ratios and operational leverage.

Detailed competition analysis for L&T Finance

Key financial metrics – Q4 FY25;

| Company | Revenue(₹ Cr.) | Net Interest Margin (%) | Cost of Borrowing (%) | CRAR Ratio(%) | PAT Margin (%) | P/E (TTM) |

| L&T Finance | 4022.92 | 8.15% | 7.84% | 22.27% | 15.81% | 19.41 |

| Aditya Birla Capital | 12214.04 | 6.07% | 7.70% | 18.22% | 5.66% | 21.52 |

| Shriram Finance | 11454.23 | 8.25% | 8.80% | 20.66% | 18.68% | 13.31 |

| Muthoot Finance | 5621.75 | 11.27% | 8.70% | 23.71% | 25.68% | 20.05 |

| SBI Cards | 4673.95 | 11.20% | 7.20% | 22.90% | 11.43% | 45.21 |

Key insights on L&T Finance

- The company disbursed ~₹67,000 crore in FY25, with ~85–90% coming from retail products – a successful execution of its new vision.

- Net Interest Margins (NIMs) have expanded steadily, reflecting the higher-yielding nature of the retail book.

- GNPA/NNPA has improved post exit from infra/wholesale, now stabilizing below 3%/1% respectively.

- LTFH’s Return on Equity (RoE) has begun to rise again, with guidance toward 15%+ over the medium term.

- L&T Finance has maintained AAA credit rating, aiding in low-cost borrowing and liquidity flexibility.

Recent financial performance of L&T Finance for Q4 FY25

| Metric | Q4 FY24 | Q3 FY25 | Q4 FY25 | QoQ Growth (%) | YoY Growth (%) |

| Revenue (₹ Cr.) | 3670.30 | 4097.58 | 4022.92 | -1.82% | 9.61% |

| EBITDA (₹ Cr.) | 2051.22 | 2421.78 | 2442.03 | 0.84% | 19.05% |

| EBITDA Margin (%) | 55.89% | 59.10% | 60.70% | 160 bps | 481 bps |

| PAT (₹ Cr.) | 553.02 | 625.65 | 635.84 | 1.63% | 14.98% |

| PAT Margin (%) | 15.07% | 15.27% | 15.81% | 54 bps | 74 bps |

| Adjusted EPS (₹) | 2.23 | 2.51 | 2.55 | 1.59% | 14.35% |

L&T Finance financial update (Q4 FY25)

Financial performance

- Revenue up 9.6% YoY to ₹4,023 crore; FY25 revenue grew 17.3% to ₹15,924 crore.

- PAT rose 15% YoY to ₹636 crore in Q4; FY25 PAT up 14.1% to ₹2,643 crore.

- NIM dropped to 8.15% due to loan mix; ROA at 2.22%.

- Loan book grew 14% YoY to ₹97,762 crore; CRAR at 22.3%.

Business highlights

- Retail loans up 19% YoY; SME +67%, Personal +34%, Home +32%.

- Disbursements down 3% YoY amid cautious stance in MFI and rural.

- Expanded to 25,401 new villages; added 5.2 lakh customers.

- Acquired gold loan business; micro-LAP scaled to 6 states.

- Asset quality GS-3 at 3.29%, NS-3 steady at 0.97%.

- Retail asset quality stable; provision coverage at 71% (retail: 73%).

- Collection impacted in Karnataka; improved customer leverage profile.

Outlook

- FY26 loan growth guidance: ~20%.

- MFI and 2W loans to grow 10–20%; NIM+Fee: 10–10.5%.

- Credit cost: 2.3–2.5%; ROA: 2.4–2.5%.

- AI-based underwriting to roll out in Q2 FY26.

Recent Updates on L&T Finance

- Acquisition of gold‑loan portfolio: L&T Finance recently announced the acquisition of Paul Merchants Finance’s gold‑loan business (~₹700 crore), aiming to diversify its asset mix and tap into secured lending growth.

- Retail disbursement trends: While total retail lending grew 19% YoY, Q4 saw a slight 1% YoY dip in disbursements to ₹14,899 crore, reflecting a calibrated lending stance.

- Stock Update: Despite strong Q4 earnings, L&T Finance saw a brief dip (~4–8%) on mixed disbursement trends. However, the stock has since rebounded, trading near ₹205–207 – close to its 52-week high – up ~8% in the past month.

Company valuation insights – L&T Finance

L&T Finance is currently trading at a P/B of 2.1x, reflecting growing investor confidence in its retail transformation and improving profitability metrics. Over the last year, the stock has delivered an 11.8% return, outperforming the broader market (Nifty 50 return: 4.7%), supported by strong retail disbursement growth, expanding customer base, and enhanced risk management practices.

The company is executing a strategic pivot toward high-quality retail lending, backed by technology-driven underwriting, calibrated expansion in rural and MFI portfolios, and rising traction in personal, home, and SME loans. With credit costs expected to moderate from H2FY26 and collection efficiency normalizing, return ratios are poised to improve steadily, driving earnings growth.

Applying a 2× multiple to the FY27E BVPS of ₹125, we arrive at a 12-month target price of ₹250, implying ~20% upside from current levels. A shorter-term target of ₹230 suggests an 11% potential upside over three months, driven by improving visibility on margins, normalized credit costs, and momentum in secured loan segments.

Major risk factors affecting L&T Finance

- Execution Risks: Rapid retail expansion brings underwriting challenges, especially in unsecured products.

- Macroeconomic Sensitivity: Rural income shocks, inflation, or monsoon failure could impact asset quality.

- Competitive Intensity: Fintechs and banks aggressively entering rural lending and digital personal loans.

- Transition Risks: While largely complete, delays or stress from the wholesale book wind-down may still impact near-term numbers.

Technical analysis of L&T Finance share

L&T Finance has recently completed a bullish cup and handle pattern, breaking out above the neckline and gaining ~5% since – indicating strong breakout confirmation. The stock has marked a fresh 52-week high and is trading well above its 50-day, 100-day, and 200-day EMAs, reinforcing its upward momentum and signaling a potential trend continuation.

The MACD remains positive at 7.38, with the MACD line comfortably above the signal line, confirming sustained bullish momentum. An RSI of 68.32 reflects strong buying interest, while Relative RSI readings of 0.08 (21-day) and 0.19 (55-day) indicate consistent outperformance versus the broader market. A firm ADX reading of 33.72 supports the presence of a strong trend, adding further conviction to the setup.

A break above ₹230 could unlock further upside toward ₹250, while ₹190 remains a key support level for trend validation.

- RSI: 68.32 (Strong Buying Interest)

- ADX: 33.72 (Strong Trend)

- MACD: 7.38 (Positive)

- Resistance: ₹230

- Support: ₹190

L&T Finance stock recommendation

Current Stance: Buy, with a 3-month target of ₹230 (~11% upside) and a 12-month target of ₹250 (~20% upside) based on 2× our FY27E BVPS estimate of ₹125.

Why buy now?

Retail-led growth: Strong momentum in personal, SME, and home loans with improving disbursement quality.

Earnings visibility: Credit costs expected to normalize from H2 FY26; return ratios trending higher.

Digital pivot: AI-led underwriting and operational efficiency to support long-term profitability.

Portfolio fit

L&T Finance offers steady, retail-driven growth with improving asset quality and return metrics - an ideal pick for investors seeking consistent compounding from a diversified NBFC.If you found this helpful and want regular stock trade calls, check out my community on StockGro here: https://app.stockgro.club/ui/social/tradeViews/groupFeed/07a7b961-b8ca-42ce-baf3-a9eec781b6ebL&T Finance: Budget 2025-26 opportunities

- Credit expansion push: Budget’s focus on rural and MSME credit growth aligns with LTF’s retail lending strategy.

- Digital infrastructure boost: Increased digital public infra investments support LTF’s AI-led underwriting and customer acquisition.

- Affordable housing thrust: Housing incentives to drive growth in home loan and LAP segments.

- Financial inclusion drive: Continued push for inclusion supports expansion in semi-urban and rural lending verticals.

- Skilling and fintech support: Upskilling and fintech incubation to benefit LTF’s digital transformation and talent pipeline.

Final thoughts

L&T Finance isn’t just exiting legacy businesses – it’s entering a new growth orbit. With a clear strategic roadmap, retail momentum, and improving profitability, it is well-positioned to emerge as a lean, tech-savvy, high-yield retail lending platform.

For investors, the stock offers a unique opportunity to ride India’s formal credit expansion and rural consumption growth, with the backing of a trusted promoter, improving return metrics, and an attractive valuation entry point. L&T Finance may just be evolving into a quiet compounding machine in the NBFC space – one that balances scale with quality.