Many traders don’t lose simply because they picked the wrong stock, it can also be due to market volatility, poor timing, or decisions driven by fear and greed. Market psychology often outweighs logic, making emotions the silent killer of portfolios. Learning how to predict market direction adds balance by combining patterns, indicators, and data. It’s not about being perfect, but about having a framework that keeps emotions controlled. In this blog, we’ll discuss how.

How to Predict Stock Market Direction

Predicting stock market direction based on various technical analysis like trading signals, market movement, indicators and using artificial intelligence.

Investors seek to understand if stocks will gain, lose, or maintain their value. This stems from the idea that the stock market follows patterns that can be interpreted through available data. Each of these data points is examined to systematically assess whatever is quantifiably predictable about the future. Learning how to predict market direction enables one to understand market trends. It is essentially about working with probabilities and statistical parameters that help optimise decision-making. It adds a layer of rationality to an otherwise emotionally and psychologically complex market.

Why Market Direction Is Hard to Predict

There are numerous reasons why it’s difficult to determine the market’s future course, some of which are as follows:

- A large number of variables: Stock prices are impacted by a variety of factors including the company’s profits, interest rates, government regulations, and any major events worldwide. With the constant change and interconnected nature of these factors, predictability is rarely possible.

- Sudden global events: Changes in regulatory compliance, acts of war, or even viral outbreaks can trigger changes that no degree of analysis can prepare one for.

- Investor psychology: Markets initially react to emotions like fear and overconfidence. This usually results in sharp price moves, which may be out of sync with company fundamentals or economic data.

- Forward-looking nature of markets: Investors are unable to act on news before the market adjusts because, by the time news is public, it has already been priced in.

- Impact of technology and algorithms: Within a few seconds, algorithm-driven strategies and high-frequency trading can create sudden price spikes or dips, contributing further to unpredictability.

- Complex mix of participants: There are different investors trading with different objectives and time horizons. This collective behaviour results in certain outcomes that even sophisticated models cannot reliably predict.

Traditional Methods of Market Prediction

The main methods used to predict stock market direction include the following:

- Fundamental Analysis

Fundamental analysis attempts to understand the intrinsic value of a company and its long term prospects. For this, an analyst studies the company’s financial statements. An analyst tries to gauge the financial health of a company by attempting to figure the growth in revenues, profit margins, and rebate of debt and cash balances. Interest rate policies, inflation, exchange rate movements, and sector-specific performance, along with other wider economic factors, are taken into account. The fundamental idea is to confirm if the stock of concern is trading above or below its real value so that the stock can later be bought when the price moves to normal levels.

- Technical analysis

The term ‘technical analysis’ means studying price behavior by studying historical charts and trading data and not corporate balance sheets. Analysts of financial markets tend to believe that market prices incorporate all known facts, so there is value in studying patterns to attempt to forecast. Smoothed price action trading technical indicators like moving averages, overbought or oversold and other pattern indicators like the RSI and candlestick patterns do have defined repeated structures that can identify these and confirmed price action moves with their volume are some tools often used. Although there are different tools used, the central theme is that in financial markets, there is a tendency that history repeats itself. This means that price behavior in the past is crucial in providing guidance on the possible price movement in the future.

The Rise of AI in Market Prediction

Artificial Intelligence (AI) systems are defined by their ability to learn from data, recognize patterns, and make decisions. Such systems have found widespread use in financial markets for prediction. In India, the AI sector is forecasted to reach USD 7.84 billion by 2025. Advanced analytics enable finance to make predictions by blending historical and real-time market data to generate predictions. AI minimizes emotional distortions such as fear and greed, biasing an analysis’s objectivity. AI-driven platforms give customized, real-time insights and democratize access to tools that were previously institutional. In addition to forecasting, stock market AI enhances risk management by detecting correlations that are not obvious and by analysing large and complex datasets quickly. The combination of scale, accuracy, and accessibility is changing the way markets are analyzed in India and across the world.

How Stock Market AI Predicts Direction

There are several steps involved in how AI stock market predicts direction, including:

- Data Collection & Big Data Processing

The first step involves integrating gigantic datasets that encompass past stock prices, trading volumes, corporate earnings, real-time stock exchange data, and macroeconomic indicators. Alongside structured datasets, unstructured data from financial advertisements, government policies, and social media commentary also needs to be processed. Big data tools like Hadoop and Spark deal with such vast data and ensure that every single aspect is analysed. The study of applying Long Short-Term Memory (LSTM) to Indian stock indices revealed an R-squared accuracy of 0.97, which shows the ability of AI to uncover subtle connections that conventional methods may overlook.

- Pattern Recognition with Machine Learning

The next step after the data is processed focuses on ML in stock market prediction. It involves training machine learning models to detect patterns which may be indicative of price changes in the future. Support Vector Machines (SVM) algorithm and XGBoost, among others, are well known for handling complicated, non-linear relations effectively. Research conducted on the Sensex demonstrated that these models could predict the index’s monthly returns with a mean squared error

error (MSE) of as low as 0.05. Unlike conventional linear forecasting these adaptive models recalibrate to adjust to new market signals that change over time and might go unnoticed otherwise.

- Sentiment & News Analysis

Markets are strongly influenced by perception rendering sentiment analysis an important component. With the aid of Natural Language Processing (NLP), an AI news analysis system can evaluate the social media, news, and analyst reports to assess market mood. The sentiment scores correlated stock price movements, showing the impact public sentiment and external events have on the short-term direction. AI can turn emotions into quantifiable data, thereby including both rational and behavioral aspects in forecasting.

- Predictive Models & Signals

Lastly, AI integrates quantitative metrics along with sentiment data to craft advanced predictive models. These models provide actionable insights buy, sell, and hold advice often with probability percentages. This space is set to expand by more than 17% CAGR worldwide and reach USD 4.1 billion by 2034. In India, deep learning and reinforcement learning based models are already improving portfolio diversification and real-time risk management, innovating their precision with every new data set.

Benefits of Using AI for Market Direction

Here are some advantages of using AI for market direction prediction:

- Speed and efficiency: The time it takes for AI algorithms to scan data and generate trading signals is measured in milliseconds. For instance, in 2021, JPMorgan’s AI-driven LOXM system demonstrated the power of automation by executing large European equity trades with near-instantaneous speed.

- Advanced pattern recognition: There are unique trading signals and subtle correlations that AI models can detect but human analysts overlook. For example, the interplay between commodity prices, interest rate changes, and performance of technology stocks can be an indicator that AI can detect.

- Elimination of emotional bias: AI does not trade under the influence of emotions like fear or greed, ensuring that all decisions remain rational. Emotional biases are the leading cause of losses for many traders, and AI offers a disciplined approach to forecasting market trends.

- Backtesting functions: Before committing to actual funds, AI models can be tested and refined using historical data. Strategies that have been tested enable traders to gauge how the model would have performed in earlier market phases and reduce uninformed risks.

- Ongoing leaning: AI systems learn and improve from recent market conditions. As the information evolves, the models transform and enhance their forecasts giving traders adaptive tools while traditional models remain rigid.

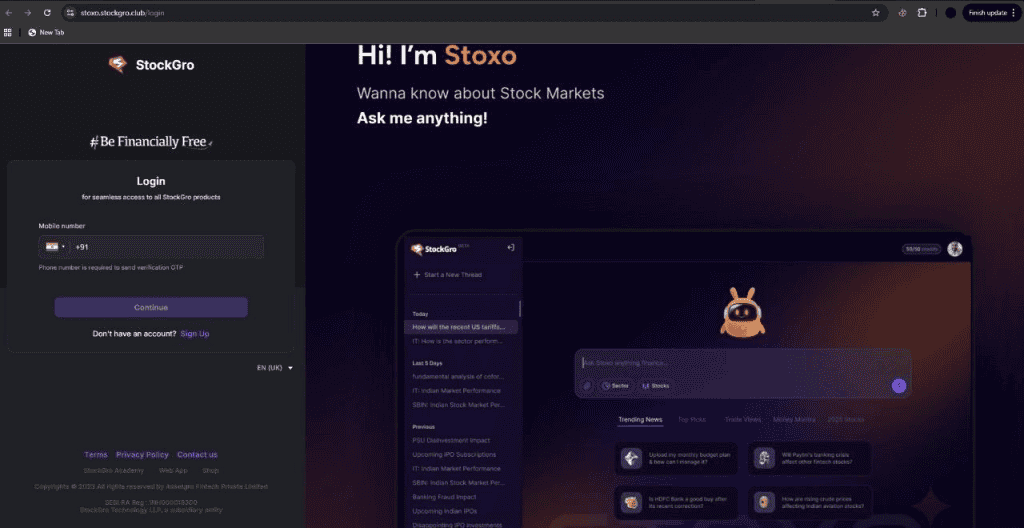

How to Use an AI Tool (Stoxo) for Prediction

Stoxo by StockGro stands out as India’s first AI-driven stock research tool, designed for over 35 million users, integrating market data, behavioral trends, and sentiment into easy-to-understand insights. The simple steps to use Stoxo are as follows:

Step 1: Visit the platform and navigate to Stoxo

Visit the Stoxo by Stockgro to familiarise users with the platform, every new registration comes with a 20-credit free trial, enabling questions without any charges. These initial credits provide you the opportunity to conduct trial searches, understand how the platform works, and assess its AI-powered insights.

Step 2: Ask you question

Once logged in, you can type in questions in natural language either about a company, a particular sector, or a broader market trend. Queries such as “What is the outlook for renewable energy stocks?” or “How to predict market direction for banking shares?” exemplify the type of questions you may ask. The AI is built to understand the underlying meaning and purpose, so technical terms are not needed. This feature narrows down your research and makes it directly pertinent to the choices you are seeking to make.

Step 3: Review insights and signals

After the query, Stoxo collects and analyses live data from the market, previous market data, financial reports, and news or social media sentiments to provide a comprehensive analysis. It distills all this information into an easy-to-understand response showing potential growth drivers, risks, and recent trends. This provides users with structured insights that essentially lessen the decision-making burden and save countless additional hours of research.

Risks & Limitations of AI Predictions

Even with its strengths, AI in market prediction comes with certain disadvantages and risks:

- Operational errors and ethical risks: Unethical or erratic behaviour of AI systems can be observed in systems that are inadequately managed. For example, the Chinese company High-Flyer suffered heavy losses in 2021 after its AI models failed to time trades in volatile markets and over expanded its holdings, showcasing loopholes in execution, not strategy.

- Inability to anticipate black swan events: AI cannot foresee unprecedented shocks. For example, in March 2023, the sudden market panic caused by the fall of Silicon Valley Bank was something that most AI trading models could not predict because no previous dataset contained such an incident.

- Market adaptation effect: The effectiveness diminishes with the extensive use of similar AI strategies. The more people capitalise on a certain pattern, the sooner it disappears, which makes the models less effective with time.

- Black box challenge: Deep learning models lack transparency, which is needed to understand such models. Traders may receive insights without clear explanations, limiting maintaining trust.

- Dependence on data quality: Inaccurate or biased data leads to a direct drop in accuracy. The 2021 Reuters study stated how some AI models failed to interpret Reddit-driven sentiments during the GameStop rally because the training data did not take retail momentum into account.

Real-World Examples

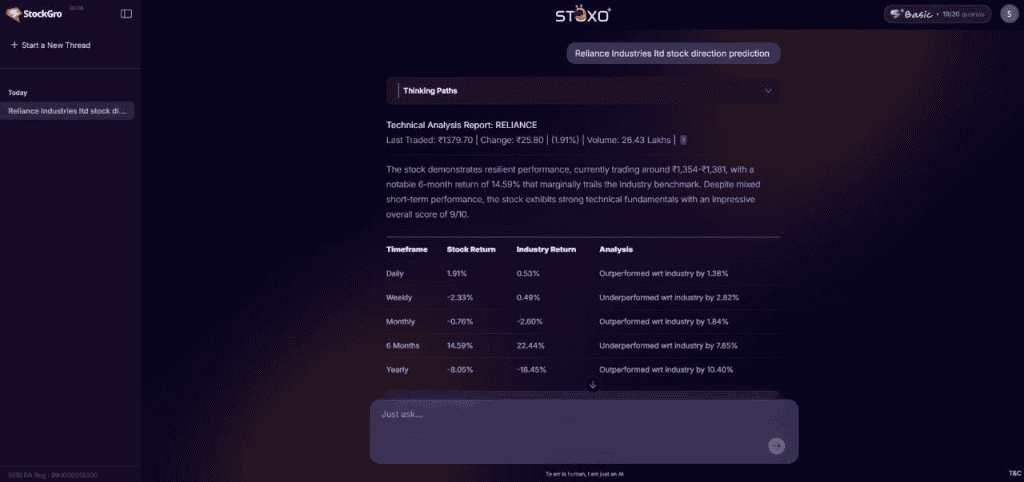

To understand how market prediction works in the real world, let’s look at Reliance Industries Ltd (RELIANCE) through Stoxo AI.

The tool shows Reliance’s performance compared to the broader industry:

| Timeframe | Reliance return | Industry return | Analysis |

| Daily | +1.91% | +0.53% | Outperformed by 1.38% |

| Weekly | -2.33% | +0.49% | Underperformed by 2.82% |

| Monthly | -0.76% | -2.60% | Outperformed by 1.84% |

| 6 Months | +14.59% | +22.44% | Underperformed by 7.85% |

| Yearly | -8.05% | -18.45% | Outperformed by 10.40% |

Looking at this table, Reliance has had short-term fluctuations (weekly underperformance) but a stronger yearly picture (beating the industry by over 10%). It’s also hovering near its support and resistance zones, suggesting a consolidation phase.

This perfectly captures what predicting market direction is all about. It’s about spotting whether a stock is gaining or losing strength compared to the broader market. Instead of just relying on instinct, tools like Stoxo bring together technical indicators, price trends, and sentiment in one place, making the decision-making framework much clearer.

To replicate this analysis, you simply:

- Log into StockGro and open Stoxo.

- Type in your query (e.g., “Reliance stock direction prediction”).

- Review the structured insights – including returns vs industry, RSI, MACD, pivot points, and sentiment indicators.

Conclusion

Certainty doesn’t exist in the market, but perspective does. When you know how to predict market direction, you stop chasing random moves and start seeing structure in the chaos. It’s the difference between guessing and decoding. And in a world driven by speed, discipline, and data, that difference can change the way you trade forever.

FAQs

AI attempts to forecast using historical data with advanced algorithms to recognize patterns and trends, offering probabilistic forecasts on direction. While it is capable of improving accuracy of prediction compared to classical methods, AI is not immune to error, and imprecise outcomes are to be expected especially given the problems of the markets and the unexpected events.

StockGro’s Stoxo is an AI-powered research tool that distills market data, trends, and sentiment into actionable insights. It combines historical data with current patterns and, like other tools, aims to enhance personal decision-making by providing a balanced angle on potential market outcomes without attempting to replace personal judgment or additional research.

Stock market direction can be studied through a mix of approaches such as sentiment analysis, technical indicators, fundamental factors, and macroeconomic signals. Looking at multiple perspectives often provides a broader view than relying on a single metric.

Attempting to predict precise market direction for novices is distracting and may exacerbate emotional decision-making. Given precise market timing, ad-hoc investment planning may be much more deleterious than executing planned risk management.

By spotting subtle patterns across extensive and dynamic datasets, AI augments human analysis. It can adapt to shifting trades faster than humans. Although AI can offer trend insights and risk evaluations, it is important to note that these are drawn from historical patterns and do not ensure future success.

The most common stock market indicators include the moving average, the relative strength index (RSI), MACD, trends in stock turnover as well as the GDP and inflation figures. These indicators help the users to understand the stock market trends as to the momentum, overbought or oversold state of the stocks, and the general economic state.

Although AI systems may be able to identify patterns of concern such as a spike in volatility or a shift in market sentiment, attempting to reliably forecast an abrupt market crash is nearly impossible because of the enormous scale, sudden impactful incidents, and the human-based elements of the market that can contradict established data-driven trends.

Leave a Comment