India’s financial ecosystem felt a fresh pulse as Budget 2026 was unveiled, setting off varied reactions across the markets. Policy choices around taxation, spending and sector priorities sparked optimism in some areas and concern in others, making interpretation crucial. This article will help investors assess what is good and what is challenging in Budget 2026 for the stock markets, so they can make decisions with more clarity.

What’s good in the Budget for the markets?

Not every supportive measure arrives wrapped in excitement. Some positives are subtle and reveal themselves only after the initial volatility fades. Budget 2026 offered several such signals that markets tend to reward gradually rather than instantly.

Tourism stocks

Tourism stocks are one of the clear beneficiaries of the budget. The government aims to train 10,000 guides at 20 tourist sites, reflecting its commitment to this sector.

This approach also supports hospitality, transport, and local employment. Investors responded positively because such initiatives improve footfall consistency and pricing power over time.

Another supportive measure came through the reduction in TCS on overseas tour packages. The rate will be lowered to 2% from the current 5% and 20%. This makes tax costs more affordable and boosts tourism bookings, particularly for middle-income tourists.

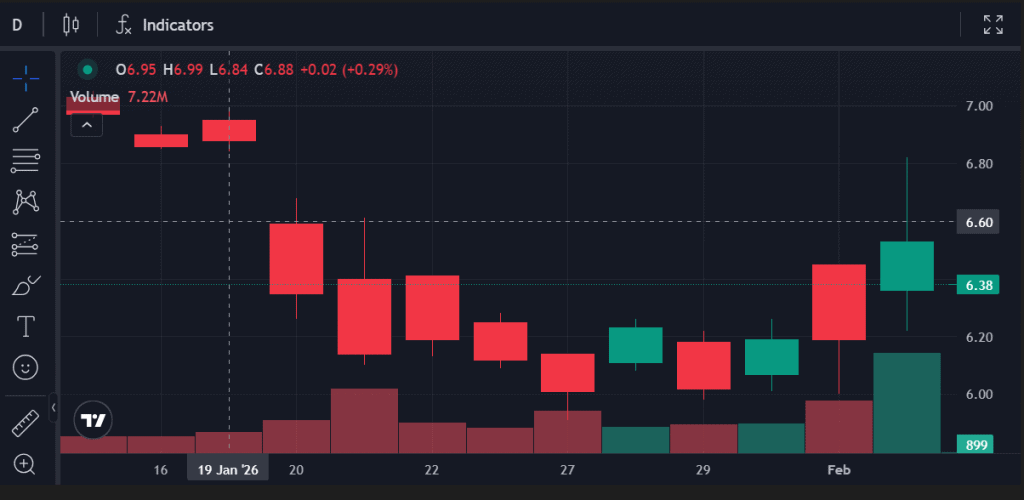

Tourism-linked stocks, such as Easy Trip and IRCTC, soared 10% and 1.7%, respectively, after the budget announcement on February 1, 2026.

Easy Trip Chart:

IRCTC Chart:

Jewellery stocks

Jewellery stocks drew strength from stability rather than expansion. The decision to keep customs duty on gold and silver imports unchanged eased a major concern for organised jewellers.

Export-oriented jewellery players benefited indirectly as markets grouped them into a broader manufacturing and value addition theme. Predictability became the key driver, and markets rewarded it.

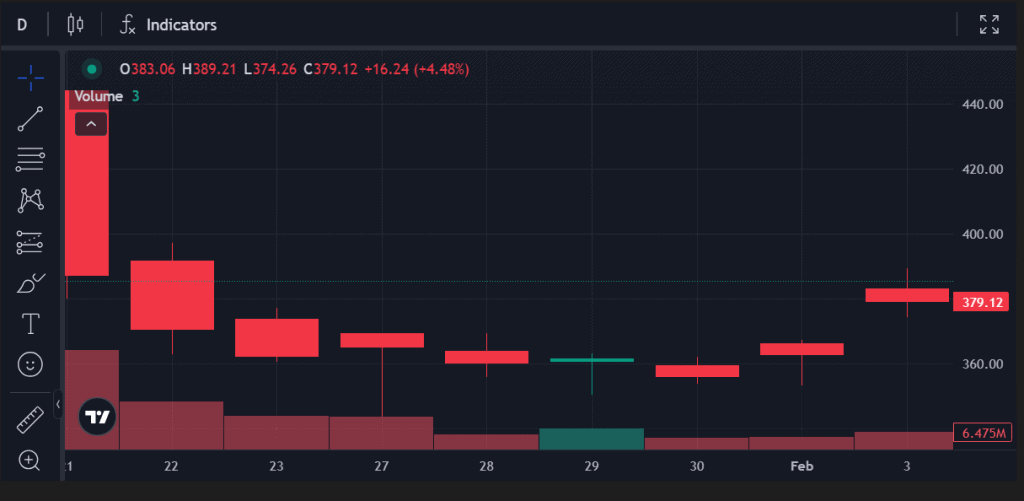

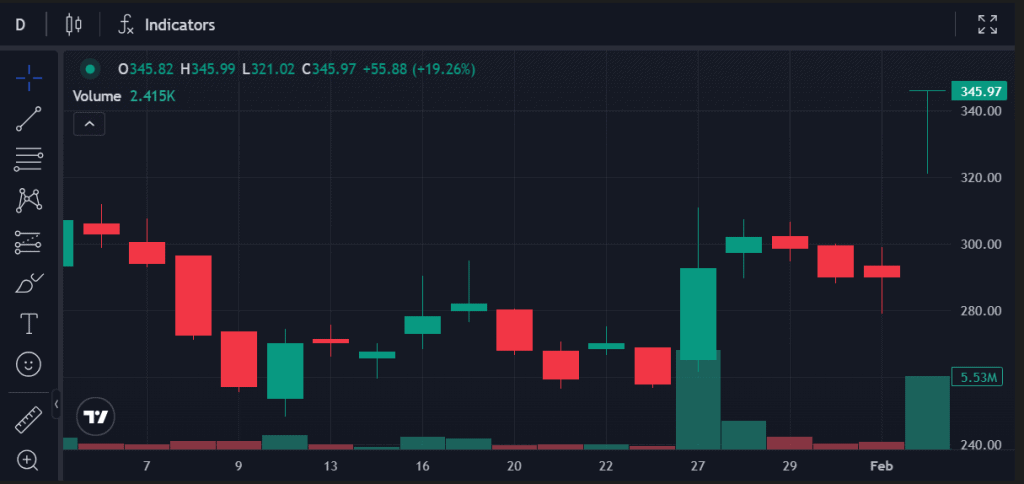

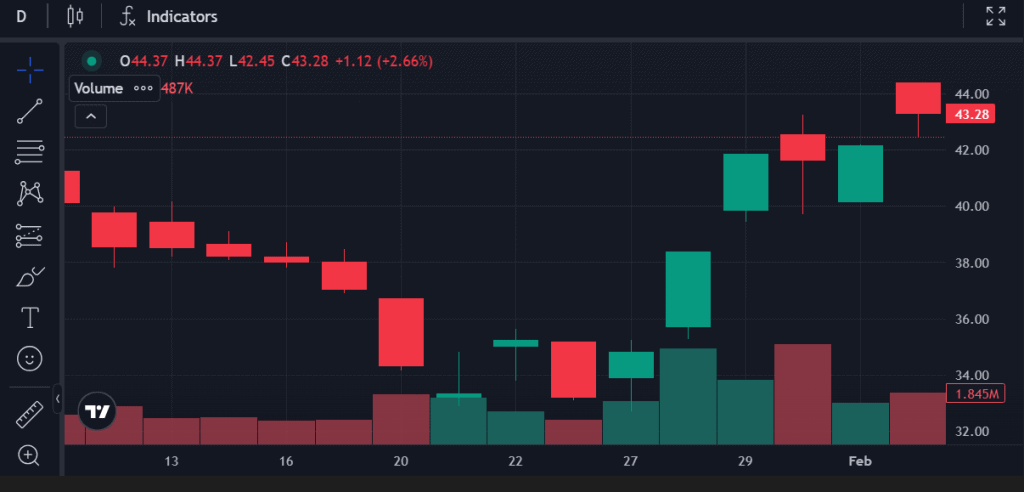

On February 1, 2026, Titan shares gained 3.27%, climbing ₹129, while shares of Kalyan Jewellers jumped to ₹379, a rise of 4.94%.

Titan:

Kalyan Jewellers:

Fisheries

Fisheries gained through indirect but meaningful policy support. The focus on rural development, export, and value addition will add to the broader ecosystem supporting aquaculture and seafood processing.

Improved cold chain infrastructure, logistics efficiency, and export facilitation all contribute to stronger earnings potential over time. Investors viewed fisheries as a structural growth opportunity rather than a speculative trade.

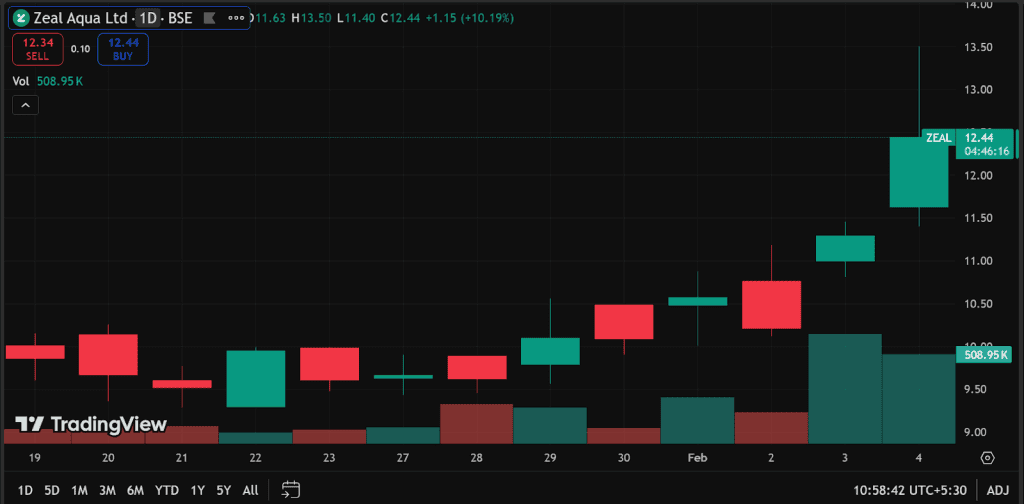

On February 1, 2026, Zeal Aqua surged by 6.64%, Apex Frozen Food rose by 4.17%, and Waterbase shares climbed 2.62%.

Zeal Aqua:

Apex Frozen Food:

Waterbase:

Semiconductor stocks

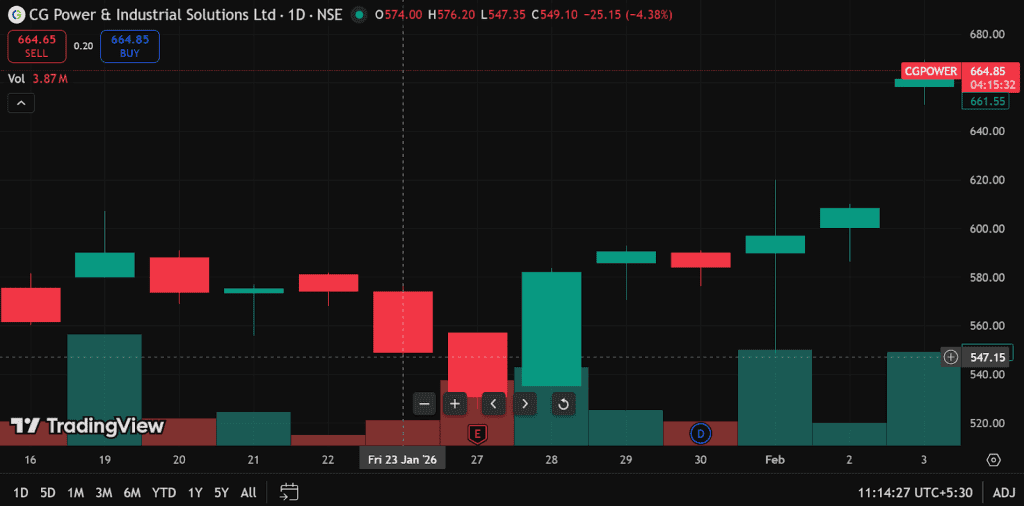

Instead of surprises, Semiconductors stocks are benefitted from continuity. The focus is on developing domestic manufacturing and supply chain via the India Semiconductor Mission 2.0. The investment in the Electronics Components Manufacturing Scheme (ECMS) has also been raised to ₹40,000 crore.

Markets responded positively to this stability. Semiconductor and electronics manufacturing stocks attracted buying interest as investors leaned into long-term industrial alignment.

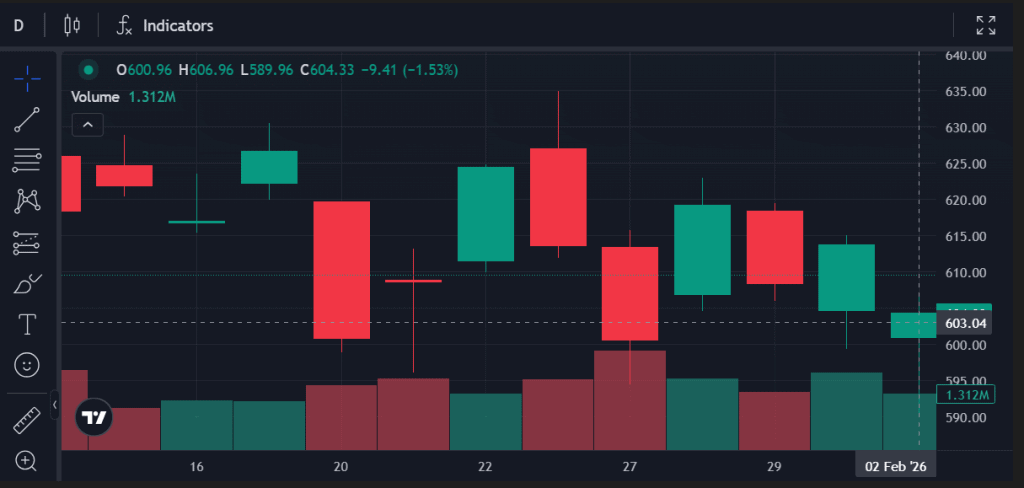

Following the budget presentation on February 1, 2026, Shares of MIC Electronics gained close to 5%, and CG Power shares jumped 6% to reach ₹620.

MIC Electronics:

CG Power:

What’s bad in the Budget for the markets?

While some sectors found comfort, others faced difficulty. Certain announcements carried sharper consequences, particularly where expectations had been high. These areas reacted swiftly as markets adjusted assumptions and pricing models.

STT on F&O increased

The increase in Securities Transaction Tax on futures and options proved to be the biggest pressure point. Futures STT rose to 0.05% while options premium and exercise also climbed to 0.15%.

This raised trading costs across the board, impacting traders, hedgers and arbitrage strategies alike. The lack of distinction between speculative and hedging activity added to concerns.

Capital market stocks reacted sharply as lower volumes and reduced participation became immediate risks.

Banking stocks

Banking stocks faced pressure amid rising uncertainty. Elevated government borrowing raised concerns around interest rate movement and liquidity conditions.

In the past, consolidation has been a topic of discussion that has historically created near-term drag. The cost of integration, disruption, and leadership uncertainty have been factors that have impacted performance.

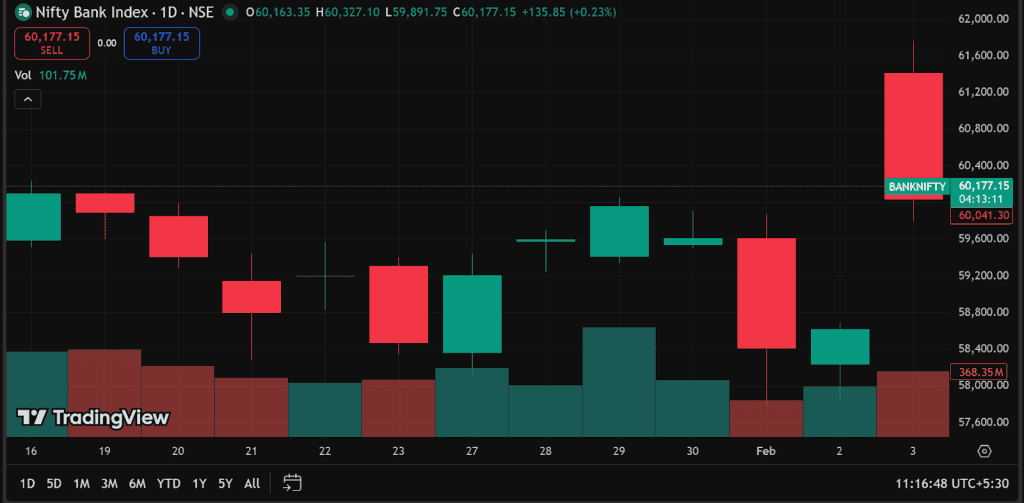

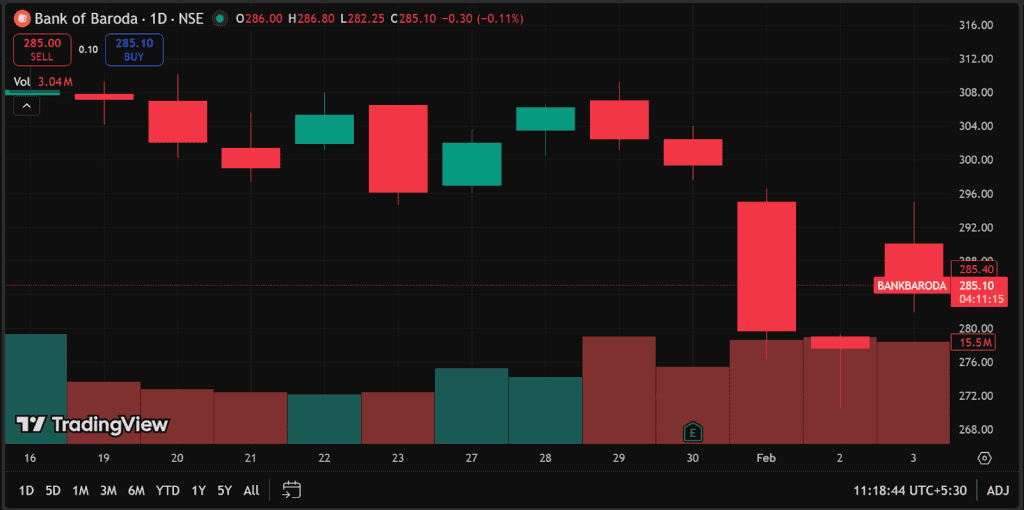

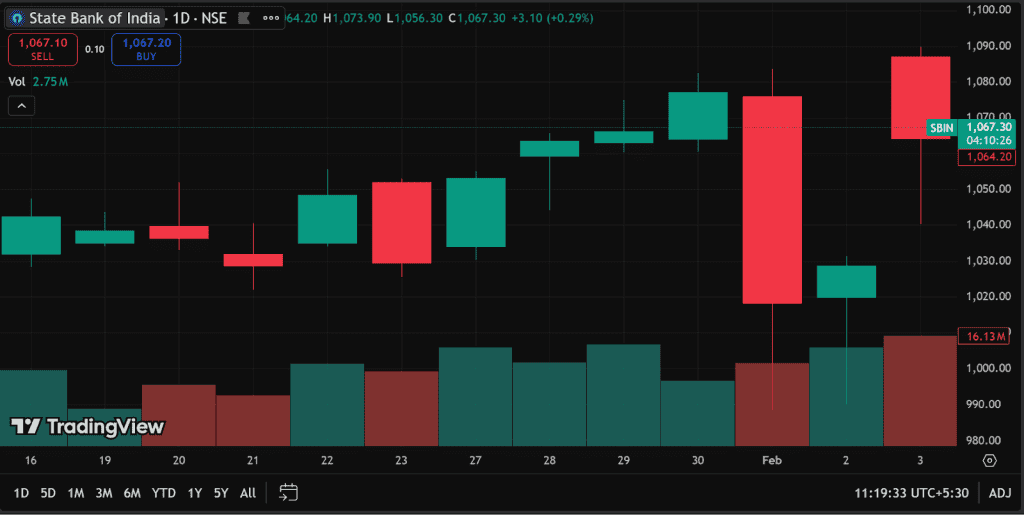

Markets reacted with caution, which pushed banking indices lower. Following the budget announcement on February 1, 2026, the Nifty Bank Index fell to 58,832, a decline of 1.3%. PSU banks were hit hard, Bank of Baroda stock was down by 4.7%, and State Bank of India shares dropped by 3.6%.

Nifty Bank:

Bank of Baroda:

State Bank of India:

No major incentive to woo foreign investors

Foreign investors have already reduced exposure to Indian equities, withdrawing ₹22,530 crore in January 2026. In fact, the increase in transaction costs has added to the hesitation.

In a scenario where market liquidity and international participation are important, the increased friction is not a welcome signal. Without specific actions to attract foreign capital, market sentiment has remained weak, particularly in the large-cap stocks that are dependent on foreign participation for valuation support.

Markets reflected this caution through muted participation and selective selling in foreign-owned names.

Defence stocks

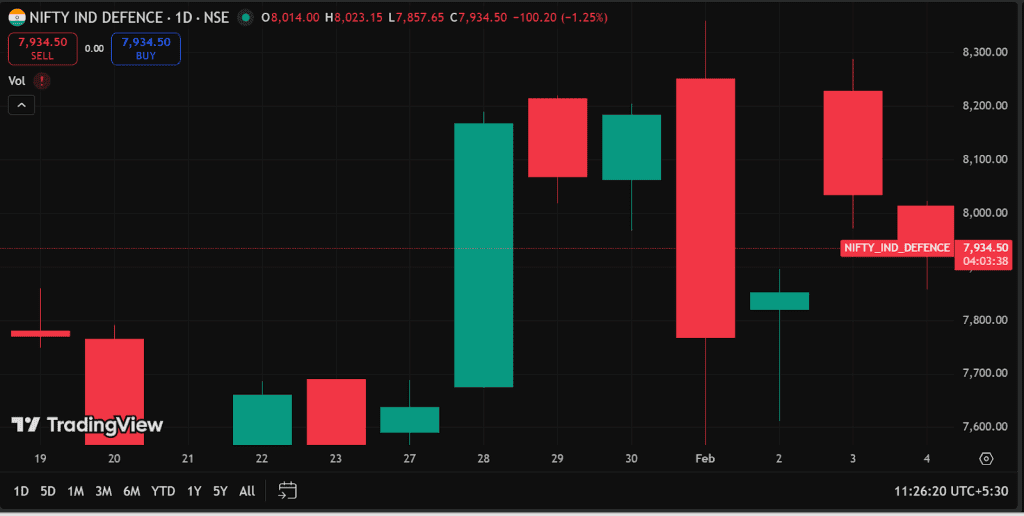

Defence stocks underperformed after allocations failed to meet market expectations. While overall defence spending increased to ₹7.85 lakh crore, the pace of capital expenditure growth did not align with assumptions priced into stock valuations.

Investors had expected a stronger acceleration in modernisation and procurement. When the numbers fell short, markets adjusted near-term growth projections. This led to selling pressure across defence companies despite the sector’s long-term strategic importance.

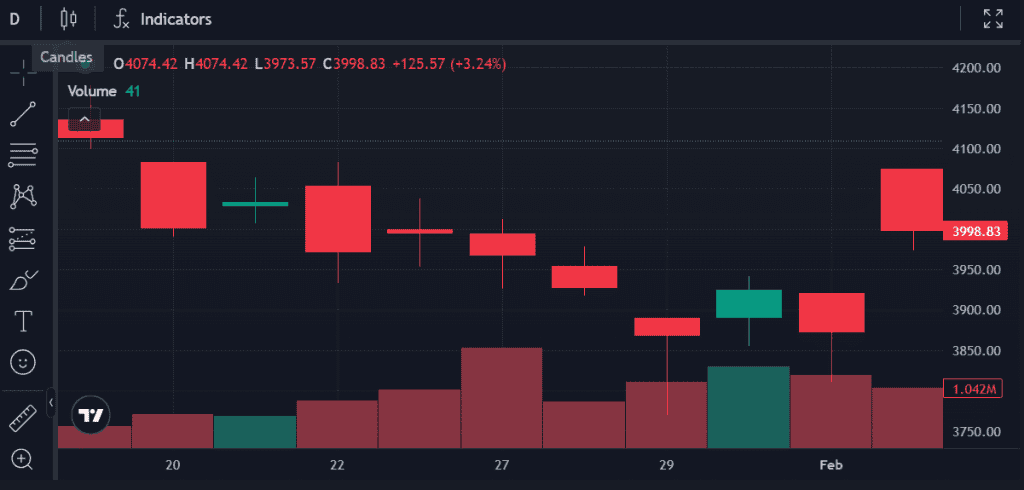

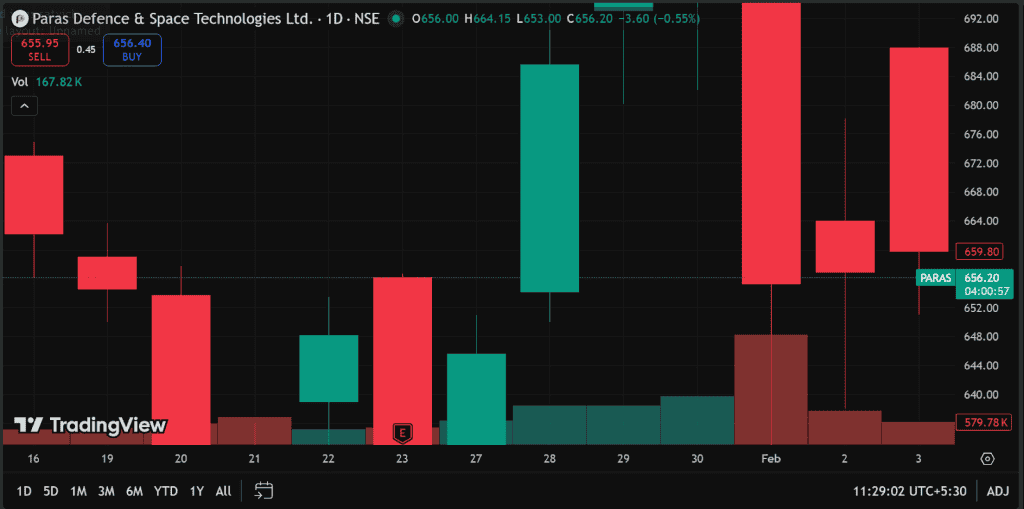

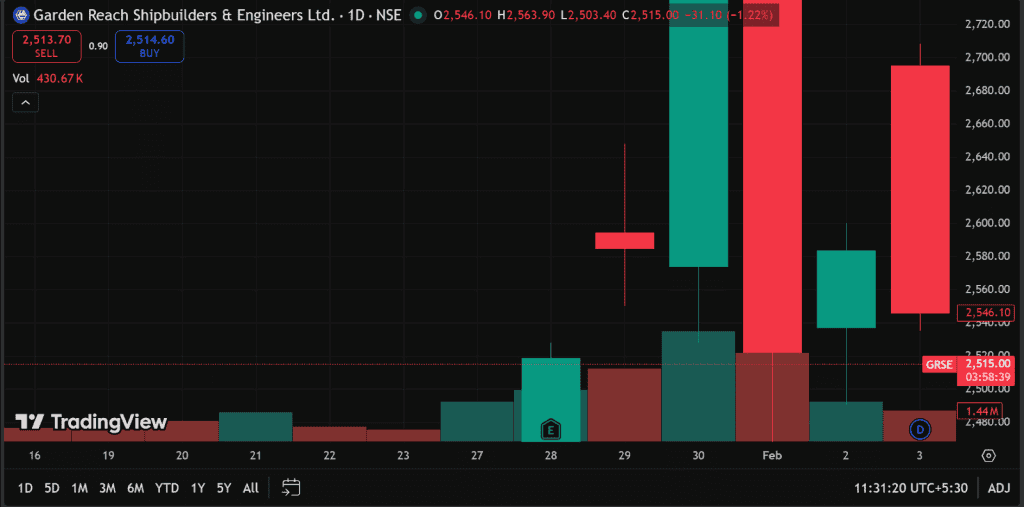

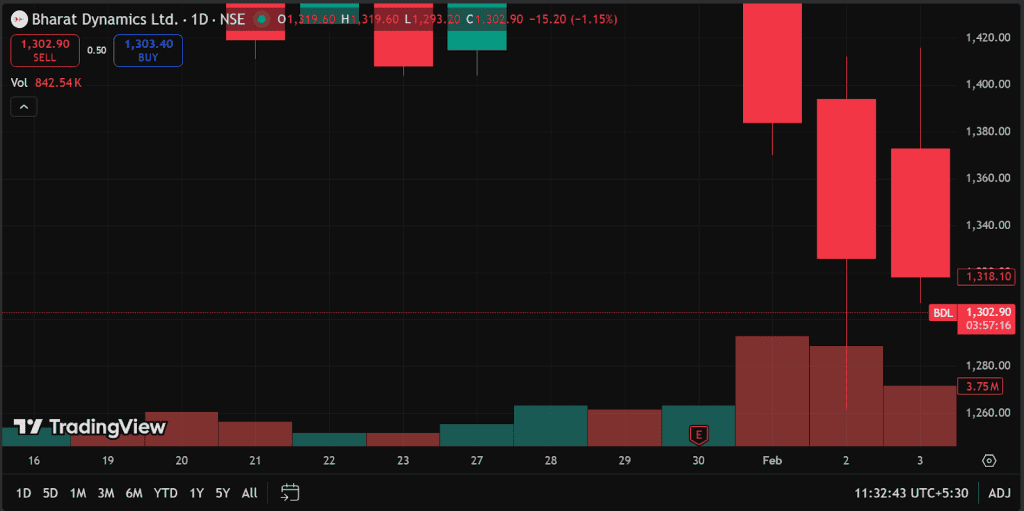

On February 1, 2026, the Nifty Defence index fell sharply to 7,458.65, a crash of nearly 9%. Paras Defence stock had a decline of 12%. Garden Reach Shipbuilders & Engineers (GRSE) fell nearly 14%, and Bharat Dynamics Limited (BDL) shares slipped to ₹1,384, a drop of 10%

Nifty Defence:

Paras Defence:

GRSE:

BDL:

Conclusion

Budget 2026 has sent mixed signals to the stock markets. Some industries have gained from clarity, restraint and alignment, while others have taken the hit of increased costs, uncertainty, or unmet expectations.

The budget did not aim to please every participant. Instead, it chose focus and moderation. Investors who move beyond headlines and study sector-level signals will be better positioned to respond.