Ever wished you could make money when you think a stock is going to fall, but also didn’t want to risk too much? That’s when the Bear Put Spread comes into play.

This strategy is popular with anyone looking to profit from a price drop, while keeping losses under control. Getting started with options doesn’t require you to be an expert! In this article, let’s break down the bear put spread, step by step, with plenty of easy examples and comparisons.

What is a Bear Put Spread?

A Bear Put Spread is an options trading strategy that helps you profit when a stock (or index) goes down, but without risking too much money.

It’s called “bear” because it’s used when you expect prices to fall. And “spread” because you use two options together.

Here’s the simple idea:

- A higher strike price puts option is one that you purchase.

- You sell a put option with a lower strike price.

Both options are on the same stock and have the same expiry date.

Why do this? The money you earn from selling the put allows you to reduce the cost of the first one. That means you spend less upfront compared to buying just a single put.

How Does a Bear Put Spread Work?

Let’s break down the process of spreading into a few simple steps:

- Buy a Put Option: Select a strike price that exceeds the current market price. This gives you the right to sell at this level.

- Sell a Cheaper Put Option: At a strike price that falls below the initial one. Here, you’re taking on the obligation to buy, but at a lower price.

Why do this? Buying the higher put costs money (called a premium). Selling the lower put gives you money (another premium). The result: your total cost drops compared to buying a put on its own.

Bear Put Spread Example

Let’s take a real-life stock chart example to understand better. Here’s MCLEODRUSS (Daily):

On April 22, 2025, MCLEODRUSS had just opened at ₹39.85, hit a high of ₹40.39, dropped to ₹37.54, and finally closed near ₹37.71. You notice the price has come off recent highs, and you are expecting more downside, but not a steep crash.

One approach to utilising a bear put spread is as follows:

Setting Up the Trade

- Buy put at ₹38 strike

Imagine you’re investing a premium of ₹1.80 for each share with this option. - Sell put at ₹35 strike

You collect a premium of ₹0.80 per share by selling this option. - Net premium paid: ₹1.80 (buy) – ₹0.80 (sell) = ₹1.00 per share

Expiry Scenarios

a) Stock falls to ₹33 by expiry

- Your ₹38 Put is worth ₹5 (₹38–₹33).

- Your ₹35 Put (sold) loses ₹2 (₹35–₹33).

- Net gain: ₹5 – ₹2 = ₹3.

- After subtracting your initial cost: ₹3 – ₹1 = ₹2 per share profit (max gain)

b) Stock closes at ₹36

- ₹38 Put is worth ₹2.

- ₹35 Put expires worthless.

- Net gain: ₹2.

- After premium: ₹2 – ₹1 = ₹1 per share profit

c) Stock closes at or above ₹38

- Both puts are worthless.

- Your only loss is the ₹1 net premium—that’s your max loss.

Why choose these strikes?

- The ₹38 strike is just about at-the-money (ATM) on April 22, making this setup affordable.

- The ₹35 strike is a popular “out-of-the-money” (OTM) level, limiting cost but also capping profit.

- Your breakeven: ₹38 – net premium = ₹37 per share. If the stock closes below ₹37, you make money!

Key Takeaway:

Even if MCLEODRUSS doesn’t collapse, a bear put spread helps you profit from a modest dip, and you always know your worst-case loss in advance. This is a good strategy for people who want to play the downside but want to keep their risks in check.

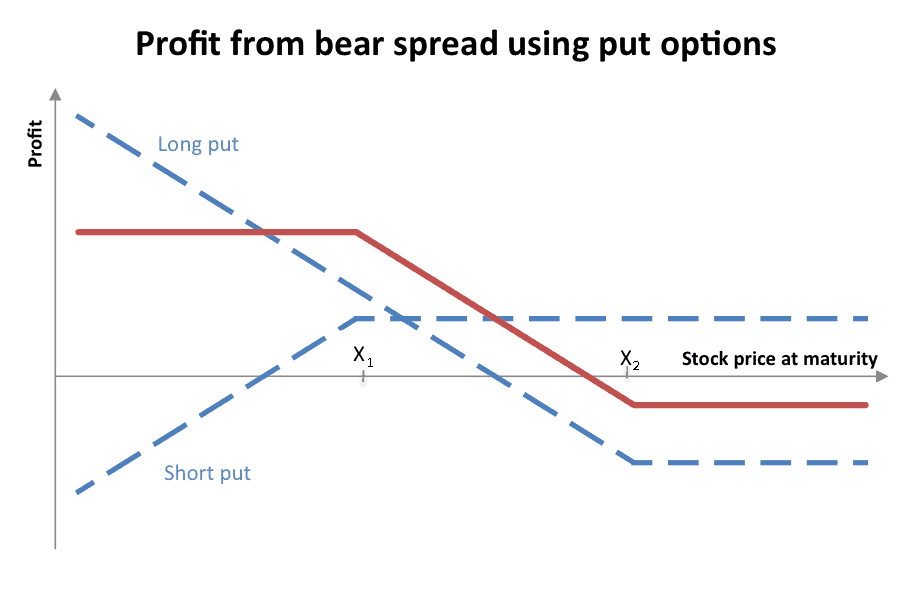

Bear Put Spread Payoff & Risk-Reward

Here’s the breakdown:

- Maximum Profit: Difference between strike prices – net premium paid.

- Maximum Loss: Net premium paid.

- Breakeven Point: Higher strike – net premium.

This helps you clearly understand what you might lose and what you might gain.

When to Use a Bear Put Spread

Select a bear put spread when:

- You think the stock will drop, but not crash

- Your goal is to minimise your losses.

- Markets are trending down, or you’ve spotted bearish signals

- Option premiums are expensive (the spread helps reduce your cost)

In options trading, it’s a great move for cautious traders who want a proper plan instead of rolling the dice.

Advantages & Disadvantages of a Bear Put Spread

Advantages:

- Lower cost: Significantly more affordable than purchasing a put option by itself

- Limited risk: You can always be aware of your highest potential loss.

- Defined reward: You can see in advance how much you could make

- Suitability: Suitable for mild to moderate downtrends

Disadvantages:

- Profit is capped: You can’t earn more even if the stock falls a lot

- Requires right timing: If the price doesn’t drop enough, the spread might not pay off

- Commissions: More contracts mean slightly higher trading costs

- Complexity: Not as simple as just buying a put

Bear Put Spread vs Buying a Put

Let’s compare directly.

| Aspect | Bear Put Spread | Buying Put Spread |

| Cost | Lower (offset by sale) | Higher (no offset) |

| Maximum Profit | Limited | Unlimited (theoretically) |

| Maximum Loss | Limited (to net premium) | Limited (to premium) |

| Breakeven Point | Higher strike – net premium | Strike – premium |

A bear put spread saves you money but limits your upside. Buying a put is simpler and can give bigger profits if the market totally tanks, but it costs more.

Bear Put Spread vs Bear Call Spread

These are two ways to profit if you expect prices to fall, but they work differently.

- Bear put spread uses puts: buy high, sell low

- Bear call spread uses calls: sell high, buy low

Bear call spreads involve selling a call (higher strike) and buying a call (lower strike). Both aim for a falling market but have different risks, rewards, and margin requirements.

| Feature | Bear Put Spread | Bear Call Spread |

| Uses | Put options | Call options |

| Max profit | Limited | Limited |

| Max loss | Limited (net premium) | Limited (difference in strikes minus net premium) |

| Margin | Often just the net premium | Usually requires margin |

Bear call spreads need more capital or margin, and are more common if you don’t own the underlying stock.

Conclusion

The bear put spread is a handy tool for traders who think the market will drop, but want to keep a tight grip on risk. It’s safer than betting everything on a single put, and can fit nicely in a smart options strategy.

If you are just getting started, practice in a demo account first, and make sure you understand how options work before jumping in. As with every strategy, no plan is foolproof, but the bear put spread is one way to tilt the odds gently in your favour.

FAQs

The maximum profit in a Bear Put Spread is the difference between the two strike prices minus the net premium paid. It happens when the stock falls below the lower strike price before expiry, giving fixed, limited gains.

A Bear Put Spread is a bearish strategy. Traders use it when they expect the stock price to fall moderately. It’s not meant for a huge crash, but for a small to medium decline in the market.

Yes, you can lose money in a Bear Put Spread. The maximum loss is limited to the net premium you paid. This happens if the stock price stays above the higher strike price till expiry.

It depends on your view and comfort. Bear Put Spread has limited risk and requires a small upfront cost. Bear Call Spread gives upfront premium but comes with higher potential risk. Beginners usually prefer Bear Put Spreads for safety.

Yes, a Bear Put Spread is a limited risk strategy. The maximum loss is only the premium you paid to set up the trade. This makes it safer than many other bearish option strategies.