Earnings season can be brutal for traders. Prices can gap sharply in either direction, volatility can crush option premiums, and protective trades often end up costing more than they deliver. In such scenarios, the broken wing butterfly can be of assistance.

By building an unbalanced spread, it allows you to reduce trade cost, define your risk, and still position for gains even if the market moves more strongly on one side. In this blog, we will discuss its meaning, working, pay off diagram and more.

What is a Broken Wing Butterfly?

A broken wing butterfly is an options trading strategy similar to a regular butterfly spread but with an uneven structure. often widely referred to as a skip strike butterfly. It uses either all calls or all puts and involves three strike prices with the same expiry date.

The “broken” part comes from skipping a strike on one side, creating unequal distances between strikes. This uneven spacing shifts the risk and reward to one side, often producing a small net credit when the trade is opened. This credit acts as the maximum profit if the market moves away from the target area in the opposite direction of the position.

How Does a Broken Wing Butterfly Work?

A broken wing butterfly uses three options with the same expiry but uneven strike spacing. Here’s how it works:

- Buy one higher-strike option: this upper long limits losses above the short strikes and sets the far edge of the payoff.

- Sell two middle-strike options: these short options create the central profit zone and supply most of the initial credit, defining the price level where the position performs best.

- Buy one lower-strike option: this lower long caps losses if price falls below the short strikes and makes the setup asymmetrical.

- Unequal spacing: the distance from the upper long to the short strikes is larger than the distance from the short strikes to the lower long, which often produces a net credit at entry and concentrates risk to one side.

Broken Wing Butterfly vs Regular Butterfly

A broken wing butterfly is a variation of the standard butterfly spread, designed with uneven strike distances to shift risk and cost. While both use three strike prices with the same expiry, their composition, cost, and bias differ. Here’s how they differ:

| Feature | Broken wing butterfly | Regular butterfly |

| Cost | Often a credit spread (premium received) | Typically a debit spread (cost to enter) |

| Risk profile | Asymmetrical, defined on one side | Symmetrical, defined on both sides |

| Directional bias | Bullish or bearish | Neutral |

| Ideal market condition | Moderate move in one direction | Low volatility, range-bound prices |

| Earnings opportunity | Capped, wider profitable range |

Broken Wing Butterfly Payoff Diagram

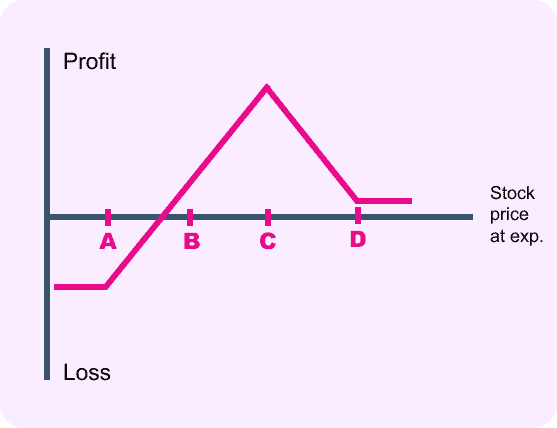

The payoff diagram of a broken wing butterfly shows how profit and loss change based on the stock price at expiry. It has an uneven shape because one wing is wider than the other. The best possible gain occurs when the share price stays close to the center strike level marked as point B on the diagram, which is identified as the optimal point in a volatile market.

If the stock price moves above the higher strike price (point C or beyond), profit is capped and stays flat, limited to the initial credit received. On the downside, if the price falls below the lower strike price (point A), the position starts to incur losses. However, losses are limited because the risk is defined and capped at a certain level, shown between points A and D.

This asymmetrical profit and loss profile allows the trader to benefit from moderate price moves toward the middle strike while protecting against large losses on one side. The broken wing butterfly is a directional strategy with defined risk, designed to profit in a specific price range.

When to Use a Broken Wing Butterfly

A broken wing butterfly suits different market views and risk preferences. Below are common situations where this strategy may be applied in options trading:

- When you expect a small move in one direction but want to cap risk.

- In bullish setups when prices will move up slowly.

- During high volatility events like earnings announcements, the credit received offsets the drop in option value afterwards.

- It allows you to enter a trade with little to no upfront cost, perfect for those with limited capital and defined risk.

- Traders can use this approach to benefit from time decay if the asset’s price remains around the middle strike until expiry.

- It gives limited risk and room for price movement.

How to Set Up a Broken Wing Butterfly

Setting up a broken wing butterfly requires choosing strike prices carefully to create its unique structure. Below is how this can be done effectively.

Choosing Strike Prices

For a bullish broken wing butterfly using call options:

- Buy one call option set at a strike above the present market value (upper long call).

- Sell two call options at a strike price closer to the current price (short calls).

- Purchase an additional call option with a strike lower than the short calls (lower long call).

The important point is that the gap between the upper long call and the short calls is wider than the gap between the short calls and the lower long call. This uneven spacing creates the “broken wing” shape and often results in a net credit when entering the trade.

For a bearish setup of the broken wing butterfly, put options are used instead of calls:

- Buy one put option with a strike that is beneath the current market rate (lower long put).

- Sell two put options at a strike price closer to the current price (short puts).

- Buy another put option with a strike placed above the short puts (higher long put).

Here, the distance between the lower long put and the short puts is wider than the distance between the short puts and the higher long put. This forms the broken wing structure on the put side.

Example of a Broken Wing Butterfly

For example, suppose a stock is trading at ₹100. A trader expecting a moderate rise sets up the following trade:

- Buy 1 call option at ₹110 strike price

- Sell 2 call options at ₹105 strike price

- Buy 1 call option at ₹102 strike price

Here, the upper wing width is ₹5 (₹110 – ₹105), and the lower wing width is ₹3 (₹105 – ₹102). Because of the uneven wings, the trader usually receives a net credit for entering this position. The top profit is made if the stock closes exactly at 105 upon expiry. If the price slips below 102, the loss is capped at the gap between the wings minus the credit received.

Adjusting a Broken Wing Butterfly

The pattern may need adjustments as the price significantly moves away from the initial target. Below are common ways to manage these changes:

- Should the price move unfavorably, exit the position to control the loss.

- If the price moves favourably but too quickly, the setup can reverse into a losing position. In this case, you can shift the strikes or “roll” the trade to match the current price.

- Adjust the spread ratio. For example, buy back one of the short options to reduce directional risk and balance the trade.

- If the underlying price moves a lot, add new options at different strikes to reset the trade and control risk.

- Monitor time decay. If expiry is near and the trade is going against you, consider an early exit.

- Volatility changes option values. If volatility increases, the trade will increase in value and you may want to take profits or adjust to the new market conditions.

- Partially close the position, like closing just the losing wing, to reduce risk while keeping some exposure.

- You can also adjust the wing widths to match the market conditions.

- The goal of adjustments is to keep a good risk-reward and prevent big unexpected losses while keeping the position manageable.

Broken Wing Butterfly vs Iron Condor

Both the broken wing butterfly and iron condor are defined-risk strategies, but they differ in structure and market outlook. Below is a quick comparison:

| Feature | Broken wing butterfly | Iron condor |

| Number of legs | Three (all calls or all puts) | Four (combination of calls and puts) |

| Directional bias | Directional (bullish or bearish) | Neutral (profits if price stays in range) |

| Strike price setup | Unequal spacing; “broken” wing | Equal or near-equal spacing on both sides |

| Ideal market outlook | Moderate move in one direction | Low volatility, price range-bound |

| Risk profile | Defined risk, skewed to one side | Defined risk, balanced on both sides |

| Entry cost | Usually a net credit (premium received) | Usually a net credit |

| Profit zone | Wider profit range on one side | Profits if underlying stays between strikes |

| Max loss | Limited to difference between wings minus credit | Limited to difference between strikes minus credit |

Risks and Rewards

This strategy offers a balance between limited risk and capped reward. Some of which have been discussed below:

Rewards:

- This strategy is often opened for a net credit, so the trader receives money upfront.

- This structure allows for a sizable potential return compared to the small amount of capital required.

- The best payoff happens when the underlying ends close to the short strike as expiry arrives.

- Profits are capped even if the price moves strongly in the favourable direction beyond the wide wing.

- Time decay works in favour of the position, especially if the underlying price remains stable within the targeted range.

Risks:

- The primary risk is a sharp move in the underlying that opposes the trade’s directional outlook.

- The maximum loss is predefined and equals the gap between one wing’s strikes minus the starting credit gained.

- Maximum loss is limited and defined as the difference between one wing’s strike prices minus the initial credit received.

- Large or sudden price moves outside the profitable range can cause losses.

- Heightened market swings can increase risk by pushing the position beyond expected price limits.

- Despite limited loss, traders must be prepared for the possibility of losing capital if the market moves unfavourably.

Final Thoughts

In options trading, balance isn’t always the goal, sometimes, a little imbalance pays. The broken wing butterfly shifts the setup to one side, cutting cost, limiting risk, and still keeping room for profit. When markets swing or earnings loom, this approach can turn uneven wings into steady gains for those who time it right and manage it with care.

FAQs

A broken wing butterfly is like a regular butterfly spread but with one “wing” placed further from the middle strike. This creates uneven risk and reward, often removes risk on one side, and can be set up for a net credit.

A regular butterfly has equal strike gaps and balanced risk. Whereas, a broken wing butterfly widens one side, shifting risk and often giving a credit entry. It becomes slightly directional, limiting risk on the wider side while keeping potential profit near the short strikes.

Adjustments may involve rolling the short strikes, moving a long wing, or closing part of the position if price moves strongly toward one side. This helps manage risk, realign strikes with price movement, and improve profit potential.

The direction depends on strike placement. A call broken wing above the price is bullish, while a put broken wing below the price is bearish. It keeps defined risk on one side while allowing for a directional bias and time-decay profit.

Widely suitable for use in moderate-volatility markets with an expected limited directional move. Often applied before events like earnings with high implied volatility. It aims to profit from time decay and movement toward the short strikes while controlling risk on one side.