Ever closed an options trade thinking you made a profit, only to see a much smaller figure or even a loss on your account statement? Many traders face this confusion because option P&L isn’t calculated the same way as stock trades. Premiums, strike prices, and expiration dates all interact in ways that aren’t always obvious. In this blog, we will discuss in detail how to calculate profit and loss for options, the formula, breakeven points and more.

How to Calculate Profit and Loss for Options

Profit and loss in options trading Calculated based on the premium paid or received, the strike price, and the price of the underlying asset is closed or expires. When an option is bought, the premium is the cost of the contract. If sold before expiry, the P&L equals the sale value minus the purchase value. If held to expiry, the outcome depends on whether the option finishes in-the-money (worth exercising) or out-of-the-money (no value at exercise).

For option buyers, the maximum loss equals the premium paid. A profit is made when the underlying’s market price goes past the breakeven point. For sellers, the maximum profit is the premium received, while losses can be high if the price moves far against the strike. Unlike stocks, options have time decay and expiry dates, meaning P&L is tied to both price movement and how close the contract is to expiry. This makes option P&L calculations more specific and dependent on multiple factors.

Understanding Options Payoff

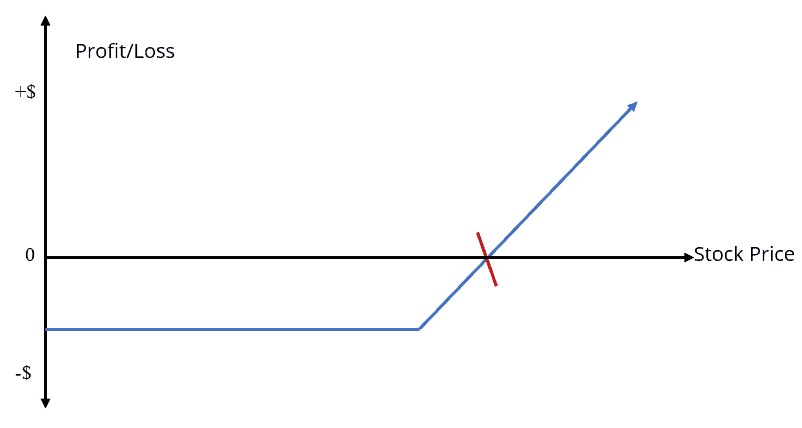

Options payoff shows the profit or loss from buying or selling options. Buyers can have unlimited profit with limited loss, while sellers have limited profit and potentially unlimited loss.

In a long asset position, the asset is bought and sold later. A short position involves selling the asset initially and repurchasing it at a later time. A long call profits if the expiry price is above the strike, while a short call profits if it stays below. A long put gains when the price is below the strike, while a short put gains when it remains above. Each payoff depends on the strike price, market price and premium paid or received.

How to Calculate Profit for Call Options

A call option grants the holder the choice, without the necessary obligation, to buy the underlying at a fixed strike price before or on expiration. Calculating profit depends on whether you are a buyer or seller:

For a Call Option Buyer

You expect the underlying price to rise above the strike price. Profit occurs when the price at expiry exceeds the strike price along with the premium paid.

Formula: Profit/Loss = (Spot Price − Strike Price) − Premium Paid

Maximum Loss: Premium Paid (if the option expires at or below the strike price)

Maximum Profit: Unlimited, as prices can rise without limit.

For a Call Option Seller (Writer)

You anticipate the price will remain under the strike price. Profit comes from the premium received if the option expires worthless.

Formula: Profit/Loss = Premium Received − (Spot Price − Strike Price)

Maximum Profit: Premium Received (if the spot price stays at or below the strike price)

Maximum Loss: Unlimited, as prices can rise indefinitely.

How to Calculate Profit for Put Options

A put option gives the buyer the right, but not the obligation, to sell the underlying asset at a predetermined strike price before or on expiry. Profit calculations differ for buyers and sellers:

For a Put Option Buyer

You look for the underlying price to fall below the strike price. A profit is made if the expiry price is below the strike price reduced by the paid premium.

Formula: Profit/Loss = (Strike Price − Spot Price) − Premium Paid

Maximum Loss: Premium Paid (if the option expires at or above the strike price)

Maximum Profit: Strike Price − Premium Paid (if the price falls to zero).

For a Put Option Seller (Writer)

You count on the price to stay above the strike price. Profit is the premium received if the option expires worthless.

Formula: Profit/Loss = Premium Received − (Strike Price − Spot Price)

Maximum Profit: Premium Received (if the spot price stays at or above the strike price)

Maximum Loss: Strike Price − Premium Received (if the price falls to zero).

Options P&L Formula

Here are the formulas to calculate profit and loss for basic option positions at expiration. Multiply the final per-share result by the contract lot size (e.g., 100, 50, etc.) to get the total P&L.

Long Call P&L: [max(0, ST – K) – C] × Lot Size

Short Call P&L: [C – max(0, ST – K)] × Lot Size

Long Put P&L: [max(0, K – ST) – P] × Lot Size

Short Put P&L: [P – max(0, K – ST)] × Lot Size

Where:

- ST = Spot Price at Expiration

- K = Strike Price

- C = Call Premium

- P = Put Premium

How Greeks Affect P&L

While the formulas above work perfectly to learn how to calculate profit and loss for options at expiration, an option’s value before it expires is dynamic. This is where the “Greeks”are helpful. They measure the sensitivity of an option’s price to various factors, influencing your unrealised P&L at any given moment.

- Delta (Δ) shows how much the option price changes for each ₹1 move in the underlying. Call options carry a positive delta, whereas put options carry a negative delta.

- Gamma (Γ) Gamma tracks how much delta shifts for every ₹1 move in the stock, with the highest readings at at-the-money options.

- Theta (θ) Theta reflects time decay, indicating the value an option loses as expiry approaches benefiting sellers but reducing returns for buyers.

- Vega (v) captures sensitivity to implied volatility. Higher volatility usually increases option premiums, benefiting holders.

Breakeven Point in Options

The breakeven point is the expiry price where the underlying must stand at expiry to recoup the original cost, which is the paid premium. At that price, the trade ends with zero profit and zero loss. Knowing this level is essential for setting realistic profit targets and assessing risk:

- Call Option Buyer: The breakeven point is the strike price added to the premium paid. It’s the price the underlying must hit for the trade to balance out.

Formula: Breakeven = Strike Price + Premium Paid - Put Option Buyer: For a put buyer, the breakeven equals the strike price less the premium paid. This is the price point to which the underlying must decline for the position to reach breakeven.

Formula: Breakeven = Strike Price – Premium Paid - Option Sellers: The breakeven points follow the same formulas, marking where their initial profit from the premium received is fully offset.

Example Profit and Loss Scenarios

Let’s take two examples using the NIFTY 50 index, which has a lot size of 25.

Scenario 1: Buying a Call Option (Bullish View)

You buy one lot of a 23,500 CE (Call Option) for a premium of ₹120 per share.

- Total Cost = ₹120 × 25 = ₹3,000

- Breakeven Point = 23,500 + 120 = 23,620

Profit Scenario: If NIFTY expires at 23,800, gross profit per share = 23,800 – 23,500 = ₹300.

Net profit = ₹300 – ₹120 = ₹180 per share.

Total profit = ₹180 × 25 = ₹4,500.

Loss Scenario: If NIFTY expires ≤ 23,500, loss = ₹3,000 (premium paid).

Scenario 2: Buying a Put Option (Bearish View)

You buy one lot of a 23,500 PE (Put Option) for a premium of ₹100 per share.

- Total Cost = ₹100 × 25 = ₹2,500

Profit Scenario: If NIFTY expires at 23,200, profit per share = (23,500 – 23,200) – ₹100 = ₹200.

Total profit = ₹200 × 25 = ₹5,000.

Loss Scenario: If NIFTY expires ≥ 23,500, loss = ₹2,500 (premium paid).

Tools to Calculate Options P&L

Different tools can be used to calculate options profit and loss, such as the following:

- Options Calculators: These let you input details like the strike price, premium and current price of the underlying asset to calculate profit & loss. Many calculators also display the probability of profit and show potential results at different expiry prices for better comparison.

- Trading Platform Tools:Most online trading platforms include built-in calculators that provide detailed profit & loss breakdowns. They often feature payoff diagrams, real-time updates, and expiry projections based on both live and historical market data.

- Strategy Builders: These are advanced tools that allow traders to design, test, and refine multi-leg strategies. They can simulate market conditions, model spreads, straddles, and combinations, and show the resulting P&L curves visually for clearer interpretation.

- Spreadsheet Models: Custom-built in Excel or Google Sheets, these models can be tailored to specific strategies. By linking live option prices, premiums, and Greeks, they offer dynamic profit and loss tracking and can be adjusted for different scenarios and assumptions.

Final Thoughts

Knowing how to calculate profit and loss for options is essential for assessing trade outcomes and managing expectations. By combining the use of formulas, payoff diagrams, and breakeven analysis, you can see exactly where a position stands at expiry or before. This helps you make the most of opportunities, understand risks, and use tools confidently to track both realised and unrealised results.

FAQs

The profit or loss on an option comes from the difference between what you paid (or received) for the option and what it’s worth when you close the trade. If held until expiry, it also depends on how far the underlying price is above or below the strike price, minus the premium paid, and multiplied by the lot size.

To calculate profit or loss for a call option, subtract the strike price and premium paid from the underlying’s price at expiration. If the price is below the strike, loss equals the premium paid. Profit increases as the underlying price rises above the breakeven point.

For a put option, calculate profit or loss by subtracting the underlying price at expiration and premium paid from the strike price. If the price is above the strike, the loss is limited to the premium. Profit grows as the price falls below the breakeven level.

Breakeven is where you neither gain nor lose. For a call option, it’s the strike price plus the premium paid. For a put option, it’s the strike price minus the premium paid. The underlying must reach these prices by expiry to break even.

Profit for option sellers (writers) is usually the premium received upfront. The maximum profit is limited to this premium. Loss occurs if the underlying moves against the seller beyond the premium amount and can be substantial depending on the option type and position.

An options profit calculator requires inputs such as option type (call/put), strike price, premium paid or received, number of contracts, and expected stock price at expiry. It then simulates potential profit or loss scenarios, helping traders plan and understand their risk and reward.