Options trading can provide a range of methods to manage risk, hedge open positions, or exploit certain market conditions. Of these, perhaps the most common with experienced traders is the call ratio spread strategy, which is a more flexible method that allows a skilled trader to manage both risk and profit potential. It also mixes long and short calls in uneven proportions such that it yields an intriguing payoff structure, which works in moderately bullish events.

This blog will discuss what a call ratio spread is, how it operates, its variations (front and back), and the application of each. We will also look at risk/reward positions, and how they can be applied to real-world situations, and how to manage or adjust such call ratio back spread when the market shifts the field and changes.

What Is a Call Ratio Spread?

Call ratio spread is an options strategy where a specific amount of call options is bought and a larger amount of call options with a higher exercise price is sold simultaneously. The most common forms are the purchase of one call and the sale of two (or more) calls at a higher strike, establishing a ratio.

- Construct: Long one in-the-money (ITM) or at-the-money (ATM) call, short two out-of-the-money (OTM) calls.

- Objective: To profit from limited upward moves in the underlying asset while reducing or eliminating the upfront cost.

- Result: The call ratio spread strategy can generate a net credit or a low-cost debit depending on strike placement and market high implied volatility.

The fundamental concept of a call spread is to use moderate bullishness without paying too much to purchase call options. A potentially unlimited loss can occur, however, should the market forcefully rally beyond the short puts in options trading.

Front vs Back Call Ratio Spread: Key Differences

The two primary variations are called front ratio spreads and back ratio spreads. Although they follow a similar logic of construction, they are rather different in their goals.

| Feature | Front Call Ratio Spread | Back Call Ratio Spread |

| Structure | Buy fewer calls and sell more calls | Buy more calls than sold |

| Cost / Premium | Usually entered for a net credit | Usually entered for a net debit |

| Market Outlook | Best for neutral to mildly bullish expectations | Best for strongly bullish expectations |

| Profit Potential | Limited profit if price stays around strike levels | Potentially unlimited profit if rally is significant |

| Risk Profile | High risk if underlying rallies too sharply (unlimited loss beyond breakeven) | Limited risk if asset stagnates, but requires a strong rally to profit |

| Goal | Income generation with defined profit window | Aggressive upside capture with directional conviction |

| Trader Type | Conservative / income-focused | Aggressive/directional |

The front ratio is a conservative ratio that takes primarily grounds in the view of income and defined profit potential, and the back ratio is an aggressive ratio looking ahead of unlimited upside but demanding a strong directional conviction.

Call Ratio Spreads Mechanics

To illustrate, let’s look at a 1×2 call ratio spread on a stock trading at ₹100.

- Buy 1 call option at strike 100 (ATM).

- Sell 2 call options at strike 110 (OTM).

Key Mechanics:

- Cost Structure

- Selling two OTM calls usually will cover the cost of the ATM call, leaving a near-zero-cost or credit position.

- Selling two OTM calls usually will cover the cost of the ATM call, leaving a near-zero-cost or credit position.

- Breakeven Points

- The call ratio spread strategy can possess two breakevens

- Lower: The long call strike, taking into account any premium collected/paid.

- Upper: The greater strike and the net credit (in case there is any).

- Profit Zone

- The profit level is the highest when the stock reaches the short strike value (110) just before the expiration.

- Risk Zone

- In the event that the stock rallies above the short strikes, the losses can be infinite due to the uncovered short call.

- In the event that the stock rallies above the short strikes, the losses can be infinite due to the uncovered short call.

Payoff & Risk/Reward Profile: Profit Peaks & Unlimited Loss

The payoff diagram of a call ratio spread is in the shape of a tent with one side open:

- Profit Peak: The short strike presents a peak of profits. The long call has acquired intrinsic value at expiry, whereas the two short calls have not yet accrued obscene losses.

- Maximum Profit: Limit at the difference between long and short prices at strike, minus premium.

- Risk: Unlimited in case the stock moves above the higher strike due to leaving the extra short call unhedged.

- Downside Risk: Limited only to the premium paid (if any). Even when the market is stagnant, a net credit can be gained when a small gain is obtained by its execution.

This provides the call ratio spread strategy with a low-volatility nature as suitable in markets that are projected to rise minimally, but not in a skyrocketing bull market.

Market Outlook Ideal for Call Ratio Spread

The short ratio call spread is best used when:

- The trader expects moderate bullish movement in the underlying asset.

- Volatility is relatively high, allowing the short calls to be sold at a premium.

- The trader is comfortable capping potential profit in exchange for a cost-efficient entry.

- There’s a low probability of a major rally, as that exposes the trade to unlimited losses.

It is less suitable in highly uncertain or news-driven markets where sudden rallies are common.

Advantages & Limitations

Advantages of Call Ratio Spreads

1. Low or No-Cost Setup

The best feature of a call ratio spread is that it can be done at minimal upfront costs and sometimes for free. The premiums received on selling subsequent calls normally cover the price of purchasing the first call option.

2. Attractive in Sideways-to-Mildly Bullish Markets

This kind of call ratio spread strategy performs best when the underlying stock is not expected to rise significantly or when it is expected to move sideways. In this case, the traders would be able to make a gain due to time decay (theta) in the short calls, but to have control over a limited amount of upside exposure.

3. Customisable Structure

The ratio spreads of call ratio spreads are adjustable and can be set in varying ratios like 1×2, 2×3, or even 3×5, based on a trader’s conviction and risk appetite. This flexibility enables investors to tailor the payoff to adjust to the profit/acceptable risk ratio.

4. Income Generation

The approach generates cash up front since the premiums collected on the sold calls are more than those received on the bought calls. This makes the call ratio spreads effective for traders seeking to earn an income while continuing to participate in further upside within a predetermined range.

Limitations of Call Ratio Spreads

1. Unlimited Upside Risk

The biggest pitfall is the exposed risk of the additional short calls. In case of the underlying rallying sharply past the higher strike, there is no limit to the growth of losses, as the underlying can keep rising. This is why close position management is very important to traders.

2. Complexity Compared to Simple Strategies

In contrast to single-leg strategies (a purchase or sale of a call), call ratio spreads involve multi-leg option strategy and strike prices. Knowledge of the payoff structure and how adjustments should be made is only learnt through experience, hence not beginner-friendly.

3. High Margin Requirements

Due to the unlimited risk of uncovered short calls, it is common to see brokers set margin requirements at a high level. This has the ability to consume a lot of capital and render the strategy attractive to some extent over the smaller traders.

4. Profit Ceiling Before Risk Resurfaces

Although the trader can be entirely correct in his or her outlook, profits can only be limited by the short strike. Past that level, the position becomes less and less lucrative and overexposed due to the bullish conditions.

Example Trade Walkthrough

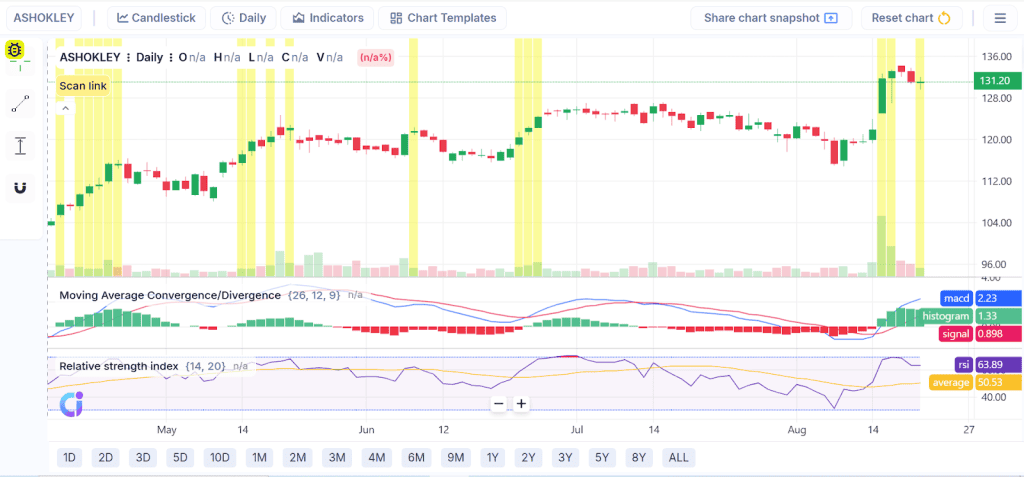

From what we can see on the Ashok Leyland (ASHOKLEY) chart, the stock has been displaying signs of bullish strength as it has lately recovered from ₹115 and is now surging beyond ₹130, thanks to strong momentum, a rising MACD, and an RSI near 64. The projected consolidation around ₹130-₹135 could be exploited by a trader in this situation by means of a call ratio spread.

If the stock settles around the 135 zone, for instance, the trader stands to gain from purchasing a 130 CE and selling two 135 CEs, since the premiums earned from the additional short calls lower the entry cost. The trade could become dangerous owing to the limitless upside obligation if the stock price breaks out well over 135, however.

Adjusting & Rolling Call Ratio Spreads

Since the biggest risk is an unexpected rally, traders often adjust spreads to control exposure:

- Rolling the Short Calls: Close the existing shorts and reopen at higher strikes to give the trade breathing space.

- Convert into a Butterfly Spread: Buy an additional call at an even higher strike to cap potential unlimited loss.

- Exit Early: If the underlying starts moving aggressively upward, locking in profit or cutting exposure early is wise.

- Hedge with Stock: Buying shares of the underlying can offset the uncovered short position, though this requires more capital.

Adjustments should be timely, as waiting too long can allow losses to accelerate.

When to Use Front vs Back Call Ratio Spreads

- Front Call Ratio Spread:

- Use when the market outlook is mildly bullish or neutral.

- Best suited for traders who want to generate premium income.

- Works well in range-bound markets.

- Use when the market outlook is mildly bullish or neutral.

- Back Call Ratio Spread:

- Use when confident about a strong bullish breakout.

- Suited for traders seeking unlimited upside with controlled risk.

- Better in trending markets with momentum.

- Use when confident about a strong bullish breakout.

In short, neutral options strategy are more defensive and income-oriented, while back ratios are offensive and directional.

Conclusion

The call ratio spread is a flexible spread option strategy that optimises cost and maximises profit. By pairing both long and short calls in certain proportions, traders can come up with a structure that continues to perform well on modestly rising conditions. But this comes at the cost of P&L asymmetry of risk/reward; the rewards have an upper limit, but on the risk side, the limit can be put to an unlimited value.

Understanding when to use front vs back call ratio spreads and the adjustments that can be made as markets change is key to success. This call ratio spread strategy can be attractive to experienced traders who have the capacity to view the risk on a regular basis, and maximise the ability to take advantage of the market trends with little initial outlay costs.

FAQs

A long ratio call spread is an options trading strategy in which one buys a number of call options and sells more calls at a higher strike price in a particular ratio, e.g., 1-2. It is made to capitalize on a lateral to slightly bullish trade. The spoilage on the extra selling calls usually offsets or pays up the long call, making it a low-cost setup or even no cost. But it is quite risky when the underlying rallies are strong.

A front call ratio spread is a spread where more calls are sold than bought, and usually has a net credit and is most suited for flat and mildly bullish markets with unlimited upside risk. A back call ratio spread, in its turn, reverses it, but with the calls being bought rather than sold at a net debit. It is skewed to rather bullish expectations where profits can be unlimited and where the downside loss is limited.

The breakeven is dependent on ratio, strikes and premiums. In a front ratio spread, the long call strike plus/minus the net premium is the bottom of the breakeven. The upper breakeven is short strike – (difference between the strike prices) – (net credit (if credited)). In back ratio spreads, one breakeven may be approximately cost plus current rate, and another breakeven much, much higher, as gains are open-ended should the underlying rally.

The maximum profit that can be made on a front call ratio spread will reach a maximum at the short strike and expire at that strike, and the maximum will be equal to the net credit and the difference between the two strikes. The loss potential is unlimited as the stock moves much higher than the short strikes. A back call ratio spread also has limited maximum loss, being limited to the net debit if the underlying does not move far enough.

A front call ratio spread will perform best in a flat to slightly bullish environment with the underlying potentially gaining but not raring to take off. It enables the policyholder to collect its profits on a timely basis and through premium collection. A back call ratio spread performs best in strongly bullish environments, particularly when anticipating a significant upside move.

Adjustments are made according to the movement in the market. With a front ratio spread, the trader can have their position defeated by a big up move and either repurchase the short calls to limit risk or roll them up in the money. Or risk can be defined by converting into a butterfly spread. In a back ratio spread, unlike other spreads, traders can exit early in the case of an insufficient move or roll to further expiries in order to gain more time.

The key hazard in the front call-ratio spread is the prospect of indefinite loss in the event of an explosive move upwards in the underlying, because uncovered short calls are at risk. There is also an early assignment risk when American-style options are utilised. In back ratio spreads, the risk is primarily contained in the possibility that a strong rally does not occur to the extent anticipated by the net premium given.