When markets swing wildly, traders face a painful dilemma: hold stocks through turbulence and risk heavy losses, or sit on cash and watch opportunities pass by. Both choices can feel like losing games. This is why seasoned traders turn to option income strategies. A cash secured put and a covered call offers a way to gain returns while keeping risk defined. They’re not identical, though, the mechanics, outcomes, and capital needs differ. In this blog, we’ll discuss the cash secured put vs call covered call differences in detail.

What Is a Covered Call?

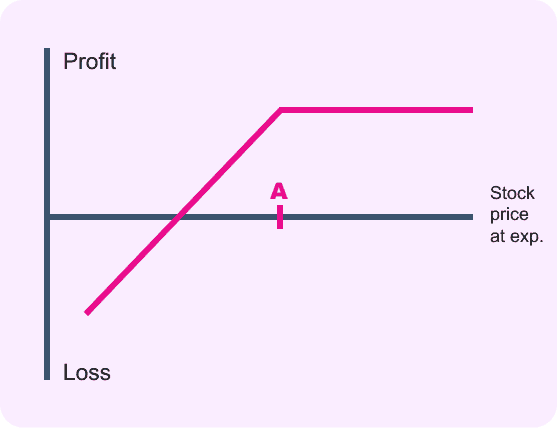

A covered call is an options strategy where a person sells a call option on stock they already own. To execute this, the trader needs to maintain a minimum of 100 shares for every option sold. Through selling the call, they collect a premium and commit to transferring their shares at the strike level if the buyer enforces the contract. This approach is commonly used to generate extra income from existing shares, while still keeping ownership unless the stock is called away.

What Is a Cash Secured Put?

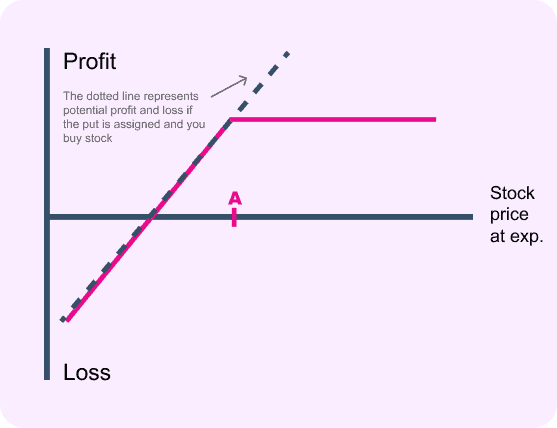

A cash secured put means offering a put contract while reserving sufficient funds to acquire the stock in case of assignment. The seller gains a premium for agreeing to purchase shares at the strike value if the price declines beneath that point. This method is commonly chosen by investors open to holding the stock at a cheaper valuation. The reserved funds guarantee the seller can fulfill the requirement if the option gets exercised.

Cash Secured Put vs Covered Call: Key Difference

The main differences between a cash secured put vs covered call are discussed below:

- Starting position: A covered call begins with stock ownership of at least 100 shares, while a cash-secured put starts with holding enough cash to buy those shares if assigned.

- Objective: A covered call is designed to generate income from already held stock, while a cash-secured put generates income from cash reserves and can also lead to acquiring stock at a lower price.

- Market outlook: A covered call fits when the expectation is neutral to slightly bullish, as gains are capped beyond the strike. A cash-secured put fits when the view is neutral to bullish with an interest in owning the stock if it drops to the strike.

- Obligation if assigned: A covered call seller may have to sell 100 shares at the strike, while a cash-secured put seller may have to buy 100 shares at the strike.

- Use of premium: In a covered call, the premium lowers the cost basis of stock ownership. In a cash-secured put, the premium reduces the effective purchase cost if the stock is assigned.

Real-World Use Cases & Strategy Matrix

Let’s take an example to understand how a covered call and a cash secured put works in options trading. As of August 19, 2025, Hindustan Unilever Ltd. is trading at ₹2,604.80.

A covered call can be created by:

- Holding 100 shares of HINDUNILVR at ₹2,604.80

- Selling a ₹2,650 call option for ₹25

This generates a premium income of ₹25 per share, or ₹2,500 in total. The strategy allows the trader to keep this premium if the price stays below ₹2,650. Should the stock move beyond the strike, the holdings are sold at 2,650, capturing the price gain along with the earned premium. Such a setup reflects a neutral-to-slightly bullish outlook with capped upside.

Now, let’s see how a cash-secured put works on the same date.

A cash-secured put can be structured by:

- Setting aside ₹2,50,000 in cash reserves

- Selling a ₹2,500 put option for ₹18

This generates a premium of ₹1,800. If the price stays above ₹2,500, the option expires worthless and the premium is retained. If the price drops below the strike, the trader buys 100 shares at an effective entry of ₹2,482, creating ownership at a discounted level.

Although both setups produce nearly identical payoff diagrams, the core distinction lies in the starting point. One begins with stock ownership, the other with cash reserves.

Pros & Cons of Covered Call vs Cash Secured Put

Both are options income strategies but work differently depending on whether shares or cash are used.

While a covered call offers income from owned stock but limits future gains. It accompanies certain pros and cons including:

| Pros | Cons |

| Creates income from shares already owned | Limits profit if the stock rises far above strike |

| Reduces the effective cost basis of holding shares | Risk of shares being sold at the strike price, losing future upside |

| Provides steady returns in stable or modestly rising markets | Full downside risk of owning the stock remains, offset only by premium |

| Option side has defined maximum loss (limited to shares held) | Premium earned is usually small compared to stock movement |

| Simple to set up for investors with long-term holdings | Cannot benefit from large market rallies once capped at strike |

On the other hand, a cash-secured put generates income from cash but requires significant reserves. Its pros and cons are as follows:

| Pros | Cons |

| Generates income from idle cash reserves | Requires holding large cash amounts, reducing liquidity |

| Allows entry into a stock at a lower effective price | Obligation to buy if the stock drops below strike |

| Premium collected reduces purchase cost if assigned | Stock may fall well below strike, leading to paper losses immediately |

| Provides a way to get paid while waiting to buy | Capital tied up in reserve cannot be used for other opportunities |

| Works well if stock trades sideways or rises slightly | If stock rallies strongly, no participation in upside gains |

Example Scenarios: Premiums, Break-Even, Returns

Let’s look at example scenarios that show how premium, break-even, and returns come together in covered calls and cash-secured puts.

Covered Call

Suppose you hold 100 shares of ITC Ltd. purchased at ₹400 each. The stock trades at ₹430. You write a one-month call at a 440 strike and collect a premium of 5 for each share.

Premium Collected: ₹500 in cash (₹5 × 100). This sum remains with you irrespective of how the stock performs.

Break-even Price: ₹395 per share, calculated as your cost price (₹400) minus the premium received (₹5). If ITC falls below ₹395, losses begin.

Returns:

- If ITC trades under 440, the call lapses without value. You keep the shares and the ₹500 premium as income.

- If ITC closes above ₹440, your shares are sold at ₹440 each. You earn ₹4,000 from the share price rise (₹40 × 100) plus ₹500 from the premium, for a total of ₹4,500.

Cash-Secured Put

Suppose Tat Motors trades at ₹980, but you aim to buy at ₹950. You sell a one-month put at ₹950, collecting a premium of ₹15 per share, while setting aside ₹95,000.

Premium Collected: ₹1,500 (₹15 × 100). This is retained whether or not shares are assigned.

Break-even Price: ₹935, worked out as strike price (₹950) minus premium (₹15). Below this, losses start.

Returns:

- If Tata Motors stays above ₹950, the option expires, and you keep the ₹1,500 without buying shares.

- If it falls below ₹950, you must buy 100 shares at ₹950, but the effective entry cost is reduced to ₹935 each.

When to Use Cash Secured Put vs Covered Call Strategy

The situations where cash secured put vs covered call may be considered are as follows:

- Covered call is often chosen when shares are already owned, and the aim is to generate extra income without expecting large price movements.

- It is also used when there is a clear selling price in mind, since placing the strike near that level allows premiums to be collected while waiting.

- Covered call can fit well for holdings intended to be kept long term, where small additional returns are useful without giving up complete ownership unless the strike is reached.

- Cash-secured put work when there is interest in owning a stock, but the current market price feels higher than the desired entry.

- It allows the seller to collect premiums while keeping cash idle, effectively lowering the eventual purchase cost if assigned.

- Cash-secured put also match with situations where capital is available and the investor is willing to acquire shares if prices drop to a set level.

- Both strategies function under a neutral to moderately bullish outlook, yet the key difference lies in the starting point. Covered call manages owned shares, while cash-secured put manages reserved cash.

Conclusion

The contrast in cash secured put vs covered call strategies lies in what you start with stock or cash and what you may end with selling shares or buying them. Both methods show how options can turn waiting into earning. They are not competing ideas but complementary ones, each with distinct mechanics that align with different setups. Understanding this variation explains how income-focused option approaches extend beyond speculation into methodical portfolio tools.

FAQs

Covered calls involve owning the stock and selling calls against it to generate income. Cash-secured puts involve selling put options while holding enough cash to buy the stock if assigned. Covered calls earn premiums plus stock appreciation; cash-secured puts earn premiums and may lead to buying stock at a cheaper price.

Cash-secured puts are options strategies where you sell put options and keep enough cash to buy the underlying stock if the option is exercised. You earn premiums while potentially acquiring stock at a lower price if the market drops, aligning with a neutral to bullish outlook with capital readiness.

Disadvantages include tying up cash that could be used elsewhere, risk of having to purchase stock at the strike price even if the market falls further, and missing out on gains if the stock price rises rapidly. Premiums earned are limited compared to owning stock outright.

Yes, cash-secured puts are generally bullish to neutral strategies. You profit if the stock stays above the strike price and are prepared to buy the stock if it falls. This aligns with wanting to own the stock at a lower price while collecting premium income in the meantime.

Neither is inherently better; it depends on your goals. Covered calls suit investors who already own shares and want income plus some upside. Cash-secured puts appeal to those wanting to acquire shares at a discount while earning premium. Both reduce risk and income but fit different capital and market outlooks.