Options trading provides traders with great tools to balance risk, income, and flexibility. Covered Call and Protective Put are among the most popular. Both entail holding stock with additional control using options.

However, they have entirely different objectives, one aiming at generating income and the other at protecting against downside risk. To the investor, it is important to understand the difference between covered call vs protective puts in order to determine which will best fit the portfolio they have.

What Is a Covered Call?

A Covered Call entails selling a call option on a security, while owning shares of the security. This way, the investor receives premiums by selling the call. The Covered Call strategy is most useful in an environment where the stock is projected to remain steady or to appreciate a small amount, since the investor appreciates premiums on both the stock and the option.

Nonetheless, there is a trade-off in terms of profitability and cost. When there is a large increase in the stock price exceeding the call option strike price, the upside is limited. The investor may be restricted in profit-taking should the investor be forced to sell their shares upon their exercise at the strike price.

Covered Calls are popular with investors looking to kindle regular income in premiums, especially in range-bound and slightly bullish markets.

What Is a Protective Put?

A Protective Put does the opposite. In this, the speculator is the stockholder, and he purchases a put option to hedge his risk of a possible decrease. The Protective Put entitles a seller to sell shares at a defined strike price, regardless of the market price.

This plan functions as a washout-draper. A decline in the stock is also limited in that owning put options, owning a stock will only result in a loss of the difference between the purchase price of the stock bought minus the strike of the put (plus the put price). In case of stock appreciation, the investor will enjoy the gains less the cost of purchasing the put.

Protective puts are typical of those investors who have a long-term view of holding a stock but want to stay risk-averse in the turbulent times.

Covered Call vs Protective Put: Key Differences

Objectives: Income vs Downside Protection

The main distinction of covered call vs protective puts lies in their purpose:

- Covered Call: Brings income in terms of option premiums with a slight decrease in the downside risk.

- Protective Put: Insures against severe loss, though at a cost (the premium paid).

Risk-Reward Profiles: Profit Caps & Loss Limits

- Covered Call: Profit is limited to the strike price plus the premium received. Downside risk remains, though there is a cushion of premiums.

- Protective Put: The put limits the downside risk. The upside is not limited, and is violated only by the price of the put option premium.

When to Use Each Strategy

Here’s when you can use each of the strategies in options trading:

- Covered Call: Best in sideways or moderately bullish markets where the investor is comfortable with limiting gains to certain levels in exchange and instant premium income. This method is more preferred by retirees or other investors who are focused on income.

- Protective Put: Works best in uncertain or bearish markets when the most value is on downside protection rather than quick income. Investors who plan to wait long before selling their stock use it to own stock but have no fears of its price plummeting anytime soon.

Examples & Payoff Scenarios

Covered Call Example

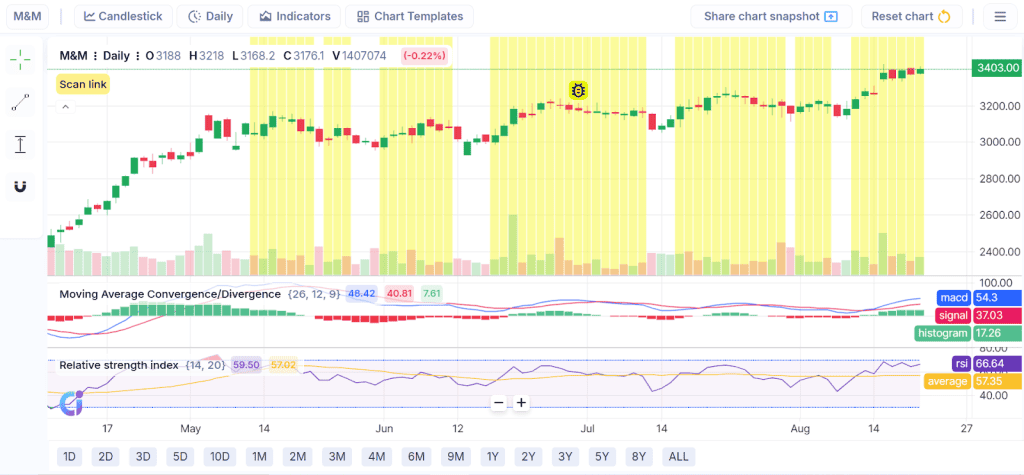

An appropriate scenario to discuss the covered call strategy is this Mahindra & Mahindra chart, which displays a strong uptrend with intervals of consolidation shown in yellow. In a covered call, a trader sells a call option with a higher strike price while holding the underlying stock (in this example, M&M trading between 3176 and 3403). The plan is to take advantage of mild upside while still earning a consistent premium income during consolidation stages (like the indicated sideways zones).

Selling out-of-the-money calls may have provided revenue while holding the stock, for instance, when the stock encountered resistance between 3200-3250 earlier. Prices typically traded sideways before continuing the climb. Therefore, this tactic is effective in these types of charts, enabling traders to profit from range-bound movements without sacrificing the fundamental advantages of stock ownership.

Protective Put Example

An important point made by this ATGL chart is the downward trend from the 700 level peak to the 600 level, which suggests a defensive put strategy could be useful. To protect themselves from a possible decline in value, investors who already possess the stock might use this strategy by purchasing a put option.

As an illustration, a defensive put with a strike near 650 would have mitigated losses when the stock declined towards 600, when the price was around 660-670, and falling candles and bearish MACD indicated weakness. By purchasing puts, investors can limit their downside exposure during strong falls while still participating in any rebound, such as the recent rally after touching 590.

Pros & Cons Comparison

Covered Call

Pros:

- Generates sustainable premium dollars: By selling calls, it results in a consistent premium level of options hedging vs income, which can provide a cushion against a minor dip in the stock.

- Lowers the break-even price point a bit: There is effectively a lower cost of purchasing the stocks through the premium collected.

- Best neutral-to-mild bullish markets: Performs best when you want to see the stock move up slightly, since the premium competes with offside market conditions.

Cons:

- Caps downside exposure: If there is a strong downward move in the stock, the price will go beyond the premium and the strike price, and therefore your losses are unlimited.

- Limited downside protection: There is little margin of downside since pronounced price decreases still lead to losses.

- Early assignment of shares: If the stock price increases, the option buyer can take delivery of the shares before the agreed date.

Protective Put

Pros:

- Excellent downside protection: The put you buy provides downside protection, meaning your losses are minimal, depending on how low the stock can go.

- Provides unlimited upside exposure: If the stock appreciates markedly, you receive full reward.

- Ideal in volatile markets: It provides security in a volatile market or one that is heavily volatile, as the put already protects your downside.

Cons:

- Requires upfront cost of put premium: The premium on the buy put is a significant cost that cuts into your returns.

- Can reduce overall returns if stock does not decline: In case the shares do not fall or increase slightly, the premium price paid to obtain protection feels like wasted money.

- Protection must be renewed when puts expire: In order to stay covered, you must roll or repurchase puts as they expire, which adds on-going costs.

Strategy Extensions: The Collar Strategy

The collar strategy is a combination of the two strategies. An investor would purchase a stock, purchase a protective put, and sell a covered call.

- The put provides downside protection.

- The result is that the call will produce income to cover the expense of the put. This provides an equal trade between the profits and the protections against downside and minimised net cost. Collars are a popular tool among conservative investors and financial institutions to ensure a gain while minimising potential losses.

Tax & Cost Considerations

Taxation

- Covered Calls: The premium earned from covered calls is subject to capital gains taxation. Your gains will be subject to a 15% tax rate if you sell the underlying stock within the first year. The gains are subject to a 10% tax rate (for gains exceeding ₹1 lakh in a financial year) if sold after 12 months.

- Protective Puts: The premium for a protective put can be either added to the purchase price of the underlying shares or subtracted from their sale value. Net gains are subject to a 15% tax rate if sold within a year. Selling it after a year will result in a 10% tax on any net gains (up to ₹1 lakh each fiscal year).

Costs

- Covered Calls: Can be nearly cost-neutral, since selling calls brings in premium.

- Protective Puts: Always involve an expense, which can be significant if renewed repeatedly in volatile markets.

Investors should evaluate after-tax returns and ongoing costs when choosing between covered call vs protective puts.

Conclusion

Covered call vs protective puts have very different uses despite both involving the ownership of stock and the use of options. A covered call is the most income-oriented exposure, and it is best during sideways or slightly bullish environments. A protective put is essentially a risk management tool that allows a trader to minimise potential losses during down periods.

The selection of an appropriate strategy is dependent on the opinion of the market, options strategies comparison, tolerance of risk factors, and the objective of investments. Investors who want a combination should consider the collar as a middle ground.

FAQs

A covered call is a contract to buy stock (ownership) and sell a call option on the stock. It has not too much downside protection but limitations on upside growth. Protective put is a position in which a stock and a put option are bought simultaneously and are used to hedge against this decline. It eliminates unlimited downside risk in exchange for unlimited upside potential.

The covered calls do not provide complete downside protection. The high amount received from selling the call reduces the stock’s actual cost basis, slightly mitigating minor losses. The protection is, however, capped by the premium earned. Although the loss could exceed the premiums received in the event of a steep fall in the stock price.

Covered calls are the most appropriate when you anticipate a low movement or a modest increase in the stock. They also earn predictable returns in the form of option premiums, but their profits are limited when the stock price soars high. Protective puts are more suitable in uncertain or erratic markets, especially when you aim to hedge against a sharp decrease. They play the role of insurance, protecting upside, and capping downside.

A protective put does not limit the gain of your profits. As the stock is standing in your sole name, a rise in the share price ups your gains without limits. The put merely serves as insurance, guaranteeing that you can sell the stock at the strike price in case it drops below that point. The only trade-off is the cost of the put premium, which will reduce overall returns when the stock rises.