Option strategies often benefit traders, offering flexible risk management and earning steady returns. The credit spread option strategy is one of the most popular options among them, as it lets investors collect a premium yield beforehand while limiting loss risk. Unlike purchasing or writing (selling) options entirely, a credit spread, as a defined-risk strategy, stabilizes risk and reward through a planned structure. Investors seeking benefits from theta (time decay) or a range-bound market can apply a credit spread as a potential tool.

In this blog, we’ll walk you through credit spread strategy, its application, benefits and risks, and the right time to use it.

What Is a Credit Spread Option Strategy?

A credit spread is an options trading strategy for investors to buy and sell the same types of options (both calls or both puts) simultaneously, with a similar expiry but at diverse set prices.

- The short option (sold one) produces more premium.

- The long option (purchased one) offered protection with limited risk.

Here, the net credit is the result that investors collect beforehand. Traders apply credit spreads to benefit from neutral market movements or modest directional moves. They profit from the passage of theta decay and the stock not massively moving against the trader’s outlook.

Types: Bull Put Spread & Bear Call Spread

There are two significant types of credit spread options strategies:

1. Bull Put Spread

- A bull put spread is structured by writing a put at a greater set price while purchasing another one at a lesser set price with one expiry date.

- The higher strike puts carries more premium, producing a net credit.

- The strategy is income-generating when the underlying remains beyond the short put strike, specifying a bullish-to-neutral outlook.

Assume a stock trades at ₹100, and an investor might sell a ₹95 put and buy a ₹90 put, where both the options expire with zero value, keeping the net premium, if the stock remains above ₹95.

2. Bear Call Spread

- A bear call spread is structured by writing a call at a lower set price and purchasing another one at a higher set price with a similar expiry date.

- Earns if the asset remains beneath the short call strike, specifying a bearish-to-neutral view.

- The long call limits losses if the stock upsurges sharply.

Assume a stock trades at ₹100, and an investor might write a ₹105 call and purchase a ₹110 call, where both yields are the net premium, if the stock remains below ₹105.

Both types involve limited profit and limited loss structures, making them appealing for traders seeking defined outcomes.

How Credit Spreads Work: Mechanics & Trade Example

The Mechanics

When you structure a credit spread options strategy, the core idea is to collect premium beforehand while limiting your downside risk. Here’s how it works gradually:

1. Sell an Option with a Higher Premium

You start by selling (writing) an option (call or put) which is near the money. It generates a higher premium income as it has a higher profitability of being applied. This sale is the spread’s income-generating leg.

2. Purchase a Further OTM Option

You simultaneously purchase another similar type of option (call if you sold a call, put if you sold a put) at a further set price to limit your risk. This cost-effective option functions as a hedge to cap potential losses during an unfavourable position.

3. Collect Net Credit

Your net credit is the gap between the premium you earn from the short option and the one you pay from the long one. This credit is immediately deposited in your account when the spread is applied.

4. Profit Conditions

Your gain is amplified if the stock remains at, above, or below the short option’s strike (depending on whether it’s a put or a call spread). Essentially, you keep the credit received as profit, as long as the asset is in your favour.

5. Defined Risk

If the stock moves against you, your losses are limited to the gap between the set prices and the net debit received.

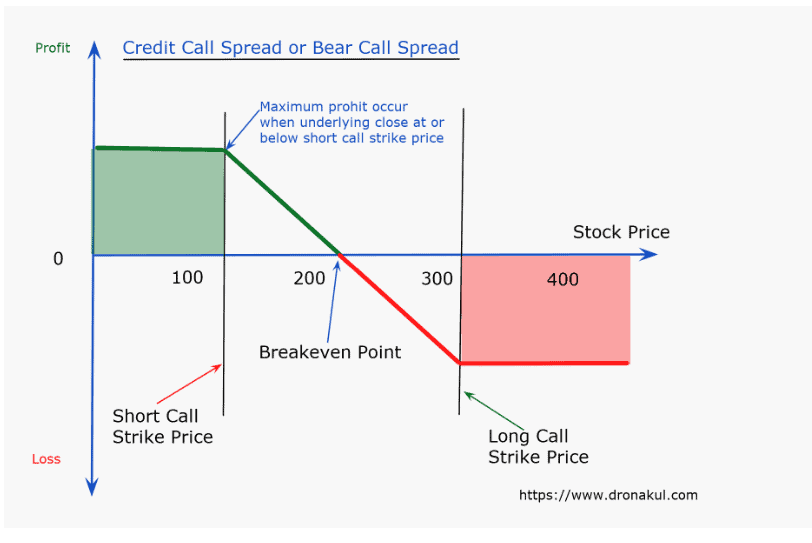

This picture shows the Credit Call Spread, a method for trading options also known as the Bear Call Spread. A short call is an option to sell a call at a lower strike price, and a long call is an option to buy a call at a higher strike price and the same expiration date. By looking at the payoff diagram, we can see that when the stock price closes at or below the short call strike price, the maximum profit is limited to the net premium earned.

Where a profit turns into a loss is the breakeven point, which is located between the two strike prices. Should the stock price surge over the long call strike price, the worst-case scenario would be a capped loss. To profit from time decay while limiting losses, this technique is commonly employed by traders with a neutral to bearish view.

Risk/Reward Profile: Max Profit, Loss & Breakeven

- Amplified Gain: The net credit received while starting the trade, which is gained if the spread expires with zero value (asset stays above the short strike).

- Amplified Loss: The gap between set prices and the net premium earned, where the long option functions as protection.

- Breakeven Point: For bull put spread, it’s the gap between the short strike and net premium received, and for bear call spread, it’s collectively the short strike and net premium received.

This balance of limited risk and reward makes credit spread alluring for income-seeking investors.

Advantages of Credit Spreads

1. Defined Risk: As the trade combines a short with a long option further out-of-the-money, you know the maximum potential loss beforehand. The long option functions as a built-in hedge, controlling downside risk and making the strategy more attractive compared to naked option selling.

2. Premium Earning: By collecting net premiums, the credit spread generates income beforehand. This instant profit makes them alluring for investors seeking stable yields, particularly in markets that remain range-bound.

3. Flexibility: Investors can plan credit spreads applying either puts (bullish bias) or calls (bearish bias), based on their view. This flexibility lets the strategy scale with different market movements.

4. Advantage of Theta: Credit spreads involving selling options obviously benefit from theta (time decay). Gradually, the sold option’s value erodes rapidly than the long one, making a favourable structure when the stock price is stable.

5. High Probability Structure: By picking set prices that are far from the OTM, investors can set-up spreads with a considerably high probability of expiring worthless. This enhances the likelihood of keeping the entire premium received, though it usually comes with smaller profit margins.

Disadvantages & Risks

1. Limited Profit Possibility: The premium received is the maximum profit, even if the market is favourable for trading.

2. Assignment Risk: The short leg can be assigned quickly, particularly with American-style options.

3. Margin Demands: Brokers may have a particular margin requirement, specifically in market volatility.

4. Market Risk: Unexpected and sharp movement in the stock can immediately turn a profitable spread into a losing one.

5. Pin Risk: At expiration, if the stock terminates near the short strike, both legs may demand active management.

Credit Spread Vs Debit Spread Comparison

Lets understand the difference between credit spread and debit spread:

| Feature | Credit Spread | Debit Spread |

| Net Cash Flow | Premium received beforehand | Premium paid beforehand |

| Directional Bias | Neutral to mild bullish (bull put) or bearish (bear call) | Bullish (call debit) or bearish (put debit) |

| Maximum Profit | Net premium earned | Gap between set price and net debit |

| Maximum Loss | Gap between set price and net premium received | Net debit paid |

| Theta (Time Decay) | Works for investors | Works against investors |

| Best Market Conditions | Sideways or moderately directional | Strong directional move anticipated |

Market Conditions Best Suited for Credit Spreads

Vertical credit spreads are ideal for consistent, range-bound and slightly trending markets where the investors expect the stock to remain within a certain range.

- A Bull Put Spread can be applied in a marginally bullish market with robust support levels.

- Bear Call Spread is perfect for slightly bearish markets where resistance is expected to hold.

In high-volatility breakouts, they’re less impactful when the asset strongly moves in one direction.

Basically, credit spread prospers in a calm and anticipated market, benefitting from theta and price stability.

Strategy Adjustments: Rolling & Combining with Condors

To manage positions, even with limited risk, investors often fine-tune credit spreads option strategy:

1. Rolling: Terminating the ongoing spread and reopening it at different set prices or expiration. Let’s say, rolling up or down to rematch with the latest price option or rolling forward to extend time.

2. Coupling with Iron Condors: Credit spreads can be pooled, where a bull put spread and a bear call spread together form an iron condor, maximizing the profit zone, which makes it perfect for strongly range-bound markets.

3. Early Closing: Early closing locks in profit and lessens the risk of sudden reversal near expiry, if most of the premium is already decayed.

Conclusion

The credit spread options strategy is a dependable technique for traders to generate yield while performing risk management. Pairing a short option with a protective long one, investors benefit from theta and neutral-to-mild market patterns. With capped profit, the highest success potential, and collecting premium beforehand makes it attractive for investors seeking stability rather than big wins.

Credit spread option strategy is best deployed in calm markets and can be fine-tuned through rolling or extended into iron condors for range trading. With proper risk management, they remain one of the most practical and popular options strategies for both beginner and experienced investors.

FAQs

A credit spread is an options strategy that lets traders write an option with a greater premium and purchase another with a lesser one, both with the identical expiry date. The credit received during entry is the net effect. Gain is limited to the premium earned, while risk is involved in the gap between the set and the credit. Credit spreads are wide in moderately trending or range-bound markets as they combine definite risk with steady earning potential.

A bull put spread is a bullish or neutral strategy that is all about selling a greater strike put and purchasing a lower one, benefiting when the stock remains above the short strike. In contrast, a bear call spread is a bearish or neutral strategy that involves selling a lower strike call and purchasing a greater one, benefiting when the stock remains beneath the short strike. Both are credit spreads, but used differently depending on directional bias.

Yes, an iron condor is when you pair up a bull put spread and a bear call spread concurrently. Basically, you sell one out-of-the-money put and call while buying another out-of-the-money option for safeguarding. The goal is for the underlying asset to remain within the two short strikes until expiration. This maximises the premium collected while limiting risk on both sides. Investors apply iron condors while expecting low volatility and range-bound price action, targeting yield from theta.

If a credit spread option strategy is not in your favour, balancing is the key to risk management. Investors usually roll the spread to the next expiration, giving the trade more time to work. Or, they may move the strikes further out to lessen assignment risk, or terminate the position early to limit losses. Occasionally, including an opposing spread

(turning it into an iron condor) helps adjust risk. The key is acting early before losses grow too large, preserving capital.

A credit spread option strategy works best when you expect limited stock movement. In marginally bullish or neutral markets, a bull put spread works well, while a marginally bearish or neutral condition is ideal for a bear call spread. They offer value when the implied volatility is higher, since writing options returns more premiums. Credit spreads limit how much you can lose or gain, making them appealing for investors seeking stability instead of indefinite upside yields.

Credit spreads carry risks despite their defined structure. The primary risk is a sharp move in the underlying that pushes past the short strike, creating losses up to the spread width minus the premium collected. Early assignment risk exists with American-style options. Margin requirements can increase in volatile markets, straining capital. Additionally, pin risk at expiration may push active management. Finally, while profits benefit from time decay, adverse price moves can quickly offset this advantage.

Credit spreads generate income upfront, profiting from time decay and limited movement in the underlying. With debit spreads, you make payments beforehand and earn when the asset makes a directional move. Credit spreads usually offer a higher prospect of success but lower potential yields, while debit spreads offer larger upside in a favourable market movement. In core, credit spreads trade higher, offering capped profit, while debit spreads trade lower, offering greater yield potential.