You located a clear market direction, but every time you buy an option, time decay chips away at your premium. Selling options seems appealing, but unlimited risk keeps you on edge. This constant tug-of-war leaves many traders stuck between risk and reward.

The diagonal spread options strategy offers a middle ground, blending different expiries and strikes to slow decay while keeping directional potential alive. In this blog, we’ll explore how it works, why traders use it, and how it differs from standard vertical and calendar spreads.

What is a Diagonal Spread?

A diagonal spread is an options strategy that uses the same type of option, either calls or puts but with different strike prices and expiry dates. It blends features of vertical spreads (different strike prices) and calendar spreads (different expiry’s).

This setup can suit either a bullish or bearish outlook while aiming to benefit from time decay. The name “diagonal” comes from the options’ placement on an options chain, where the combination of different strikes and expirys forms a diagonal alignment.

How Does a Diagonal Spread Work?

It works by combining elements of time-based and price-based spreads. Here’s how this core option trading strategies function:

- Combining spreads: It merges a vertical spread, which uses different strike prices, with a calendar spread, which uses different expiry dates, creating a hybrid structure.

- Time decay benefit: Shorter-term options lose value faster than longer-term ones. Selling a short-term option while holding a long-term one allows the position to gain from this difference in decay rates.

- Directional bias: Strike price selection adds a bullish or bearish view. For example, a bullish diagonal call spread might involve buying a lower-strike long call and selling a higher-strike short call.

- Impact of volatility: Changes in implied volatility affect the position’s value. A rise in the volatility of the longer-term option can increase its worth relative to the short-term option, improving the spread’s value.

Components of a Diagonal Spread

A diagonal spread is built with two options that share the same type but differ in key aspects. The main components are:

- Two options of the same type: Both are calls or both are puts, ensuring the strategy is either fully bullish or fully bearish.

- Different strike prices: The strikes are chosen to match the directional view. A higher strike for the short option in a bullish setup or a lower strike for a bearish one helps define the expected price movement.

- Different expiry dates: The short option expires sooner, the long option later, that’s the time decay advantage.

- Long and short: The long option in the later dated option gives you ongoing exposure, the short option in the nearer term option gives you a premium to reduce the cost of the long option.

Diagonal Spread vs Calendar Spread

While both a diagonal spread and a calendar spread involve options with different expiry dates, the way strike prices are chosen creates very different outcomes. The core differences among these two are as follows:

| Feature | Diagonal spread | Calendar spread |

| Strike prices | Different for each option | Same for both options |

| Expiry dates | Different, usually one short-term and one long-term | Different, typically front month and back month |

| Market view | Directional, can be bullish or bearish | Neutral, focused on time decay |

| Profit drivers | Time decay plus price movement | Primarily time decay |

Diagonal Spread vs Vertical Spread

A diagonal spread and a vertical spread both vary strike prices, but they take a different approach to expiry and profit generation. Here’s how they differ:

| Feature | Diagonal spread | Vertical spread |

| Strike prices | Different for each option | Different for each option |

| Expiry dates | Different, mixing short and long durations | Same for both options |

| Market view | Directional with added time decay effect | Directional only |

| Profit drives | Price movement and time decay | Price movement between strikes |

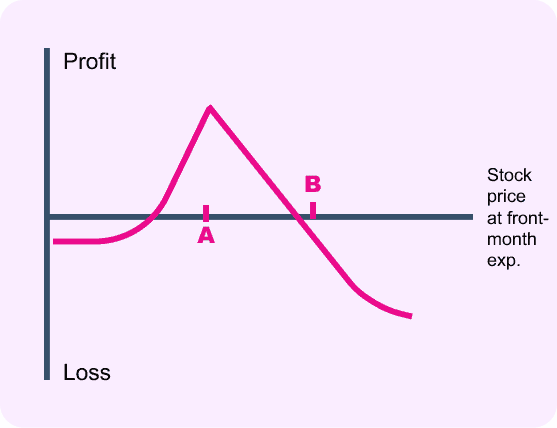

Payoff Diagram of a Diagonal Spread

The payoff diagram for a diagonal spread shows how profit or loss changes with the underlying price at the short option’s expiry. In the diagram, Point A marks the strike price of the short option, where maximum profit is usually achieved. This is the peak of the tent shape, driven by the short option expiring near its strike while the long option retains value.

Point B represents the strike of the long option, beyond which profits start declining as the long option’s cost outweighs gains from the short option. Losses occur if the price moves far above Point B or well below Point A, with the maximum loss typically limited to the initial net debit paid.

When to Use a Diagonal Spread

A diagonal spread can fit into different market situations of options trading where both time decay and a price view play a role. The common uses are as follows:

- When expecting a mild upward or downward price move while aiming to benefit from the faster value loss of the short-term option compared to the long-term one.

- Selling the short-term option can generate premium, adding income while holding the longer-term option. This is also a feature of the “poor man’s covered call.”

- The premium from the short option reduces the net cost of the position, making it cheaper than directly buying a long-term option.

- Near events such as earnings, it can be used when a specific price range is expected and the short-term option is likely to lose value quickly after the event.

Example of a Diagonal Spread

Based on the chart, HDFC Bank is trading at ₹1,970.70 on August 13th. An investor is moderately bullish, believing the stock will rise towards ₹2,000 by the end of the month but wants to reduce their initial cost. They could execute a bullish diagonal call spread:

- Buy 1 SEP Expiry ₹1,960 Call at a premium of ₹60

- Sell 1 AUG Expiry ₹2,000 Call at a premium of ₹18

This results in a net debit of ₹42. The goal is for HDFC Bank to trade near ₹2,000 by the August expiry. The short call would then expire worthless, and the long September call would have profited from the price move while benefiting from the collected premium.

Risks and Rewards of a Diagonal Spread

The main rewards and risks of a diagonal spread are as follows:

Rewards:

- Profit is usually capped and is often achieved when the underlying price is close to the short option’s strike at its expiry, allowing the spread to benefit from both time decay and price positioning.

- Gains can come from the difference in value between the short-term and long-term options as the short option decays faster, creating an advantage even if the price stays near the target range.

- Premium from the short option helps reduce the cost of the longer-term option, making the setup more cost-efficient than buying a long-term option alone.

- An increase in implied volatility for the long-term option can add value to the spread, enhancing returns without a large price move.

Risks:

- The maximum loss is usually the net debit paid to enter the spread, which happens if the price moves sharply against the directional view and reduces the value of both options.

- A large move can quickly erode the value of the position, especially if the long option loses value faster than expected.

- There is assignment risk if the short option is exercised before expiry, leading to an obligation to deliver or buy the underlying asset.

- A drop in implied volatility of the long-term option can lower the spread’s value even if price movement is favourable.

How to Adjust a Diagonal Spread

Some of the common ways to adjust a diagonal spread are as follows:

- Roll the short option: As the short-term option gets close to expiry, close it and replace it with another short option with a later expiry to collect more premium and keep the trade open.

- Change strike prices: If the underlying price moves a lot, roll the short option to a strike closer to the current price to match the setup to the market.

- Close the spread: If the position reaches the desired profit or no longer fits the view, close both legs together to get out completely.

- Convert to another strategy: Close one leg and turn the position into a single long call or put depending on the market view and time left until expiry.

Final Thoughts

When you need a strategy that thinks ahead, the diagonal spread delivers. It merges the best of vertical and calendar spreads, letting you profit from time decay while holding a directional view. With defined risk, controlled cost, and flexibility to adjust, it’s a tool for traders who want steady returns without constant stress. Simple in concept, powerful in execution, this is the spread worth knowing.

FAQs

A diagonal spread is an options strategy involving buying and selling options with different strike prices and different expiry dates. It combines elements of calendar and vertical spreads, allowing some directional bias while benefiting from time decay and changes in volatility.

A calendar spread uses options with the same strike but different expiry. A diagonal spread uses both different strikes and different expiry. This gives the diagonal spread more flexibility and can add a directional bias compared to the neutral setup of a typical calendar spread.

Adjustments can include rolling the short option to a different strike or expiry, moving the long option to a new strike, or closing parts of the spread. These help manage risk or adapt to price moves and changing market conditions.

The main risk is if the price moves sharply against your position, especially if the value of the long leg doesn’t keep up with losses on the short leg. There can also be assignment risk if the short option is in the money near expiry.

Profit usually comes from time decay on the short option and favourable movement in the underlying price towards your strikes. The spread benefits if the underlying approaches the short strike by expiry while the long option keeps value.