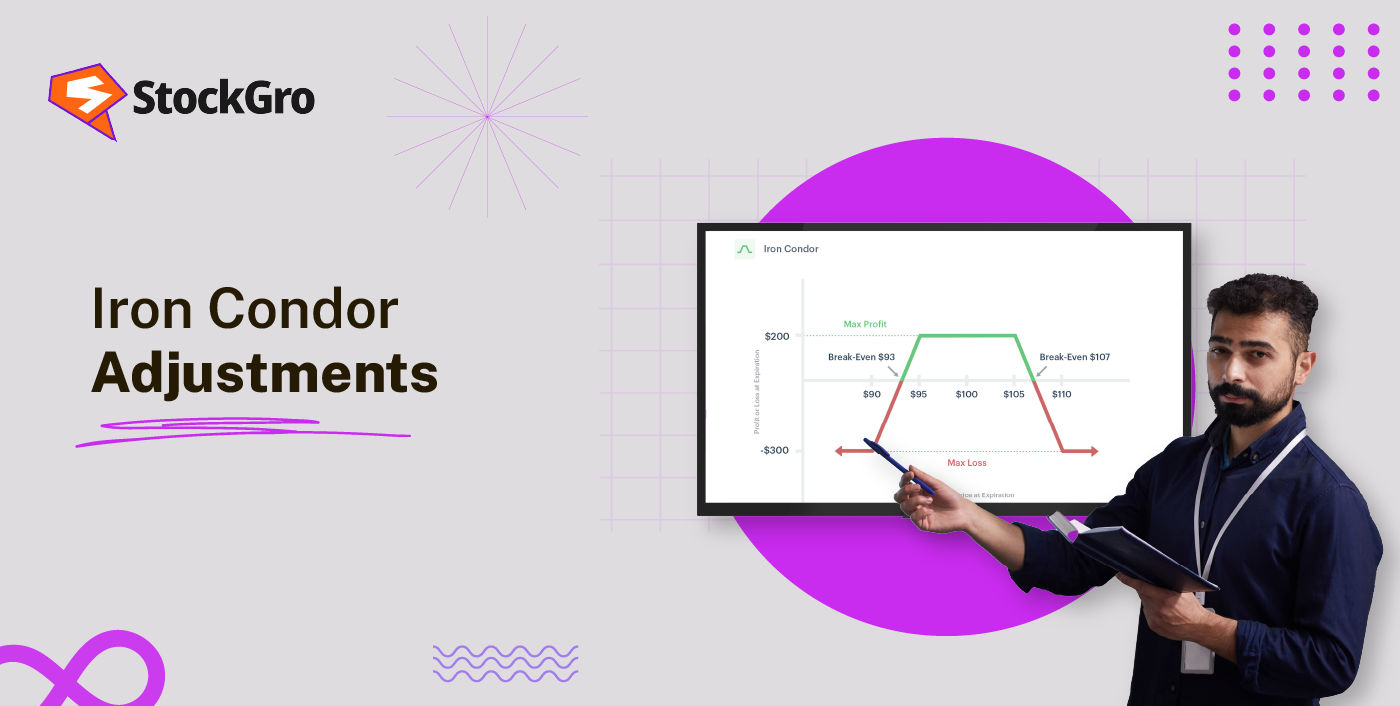

You built your iron condor strategy carefully, price was consolidating, theta was working in your favor until a sudden breakout turned your neutral position into a directional problem. Be it due to a macro event or intraday volatility, many positions in this options trading strategy go off-course faster than traders can react. In this blog, you’ll learn how you’ll learn how to handle these situations with effective iron condor adjustments that help you stay in control.

How to Adjust an Iron Condor: Common Methods

Iron condors adjustments done by extending the time horizon of the trade or by rolling one of the spreads up or down as the price of the underlying stock moves. These iron condor adjustments methods are often used when an iron condor comes under pressure due to price movement:

- Rolling Up or Down the Unchallenged Side

If one side of the iron condor is being tested, say, the price is approaching the short call, traders may adjust the unchallenged side (in this case, the put spread) by rolling it up. This means closing the existing put spread and opening a new one at higher strike prices. The new spread is closer to the current price and typically brings in extra credit, which helps widen the break-even zone. The same logic applies when the put side is tested; in that case, the call spread is rolled down to reduce directional pressure.

- Rolling the Entire Spread Out in Time

If the position is nearing expiration or needs more time to recover, all four option legs can be closed and re-established at a later expiry. This roll often keeps the same strike distances but moves them to a new date, extending the life of the trade. If done for credit, this adjustment can improve the risk-reward by collecting more premium. It also gives the price more time to get back to a range where the iron condor is profitable, especially when the market is temporary or news driven.

- Adding Another Iron Condor (Double Condor)

If price breaks through the initial profit range, another iron condor can be opened around the new price level. This “double condor” increases the total number of option legs to eight, but also expands the range in which the overall position could remain profitable. The goal is to collect enough premium from the second condor to offset the loss in the first. This requires close monitoring as managing two overlapping positions adds complexity and risk, but it gives the position more room to breathe when the original setup is no longer viable.

- Converting to an Iron Butterfly

An iron condor can be adjusted into an iron butterfly by rolling the untested side so that both the short call and short put share the same strike. For example, if the call side is being tested, the trader can move the short put up to match the short call strike. This narrows the profit zone sharply but significantly boosts the total premium collected. It’s a tighter position that works best when a trader believes price will settle near the center strike. The trade-off is a smaller room for success but a larger reward if the price remains near that level.

- Adding a Hedge or Protective Option

Instead of changing the iron condor itself, a separate position can be added to hedge against the side under pressure. For instance, if the price is rising and challenging the short call, a call debit spread above the current price can be added. This additional spread can offset losses from the iron condor if the move continues. Similarly, for a falling market, a put debit spread can be used. This adjustment doesn’t disturb the original position but creates a backup layer that benefits from further direction, helps to control risk without restructuring the whole setup.

Why You Might Need to Adjust an Iron Condor

Iron condor adjustments help traders in the following manners:

- Limits the risk of a small manageable loss turning into the maximum defined loss if price breaches a short strike.

- Adds credit to the position, which can widen break-even levels and improve potential return.

- Repositions the profit range to better reflect where the underlying is now trading.

- Extends the time available for price movement to settle back within the range by rolling to a later expiration.

- Helps keep the position active without needing to fully close or take a loss prematurely.

When to Adjust an Iron Condor

Adjustments are typically made based on predefined rules rather than instinct. A common trigger is when the underlying price touches either short strike, indicating that side is under pressure. Another method is monitoring delta if the short call or put reaches a delta of 0.30 or 0.40, it suggests higher risk of that option finishing in-the-money. Using such mechanical triggers helps traders respond objectively rather than emotionally when a trade starts moving out of range.

Example: Iron Condor Adjustments

Now, let’s take an example to understand this better. Assume you have an iron condor on Bank Nifty with these strikes:

- Short 54000 Put and Short 54500 Call

- Long 53500 Put and Long 55000 Call

In this setup, the maximum profit is around ₹3,600, while the maximum loss is around ₹3,800. At the moment, Bank Nifty is trading at 54,375, close to the short call strike of 54,500. The payoff chart shows a small unrealized loss of ₹-24, but a continued upward move could push losses toward the max limit.

In such a case, adjustments could include:

- Rolling up the untested put spread to collect more premium and expand the upper breakeven.

- Adding a call debit spread above 54,500 as a hedge if the price continues higher.

- Rolling the entire position to a later expiry to give more time for the price to move back within range.

This shows how adjustments can help manage directional pressure without closing the trade entirely.

Advantages of Iron Condor Adjustments

Some of the benefits of iron condor adjustments include:

- Active risk control: Adjustments let you manage risk without closing the trade entirely. Instead of waiting for a loss to hit its maximum, you can take steps to reduce the potential impact.

- Improved premium collection: Many adjustments, like rolling the untested side, bring in additional credit. This increases the total premium collected and may enhance the trade’s risk-reward balance.

- Wider break-even range: By collecting more credit or repositioning strikes, the break-even levels expand. This gives the underlying more room to move without hurting the position.

- Recenter the position: If the underlying asset has moved far from the original range, rolling can help recenter the position around the new price. This improves the likelihood of staying within the profitable zone.

- More time for recovery: Rolling out to a later expiration gives the position a longer life. If the price is expected to return to a better range, this time extension can work in your favor.

- Flexibility without exiting: Adjustments allow you to modify the position without starting a new one. This avoids additional analysis or timing a fresh entry while still responding to changing price conditions.

Risks & Drawbacks of Adjusting an Iron Condor

When adjusting iron condor adjustments, consider the risks that come with these changes:

- Each adjustment adds transaction costs, commissions and fees that reduce the overall net profit of the trade.

- reduce the overall net gain from the trade.

- Price can reverse after making an adjustment, turning the new setup into another losing position.

- Certain adjustments may require more margin or increase the total capital at risk.

- Modifying the position can sometimes widen the possible maximum loss if the market continues moving unfavorably.

- Adjustments made too frequently can lead to “over-trading,” where losses compound instead of being contained.

- At times, accepting a small loss early may be less costly than continuous adjustments.

Tips for Managing Iron Condors Like a Pro

Here are the top tips for effective iron condor adjustments:

- Have a trading plan that defines entry, exit and adjustment criteria before you start.

- Set a profit target and a max loss level to know when to close regardless of adjustments.

- Know the transaction costs, multiple adjustments can eat into your net profit.

- Know when to close for a small loss rather than trying to adjust, especially if the market has changed fundamentally.

- Too many adjustments can increase costs and complexity. If you find yourself adjusting more than 2 or 3 times or feel overwhelmed, it’s often better to close the trade and wait for a new setup rather than risking more losses.

- Beginners can learn basic adjustments like rolling a spread or closing early if losses grow, but complex multi-step adjustments can be tricky. It’s best for new traders to keep it simple, practice with small positions and focus on risk control.

Conclusion

Iron condor adjustments keep a trade alive when the market moves beyond your range. From rolling to adding hedges, these strategies can limit losses and recover premium. The key is to have a plan, manage costs and not over-adjust to save a trade.

FAQs

Adjusting iron condors early is common when price reaches your breakeven points or one spread’s premium increases sharply. Adjusting too late may reduce your options for recovery.

Too many adjustments can add costs and complexity. If you find yourself adjusting more than two or three times or feel overwhelmed, it’s usually safer to close the trade and wait for a new setup instead of adding more risk.

Rolling the unchallenged side closer to the market, narrowing strike widths or adding protective options are considered safe Iron Condor adjustments. These strategies aim to control losses without adding extra risk or large positions.

Most iron condor adjustments, like rolling or adding spreads, involve new trades and extra commissions or margin. “Free” adjustments are rare but sometimes small tweaks like moving profitable spreads can be done with very low cost.

Beginners can learn basic adjustments like rolling a spread or closing early if losses grow but complex multi-step adjustments can be tricky. It’s best for newer traders to keep it simple, practice with small positions and focus on risk control.