Events like budget announcements, central bank decisions, or major corporate results often send prices swinging in unpredictable ways. For traders, betting in one direction can feel like walking a tightrope, too risky if the market moves the other way. The long iron butterfly strategy is built for such situations, providing a defined-risk framework that can benefit whether the market moves slightly or stays near a target price. In this blog, we explain its definition, working, and more. Let’s begin then.

What is a Long Iron Butterfly Strategy?

The long iron butterfly is an options trading strategy that combines a bull put spread and a bear call spread with the same expiry. This iron butterfly strategy sells both a call and put at the central strike price, forming the body, while buying a call above and a put below creates the wings. It has clearly defined risk and works best when the price stays close to the middle strike until expiry. Profit is highest when the closing price is at the middle strike. Large price moves beyond the breakeven points can cause losses, making it suitable for stable price conditions.

How Does the Long Iron Butterfly Work?

The long iron butterfly strategy works by earning from time decay when the price stays near the middle strike. Follow these steps below to establish it properly.

- Choose the asset: Select one likely to stay within a tight price range.

- Choose the expiration date: Pick a date based on expected price stability; weekly setups work for short-term stability.

- Find the ATM strike: Use the current asset price to decide the middle strike, then determine the out-of-the-money strikes for the wings.

- Open four positions: Sell an ATM call and ATM put, buy an OTM call and OTM put. This starts with a net credit.

- Manage to expiry: If the price closes near the ATM strike, maximum profit is realised; adjust or exit if it moves near OTM strikes.

- Monitor positions: Regular monitoring helps limit losses if large price movements occur.

Long Iron Butterfly Example

Let’s take an example where XYZ stock is trading at ₹100. Expecting the price to stay within a narrow range over the next 6 weeks, the trader implements a Long Iron Butterfly to benefit from low volatility.

- The trader buys 1 contract of the 90-strike call option (out-of-the-money) for ₹2, forming the lower wing to limit risk if the price drops below 90.

- Then, they sell 1 contract of the 100-strike call option (at-the-money) for ₹6, creating the body of the butterfly, anticipating it will expire worthless if the price remains near ₹100.

- Next, they buy 1 contract of the 100-strike put option for ₹6, completing the body and adding downside protection.

- Finally, they sell 1 contract of the 90-strike put option for ₹2, forming the lower wing on the put side.

The net premium calculation is:

Premiums collected: ₹6 (short call) + ₹2 (short put) = ₹8

Premiums paid: ₹2 (long call) + ₹6 (long put) = ₹8

Net Credit = ₹8 – ₹8 = ₹0

If there is any difference in premiums resulting in a credit or debit, that represents the maximum profit or loss potential.

The maximum loss is defined by the difference between the strikes (₹10), while maximum profit occurs if the stock price finishes at ₹100 at expiration. The trader monitors XYZ closely, aiming to profit if prices stay within the expected range, while managing risk if prices move beyond the wings.

Long Iron Butterfly Payoff, Max Profit & Loss

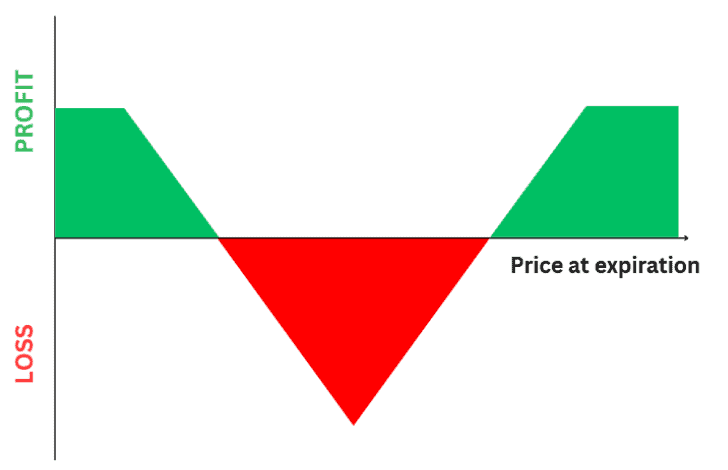

The long iron butterfly’s payoff at expiration forms a distinct “W” shape, showing how profit and loss change as the underlying price moves. The maximum loss happens when the price finishes exactly at the middle strike, while profits increase as the price moves away from this point beyond breakeven levels.

- Maximum profit

It occurs when the price closes beyond the outer strikes, either above the upper strike or below the lower strike. The maximum profit equals the difference between the outer and middle strikes minus the initial net debit paid.

Max Profit = Strike Width – Net Debit

- Maximum loss

The maximum loss happens if the underlying price ends exactly at the middle strike at expiry. This loss is capped at the net debit, the initial cost paid to open the position.

Max Loss = Net Debit Paid

- Breakeven points

There are two breakeven prices that mark the boundary between profit and loss. These are calculated by adding and subtracting the net debit from the middle strike.

Upper Breakeven = Middle Strike + Net Debit

Lower Breakeven = Middle Strike – Net Debit

Between these breakeven points, the trade results in a loss, while outside them, the trade is profitable up to the capped maximum. This payoff design clearly outlines the risk and reward before initiating the trade.

When to Use the Long Iron Butterfly

The long iron butterfly strategy is most suitable when the outlook suggests stable prices within a narrow range. The following conditions help identify suitable setups:

- Low implied volatility allows cheaper options pricing and enables collecting a higher credit when selling the middle strike options.

- Sector and industry is stable so prices don’t move much, so the price will stay range bound.

- Technicals like Bollinger Bands, moving averages and support-resistance zones will tell you if prices are holding within a range.

- Don’t enter when big events like earnings or policy announcements are scheduled, as these can cause big price moves.

- Give the strategy 6–8 weeks until expiration to allow time decay to work; the last month before expiry is where time decay is fastest.

- Place short strikes close to the current market price, with long wings placed further out, to balance credit received and distance to loss points.

Iron Butterfly vs Iron Condor

The iron condor and iron butterfly are neutral option strategies with key differences in structure and performance. Here’s how they differ:

| Aspect | Iron condor | Iron butterfly |

| Strike prices | Four strikes, short options placed further out-of-the-money | Three strikes, short call and put at the same middle strike |

| Profit zome | Wider range between short strikes | Very narrow, centred on middle strike |

| Premium collected | Lower due to wider strikes | Higher as shorts are closer to current price |

| Risk | Lower due to more price movement tolerance | Higher as narrow range is breached faster |

| Best market conditions | Slightly risky, rangebound markets | Very stable, low-volatility markets |

Risks & Drawbacks of Iron Butterfly

This strategy has multiple limitations that traders need to understand. Some of which include:

- Capped profit potential is limited to the net credit collected, even if price moves favorably.

- Narrow profit zone, with maximum gains only if the underlying closes at the short strike; movement outside erodes returns quickly.

- Expiration risk, as outcomes are realised at expiry, with the possibility of early assignment affecting positions.

- Dependency on low implied volatility; increased volatility can breach the wings and cause losses.

- Requires a neutral price outlook, as directional movement beyond the wings leads to loss.

- Time decay erodes the value of long options, which can reduce protection before expiry.

- Early assignment risk on short options, potentially exceeding the planned maximum loss if exercised before expiry.

- Requires margin as well as collateral, which ties up capital that might be used elsewhere.

How to Adjust a Long Iron Butterfly

Adjustments to a long iron butterfly strategy depend on whether the trade is performing well or moving against expectations.

- When the position is profitable, one approach is to exit entirely to lock in gains before expiry risk sets in.

- Another is to roll strikes by closing the existing short call and put, then opening new ones at different strikes to capture more time decay.

- If the market moves against you, close the position early to limit losses.

- Alternatively, buy back the current short legs and open new short options further from the market price, widen the profit zone.

- You can also convert the trade into another spread, like a condor, to balance risk.

- Monitor price action and option premiums regularly so adjustments happen before losses get out of hand, keep the trade manageable throughout its life.

Conclusion

The long iron butterfly strategy has a clear payoff structure with limited risk and capped profit. It works best in quiet markets where the price is near the middle strike. By selling options in the middle and buying protective wings, you can benefit from time decay and price stability while managing risk over the life of the trade.

FAQs

Yes, the iron butterfly is a neutral options strategy. It makes money when the underlying asset’s price is close to the middle strike price at expiration. It loves low volatility and no price movement.

Yes, you can lose if the underlying price moves far beyond the spread’s wings. Big price moves or unexpected volatility can cause losses, especially if the price moves way outside the expected range.

The best market for an iron butterfly strategy is low volatility and a stable price that will stay in a range. It works well when there’s no price movement expected before the options expire.

Beginners can trade iron butterflies but be careful. It has multiple option legs and requires risk management. Start small, learn the basics and practice adjustments before you use it extensively.