When you first hear about stock markets, the usual idea is simple, you buy when prices go up and sell before they go down. But trading is not always about predicting one direction. Sometimes, it’s about making money whether the market goes up, down, or even stays flat. This is where non directional trading options come into play.

For young traders, options feel complex at first glance. But once you break them down, they are simply tools to help you bet on different possibilities. Non-directional options methods are extremely interesting since they let you make money from market movement no matter which way it goes.

In this article, we will talk about non-directional trading, why people trade it, how volatility affects it, and the most common neutral options trading methods, such as straddles, strangles, and iron condors.

What Is Non-Directional Trading Options?

Non-directional trading options are strategies designed to profit from market volatility or time decay without predicting whether prices will rise or fall.

In short, non-directional trading options are ways to do options trading without having to guess whether the stock will move up or down. Instead, you pay attention to how much the stock moves, not where it goes.

For instance, if you think that the Nifty will move a lot following a huge budget announcement but aren’t sure if it will go up or down, you might adopt a strategy that doesn’t point in either direction. The goal here is to capture profits from movement, without taking a one-sided bet.

This makes it very different from regular trading, where you are usually betting on a rise or a fall.

Why Use Non-Directional Strategies?

You might ask: why not just buy stocks or options in the direction you expect? The answer is simple: the market is unpredictable.

Non-directional strategies help in three ways:

- Flexibility: You don’t have to worry about choosing a single side.

- Volatility advantage: You can use expected swings in the market to your benefit.

- Risk control: A lot of neutral techniques let you take on limited risk while still trying to get high returns.

In short, non-directional tactics give you an edge when you know something big is going to happen but don’t know how it will come out.

Key Concepts: Implied Volatility & Time Decay

Before you start using volatility trading methods, there are two main things you need to know:

- Implied Volatility

Implied Volatility (IV) measures how much movement the market expects in a stock or index. If IV is high, it means people are expecting sharp price swings. If IV is low, the market expects stability.

For a trader, IV helps decide whether a strategy like a straddle is worth the cost.

- Time Decay (Theta)

Options lose value as they get closer to expiry. This is called Time Decay (Theta). If you are buying options, time works against you. If you are selling, time decay can work in your favour.

When you combine IV and time decay, you get the base for almost every non-directional options strategy.

Popular Non-Directional Strategies

There are several strategies under this category. Let’s look at the most common ones used by traders.

Straddle & Strangle

A long straddle means buying a call and a put at the same strike price. A strangle is similar but uses slightly different strikes.

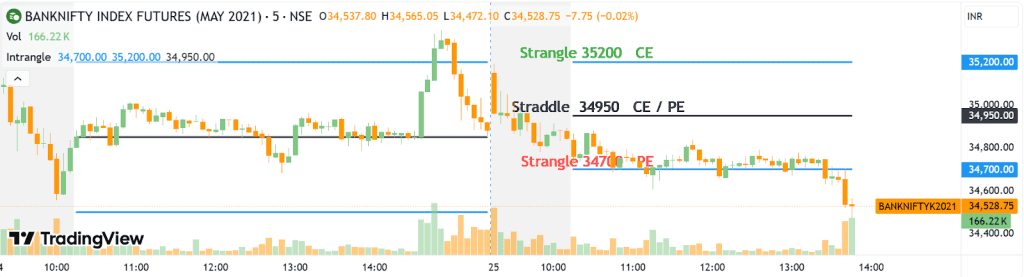

Example:

Straddle:

You buy both a call and a put option at the same strike price, in this case: ₹34,950. This means you are betting that Bank Nifty will make a big move, but you are not sure which way. If Bank Nifty rises sharply above ₹34,950, your call option becomes valuable. If it falls sharply below ₹34,950, your put option gains value. The catch? If the index stays close to ₹34,950 until expiry, both options lose value, and you lose the premium paid.

Strangle:

Here, you buy a call option at a higher strike price (₹35,200) and a put option at a lower strike price (₹34,700). These are “out-of-the-money” options, so they cost less than the straddle. Your trade profits only if Bank Nifty moves significantly above ₹35,200 or below ₹34,700. If it stays within this range, you’ll likely lose the premium paid. It’s a cheaper bet, but requires a bigger move to make money.

In both strategies, you’re aiming to profit from volatility—big price swings either way. Straddles tend to be more expensive but require smaller moves, while strangles cost less but need bigger moves to pay off.

Butterfly & Condor

A butterfly spread involves buying and selling multiple options to create a narrow profit range. It’s useful when you expect the stock to stay close to its current price.

A condor is similar but creates a wider profit range, giving you more room for small fluctuations.

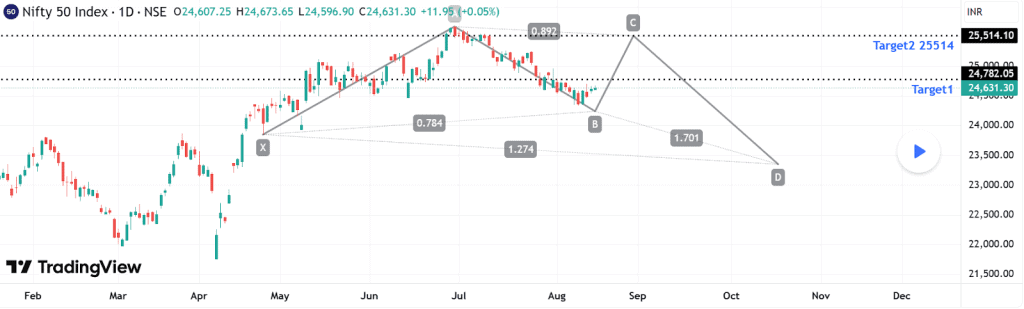

Example: Butterfly Spread on Nifty

- Nifty is currently around ₹24,631.

- The chart shows a possible bearish butterfly pattern forming if Nifty holds the support near ₹24,239.

- If the support holds, Nifty could initially drop to ₹24,239 and then potentially move up to ₹24,782 or ₹25,514 after the reversal.

- This setup implies trading a butterfly spread that profits if the price stays near or dips to the ₹24,239 area before a bounce.

- Traders watch for the support level to hold as confirmation for this strategy, aiming to capitalize on limited expected movement around these strikes.

These strategies are great when the market feels calm and you expect sideways movement.

Iron Condor & Iron Butterfly

These are combinations of calls and puts where you sell options near the current price and buy others further away to protect yourself.

- Iron Condor: Profits if the stock stays within a wider range. Lower profit potential but higher probability of success.

- Iron Butterfly: Narrower range but higher potential return.

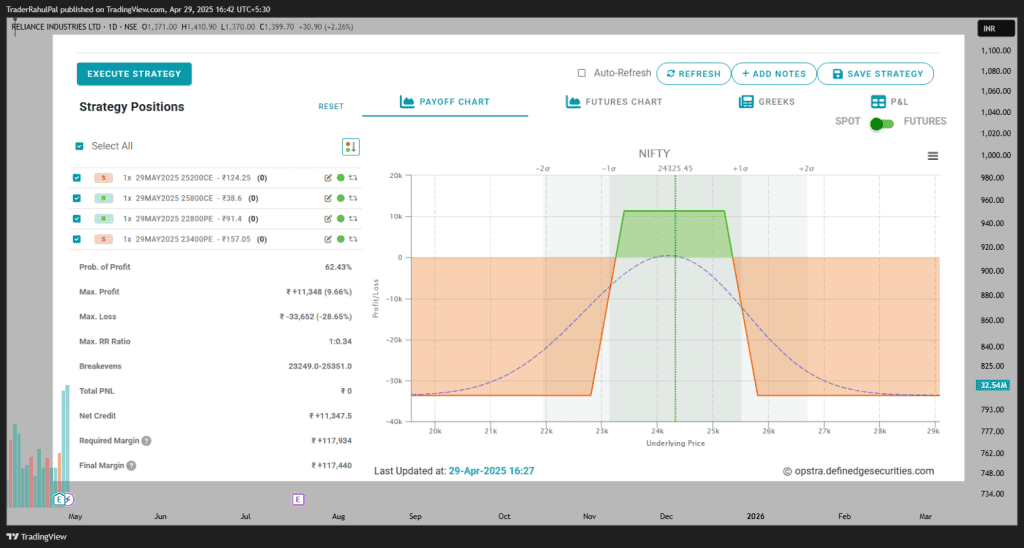

Example: Nifty Iron Condor, May 29, 2025 Expiry:

Nifty trades around 24,845 and is expected to stay between 23,400 and 25,200 in the coming weeks.

The trade setup involves selling a 25,200 call and buying a 25,800 call as an upper hedge. On the downside, selling a 23,400 put and buying a 22,800 put provides lower protection.

This strategy profits if Nifty remains within this range, mainly by collecting premiums and benefiting from time decay.

The maximum profit possible is ₹11,348, while the maximum loss is ₹33,652. Currently, the position is up by ₹5,783 (+4.61%).

The plan is to exit near the maximum profit or if the price breaks out of the range with strong volume.

The trade worked well because Nifty stayed within the predicted range, allowing gains to be locked in comfortably.

Calendar Spread

A calendar spread is when you sell a short-term option and buy a long-term one at the same strike price.

This strategy is about managing time rather than price.

Example:

- Underlying: SBI Life Insurance Futures at ₹1,862 (close price)

- Trade Setup:

- Buy 28-Aug-2025 call option at ₹1,860 strike (longer expiry)

- Sell 30-Sep-2025 call option at ₹1,860 strike (nearer expiry)

- Purpose:

You expect SBI Life to stay near ₹1,860 in the short term, allowing the nearer expiry option sold to lose value faster than the longer expiry option bought. - Goal:

Profit from the difference in time decay between the two options, with limited directional risk because both options share the same strike. - When to Use:

Best when volatility is stable and you expect limited price movement around the strike.

Benefits of Non-Directional Trading

There are several benefits, and each appeals to young traders in different ways:

- No pressure of guessing right: You don’t need to spend sleepless nights wondering if your bullish bet will crash. You’re safe as long as the market moves.

- Perfect for event-driven trades: Elections, budgets, RBI policy changes, or even global news – all create movement. These strategies let you ride the wave without choosing a side.

- Controlled risk: With spreads like iron condors, your maximum loss is defined upfront. This is important for students and beginners with limited capital.

- Regular opportunities: Volatility is always present in the market. Some days it’s high, some days it’s low, but there’s always a plan that works.

- Learning curve: This will help you understand risk, chance, and volatility, which will make you a better trader over time.

The best thing is that it gives you confidence. Even if you don’t know where the market is heading, you can still make smart choices.

Risks & Mistakes to Avoid

There are pros and cons to every trading strategy, and non-directional techniques are no different. Some key risks are:

- High premium cost: Buying both calls and puts (like in straddles) can be expensive. If the stock doesn’t move enough, you lose.

- Underestimating time decay: Many new traders ignore theta. They hold on too long, hoping for a move, only to see premiums vanish.

- Overconfidence: Because these strategies seem “safer,” beginners sometimes overtrade. This leads to unnecessary losses.

- Wrong volatility judgment: Entering when IV is already high can backfire. Even if the stock moves, a drop in IV (known as volatility crush) can reduce profits.

Mistake example: A student trader buys a straddle on Infosys before results, paying a high premium. Infosys announces results, but the stock only moves 1%. The premium crashes, and the trader loses money.

You should always change your strategy based on how much danger you think there is, and you should never risk more than you can afford to lose.

Implementing in Your Portfolio

Now let’s talk about how to actually start.

- Begin with paper trading: Use virtual trading apps available in India. This helps you understand strategies without real money risk.

- Start small: If you wish to practice with real money, trade just one lot of Nifty or other indexes as you like. Don’t put too much money into too many stocks at once.

- Focus on events: Choose events that are likely to happen, like the RBI policy, the results season, or the Union Budget. When you know volatility is likely, non-directional setups work well.

- Track implied volatility: Always check IV before entering. High IV means premiums are costly; low IV means range strategies work better.

- Stick to one strategy at a time: Don’t go back and forth between calendars, straddles, and condors. Instead, focus on getting to know one method well.

- Risk management: Set a stop loss not just in points but also in total money. For example, “I won’t risk more than ₹2,000 on this trade.”

Over time, you will find which strategy fits your personality. Some traders love straddles because of the thrill of big moves. Others prefer iron condors for steady but smaller profits.

Conclusion: When and Why It Works Best

Non-directional trading options are like a safety net for traders who don’t want to take a chance on the market’s direction. They work well when there is a lot of volatility or when you think there will be big changes but don’t know which way they will go.

These strategies open a world beyond simple buying and selling. They let you learn about volatility, time decay, and market psychology – all while giving you more ways to profit.

The most important thing is to start slowly, practise on virtual platforms, and always think about how to manage risk. Non-directional options strategies can be a very useful tool for your trading adventure if you know how to use them.

FAQs

When you trade options without a plan, you apply strategies that work no matter which way the market moves. Instead, you pay attention to movement or volatility. The idea is to make money from price changes or stability without knowing which way the market will move.

Implied volatility decides the option’s price based on expected movement. Higher volatility means expensive premiums. Time decay reduces option value as expiry nears. In neutral strategies, success depends on balancing these two, knowing when they work for or against you.

An iron condor profits when the stock stays within a chosen range. You sell options close to the current price and buy others further away. If the market stays the same, the options you sold will lose value, but you will still get the premium.

The main risks are paying too much in premiums, not knowing how unstable the market is, and losing money over time. The market doesn’t always move enough, or it can drop severely in volatility. Overtrading without discipline also makes things riskier, especially for new traders with little money.

A straddle is when you buy a call and a put at the same price. A strangle is cheaper, with strikes set above and below the current price. Straddles need smaller moves to profit, while strangles need bigger market swings.