Leverage is a powerful concept for attracting many investors to the options market. It authorises you for a large position with a relatively small amount of capital. However, with great power comes great responsibility. Leverage can actually magnify your wins and losses. So, young Indian traders need to learn how it works, to invest smartly and keep their money safe.

This guide breaks down everything you need to know about options trading leverage, from how it functions to managing risks with efficiency.

What is Leverage in Options Trading?

Options trading leverage means using a small amount of money to control a much bigger position in the stock. Instead of buying the entire stock, you can opt for an option trading contract. It lets you, but doesn’t pressure you to buy or sell your stock at a set price within a specific timeframe.

Since the cost of the option, known as the premium, is much cheaper than directly buying shares, you get more exposure for considerably less capital. This potential to control more shares without spending a lot is what leverage is. It’s why options are popular for investors looking to amplify their returns.

How Does Leverage Work in Options?

Leverage is effective because the option premium signifies only a portion of the stock price. Let’s say a stock costs ₹2,000 per share. Buying 100 shares would cost you ₹2,00,000. Nevertheless, you could buy a call option for that stock only at ₹10,000.

If the stock goes up, your option’s value can quickly jump above the stock price itself, giving you bigger return percentages on the money you traded. This options trading leverage effect specifies that small stock price swings can lead to huge profits.

However, if the stock doesn’t go your way, you might lose the whole premium paid for the option, which makes leverage a risky investment choice.

Examples of Leverage in Options Trading

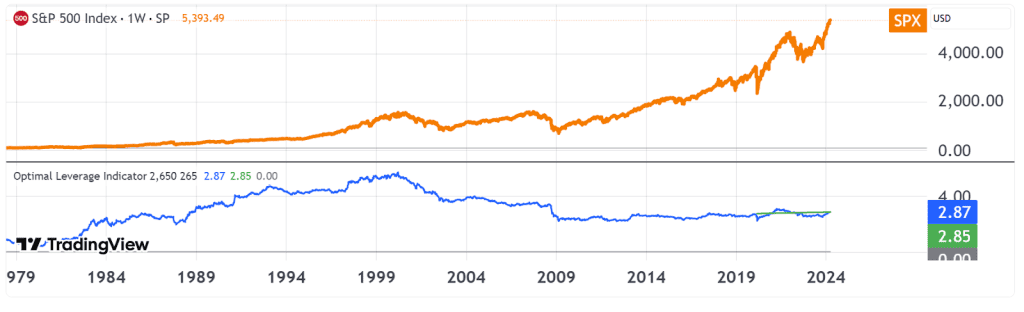

Over many decades, this graphic displays the Optimal Leverage Indicator (blue and green) and the S&P 500 Index (orange) as they have grown over time. From below 500 in the late 1970s to over 5,300 by 2024, the index has expanded rapidly, as seen by the orange line. This shows the strength of market appreciation. Just below it, the Optimal Leverage Indicator shows the ideal leverage that numerous investors could employ while trading S&P 500 options or leveraged securities, which is about 2.5 to 3.

Given the strong rising trend in the market trend, it appears that utilising leverage of approximately 2.85 to 2.87 times your capital could maximise gains while minimising risk in the past. Given the market’s volatility and growth patterns in the past, this indicator can help you determine the appropriate level of leverage to use in options trading, which amplifies both possible gains and risks.

Benefits of Using Leverage in Options

- Lower Requirement of Capital: Options trading leverage allows you to enter large positions without the need for your entire capital to buy shares.

- Magnifying Profits: Small price swings in the stock can magnify the profits due to options trading leverage.

- Adaptability: Options let you adjust your potential gains and losses, which can match both your aggressive and conservative investing strategies.

- Diversification: With less money invested in every trade, you have the opportunity to invest across multiple sectors or underlying assets.

- Lower Risks for Buyers: Selling options on margin carries the risk of margin calls if the market goes against you.

Risks of Leverage in Options Trading

- Total Loss Risk: You could lose all the money you spent on Options if they expire worthless.

- Huge Losses: With options trading leverage, your losses can also be huge, just like profits, specifically if you’re using intricate methods or writing options.

- Time Decay: Options start losing value as expiry dates come closer, which can impact your leveraged positions.

- Volatility Risk: Unexpected movements in volatility can considerably impact option prices.

- Margin Calls for Writers: Selling options on margin brings the risk of margin calls if the market is not favourable for you.

Margin Requirements for Options Trading

Margin is the portion of your investment you must preserve to keep your leveraged position. The margin indicates the premium paid for buying options. However, for the writing (selling) options, margin requirements can be much higher as you anticipate unlimited risk.

Depending on factors like strike price, volatility, stock, and expiry date, brokers calculate the margins. For options trading in India, the Securities Exchange Board of India or SEBI has some ground rules, which help protect traders and keep the market stable.

Make sure to validate the margin demands with your broker and verify your funds to avoid forced liquidations.

How to Manage Leverage in Options

Position Sizing

Position sizing is all about deciding how much capital you should allocate for each trade. Avoid putting too much money into one leveraged options trade. Your smartness lies in risking only 1-2% of your trading capital in a single position. This helps you protect your portfolio from sudden losses.

Based on your stop loss and risk tolerance levels, estimate the position size. Remember that even small adverse moves can result in significant losses with options trading leverage, so carefully control your exposure.

Stop Loss and Risk Control

Stop loss orders help control losses by closing a position automatically when it hits a certain price. For options, this might indicate contract selling if it falls to a set premium level.

Risk control also brings strategies to follow, like keeping tabs on implied volatility, overlooking over-leveraged trades, and tracking your status frequently. Apply alerts or trading tools to track your trades and respond quickly if the market turns against you.

Leverage in Options Vs Futures

Both options and futures offer leverage, but function differently:

- Options leverage is restricted to the premium paid when buying a contract, signifying risk is capped for buyers. However, sellers can face unlimited risk.

- Future contracts demand a margin upfront and expose investors to unlimited risks as price swings. Profits and losses regularly fluctuate with market-to-market settlement.

- Options are more flexible for controlling losses while profiting from options trading leverage, whereas futures involve a bigger investment and risk tolerance.

Selecting one entirely depends on your planning, risk tolerance and market overview.

Conclusion

Options trading leverage is a noteworthy profit that makes options trading appealing, especially for investors with limited capital. Options trading leverage can boost your profit by letting you control bigger positions. But it can also bring bigger losses. If you get how it works and use risk management like stop losses, you can trade options smartly.

No matter how much experience you have, always strategise your leverage cautiously. Consider it a tool to work on your strategy, instead of a shortcut for profits. With options trading leverage, your trading journey becomes better when your approach is smart and methodical.

FAQs

Based on how much money you traded, the contract details, and the broker, the maximum leverage in options trading could fluctuate. Usually, it’s somewhere between 5 and 20 times your money or more. This specifies that you can get complete authority on a position worth 5 to 20 times your invested premium. However, higher leverage means bigger risks. Make sure to check what your broker allows and carefully use leverage to avoid huge losses.

If you’re just starting out, using leverage can be tricky. While it can increase your profits with less investment, it also magnifies losses. It might seem alluring for new investors, but it is risky if they lack risk management skills. Starting small with limited leverage to understand market movements is a smart approach for beginners. Using leverage correctly involves learning risk management, setting stop losses, and avoiding overexposure before scaling up trading size.

Brokers calculate options trading leverage depending on the premium paid relative to the value of your stock. For buyers, leverage is basically the stock price times contract size ratio divided by the premium. Now, if you’re selling options, brokers factor in margin rules, which depend on strike price, volatility, and expiry dates. These margin rules authenticate the potential loss coverage by the trader. Broker platforms usually display leverage and margin details upfront before trade execution.

Yes, options trading leverage can magnify your losses. While it amplifies profit possibilities, it also intensifies risk factors. If the market goes against you, losses can rapidly beat the initial trading amount, particularly for option sellers. For buyers, losing the entire premium is the main risk. High leverage without applying a risk management strategy can quickly wipe out the initial investment. The smart strategy lies in using stop losses, position sizing, and ignoring over-leveraging to control losses efficiently.