Poor man’s covered call explained

A poor man’s covered call is an options trading strategy designed to imitate the effect of a standard covered call, but with a much smaller cash requirement. Rather than purchasing 100 shares of the underlying asset, the trader acquires a long‑term, deep in‑the‑money call option to act as a substitute for share ownership. They then write a short‑term, out‑of‑the‑money call option on the same asset to earn premium income. Known as a diagonal call spread, this method provides capital efficiency while retaining the basic structure of a covered call, though it still involves the inherent risks of options trading.

How does a poor man’s covered call work?

A Poor Man’s Covered Call is essentially created by purchasing a long-term, deep-in-the-money call option to imitate the impact of the underlying shares. A slightly shorter-term, out-of-the-money call option is written against the long call to generate premium income. The long call is the exposure to the company’s price changes, whereas the short call provides the income but puts a limit on the possible profits. This method requires less money than buying the shares outright, but it still carries the standard options trading risk.

Poor man’s covered call vs covered call

A Poor Man’s Covered Call and a traditional Covered Call strategy share similar objectives, but they differ in many ways, as shown below:

| Aspect | Poor Man’s Covered Call | Covered Call |

| Capital Requirement | Needs less capital, as it uses a long‑term, deep in‑the‑money call option in place of buying the shares. | Requires the full purchase of 100 shares, which demands more capital. |

| Structure | Involves purchasing a long‑dated call option and selling a shorter‑term call option on the same asset. | Involves owning the shares and writing a call option against them. |

| Downside Risk | Loss is limited to the premium paid for the long call option. | Fully exposed to share price declines on the owned stock |

| Profit Potential | Gains are capped by the short call, and the long call’s value may be reduced by time decay. | Gains are capped by the strike price of the sold call, but the shares themselves do not suffer time decay. |

| Capital Efficiency | More capital‑efficient because it avoids buying shares outright. | Less capital‑efficient since funds are tied up in share ownership. |

| Market Outlook | Works best with a neutral to moderately bullish market view. | Also best suited for a neutral to moderately bullish outlook. |

When to use a poor man’s covered call

A Poor Man’s Covered Call is often employed when there is a neutral to mildly positive expectation for a share’s future performance, with the intention of earning income without tying up substantial capital. Instead of purchasing the shares directly, the approach uses a long‑term, deep in‑the‑money call option to mirror ownership. A shorter‑dated call option is then sold on the same share to collect premium income. This structure can enhance capital efficiency while limiting downside exposure compared to full share ownership.

Example of a poor man’s covered call

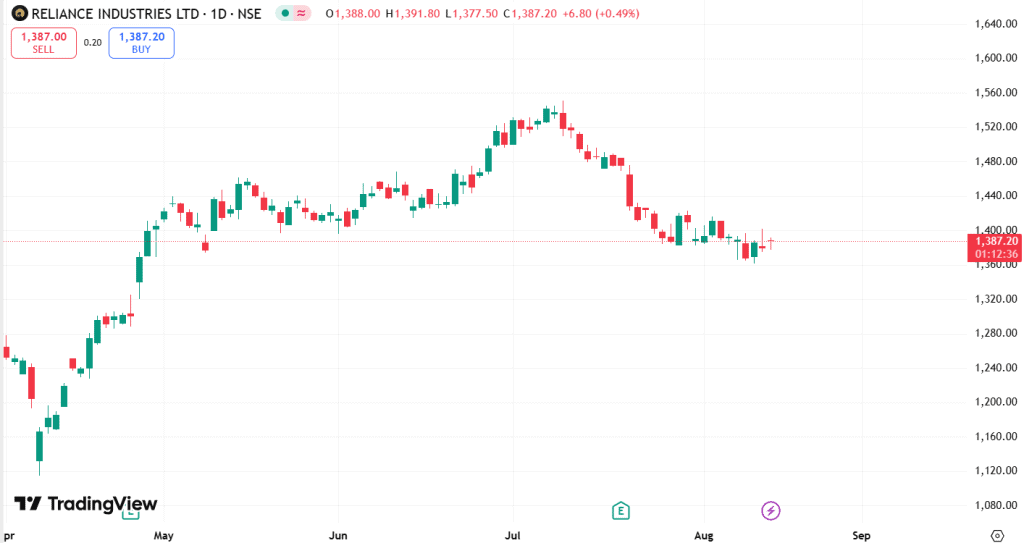

Consider Reliance Industries on the NSE, currently trading at ₹1,387.20 per share. Purchasing one lot of shares (250 units) outright would cost approximately ₹3,46,800.

On the other hand, the plan can be worked out with a smaller amount of money using options:

Buy a Deep In‑the‑Money Call:

Get a long‑term call option with a strike price of ₹1,300. If the premium is approximately ₹100, the cost will be around ₹25,000 for one lot (250 shares).

Sell a Short‑Term Out‑of‑the‑Money Call:

Just write a short-term call option with a strike price of ₹1,400 and take a premium of about ₹13.60 per share, which is a total of ₹3,400 for one lot.

With both positions in place, the total capital outlay is approximately ₹28,000, significantly less than owning the shares outright. The long call replicates the shares, but downside risk is only the premium paid, while the short call provides a return.

Should Reliance be under ₹1,400 at expiry, the short call option’s premium remains with the writer. However, if the stock went higher than ₹1,400, the profit would be capped at that point, and if the price went down, the loss directly caused by the long call would be limited to the premium paid.

This solution is a very capital-efficient way to implement the covered call strategy as it requires substantially lower investment.

Greeks and risk of a poor man’s covered call

Greeks

The main options Greeks are the biggest factors that determine this strategy’s characteristics and performance; each has its distinct role:

- Delta: A long‑term, deep in‑the‑money call usually has a delta ranging from 0.70 to 0.85, which means that its price changes are similar to those of the underlying stock but with slightly less sensitivity. The short‑term call, sold to make income, has a smaller delta, and it partially neutralises the movement. The overall position can therefore allow the holder to profit from moderate increases in the price of the underlying, but with limited upside.

- Theta (Time Decay): The value of the short call is lost at a quicker pace as expiration draws near, while the long call’s time decay is slower. Conveniently, the short call’s premium will disappear at a faster rate than the long call’s value.

- Vega (Volatility): The long call is more positively impacted by the increase in implied volatility than the short call is, which makes the latter beneficial when volatility drops. The mixed reaction to changes in volatility is therefore easy to understand.

- Gamma: Generally, the gamma of the position is low, which means that the delta changes gradually, and at the same time, the sensitivity to sudden, sharp moves in the stock price is limited.

Risks

A Poor Man’s Covered Call is exposed to various risks such as market movement, option expiration, and trade mechanics:

- Sharp Share Price Decline: If the share price plummets dramatically, the long call’s value will be reduced significantly, which means that only the premium paid for it will remain at risk.

- Early Assignment: The short call can be turned into cash before the expiry, for instance, if it is in the money or before ex‑dividend dates. Not having the shares means that you can be compelled to halt the long call or sell it in another account, thereby creating losses.

- Time Decay: The long call becomes worthless faster as time goes by, especially in the last several months before expiry, which is the reason why a long call can face a loss even if the share price is kept unchanged.

- Volatility Swings: The decrease in implied volatility can reduce the long call’s value at a rate faster than the short call’s gain, thus resulting in overall losses.

- Dividend Risk: The risk of a dividend shortfall is that no dividend will come from the stock, and assignment will be done before the ex‑dividend dates.

How to adjust a poor man’s covered call

A Poor Man’s Covered Call requires active management to respond to changes in the underlying share price and market conditions. Here are neutral, practical ways to adjust the strategy:

- Rolling the Short Call: In case the price of the share is close to or goes beyond the strike price of the call with the nearest expiration, selling the call and buying (closing) another one with a different strike and later expiry is the way to go. This helps to collect the premium for a longer time and, at the same time, assists in managing the risk of early assignment.

- Managing Early Assignment: The more a short call is in the money, the more probable it is that the holder will exercise it early. In the case when the shares are not owned, this might mean that the long call has to be sold, or margin arranged, both of which lead to realised losses and extra costs.

- Lowering the Strike: If the short call is relocated to a lower strike as a result of the share price fall, the premium will increase, and thus the long call loss will be partially offset.

- Letting the Short Call Expire: That is, if the short call is out-of-the-money, then it can be allowed to expire worthless, thereby the investor keeps the full premium before selling a new short-term call.

- Exiting or Partially Adjusting: The positions can be simultaneously closed if profit targets are reached or losses are experienced. Moreover, one may just partially adjust or close their positions to take some of the profits while still having a chance of earning an income.

Poor man’s covered call vs cash secured put

A Poor Man’s Covered Call and a Cash Secured Put are both option strategies designed to generate income with somewhat bullish expectations, but they differ in structure, capital required, and risk, as shown below:

| Aspect | Poor Man’s Covered Call | Cash Secured Put |

| Capital Required | Lower, as it involves the cost of a long‑term, deep in‑the‑money call option. | Higher, as the full cash amount is set aside to buy shares if assigned. |

| Structure | Purchase a long‑dated call option and sell a shorter‑term call on the same share. | Sell a put option while holding enough cash to purchase the shares if exercised. |

| Ownership Outcome | Does not result in direct share ownership. | May lead to owning the shares if the option is exercised. |

| Maximum Profit | Limited, based on the premium from the short call option. | Limited, based on the premium from the short put option. |

| Downside Risk | Restricted to the cost of the long call option. | Significant, as shares must be bought if the price falls below the strike. |

| Ideal Market View | Neutral to moderately bullish outlook. | Neutral to moderately bullish outlook. |

Final thoughts

A Poor Man’s Covered Call provides a more efficient use of capital to mimic the results of a covered call, which is attractive to investors who want to generate income but with less money invested at the start. The method, however, although decreasing the exposure to the capital risk, necessitates the involvement of the trader and comes with some risks. For traders who are careful about the balance between risk and return, it remains a flexible, options-based strategy.

FAQs

A Poor Man’s Covered Call is a strategy where shares are replaced by a deep in-the-money long-term call, and a shorter-term call is sold to generate income. The profits of this strategy are similar to a covered call, but it allows you to use less money, while limiting your losses to the cost of the long call and keeping the capital efficient.

A Poor Man’s Covered Call is a strategy that replaces stock ownership with a long-term, deep-in-the-money call option, combined with a short-term call sale. The operation uses less money, and the potential loss on the downside is limited to the option premium. In contrast, a Covered Call is a combination of share ownership and call sales, which puts the entire stock price at risk.

Poor Man’s Covered Call needs less capital than just buying shares, but the holder is still exposed to risks like the fall of the stock price, the option being assigned early, time decay, and volatility changes. Capital efficiency is provided by the method; however, prudent management is necessary to weigh the possible returns against the risk of the underlying asset.

A Poor Man’s Covered Call fits a market view that is neutral to moderately bullish, where a long-term deep in-the-money call is employed in place of shares and shorter-term calls are sold to generate income, allowing for capital efficiency and limited downside relative to just holding the stock.

The Poor Man’s Covered Call is still exposed to risks like a steep drop in the underlying stock, the short call being exercised early, the option losing value due to time decay, and changes in volatility. The company can suffer a loss greater than the premium they received; thus, they should carefully manage these factors.

A Poor Man’s Covered Call is a versatile strategy that can be tailored to your requirements if you manage the short call by rolling it to a different strike or later expiry, controlling early assignment by closing or hedging positions, reducing strikes during drops, dropping out-of-the-money calls at expiry, or parting with shares either to take a profit or limit a loss.