Option traders are always seeking strategies that let them gain profit from certain market conditions while managing risks. One such strategy is the Put Calendar Spread. It’s intended to take advantage of time decay and volatility changes, while making both bullish and bearish market scenarios flexible for traders. By combining temporary and sustainable puts with the same strike price, traders can establish a position that benefits from the passage of time and potential from directional movement in the stock.

In this blog, we’ll explain how a Put Calendar Spread functions, its benefits and risks, how to apply it, and how it is different from other spreads. We’ll also focus on examples and practical tips for the effective execution of this strategy.

What Is A Put Calendar Spread?

A put calendar spread is an option trading strategy where traders buy a long-term put option and sell a short-term put option with the same strike price. You get the benefits of time decay on the short put. It works best when the underlying stock stays closer to the strike price until the short-term option expires.

How Does a Put Calendar Spread Work?

A Put Calendar Spread is described as the event of selling a short-term put option and buying a long-term put option at an equivalent strike price. Both options are on the same stock.

Here’s the key calendar spread strategy:

- Due to time decay (Theta), the temporary put will quickly lose value.

- The sustainable product will hold its value for a longer time because it has a longer expiration date.

The investor profits if the stock price stays close to the strike price of the options, as the near-time options move towards time decay. This is because the short put’s value wears down quickly, while the long put holds most of its value in option trading.

Components of a Put Calendar Spread

The strategy has two key components:

1. Sell a temporary Put

- Usually, this is close the latest market price (at-the-money or a bit out-of-the-money)

- Produces premium income but also includes the compulsion to buy assets if assigned.

2. Buy a Sustainable Put

- Same strike price like the temporary put.

- Protects against potential losses and functions as the “long leg” of the spread.

Put Calendar Spread Example

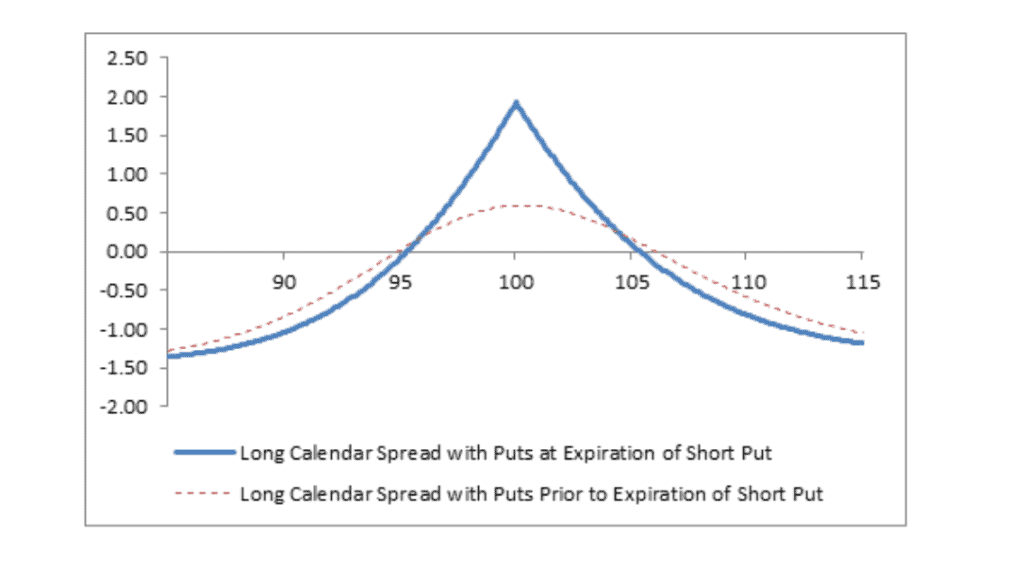

The asset price is on the horizontal axis and the payoff for a long calendar spread put option is shown on the vertical axis. payout at expiry is shown by the solid blue line, and payout before expiration is represented by the dashed red line in the short put. Profiting from the spread is at its peak when the asset price is close to the strike (around 100), because the long put preserves its time value and the short put expires worthless.

To do this, one must sell a shorter-term put and buy a longer-term put at the same strike. This technique is most effective in low-volatility markets close to the strike price, as profits are reduced as the curve smooths out before the short put expires.

When to Use a Put Calendar Spread

A Put Calendar Spread is most effective under certain market conditions.

- Low temporary volatility with potential sustainable movement – This approach stands out when you believe the market condition will be relatively calm in the upcoming days, but could significantly move later. The temporary option benefits from time decay, while the sustainable one holds value if volatility picks up.

- Investing near a significant support level – If the stock is moving around a significant support zone, a put calendar spread lets you position for a probable breakdown in future without overpaying for premium beforehand.

- Benefit from time decay while keeping protection – Selling the temporary put generates income from time decay, helping nullify the cost of the sustainable put, functioning as your safety in the case of price drops.

- Before potential volatility events – Investors often set up this trade way before scheduled events like central bank meetings, earnings announcements, or economic data releases. The expectation is that values will maintain stability prior to the event, but volatility (and potentially price swings) will surge afterwards, making the sustainable put more valuable.

Put Calendar Spread Payoff Diagram

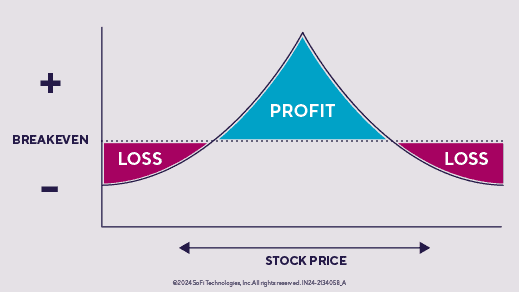

In this diagram:

- As the front-month put expires worthless and the longer-dated option still holds value (time decay differential), the green peak—the highest point of the curve—occurs when the underlying asset’s price is at the strike at the short-leg expiration.

- The red zone represents losses limited by the initial net debit paid to enter the spread, and the curve slopes towards it as prices diverge above or below the strike.

- This yields a neutral to bearish defined-risk strategy that takes advantage of the fact that the short leg of a trade benefits more from theta (time decay) than the long leg does, and that the back-month option can profit from an increase in implied volatility (vega).

Advantages of a Put Calendar Spread

- Risk Management – Your majority of the potential loss is restricted to the net debit you invested to enter the trade. This makes risk management easier and evaluates worst-case scenarios beforehand.

- Benefit of Theta – The temporary pit rapidly loses value in comparison with sustainable value due to time decay. As the temporary option expires, you can potentially benefit from the different rates in time decay.

- Benefits of Volatility – If implied volatility increases, particularly after the expiration of your temporary put, the sustainable pit’s value can increase. This gives the trade an edge when volatility is expected to surge in the upcoming days.

- Flexibility for Adjustments – With the expiration of the temporary option, you can sell another temporary put (roll the position) against your existing sustainable put. This helps boost additional income and extend the trade’s lifespan.

Risks and Limitations

- Time Sensitivity – The approach works best for the time when the stock price hovers near the strike during the span of the temporary put. If the price aggressively swings before expiry, you may lose your profit.

- Risk of Assignment – If the temporary put deeply moves in the money before time decay, there’s a likelihood of early exercise, pushing you to buy the asset at the strike price. This is more likely in low-interest environments or around ex-dividend dates.

- Effect of Volatility Drop – A sudden drop in implied volatility can affect the sustainable put’s value, particularly if the drop happens after the expiry of a short put. This could lead to a loss of your overall gains or turn a profitable position into a loss.

- Capital Involved – Since you’re obliged to pay a net debit beforehand, a portion of your investment is locked in this investment, potentially restricting you from taking other opportunities.

Put Calendar Spread Vs Call Calendar Spread

Let’s look at the differences between a put calendar spread and a call calendar spread:

| Feature | Put Calendar Spread | Call Calendar Spread |

| Option Type | Developed using put options, giving the authority to sell stock at a set strike price. | Developed with the application of call options. This empowers you to trade underlying assets at a set strike price. |

| Market Bias | Ideal for a slightly bearish or neutral position, works well if you expect the asset’s stability or movement lower in future. | Ideal for a bullish or slightly bullish or neutral position, works well if you expect the asset’s stability or movement higher in future. |

| Protection | Provides downside protection, where the long put can benefit if the stock drops after the expiry of short puts. | Provides upside protection, where the long call can benefit if the asset spikes after the expiry of short puts. |

| Ideal Use Case | Perfect when expecting price stability near a key support level, can profit from future declines after temporary time decay. | Perfect when expecting price stability near a key resistance level, can benefit from later rallies after temporary time decay. |

Put Calendar Spread Vs Diagonal Spread

Now let’s compare put calendar spread with a diagonal spread:

| Feature | Put Calendar Spread | Diagonal Spread |

| Strike Prices | Both the temporary and sustainable put options are set at the same strike price, making the positions less sensitive to large directional swings. | The temporary and sustainable options are set at diverse strike prices, together with a directional bias to the trade. |

| Expiry Dates | The two puts have different time decays, temporary one expires quickly and sustainable one takes longer time. | The two options also have different time decays, but the strike difference transforms the payoff profile. |

| Flexibility | Usually less directional, where profits are mainly based on expiry dates and volatility shifts instead of large price swings. | More directional, due to different strikes, the trade benefits more if the price is directed towards the strike of the sustainable option. |

| Risk / Reward | Offers a balanced risk or reward profile, not overly aggressive, suitable for more controlled approaches. | Can be more aggressive, as directional bias enhances potential gains but also magnifies exposure if the move is in the opposite direction. |

How to Trade a Put Calendar Spread

Choosing Strike Prices

- Pick a strike price near the latest market price (at-the-money) for the best advantage of time decay.

- If you expect a minimum swing, you can modify the strike slightly below (for bearish bias) or above (for bullish bias) the latest price.

Managing the Position

- If you’re willing to continue the strategy, keep tabs on the temporary put’s decay and roll it forward to another temporary time decay.

- If the stock is unfavourable for you, consider closing the trade early to limit losses.

- Keep tabs on implied volatility, as a spike in volatility often paybacks your long-term option.

Common Mistakes to Avoid

- Entering in High Volatility – The strategy works better if you enter in a low implied volatility, as you benefit from future rises.

- Picking Strikes far from the Latest Price – This reduces the likelihood of maximum profit.

- Overlooking Earnings Dates – A sudden rise in price can disrupt your setup.

- Not Following Early Assignment Risk – Specifically in American-style options.

Conclusion

The Put Calendar Spread is a resourceful options strategy that unifies the time decay benefits with the security of a sustainable option. By choosing strike prices cautiously and handling the position, investors can generate stable profits in low-volatility environments while focusing on risk management.

It’s not a “set and forget” trade. Here, you’ll have to be careful about market movements, implied volatility, and short options’ time decay. However, it can be a potential addition to the option toolkit for investors who have knowledge of mechanics.

FAQs

A put calendar spread is an options strategy involving the method of buying a long-term put and selling a short-term put at the equivalent strike price, where both options are on the similar stock with different expiration dates. The aim is to benefit from expiry dates on the short option while maintaining protection from the long one. Traders usually use this when expecting the underlying asset’s price to stay near the strike price until the short option’s expiration, enabling potential profit from volatility changes.

For a put calendar spread, the maximum profit spread happens if the stock price is at the strike price at expiry of the temporary put. At this point, the short option loses all time value, while the long one still maintains significant time value. This creates the largest possible spread value. While the particular profit is based on the actual premium paid and implied volatility, it’s inadequate because profits depend on the value of the long option after the short expires, not from large price swings.

You should implement a put calendar spread while expecting a consistent stock price or a marginally declining stock price over the near term, without sharp drifts. It’s appropriate when implied volatility for the temporary option is relatively high compared to the sustainable one. With this, you get an advantage from rapid time decay on the temporary option and at the same time can protect the long one.

A put calendar spread is usually measured as slightly bearish to neutral, which profits hugely when the stock value is close to the strike price at the short option’s expiration. The strategy uses put, but it’s not aggressively bearish, since large downward moves can impact profitability. Instead, it gets profit from steady or relatively low prices and higher implied volatility in the closest term. So, it’s perfect for investors seeking to limit their risk while targeting profits from volatility movements and time decay.

If the stock moves far away from the strike price in either direction, the profitability of a put calendar spread usually decreases. For a sharp drop below the strike, the long put gains value but the short put may cause losses that offset gains. For a sharp rise above the strike, both puts lose intrinsic value, and the strategy may incur a net loss. Because the setup works best when prices hover near the strike, large moves in either direction reduce its effectiveness significantly.