Earnings season often tempts traders with promises of quick profits. Yet, history shows that disappointments usually hit harder than positive surprises lift prices. up. A single disappointment can wipe out value instantly, while positive news often brings only limited upside. This uneven reaction makes traders look for smarter ways to protect themselves. The strip option strategy offers such a shield by creating positions that lean toward downside moves without ignoring the upside, making it a suitable choice for events where reactions to bad news outweigh good. In this blog, we discuss its meaning, its working, benefits, limitations and more.

What Is the Strip Option Strategy?

In option trading, the strip option strategy is built to capture gains from rising volatility rather than directional price moves. It involves buying both a call option and a put option with the same strike price and expiry, creating a position similar to a straddle. The maximum loss is limited to the premiums paid, while profits can expand significantly if volatility increases and drives up option values in either direction.

How Does the Strip Strategy Work? (Mechanics)

The mechanics of strip strategy options involve a sequence of steps that define how the trade is managed, including:

- Identify situations where markets are expected to remain uncertain or experience a sudden surge in price movement, often linked to corporate announcements, policy updates, or major economic releases.

- Select strike prices at or near the current asset level so that both the call and put options remain equally positioned to capture sharp moves in either direction.

- Execute the trade by purchasing one put option and two call options simultaneously, all with the same strike price and expiration date, creating a structure with greater downside weight.

- Manage the position by monitoring price behavior, adjusting strikes if necessary, or holding steady until the chosen event passes and market action confirms expectations.

- Exit by closing both legs or holding to expiry; losses remain capped at the total premium, while profits expand with strong directional moves.

Example of a Strip Option Setup

Let’s take an example to understand the working of strip option trading strategy. On 22 Aug 2025, Reliance Industries was trading at ₹1,409.20 after a pullback. An investor expects the price to drop further rather than rise, making this an ideal situation for a strip option strategy.

Using the September 2025 expiry with a ₹1,410 strike price:

- Buy 1 Call Option (CE) at a premium of ₹25.

- Buy 2 Put Options (PE) at a premium of ₹30 each.

The total upfront cost (net debit) is ₹25 + (2 × ₹30) = ₹85 per share, which is also the maximum possible loss. With two puts in the position, profits are higher if the stock falls sharply, while a strong upward move can still yield gains, but the downside profit potential is greater.

Breakeven Points & Payoff

In a strip option strategy, the breakeven point is the stock price where the position neither makes a profit nor incurs a loss. It is calculated as the strike price of the sold call plus the net debit paid.

For example, selling a 50 strike call with a net debit of ₹2 gives a breakeven at ₹52. If the stock ends below ₹52, the long put offsets the debit, and the trade breaks even. If the stock rises above ₹52, the assignment on the short call results in losses.

Wider breakevens create more scope for profitability, and time decay tends to lower the effective breakeven as expiry nears, improving the position’s balance.

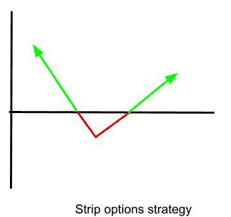

Now, looking at the payoff diagram of a strip option strategy it can be understood that:

- Profit if expiry is above the upper breakeven.

- Profit if expiry is below the lower breakeven.

- Loss occurs if expiry remains between the breakeven points.

This structure makes the strip option strategy suitable as a market neutral bearish strategy.

Advantages of the Strip Strategy

The main benefits of using the strip option strategy are as follows:

- Defined and limited risk, since the long put fixes the maximum possible loss at the net debit paid. This built-in protection limits downside exposure and offers better control compared to strategies carrying unlimited risk.

- Lower cost structure, because the premium earned from selling the call offsets part of the put’s cost. This reduces the total cash outlay and makes establishing a strip options position more capital-efficient.

- Uncapped profit potential, as gains can continue beyond the short call strike if the stock rises. Unlike capped-return strategies, this setup allows full participation in extended upward price moves.

- Flexibility, since the strip can be adjusted into spreads or collars to refine risk. Traders may also roll or widen positions to match different market setups.

- Higher probability opportunities, as strips tend to perform well under frequently seen market conditions. This increases the odds of consistent outcomes.

Risks & Limitations

Like any structured trade, the strip option strategy carries certain drawbacks, including:

- Requires accurate forecast as results rely on the stock staying within the range set by strikes. A wrong outlook can push the position out-of-the-money and create higher-than-expected losses.

- Time decay impacts long puts as expiration nears, eroding downside cover. Active management is needed to roll or adjust; otherwise, the position may lose protection.

- Assignment risk is possible on short calls if they move in-the-money, particularly around dividend dates. This may force early exit or adjustment.

- Unbalanced Greeks tilt exposure toward the short call leg, with sensitivity to delta, theta, and vega making risk management uneven across the strategy.

- Limited profit potential restricts upside beyond the short call strike. Unlike holding stock, this structure limits the chance of capturing large upward rallies.

- Market conditions must align closely, making the strategy less flexible compared to simpler directional trades.

Strip vs Straddle vs Strap

Strip, strap and straddle all three are multi-leg option strategies built around calls and puts, each structured to respond differently to price direction. Here’s how they differ:

| Aspect | Straddle | Strip | Strap |

| Construction | Buy 1 Call + Buy 1 Put (same strike, same expiry) | Buy 1 Call + Buy 2 Puts (same strike, same expiry) | Buy 2 Calls + Buy 1 Put (same strike, same expiry) |

| Bias | Neutral | Bearish | Bullish |

| Profit potential | Large move either way | Higher gains if price falls, still gains if it rises sharply | Higher gains if price rises, still gains if it falls sharply |

| Loss possibility | Limited to premiums paid | Limited to total premiums | Limited to total premiums |

| When used | Expecting strong movement, but unsure of direction | Expecting downside move with some chance of upside | Expecting upside move with some chance of downside |

Best Market Conditions to Use It

The effectiveness of this bearish option strategy depends on specific setups, such as:

- Overall market direction showing weakness: When broader indices or sectors are trending downward, applying this strategy can align with the bearish outlook and help capture declines.

- Stock trading near resistance: If a stock repeatedly fails to move above a certain price point, it signals strong resistance, making bearish positioning more suitable.

- Gradual price declines expected: This strategy fits when the expectation is for steady downward movement rather than sharp drops.

- Limited upside potential: If market conditions suggest little room for price increases, the strategy works well by focusing on downside opportunities.

- Portfolio protection needs: Investors may use it to reduce exposure to anticipated declines in existing holdings.

- Weak fundamentals or negative sentiment: When earnings, guidance, or broader news suggest pressure on a stock, bearish positioning is justified.

Conclusion

The strip option strategy demonstrates how traders design setups to match market psychology. Markets often punish bad news more harshly than they reward good news, and this imbalance creates space for strategies tilted toward the downside. By leaning on that behavioral tendency, strip strategy options illustrate how options trading can capture asymmetry in market reactions. It underlines the role of planned approaches in turning sentiment-driven moves into defined, risk-managed trades.

FAQs

A strip option strategy involves buying one call option and two put options with the same strike price and expiration date. It’s designed to profit from large price moves, especially downward moves, by emphasizing downside protection.

The maximum loss is limited to the total premium paid for the options. If the underlying price remains near the strike at expiration, the strategy can lose the entire premium paid.

A strip has twice as many puts as calls, focusing more on downside moves. A straddle buys equal calls and puts, betting on volatility in either direction. A strap buys twice as many calls as puts, favoring an upside move.

Yes, the strip strategy is used in Indian options markets, especially on liquid stocks or indices with active options chains, like Nifty or Bank Nifty. Ensure you understand margin and regulatory requirements before trading.

There are two breakeven points:

On the upside: Strike price + total premium paid divided by the number of contracts weighted for calls.

On the downside: Strike price − total premium paid divided by the number of puts weighted twice.

It is most effective when expecting significant price moves with higher probability of a downward move, such as before earnings announcements or uncertain market conditions with bearish bias.

Risks include losing the entire premium if the underlying price stays near the strike until expiry. Time decay and volatility changes can also affect profitability. The strategy can be costly and requires careful management of risk and exit points.