What is a Synthetic Call Strategy?

The synthetic call method is a financial derivatives technique which involves owning the stock and buying a put option on the same stock so that the return function of a normal call option is visually identical. The strategy limits the loss risk to a certain extent and retains the option’s upside potential without limit, thus serving as an instrument for investors having a positive view on the stock but willing to shelter from a temporary fall in the share price.

How Does a Synthetic Call Work?

A synthetic call is a combination of a long stock position and a put option purchased on the same stock. Essentially, this setup is a payoff function that is the same as that of a conventional call option.

When the stock price increases, the user profits from the increase; if the price declines, the put limits the loss, thus the investor has an upside potential that is not limited and a limited downside risk. A call option buyer who wants to achieve the same result but without having to buy a call would likely use this strategy.

Components of a Synthetic Call

A synthetic call strategy consists of two main components:

- Long stock position in the underlying share – Having the stock means direct contact with the changes in the stock’s price and gives the investor the right to dividends and shareholder privileges.

- Long put option on the identical share – Generally, this put option with the same strike price and expiration date as the synthetic call is made to imitate the call and gives the owner the loss limit by allowing the share to be sold at the strike price.

Why Use a Synthetic Call?

One of the main reasons for creating a synthetic call is to imitate a traditional call option payoff by purchasing a put on the same share while owning a share. By doing so, the investor gets the possibility of going up to infinity if the share price goes up, at the same time limiting the downside through the protective put.

Moreover, through this strategy, which falls under hedging strategies, investors get the opportunity to better use their capital and have great flexibility, which enables them to take positions that fit their market view or risk without actually purchasing a call option.

Furthermore, the technique keeps the stock from falling for a short period, giving off a feeling of security as well as being potentially cheaper than other methods, especially when call options are expensive or difficult to trade.

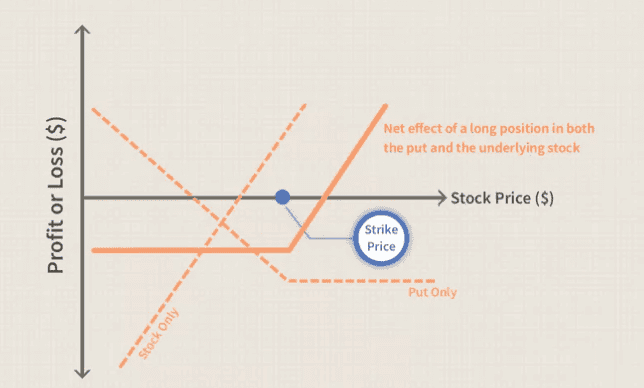

Synthetic Call Payoff Diagram

A synthetic call payoff graph illustrates how the use of a long put option together with the ownership of the underlying share forms a risk/reward profile that matches a normal call option. The protective puts limit losses at levels lower than the strike price, while the positive side at the strike remains endless if the share price goes up. The pictorial “hockey stick” form depicts a scenario of limited downside and unlimited profit potential.

Synthetic Call Example

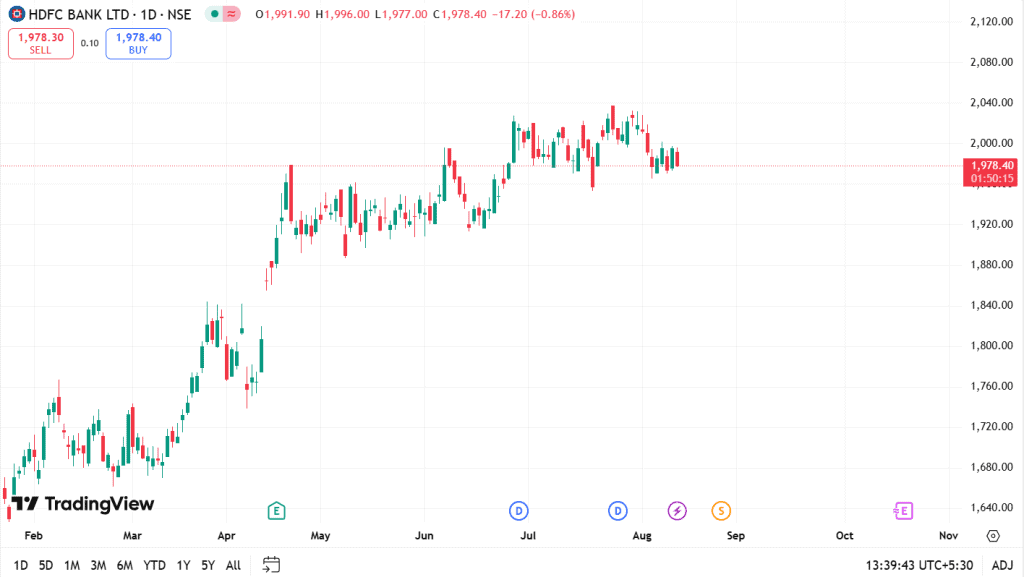

Let’s say an investor has 100 shares of HDFC Bank, which are currently ₹1,978 per share in the market. To build a synthetic call, the investor picks up a ₹1,980 (nearly the current share price) strike put option and pays a premium of ₹23.60 per share for the option expiring on 28 August 2025.

At expiry:

- If the share price rises to ₹2,100: The put option is of no use, and the profit on shares is ₹122 per share (₹2,100 – ₹1,978).

- If the share price is still around ₹1,978: No profits and losses on the shares; the investor loses only the put premium (₹23.60 per share).

- If the share price drops to ₹1,900: The put option is activated, hence selling at ₹1,980, the loss is limited to the premium paid (₹23.60 per share).

| Share Price at Expiry (₹) | Payoff on Shares (₹) | Put Option Value (₹) | Net Profit/Loss per Share (₹) | Total for 100 Shares (₹) |

| 2,100 | +122 | 0 | 122 – 23.60 = +98.40 | +9,840 |

| 1,978 | 0 | 0 | -23.60 | -2,360 |

| 1,900 | -78 | +80 (put exercised) | 2 – 23.60 = -21.60 | -2,160 |

Synthetic Call vs Long Call

A synthetic call and a long call option can both profit from rising share prices, but they differ in structure, cost, and ownership benefits.

| Aspect | Synthetic Call | Long Call |

| Position | Combines holding the underlying share with buying a put option on the same share. | Involves purchasing a single call option on the underlying share. |

| Initial Cost | Higher, as it includes the full share price plus the put option premium. | Lower, since only the call option premium is paid. |

| Risk | Downside is limited by the put option, but total investment is larger. | Risk is limited to the call option premium paid. |

| Profit Potential | Unlimited gains if the share price rises significantly, with downside protection. | Unlimited profit potential if the price rises above the strike price. |

| Dividends & Rights | Entitled to dividends and shareholder rights because the share is owned. | No dividend entitlement or shareholder rights without share ownership. |

Risks of a Synthetic Call Strategy

A synthetic call can replicate the upside of a traditional call option, but still has some risks that can lead to different results in diverse market conditions.

- Higher Capital Requirement – If one wanted to own the underlying share, they would need to have a substantial amount of investment capital.

- Cost Impact – The premium paid for the put option can reduce overall returns, especially if the share price remains stable or rises only slightly.

- Time Decay – The Put option value is diminished as the date of expiration comes closer, which may cause losses in case the stock price doesn’t move much.

- Strike Price and Expiry Risk – If the choice of the strike price and the expiry date is not good, there may not be enough protection from the downward movement, or the costs may be higher than necessary.

- Unfavourable Market Movements – Even with the protection against the downside when the price falls, short-term drops can still result in temporary losses.

When to Use a Synthetic Call Strategy

Investors generally use a synthetic call strategy method when they are optimistic about the stock which they already have, but still want to shield themselves from a possible temporary fall in the stock price. The method provides an opportunity to keep the profit on the stock while lowering the risk of loss to the extent that protection is used. Such a tactic could be effective in times of unstable markets, serving as a safety net for the holder but also permitting an increase in value.

How to Set Up a Synthetic Call

To set up a synthetic call, follow these steps:

- To get direct exposure to the price changes of the stock, you should either hold or buy a long position in the underlying share.

- Typically, to create a synthetic call, you should put a buy order for a put option with the same strike price and expiry date as the call option you want to imitate.

- The put option is a safety net against downside risk; thus, if the share price decreases, the option holder’s losses will be limited.

- This combination replicates the payoff of a traditional call option while involving share ownership.

- The choice of strike price and expiry should be consistent with the desired market exposure and time frame.

Final Thoughts

A synthetic call is a mix of ownership of shares and a put option for protection that imitates the payout of a standard call. Such a financial instrument provides an outlined equilibrium between the possible profits and the limited losses. Although the design of such a financial instrument reflects a long call option, its total effectiveness is still dependent on capital requirements, cost of protection, and market conditions.

FAQs

A synthetic call strategy means a person owning a share of an underlying stock and at the same time purchasing a put option on that same stock, typically with the same strike price and expiration date. This twin acts as a call option’s return function, allowing the user to gain the upper hand with minimal losses.

One of the main reasons why a synthetic call would be preferred over a standard call option is that it behaves like a call option but at the same time it gives you as an investor, the possibility to benefit from the stock’s potential increase, to limit your losses to some extent, and also to receive dividends and voting rights. It is still more expensive as you have to put in more money upfront as compared to just purchasing a call option. This makes synthetic calls suitable when calls are expensive, illiquid, or ownership benefits are desired.

A synthetic call is a bullish trade that consists of the owner of the underlying stock and the purchase of a put option as a safeguard against negative movement of the underlying asset. Consequently, it tries to make money by the rise of the stock, at the same time that it is controlling the losses, hence mimicking a normal call option’s payoff.

A synthetic call is the combination of owning the underlying stock and buying a put option, which imitates the payout of a long call but needs more capital and provides dividends and ownership rights. In a long call, one just buys the call option premium, with less upfront cost and no ownership rights; nevertheless, both methods allow for unlimited profit potential.

A synthetic call strategy is used when someone has a stock and foresees its value going up, but desires security against possible temporary decreases or uncertainty in the market. It is appropriate for circumstances in which there is a need for the protection of downside without sacrificing the advantages that come with owning the stock, such as dividends and voting rights.