Large-cap stocks often look attractive for covered calls, but buying 100 shares can lock up huge amounts of capital, making it hard for smaller portfolios to participate. This capital freeze keeps many traders from exploring income-generating strategies. The synthetic covered call offers a workaround, delivering the same risk-reward profile as a covered call without the heavy share purchase. In this blog, we discuss how this options setup works, and why it can be a game changer for cost-conscious traders.

What is a Synthetic Covered Call?

A synthetic covered call is an options trading strategy used to replicate the risk reward profile of a traditional covered call without owning the stock itself. The term is often misused as a synonym for the “Poor Man’s Covered Call.” The position is created by buying a call and selling a put with the same strike and expiration. This design can lower capital needs versus purchasing shares, generate premium income, and offer measured price exposure while using only options instead of committing cash to stock ownership.

How Does a Synthetic Covered Call Work?

A synthetic covered call mirrors the payoff of a traditional covered call but skips the need to own the actual stock. Instead, it uses options to create a similar profit-and-risk setup. The position is built entirely through contracts, often forming part of broader spread trading strategies.

It works as follows:

- Sell a Put Option: This is a commitment to buy the stock at a set strike price if its market price falls below that level. The seller receives a premium upfront, which represents the maximum profit if the stock price stays above the strike.

- Buy a Call Option: This gives the right to purchase the same stock at the same strike price within the same expiration period. It allows participation in upward price moves without the cost of buying shares directly.

Synthetic Covered Call vs Covered Call

A covered call and a synthetic covered call are two variations of the covered call strategy, each with similar risk–reward potential but different capital requirements, such as:

| Feature | Covered call | Synthetic covered call |

| Structure | Long 100 Shares + Short OTM Call | Short ATM Put + Long ATM Call + Short OTM Call |

| Capital required | High (cost of owning full shares) | Significantly lower due to options-based stock replacement |

| Performance | Similar profit/loss profile to synthetic | Similar profit/loss profile to classic |

| Return on capital | Lower due to high capital tie-up | Higher because of reduced capital usage |

| Flexibility | Limited adjustments without selling shares | Easier to adjust by rolling options |

| Margin usage | None or minimal (if cash secured) | Requires margin for short put |

| Dividend eligibility | Eligible for dividends | Not eligible for dividends |

| Risk if stock drops | Loss in share value minus premium | Loss in synthetic stock value minus premium |

Synthetic Covered Call Payoff Diagram

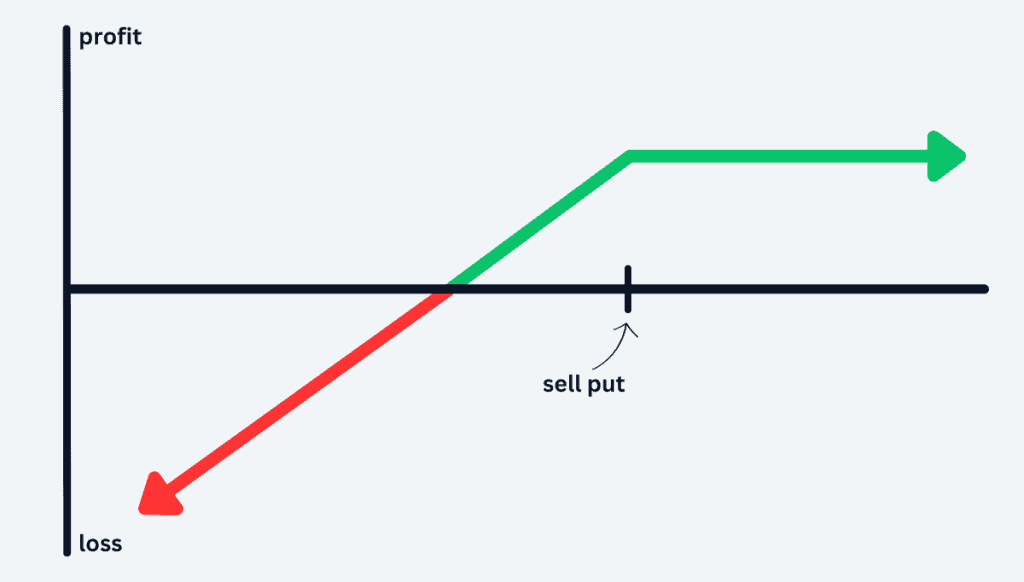

The diagram shows the payoff profile of a synthetic covered call strategy at expiration. The position is created by combining a synthetic long stock (long ATM call + short ATM put) with a short out-of-the-money call. Profits rise as the underlying price moves up to the short call’s strike, after which gains are capped. Losses increase if the price falls below the break-even point. This profile mirrors a traditional covered call but requires less capital. The slope of the green line indicates profit potential, while the red line displays downside risk in case of significant price decline.

When to Use a Synthetic Covered Call

Some situations where using a synthetic covered call can be an effective move are as follows:

- Mildly bullish: This approach works when you expect the stock to go up gradually, not sharply. It benefits from steady gains and earns premium from the sold put, but a big drop can lead to losses from the put obligation.

- Low volatility: Calmer markets keep big price moves in check. Lower volatility means lower cost to get into the position as option premiums for both the bought call and sold put are lower.

- Capital efficiency: Instead of buying the stock outright, this strategy requires less capital upfront while still giving you directional exposure and income from option premiums.

- Defined time frame: It’s good for short to medium term views, align the option expirations with the expected price movement period.

- Premium income goal: The sold put generates income upfront which can help offset the cost of the bought call and improve the overall payoff.

Example Setup

To take an example, let’s say XYZ Ltd. stock trades at ₹1,000. You expect a modest rise over the next month but want to avoid tying up ₹1,00,000 for 100 shares. A synthetic covered call can be built as follows:

- Buy 1 ATM Call (₹1,000 strike, 30-day expiry): Gives upside participation without owning shares.

- Sell 1 ATM Put (₹1,000 strike, same expiry): Obligates you to buy shares if price falls, completing synthetic stock exposure.

- Sell 1 OTM Call (₹1,050 strike, same expiry): Caps upside but earns premium income.

Outcome:

- You mimic the payoff of a covered call without owning the shares.

- Capital requirement is far lower since only margin for the short put is needed.

- Profit potential is capped but steady income is earned from premiums.

Risks and Greeks

Understanding both the Greeks and the risks is important to running a synthetic covered call without getting caught off guard. Here’s some of these:

Greeks

- Delta: Measures how the position reacts to changes in the stock’s price. It starts positive, favoring upward price movement, but moves toward zero as the stock nears the short call strike because gains on the long call are offset by losses on the short call.

- Theta (Time Decay): Time decay helps the short call by lowering its value but works against the long call. The net effect depends on their relative time values, often becoming more favorable if the stock price stays between the strikes as expiration nears.

- Vega (Implied Volatility): A rise in volatility benefits the long call but hurts the short call. Early in the trade, net vega may favor volatility increases, but this can reverse as expiration approaches. Differences in implied volatility between strikes can add complexity.

- Gamma: Shows how quickly delta changes with stock price moves. Gamma stays modest for most of the trade but rises sharply as the price approaches either strike near expiration, making profits or losses change faster.

Risks

- Caps profit at the short call strike, leading to missed gains if the share price rallies far beyond it.

- Long call constantly loses value from time decay, unlike owning shares.

- Needs active monitoring for price, volatility, and Greek changes.

- Works best with highly traded options, limiting stock choices.

- Complexity can challenge traders without sufficient experience in managing multi-leg positions.

Adjusting a Synthetic Covered Call

Common scenarios that call for adjusting a synthetic covered call are:

- Rolling means closing one set of option legs and opening another with different strikes or expirations to fine tune risk and reward.

- Through rolling the long call down it reduces the cost basis when the stock goes down, but also reduces the max profit.

- Close the position early if it looks like the stock will continue to go down.

- If the stock gets close to the short call strike, close the entire position to lock in gains.

- By rolling the short call up can increase profit potential and bring in more premium.

- When implied volatility goes up big time, close the short call and capture the inflated premium and turn the position into just a long call.

- If volatility goes down, roll the short call to a new strike and collect more premium and keep the strategy going.

Final Thoughts

Options give traders the power to shape risk and reward exactly as they want. The synthetic covered call captures the essence of a traditional covered call, steady income with limited upside while eliminating the need to own the stock. This makes it more capital-efficient, flexible, and suitable for active traders. It’s the covered call’s modern counterpart, delivering similar benefits with a lighter investment footprint.

FAQs

A synthetic covered call is an options strategy that mimics a traditional covered call but without owning the actual stock. It involves buying a long call option (usually deep in-the-money) and selling a short call option, generating income with less capital than buying the stock.

A poor man’s covered call is a diagonal call spread using a long LEAP call and a short near-term call to mimic holding stock and selling calls. A synthetic covered call often refers to selling an at-the-money put while owning a long call, creating a position like a covered call but via different option combinations.

Use a synthetic covered call when you want covered call exposure but without buying the stock, especially if you want to reduce the capital needed. It suits neutral to moderately bullish markets, or when you want to leverage price movement without owning shares, particularly if dividends are not a priority.

Set it up by buying a long, deep in-the-money call option (often a LEAP) as a stock substitute, then selling a shorter-term out-of-the-money call option against it. This combination replicates the covered call payoff and income stream with less capital.

A covered call requires owning the underlying stock and selling a call. A synthetic covered call uses options (long call plus short put) to mimic the same payoff, needing less capital but with different risk, such as no dividend rights and potentially unlimited downside risk.

The main risk is unlimited downside if the stock falls sharply, similar to owning the stock in a covered call. However, margin requirements can be higher, and losses grow if the underlying price drops below the strike price. Also, you miss out on dividends and shareholder rights.

It is generally a neutral to moderately bullish strategy. It profits from steady or modestly rising stock prices by collecting premium income while having capped upside, similar to traditional covered calls but with more leverage due to option use.