Are you wondering if different types of indices are constructed in the same way? No, an index can be built in three different ways depending on the weights assigned to each constituent stock.

Sensex is a capitalization-weighted index wherein both the number & price of the shares of a company are factored in. In such indices, larger companies with higher market cap weigh more. Dow Jones is a Price-Weighted index in which stocks with higher prices have higher weightage.

In both cases, fluctuations in the price of a higher weighted stock contribute more significantly to the value of the index. However, in the Equal Weighted Index, the same amount of money is invested in each constituent stock, and the impact is consistent.

Did you know there is an S&P 500 Equal Weight Index too?

How to Calculate Stock Exchange Index

A stock exchange index helps measure the overall performance of a specific segment of the market, often by tracking a selection of top-performing stocks. The method of calculating an index depends on whether it is price-weighted or market-capitalization-weighted.

For a price-weighted index (like the Dow Jones Industrial Average), the stock prices of the selected companies are summed up and divided by a divisor. This means that higher-priced stocks have a larger impact on the index’s movement. It’s a simpler method, but it can sometimes skew results if one stock with a very high price dominates the calculation.

In contrast, a market-cap weighted index (like the Nifty 50 or S&P 500) gives more weight to companies with a higher market capitalization (i.e., the total value of a company’s outstanding shares). This type of index reflects the actual market value of the companies more accurately, as larger companies tend to have a bigger influence on the market.

Stock Market Index Formula

To get a clearer picture of how indices work, let’s break down the basic formulas:

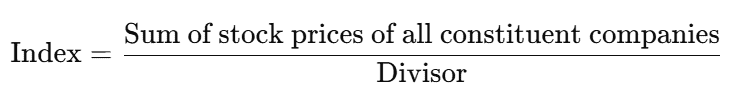

- Price-weighted index formula:

Here, the divisor is used to adjust the index for stock splits, dividends, or any other corporate actions that could affect the price of stocks.

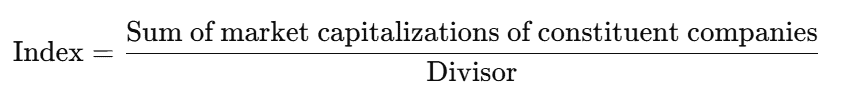

- Market-cap weighted index formula:

In a market-cap weighted index, each company’s market cap is calculated by multiplying its stock price by the number of outstanding shares. This gives a more accurate representation of a company’s value relative to others in the index.

How to Calculate Index Price

To calculate an index price, follow these steps, which depend on the type of index you’re dealing with:

- Price-weighted index:

- Add up the stock prices of all the companies in the index.

- Divide by the divisor, which ensures the index remains consistent despite stock splits or changes in the index composition.

- This gives you the index value, but remember, it’s skewed by the stock price rather than the company size.

- Market-cap weighted index:

- First, calculate the market capitalization of each company by multiplying its stock price by the total number of shares outstanding.

- Add these market caps together for all the companies in the index.

- Divide the total market cap by the divisor to adjust for corporate actions and ensure continuity.

- This method gives you the index price, reflecting the actual size and performance of companies in the index.

Conclusion

The construction of an index depends on how the weights are assigned to its constituent stocks. Whether it’s capitalization-weighted, price-weighted, or equal-weighted, each method has its own impact on the way the index behaves. Understanding these differences helps investors better interpret market movements and make informed decisions about which index or investment strategy aligns with their financial goals.

FAQ’s

Capitalization-weighted indices (e.g., Sensex) assign higher weight to companies with larger market caps, meaning larger companies influence the index more.

Price-weighted indices (e.g., Dow Jones) give higher weight to stocks with higher prices, meaning price fluctuations in expensive stocks have a greater impact on the index.

Equal-weighted indices invest an equal amount in each constituent stock, ensuring that all stocks, regardless of price or market cap, have the same impact on the index.

In capitalization-weighted indices, larger companies with higher market caps have a bigger impact on the index. This means that stock price movements in these larger companies will drive the index performance more significantly, giving investors exposure to the biggest players in the market.

The Dow Jones Industrial Average is price-weighted, meaning stocks with higher prices have more influence on the index’s movement. This method was historically used to reflect the overall market’s health but can sometimes skew results due to the influence of a small number of high-priced stocks.

The S&P 500 Equal Weight Index is an equal-weighted version of the popular S&P 500 Index. Unlike the traditional S&P 500, where larger companies have more influence, each stock in the Equal Weight Index has the same impact, regardless of its size or price.

The best index for investors depends on their strategy. If you want exposure to the largest companies in the market, a capitalization-weighted index may be a good choice. If you believe that smaller companies or undervalued stocks will outperform, an equal-weighted index might suit you better. A price-weighted index might appeal to those focused on high-priced, prominent companies.