The thought of investing in the stock market has likely crossed your mind more than once. It’s everywhere today – social media, news alerts, casual conversations. As of October 2025, India has over 20 crore demat accounts, a sign of how mainstream investing has become. With so many voices and opinions competing for attention, it’s easy to feel unsure – should you invest now, or wait for a better moment?

This article isn’t here to hype you up or scare you away. It’s here to help you think clearly and make a decision that actually fits your life.

Is It the Right Time to Invest in the Stock Market?

There is no universally best or right time to invest in the stock market. Each investor is unique in their own, and needs a strategy that suits them.

The truth is this: the stock market never feels comfortable at the moment of entry. When prices are low, fear dominates. When prices are high, doubt takes over. The idea of a “perfect time” exists mostly in hindsight.

Understanding timing doesn’t mean predicting markets. It means understanding your position, your patience, and your purpose.

Why Timing the Market Is Difficult

Market timing is hard because markets and people respond to very different things. Markets move on what they expect to happen next. People react to what already feels painful.

Bad news, scary headlines, and real-life stress usually arrive after prices have moved, not before. By the time danger feels obvious, markets are often done adjusting. Fear pushes investors to step away during falls, and hesitation keeps them out when recovery begins. That emotional lag is what quietly breaks most timing attempts.

To succeed, timing requires two correct decisions: knowing when to enter and knowing when to exit. Missing either one can undo the entire strategy.

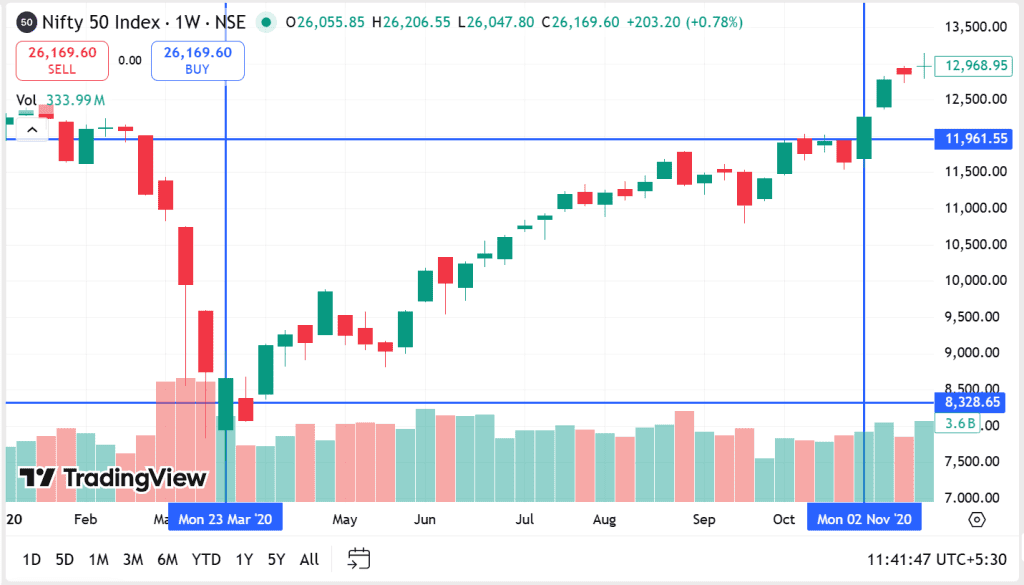

Let’s take the example of the Nifty 50 Index during the 2020 COVID crash to understand why market timing fails in real life.

From January 20 to March 23, 2020, the Nifty 50 dropped from roughly 12,400 to about 8,300. That’s a fall of nearly 33% in just over two months. What matters here is when this happened.

The market had already fallen sharply before India announced the nationwide COVID lockdown on March 24. By the time the announcement came, fear was already everywhere. Offices were closing, salary cuts were becoming common, and no one had a clear idea about income or job security. For many first-time investors, staying out of the market or getting out completely felt like the only sensible thing to do.

What happened after that caught most people off guard.

The market didn’t slow down to look for reassurance. It turned after March 23, 2020, even though nothing felt clear at the time. Confusion was still everywhere. By June, the Nifty was already back above 10,000. Then, almost quietly, it crossed 12,000 by the end of November 2020, close to its pre-COVID level.

None of this matched what daily life looked like. Businesses were still under pressure. Confidence hadn’t settled. Normal routines hadn’t returned. Yet prices kept moving ahead, long before most people felt ready to believe that things were actually getting better.

The recovery began well before reassurance returned.

Investors who waited for clarity often re-entered months later, at significantly higher levels. This chart makes one point clear: markets move ahead of confidence, not alongside it.

Fundamental Factors to Consider Before Investing

Before asking “Is this a good time?”, it’s worth asking something more honest:

“Am I ready to stay invested when things get uncomfortable?”

Income stability matters more than most people realise. When your earnings are predictable, market swings feel manageable. When income is uncertain, even small dips feel personal.

Emergency savings change how risk feels. Without a buffer, market falls feel dangerous because you might need the money. With one, volatility feels temporary – annoying, but not threatening.

Debt quietly changes the equation. High-interest loans keep growing in the background while you wait for the “right” moment to invest. Often, that silent compounding hurts more than entering the market imperfectly.

Lifestyle discipline plays a role, too. Fewer fixed expenses mean more flexibility. Flexibility makes patience possible.

Preparation doesn’t stop markets from falling. It stops you from panicking when they do.

Economic & Valuation Indicators to Watch

Economic indicators aren’t signals to act. They provide context for why the markets behave the way they do.

- Gross Domestic Product (GDP) numbers reflect the pace of the economy, but growth doesn’t move smoothly. In India, it comes in bursts and pauses. Markets often react to surprises rather than confirmed data; for instance, Q2 FY25 GDP grew at just 5.4% against expectations of 6.5%, prompting Sensex and Nifty to dip 0.5-1% the next day amid growth worries.

- Interest rates work slowly – RBI decisions don’t flip markets overnight. They influence borrowing, sentiment, and valuations over time. Waiting for “perfect” rate conditions often leads to waiting forever. In April 2025, the RBI’s 25 basis points rate cut to 6% provided borrower relief but squeezed bank margins, causing Nifty Bank to fall 1%

- Valuations simply tell you how optimistic the market already is – higher valuations usually mean returns may be steadier and slower, not that investing stops making sense. Even at 22.7x forward P/E in November 2025, Nifty hit record highs fueled by earnings optimism and steady domestic inflows.

Risk Tolerance & Investment Time Horizon

Risk tolerance is often misunderstood. Many investors assume they can handle volatility, but true tolerance is revealed only when losses are real and prolonged.

Time horizon is what determines whether volatility feels survivable or destructive. Short horizons turn temporary declines into permanent mistakes. Longer horizons allow markets to heal before decisions are forced.

During the 2008 global financial crisis, the Sensex fell from around 21,000 to nearly 8,000 in a span of 10 months, erasing close to 60% of market value. For many retail investors, this wasn’t just a market fall – it felt like a collapse of trust. Fear dominated, and a large number exited equities during this period and never returned.

Those who stayed invested didn’t see an immediate turnaround. The recovery took time. After bottoming near 8,000 in March 2009, the Sensex climbed back above 17,000 by late 2009 and crossed its previous highs over the following years. Patience made the difference. Long-term investors were able to rebuild and compound wealth that panic had locked away, while those who exited struggled to re-enter once confidence returned.

The lesson was simple but uncomfortable: risk tolerance isn’t imagined during calm markets, and youth only helps if time is actually used.

Dollar‑Cost Averaging vs Lump Sum Strategies

Most investors eventually face this decision: should you invest gradually or put all your money in at once? The difference between these two approaches is not about returns alone, it’s about behaviour, timing risk, and emotional comfort.

Rupee-Cost Averaging (RCA):

It is the Indian equivalent of the Dollar-Cost Averaging strategy. In practice, it’s implemented through Systematic Investment Plans (SIPs). Under RCA, you invest a fixed rupee amount at regular intervals, regardless of whether markets are rising or falling. When prices are high, your fixed amount buys fewer units. When prices are low, it buys more. Over time, this evens out the average cost of purchase and reduces the risk of entering at the wrong moment.

Assume an investor invests ₹10,000 every month for six months in an index fund during a volatile phase.

| Month | NAV (₹) | Investment (₹) | Units Bought |

| January | 100 | 10,000 | 100.00 |

| February | 90 | 10,000 | 111.11 |

| March | 80 | 10,000 | 125.00 |

| April | 85 | 10,000 | 117.65 |

| May | 95 | 10,000 | 105.26 |

| June | 100 | 10,000 | 100.00 |

| Total | – | 60,000 | 658.02 units |

Average cost per unit = ₹60,000 ÷ 658.02 = Approx. ₹91.20

Even though the NAV ends where it started (₹100), the investor benefits because more units were accumulated during lower prices. This is the core strength of Rupee-Cost Averaging – it works with volatility instead of trying to avoid it.

Lump sum investing:

It involves investing the entire amount at one point in time. This approach can work well when valuations are attractive or when markets are already depressed. However, it demands conviction. Large short-term losses immediately after investing can test patience and often lead to premature exits.

If the same ₹60,000 were invested as a lump sum in January at an NAV of ₹100, the investor would own 600 units. At ₹100 NAV in June, the investment would simply return to ₹60,000.

This doesn’t mean lump sum investing is wrong. It means RCA reduces timing risk, while lump sum investing magnifies timing accuracy.

The right choice depends less on forecasts and more on how comfortably you can stay invested when markets don’t cooperate.

When It Might Be a Good Time for You to Invest

It might be a good time for you to invest when the decision feels less urgent and more deliberate. The market hasn’t changed dramatically-you have. That shift often matters more than prices.

Routine Over Drama

Investing becomes a regular habit rather than a reaction to market highs or lows. You invest because it’s time, not because something happened.

Discomfort Without Panic

Short-term losses no longer trigger stress or impulsive decisions. You understand volatility as temporary, not threatening.

Clear Goals Anchor Behavior

Clear financial goals reduce fixation on entry points. Purpose replaces prediction, making timing far less.

Advantages of Investing During Market Volatility

Volatility feels unpleasant. There’s no way around that. But it often creates space for better decisions. Prices become more reasonable. Expectations cool down. Fundamentals start mattering again.

Markets usually recover before people feel confident enough to return. Waiting for comfort often means missing early momentum.

Consistency during unstable periods isn’t heroic. It’s practical. Over time, patience does what prediction never can.

Conclusion

The stock market never gives a clear green signal. It rarely feels safe. It never feels perfectly timed. Waiting for certainty often means staying stuck while opportunities move on. For young Indian investors, what matters isn’t timing – it’s readiness, consistency, and the ability to stay invested when things feel uneasy. Markets don’t reward confidence. They reward patience. The real question isn’t when you invest. It’s whether you’re willing to start – and stay.

FAQ‘s

If your goals are long-term, income is stable, and expectations are realistic – yes. If you’re chasing quick profits, no time will ever feel right.

You’re ready when market ups and downs stop influencing your mood or decisions. The moment investing feels like a habit rather than a reaction to headlines, timing becomes far less critical.

Look inward before looking at charts. Income stability, emergency savings, debt levels, time horizon, and emotional tolerance matter more than short-term market direction.

Dips are obvious only after they pass. Gradual investing reduces regret and keeps you moving forward without relying on prediction.