Thermo-Mechanically Treated (TMT) Bars are a widely used component in the construction of residential or industrial buildings, infrastructure projects, bridges, flyovers, and more. Gujarat-based VMS TMT is an established player that manufactures TMT bars under its brand name ‘Kamdhenu’. Their distribution channel includes 3 distributors and 227 dealers up till July 2025.

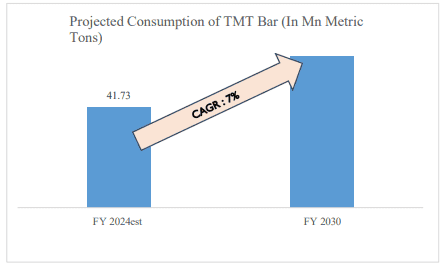

India’s TMT bars demand is set to grow at a CAGR of almost 7% by 2030, owing to robust spending and government initiatives in infrastructure, like the National Infrastructure Pipeline (NIP) and initiatives like PM Gati Shakti.

With strong growth prospects, VMS TMT is all set to launch its IPO on the 17th of September 2025. This blog establishes a perspective on the upcoming VMS TMT IPO.

What does VMS TMT do?

VMS TMT was launched in 2013 with its manufacturing facility in Bhayla Village, Gujarat. Currently, they manufacture TMT bars using scrap material and billets. Their total installed capacity for producing TMT bars stands at 200,000 metric tonnes per annum.

VMS TMT conducts its primary business within the state of Gujarat, through both retail and institutional sales. The company also ventured into MS pipes and strategic partnerships to enhance efficiency and expand market reach. However, the MS pipes business is no longer operational.

As of FY25, their revenue stream can be broken down into:

| Revenue Segment | % of Revenue Contribution |

| TMT Bars | 91.63% |

| Billets | 0.18% |

| Binding Wires | 0.33% |

| Scrap and others | 6.84% |

Objectives of the VMS TMT IPO:

The main objective of the VMS TMT IPO is to repay loans and borrowings worth ₹115 Crores undertaken by the company. Whatever remains is to be used for general corporate purposes.

Financial Overview of the VMS TMT IPO:

Looking at the financial statements of a company is essential before deciding to invest in its IPO. Let’s study the financial performance of VMS TMT over the past three financial years.

| Financial Year | Revenue from Operations (₹ Lakhs) | PAT (₹ Lakhs) | Total Borrowings (₹ Lakhs) |

| 2022–23 | 88,201.35 | 419.53 | 16,269.68 |

| 2023–24 | 87,295.77 | 1,346.84 | 19,786.00 |

| 2024–25 | 77,019.10 | 1,473.70 | 27,571.56 |

Over the years, despite a fall in the Revenue from Operations, Profit After Tax has witnessed a growth. The company experienced a decline in the sale and pricing of TMT bars between FY24 and FY25, which contributed to the lower revenue from operations in FY25.

Core Details of the VMS TMT IPO

Here are the core details of the VMS TMT IPO:

| Detail | Information |

| IPO Date | September 17, 2025 to September 19, 2025 |

| Listing Date | September 24, 2025 |

| Face Value | ₹10 per share |

| Issue Price Band | ₹94 to ₹99 per share |

| Lot Size | 150 Shares |

| Sale Type | Fresh Capital |

| Total Issue Size | 1,50,00,000 shares (₹148.50 Cr) |

| Listing At | BSE, NSE |

Threats to VMS TMT:

Some of the biggest threats to VMS TMT are:

- Heavy dependence on the Kamdhenu brand: VMS TMT has used the brand name ‘Kamdhenu’ since 2022 to sell TMT bars through a 5-year license agreement with Kamdhenu Ltd. Kamdhenu retains the right to terminate the agreement with a month’s notice. This puts VMS TMT at a major risk of a severe impact on sales.

- Top 10 customer concentration: The top 10 customers of VMS TMT contributed 92.82% of total sales in FY25. In case of any customer loss, the company could suffer huge sales losses.

- No long-term business contracts: VMS TMT does not engage in any long-term business contracts with its customers. Instead, the business terms include purchase order-based arrangements. Any termination of the customer base could lead to significant losses.

- Revenue stream depends majorly on one product: More than 90% of revenue comes from the sale of TMT bars. This serves as a major threat to the company in case of any raw material, customers, or pricing changes.

Bottomline

As of 12th September 2025, the VMS TMT IPO is trading at a 10.10% premium on the grey market. VMS TMT has successfully implemented backward integration by shifting to in-house biller production to boost quality control and efficiency. The upcoming VMS TMT mainboard IPO provides investors with a lucrative opportunity to invest in the growing construction industry.

Will the VMS TMT IPO be a hit or a miss? Stay tuned to get an update.

Other recent IPO’s

| Tech cyber security IPO | https://www.stockgro.club/blogs/ipo/techd-cybersecurity-ipo/ |

| Euro patrik sales IPO | https://www.stockgro.club/blogs/ipo/euro-patrik-sales-ipo/ |