The year 2025 has been a milestone year for IPOs in India, as October alone brought some of the major names like Tata Capital, LG India, and WeWork India to the market.

Every IPO, however, follows a defined journey before reaching the trade exchanges. From the initial decision to go public to listing and post-market performance, each stage forms a part of what’s known as the IPO cycle.

This blog breaks down the IPO life cycle to help investors understand how a private company transforms into a public company.

What is IPO Cycle?

The Initial Public Offering (IPO) or IPO cycle is the multi-stage process that a private company goes through to become a publicly traded company on a stock exchange. It involves phases like planning, preparing documents, filing with regulatory bodies, marketing the shares to investors, and listing the shares on the stock market.

An IPO allows a private company to raise capital for growth, expansion, or debt repayment, while providing the public with an opportunity to invest and own a piece of the company. After an IPO, anyone can buy and sell the company’s shares through a broker.

Why “Cycle” Matters — Beyond a Linear Process

- Market timing and macroeconomic fluctuations: The IPO cycle is a measure of the overall market sentiment. The IPO activities usually increase in strong markets and decline during downturns, and this mirrors the investors’ mood and economic confidence.

- Information asymmetry and market signaling: In the case of IPOs, since the investors know less about a company’s true value, IPOs are underpriced to encourage participation, while longer lock-up periods and transparent disclosures signal confidence in long-term performance.

- Post-IPO feedback loops: Post-IPOs create new market pressure as companies face pressure to meet market expectations and quarterly earnings. While in the long run, IPOs tend to underperform and the stock prices go through a correction.

- The cycle of funding: The IPO is not a one-time event but a strategic step in a larger funding cycle. It allows early investors to exit and provides access to raise capital through secondary offerings.

Standard IPO Cycle: Stages & Phases

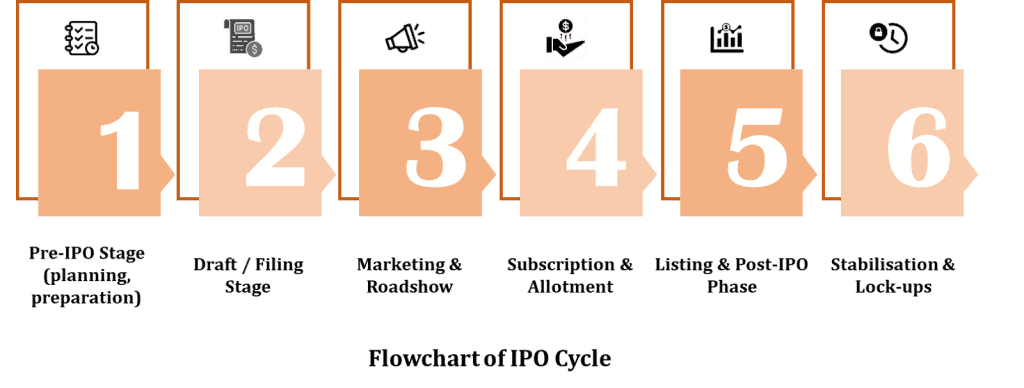

The IPO cycle outlines the complete journey of a company from preparation and regulatory approval to market listing and post-IPO stability, with each stage shaping its valuation and investor confidence. Let’s discuss them in detail:

1. Pre-IPO Stage (planning, preparation)

In the initial stage, the companies evaluate their readiness to go public. They appoint investment banks or underwriters, lawyers, and auditors to manage the IPO process, conduct due diligence, and prepare regulatory documents.

The underwriters and management work together to ascertain the market value of the company, which helps in setting the IPO price.

2. Draft / Filing Stage

In this phase, the company and its advisors prepare a Draft Red Herring Prospectus (DRHP), containing detailed information about the company’s business, finances, management, and risk factors.

Then, the DRHP is submitted to the Securities Exchange Board of India (SEBI) for review. After the regulator approves it, a final prospectus, that is, the Red Herring Prospectus (RHP), is prepared.

3. Marketing & Roadshow

After the prospectus is approved, the company promotes the offering to prospective investors. The company executives and underwriters engage with large institutional investors, such as mutual funds and hedge funds, to present the company’s story and growth prospects.

The marketing team generates investor interest and measures the demand for the IPO, which helps to estimate the final IPO price.

4. Subscription & Allotment

In this phase, the shares are offered to the public for subscription and later distributed among investors. Here, the IPO is open for a period of around 3 to 10 working days, during which the investors place their bids. After the bidding period ends, the shares are allocated.

If the IPO is undersubscribed, all applicants receive the applied shares, and if it is oversubscribed, shares are allotted based on some formula or lottery system.

While application funds are debited from the bank accounts of successful applicants, the amount of un-allotted shares is refunded to investors.

5. Listing & Post-IPO Phase

At this stage, the company’s shares are officially listed on a stock exchange and become available for public trading.

The company’s shares are added to the stock exchange on the scheduled ipo listing date. And normal trading begins, with the shares being freely bought and sold by any investor on the open market.

Besides, the newly public company must comply with the ongoing regulatory requirements, including periodic financial reporting and corporate governance standards.

6. Stabilisation & Lock-ups

This is the final phase, which involves measures to ensure a stable market for the stock after its debut.

The lock-up period is set to prevent early investors and company insiders from selling their shares for a specific period, which could be 6 months to over a year after the IPO. This prevents sudden floods of company shares that might destabilise the stock price.

Visual Diagram / Flowchart of IPO Cycle

This diagram illustrates the IPO process cycle.

Market Cycles & Trends in IPOs

- 2020–2021 IPO Boom: In this period, the IPO market saw a surge in activity, driven by low interest rates and high investor optimism. Many high-growth and unprofitable companies went public during this time period.

- 2022–2023 Downturn: During this period, the rising inflation and interest rates led to a more subdued IPO environment. Many companies delayed or withdrew their listings, and the ones that proceeded faced lower valuations.

- 2024–2025 Rebound: At this time period, the global markets staged a recovery, driven by easing monetary conditions and strong investor confidence in specific regions and sectors, particularly in AI and tech companies. India became a global leader in IPO volume, while the US regained the top spot in proceeds, driven by tech and healthcare listings and record cross-border activity.

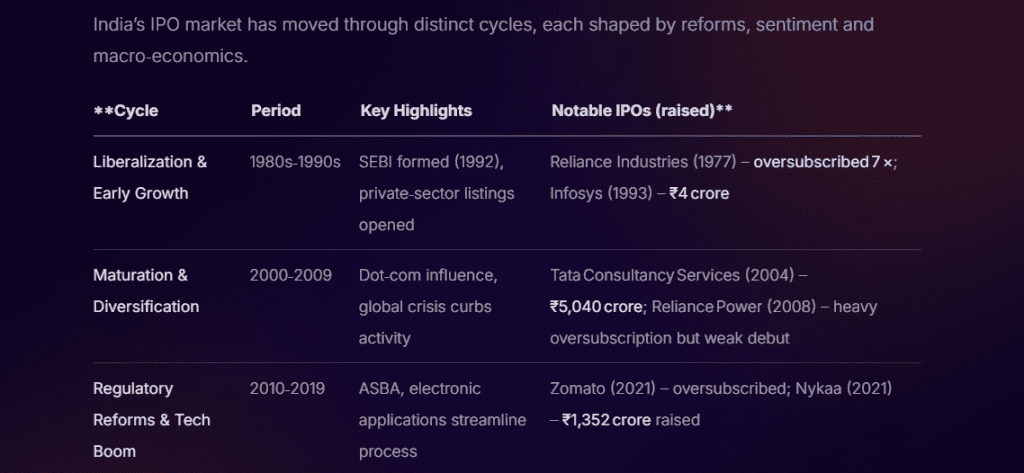

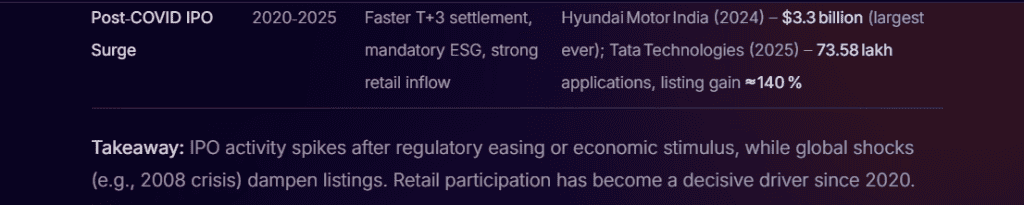

Historical Examples of IPO Cycles

With the help of Stoxo, this illustration shows how India’s past IPO phases reveal the repeating patterns that define an IPO cycle.

This result from Stoxo highlights how each historical IPO cycle in India reflects shifts in policy, sentiment, and economic conditions.

From the liberalisation era to the post-COVID surge, every phase shows how reforms, global trends, and retail participation have shaped market momentum, proving that the IPO cycle moves in tune with wider growth patterns.

How to Participate in an IPO Cycle

The following steps should be followed by investors while participating in an IPO:

- Before the IPO opens: Before making a decision, investors should first carefully read the prospectus available at the SEBI website to understand the company. The investors should also analyse the market conditions and check out the GMP for the particular IPO they’re interested in to understand market hype.

- During the IPO window: Next, once the IPO bidding opens, investors can place their bids based on their investor category, through the ASBA system of their banks, or directly using UPI through broking platforms.

- After the IPO subscription period ends: After subscription period ends, the shares are credited to the demat accounts of the investors. If the IPO is oversubscribed, the investors might not get the applied number of shares, and the leftover money would be refunded to the investors.

- Post-IPO trading: After the company shares are listed on the stock exchange and the company is public, any investor can buy or sell shares on the stock exchange. Since there is no guarantee that the company will perform well, it is important to monitor the performance and market conditions to make timely decisions.

Risks & Challenges across the Cycle

Since the investors know very little about the company during IPO, it is essential to understand the risks and challenges which is usually involved in the IPO cycle:

- Pre-IPO Phase: The pre-IPO phase requires careful preparation for listing. It involves high costs, increased regulatory scrutiny, and pressure on management and finance teams, often exposing governance gaps and diverting focus from operations.

- IPO Phase: During the IPO phase, the companies face market volatility, valuation risks, and pressure to manage investor expectations. So, strong timing, pricing, and marketing strategies are important for ensuring a successful market debut.

- Post-IPO Phase: After listing, the companies must maintain compliance, manage price volatility, investor confidence, regulatory obligations, performance pressure, and risks, like lock-up expirations and shareholder dilution.

The IPO cycle is more than a checklist but a reflection of how confidence, timing, and strategy meet the market. Each stage tests a company’s discipline and investors’ belief. Whether it ends in a strong debut or quiet fade, the cycle always reveals where the economy and sentiment truly stand.

FAQ

The IPO cycle includes pre-IPO preparation, draft filing, marketing and roadshow, subscription and allotment, listing and post-IPO phase, and finally, stabilisation and lock-ups.

The entire IPO cycle usually takes up to 6 to 12 months. The pre-IPO and filing stages take the most time, while marketing, subscription, and listing happen within weeks of the regulatory approval.

The IPO boom is usually triggered by market confidence, economic growth, and liquidity. While inflation, high interest rates, and weak investor sentiment drive bust cycles or IPO slowdowns.

During the pre-IPO stage, the companies strengthen governance, appoint underwriters, complete audits, and ensure financial readiness. They also assess valuation, market timing, and compliance with regulations before filing with authorities.

The lock-up period in the IPO cycle restricts insiders and early investors from selling shares for 6 to 12 months after listing to prevent sudden sell-offs and help stabilise the stock price.

Special Purpose Acquisition Companies (SPACs) and direct listings skip the traditional book-building and underwriting process and offer faster listings. But face higher volatility and limited price discovery compared to IPOs.

Timing IPO cycles might be difficult. Investors often benefit more by focusing on the company fundamentals, sector strength, and market trends instead of short-term listing gains.