As India embarks on a massive infrastructure and housing push, the cement sector is poised for significant expansion. Among the key players leading this charge is Ambuja Cements, a part of the Adani Group. With strong operational efficiency, aggressive capacity expansion, and a growing retail footprint, Ambuja is positioning itself to ride the multi-decade construction and urbanization wave.

But does Ambuja Cements offer a compelling case for long-term investors? Let’s delve deeper.

Stock overview

| Ticker | AMBUJACEM |

| Industry/Sector | Construction Materials (Cement) |

| CMP | 609.80 |

| Market Cap (₹ Cr.) | 1,50,201 |

| P/E | 36.65 (Vs Industry P/E of 47.97) |

| 52 W High/Low | 693.50 / 453.05 |

| EPS (TTM) | 16.92 |

| Dividend Yield | 0.33% |

About Ambuja Cements

Founded in 1983 and headquartered in Mumbai, Ambuja Cements is one of India’s leading cement manufacturers. It operates as a subsidiary of Adani Cement Industries and is known for its strong brand equity, sustainability practices, and customer-centric distribution network. The company has a current capacity of over 38 million tonnes per annum (MTPA), with aggressive plans to double it over the next few years.

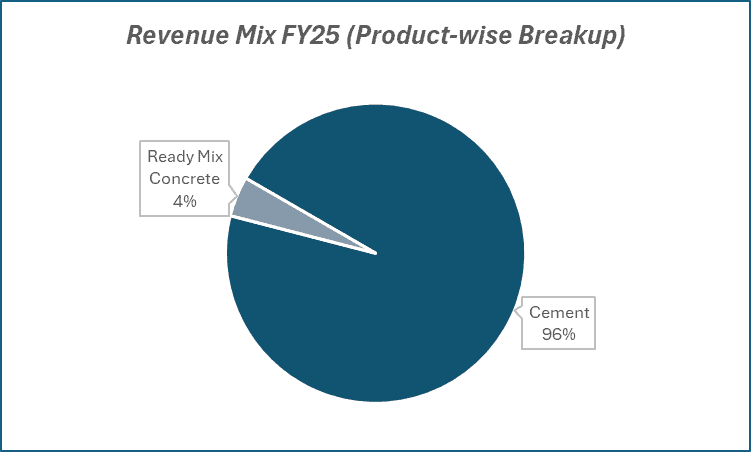

Key business segments

Ambuja Cements operates primarily in the following key business segments:

- Cement Manufacturing: Core product includes Ordinary Portland Cement (OPC) and Portland Pozzolana Cement (PPC).

- Ready-Mix Concrete (RMC): Value-added construction solutions catering to urban markets.

- Sustainable Products: Including low-carbon cements and green building materials.

Primary growth factors for Ambuja Cements

Ambuja Cements key growth drivers:

- Government Infrastructure Push: Increased budgetary allocations for roads, railways, housing, and urban development boost cement demand.

- Adani Group Synergies: Strategic integration with Adani’s logistics, energy, and resource chains enhances cost efficiency and accelerates expansion.

- Retail & Rural Demand: Growing construction activity in Tier 2/3 cities and rural areas supports steady volume growth.

- Capacity Expansion: Target to reach 140 MTPA capacity in the coming years through greenfield and brownfield expansions.

- Sustainability Focus: Strong emphasis on green energy, waste heat recovery, and low-carbon products improves ESG profile and long-term margins.

Detailed competition analysis for Ambuja Cements

Key financial metrics – FY25;

| Company | Revenue(₹ Cr.) | Realization / Tonne (₹/MT) | EBITDA / Tonne (₹/MT) | EBITDA Margin (%) | PAT Margin (%) | P/E (TTM) |

| Ambuja Cements Ltd. | 35044.76 | 4897 | 898 | 17.04% | 14.68% | 36.65 |

| Ultratech Cement | 75955.13 | 5052 | 1270 | 16.53% | 7.97% | 52.62 |

| JK Cement Ltd. | 11879.15 | 4899 | 1277 | 17.06% | 7.34% | 51.12 |

| Shree Cement | 19282.83 | 5325 | 1403 | 20.40% | 5.83% | 101.93 |

| ACC Ltd. | 21762.31 | 4778 | 480 | 14.07% | 11.03% | 14.68 |

Key insights on Ambuja Cements

- Ambuja’s operating margins remain among the best in the industry, supported by energy efficiency and cost controls.

- A strong balance sheet with low debt and high cash generation provides flexibility for expansion and acquisitions.

- The company is aligning with circular economy practices by using alternative fuels and reducing carbon footprint.

- Its wide dealer network and brand equity help maintain pricing power and customer stickiness in competitive markets.

Recent financial performance of Ambuja Cements for Q4 FY25

| Metric | Q4 FY24 | Q3 FY25 | Q4 FY25 | QoQ Growth (%) | YoY Growth (%) |

| Revenue (₹ Cr.) | 8893.99 | 9328.56 | 9888.61 | 6.00% | 11.18% |

| EBITDA (₹ Cr.) | 1698.65 | 1711.85 | 1867.55 | 9.10% | 9.94% |

| EBITDA Margin (%) | 19.10% | 18.35% | 18.89% | 54 bps | -21 bps |

| PAT (₹ Cr.) | 1517.78 | 2617.14 | 1277.58 | -51.18% | -15.83% |

| PAT Margin (%) | 17.07% | 28.06% | 12.92% | -1514 bps | -415 bps |

| Adjusted EPS (₹) | 4.78 | 8.59 | 3.88 | -54.83% | -18.83% |

Ambuja Cements financial update (Q4 FY25)

Financial performance

- Revenue rose 11.2% YoY to ₹9,889 crore in Q4 FY25, led by higher volumes.

- EBITDA grew 10% YoY to ₹1,868 crore with margins steady at 19%.

- Net profit declined 15.8% YoY to ₹1,278 crore due to lower realisations and one-time impairment.

- Full-year revenue stood at ₹35,045 crore (up 5.7% YoY), and PAT at ₹5,158 crore (up 9% YoY).

- Strong liquidity with ₹10,125 crore in cash and equivalents.

Business highlights

- Volumes grew 13% YoY in Q4 to 18.7 MT; FY25 volumes at 65.2 MT.

- Crossed 100 MTPA capacity; added wind power (99 MW) and green energy share rose to 26%.

- Premium products contributed 29% to trade sales; EBITDA/tonne at ₹1,001.

- Secured 367 MT limestone reserves; completed OCL acquisition.

- Logistics improved via new rail rakes and shorter lead distances.

Outlook

- Capacity to reach 118 MTPA by FY26 and 140 MTPA by FY28.

- Targets ₹1,500 EBITDA/tonne and ₹3,650 cost/tonne by FY28.

- 35% premium cement sales target by FY26.

- Capex of ₹9,000 crore planned for FY26; confident on 7–7.5% industry demand growth.

Recent Updates on Ambuja Cements

- Crossed 100 MTPA cement capacity in FY25, a 50% increase in just 30 months, reinforcing its position among India’s top cement manufacturers

- Commissioned 99 MW of wind power at Khavda (Gujarat), boosting green energy share to 26% and supporting long-term sustainability goals.

- Secured 367 MT of limestone reserves across three mines, expanding total reserves to ~9 billion tonnes and ensuring long-term raw material security.

- Completed acquisition of Orient Cement Ltd. (OCL) and initiated SEBI process for the open offer with ₹2,000 crore deposited in escrow.

- Strengthened logistics with delivery of 11 GPWIS and 8 BCFC rail rakes; aims to further reduce cost and enhance distribution efficiency through marine logistics and company-owned coal transport rakes.

Company valuation insights – Ambuja Cements

Ambuja Cements is currently trading at an EV/EBITDA of 21x, slightly above its long-term average, reflecting optimism around its scale-up and margin recovery. However, it has delivered a 1-year return of -9.8%, underperforming the Nifty 50’s 1.8% gain, signalling some investor concern over near-term cost pressures and integration risks post-acquisitions.

With clear visibility on capacity ramp-up (targeting 140 MTPA by FY28), strong operating leverage, and a focused shift to premium cement (~₹400/tonne higher profitability), Ambuja appears well-positioned for margin expansion and volume-led growth.

The company is also improving efficiencies via green power, logistics optimization, and digitization, enhancing its cost competitiveness and sustainability profile. Consolidation of acquisitions and premiumisation are expected to improve profitability and valuation multiples.

Applying a target EV/EBITDA of 20x on FY27E, we arrive at a 12-month target price of ₹700, implying a 15% upside. A short-term target of ₹660 suggests an 8% upside, supported by improving demand outlook, ongoing cost reductions, and operational synergies.

Major risk factors affecting Ambuja Cements

- Input Cost Volatility: Coal, pet coke, and freight cost fluctuations may impact margins.

- Execution Risk: Delays in capacity addition or integration of acquired assets could affect growth targets.

- Regulatory & Environmental Norms: Stricter emission and mining regulations may lead to compliance costs.

- Competitive Pressure: Regional oversupply and aggressive pricing from peers can impact profitability.

Technical analysis of Ambuja Cements share

After forming a classic inverse head and shoulders pattern, Ambuja Cements has confirmed a bullish breakout with a 3% upside move, marking the start of a potential medium-term rally. The stock is currently trading well above its 50-day, 100-day, and 200-day EMAs, indicating strong bullish momentum and reinforcing a positive outlook.

The MACD remains firmly positive at 14.13, with the MACD line positioned above the signal line, supporting continued upside potential. The RSI stands elevated at 77.12, reflecting strong buying interest and bullish sentiment. Relative RSI values of 0.12 (21-day) and 0.15 (55-day) highlight the stock’s consistent outperformance versus the broader market. In addition, an ADX of 31.69 confirms that a powerful trend is in motion and gaining strength.

A sustained breakout above ₹660 could propel the stock toward ₹700, which coincides with its 12-month fundamental target. On the downside, ₹580 remains a key support level; holding above this will be critical to maintain the ongoing bullish structure.

- RSI: 77.12 (Strong Buying Interest)

- ADX: 31.69 (Strong Trend)

- MACD: 14.13 (Positive Momentum)

- Resistance: ₹660

- Support: ₹580

Ambuja Cements stock recommendation

Current Stance: Buy, with a 3-month target of ₹660 (~8% upside) and a 12-month target of ₹700 (~15% upside).

Why buy now?

Capacity-led growth: Ambuja is on track to reach 118 MTPA by FY26 and 140 MTPA by FY28, aided by organic expansion and acquisition integrations.

Margin expansion visibility: Focus on cost savings (green power, sea logistics, group synergies) and premium cement (~₹400/tonne higher profitability) is expected to lift EBITDA/tonne to ₹1,500 by FY28.

Operational tailwinds: Improved utilization, logistics efficiency, and strong cement demand (7–7.5% CAGR till FY30) are likely to drive consistent earnings growth.

Portfolio fit

Ambuja offers quality exposure to India’s infrastructure and industrial buildout, backed by scale, margin visibility, and sustainability alignment. It is well-suited for long-term investors seeking stable, large-cap industrial compounders with strong cash flows and operational leverage.If you found this helpful and want regular stock trade calls, check out my StockGro profile here: https://stockgro.onelink.me/vNON/6m6ykj0dAmbuja Cements: Budget 2025-26 opportunities

- Infra push: Continued focus on infrastructure and housing to drive cement demand.

- Green energy: Incentives support Ambuja’s renewable power goals and cost savings.

- Logistics boost: Investment in coastal and rail logistics aids Ambuja’s marine transport shift.

- Mining reforms: Eases limestone sourcing and accelerates capacity expansion.

- Make in India: Encourages regional plant expansion and domestic manufacturing efficiency.

Final thoughts

Ambuja Cements isn’t just pouring concrete, it’s laying the foundation for India’s future. With a bold capacity vision, strategic Adani synergies, and a commitment to sustainability, the company is well-placed to participate in India’s next wave of infrastructure-led growth. For investors seeking a stable compounder with both cyclical and structural tailwinds, Ambuja presents a strong case for long-term inclusion.