From vibrant homes to towering office spaces, Asian Paints has become synonymous with color, creativity, and consumer trust in India. With its iconic tagline “Har Ghar Kuch Kehta Hai,” the company has not only dominated the paint industry but has also evolved into a comprehensive home décor and solutions brand. In an era where consumer preference is shifting toward premium, sustainable, and technologically advanced products, Asian Paints stands at the intersection of innovation, scale, and brand power, making it one of India’s most admired consumer franchises.

But does Asian Paints Ltd. offer a compelling case for long-term investors at its current valuation? Let’s delve deeper.

Stock overview

| Ticker | ASIANPAINT |

| Industry/Sector | Chemicals (Paints) |

| CMP | 2602.90 |

| Market Cap (₹ Cr.) | 2,49,593 |

| P/E | 65.52 (Vs Industry P/E of 55.46) |

| 52 W High/Low | 2962.15 / 2124.75 |

| EPS (TTM) | 37.95 |

| Dividend Yield | 1.00% |

About Asian Paints Ltd.

Founded in 1942, Asian Paints is India’s largest paint manufacturer and the fourth-largest decorative paint company in the world. Headquartered in Mumbai, it serves both decorative and industrial coatings markets across over 60 countries. The company operates 27 manufacturing facilities globally and reaches over 70,000 retail touchpoints across India.

Over the years, Asian Paints has diversified beyond paints into home décor, bath fittings, and furnishings, transforming itself into a one-stop home improvement solutions brand. Subsidiaries like Sleek Kitchens and Ess Ess Bath Fittings further complement its strategic vision of offering end-to-end interior design solutions.

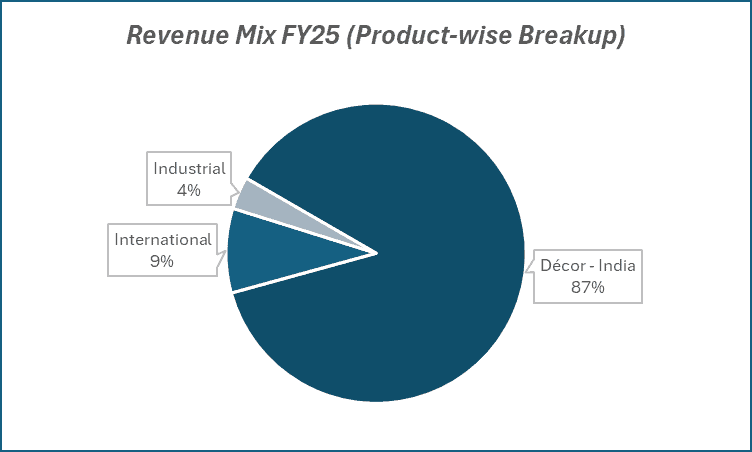

Key business segments

Asian Paints Ltd. operates primarily in the following key business segments:

- Decorative Paints (India) – The core revenue driver, contributing ~85% of total sales, spanning interior and exterior paints, enamels, wood finishes, and waterproofing solutions.

- Industrial Coatings – Provides automotive, protective, and powder coatings, in partnership with PPG Industries.

- Home Improvement & Décor – Includes kitchen solutions (Sleek), bath fittings (Ess Ess), and interior design services through the Beautiful Homes Studio.

- International Operations – Presence in Asia, Middle East, Africa, and the South Pacific, catering to both decorative and industrial paint markets.

Primary growth factors for Asian Paints Ltd.

Asian Paints Ltd. key growth drivers:

- Premiumization Trend: Strong consumer shift toward high-end decorative paints, waterproofing, and texture finishes enhances margins.

- Rural & Tier-II Expansion: Penetration-led growth from semi-urban and rural markets through deeper dealer networks and tinting machines.

- Home Décor Diversification: Integration of paints with furnishings, lighting, and modular solutions creates a holistic “Beautiful Homes” ecosystem.

- Innovation & Sustainability: Launch of eco-friendly, low-VOC paints and smart coatings positions the company for the next wave of demand.

- Raw Material Stability: Easing crude and titanium dioxide prices provide margin comfort and support earnings recovery.

- Digital Transformation: Focus on consumer experience through digital colour visualizers, home painting apps, and e-commerce presence.

Detailed competition analysis for Asian Paints Ltd.

Key financial metrics – TTM;

| Company | Revenue (₹ Cr.) | EBITDA (₹ Cr.) | EBITDA Margin (%) | PAT (₹ Cr.) | PAT Margin (%) | P/E (TTM) |

| Asian Paints Ltd. | 33874.44 | 5937.41 | 17.53% | 3499.66 | 10.33% | 65.52 |

| Berger Paints Ltd. | 11707.34 | 1780.16 | 15.21% | 1041.75 | 8.90% | 54.79 |

| Kansai Nerolac | 7854.75 | 919.21 | 11.70% | 1113.60 | 14.18% | 18.26 |

| Akzo Nobel India | 3902.60 | 571.40 | 14.64% | 1990.80 | 51.01% | 36.36 |

| Indigo Paints Ltd. | 1351.10 | 235.46 | 17.43% | 144.56 | 10.70% | 33.57 |

Key insights on Asian Paints Ltd.

- Maintains over 50% market share in India’s decorative paint segment, a clear sign of its dominance and brand loyalty.

- Consistent ROCE above 25%, underscoring superior capital efficiency.

- Strong pricing power and ability to pass on input cost volatility to consumers.

- Increasing contribution from waterproofing and décor categories, offering new revenue avenues.

- Long-term strategy focused on premiumization and customer engagement rather than price-based competition.

Recent financial performance of Asian Paints Ltd. for Q1 FY26

| Metric | Q1 FY25 | Q4 FY25 | Q1 FY26 | QoQ Growth (%) | YoY Growth (%) |

| Revenue(₹ Cr.) | 8969.73 | 8358.91 | 8938.55 | 6.93% | -0.35% |

| EBITDA (₹ Cr.) | 1693.77 | 1436.20 | 1624.97 | 13.14% | -4.06% |

| EBITDA Margin (%) | 18.88% | 17.18% | 18.18% | 100 bps | -70 bps |

| PAT (₹ Cr.) | 1150.07 | 677.78 | 1080.73 | 59.45% | -6.03% |

| PAT Margin (%) | 12.82% | 8.11% | 12.09% | 398 bps | -73 bps |

| Adjusted EPS (₹) | 12.20 | 7.22 | 11.47 | 58.86% | -5.98% |

Asian Paints Ltd. financial update (Q1 FY26)

Financial performance

- Revenue: Standalone sales declined 1.2% YoY, with consolidated revenue at base levels amid muted industry growth.

- Volume Growth: Decorative business up 3.9%, industrial up 8.8%, driving total coatings volume growth of 4.2%.

- Profitability: Gross margins at 43.2%, up YoY on 1% input cost deflation; PBDIT margins at 19.4% (standalone) and 18.2% (consolidated).

Business highlights

- Domestic: Economy emulsions and waterproofing drove growth; luxury emulsions saw down-trading.

- Industrial: Strong growth in auto refinishes and marine, moderate in protective and powder coatings.

- International: Grew 8.4% in INR terms and 17.5% in constant currency, led by Asia, UAE, and Egypt.

- Innovation: New products contributed ~14% to revenue; regionalized packs and tech integration boosted customer engagement.

- Distribution: Network expanded to ~1.7 lakh retail outlets; backward integration projects on track.

- Home Décor: Growth muted on weak discretionary spends; Weatherseal performed well, White Teak lagged.

Outlook

- Expects single-digit growth in near term, aided by a normal monsoon and stable inflation.

- Reaffirmed 18–20% PBDIT margin guidance.

- ₹700 crore CapEx planned for FY26; backward integration benefits to flow from upcoming quarters.

- Focus on innovation, brand strength, and regionalization to sustain leadership.

Recent Updates on Asian Paints Ltd.

- Capacity Expansion: Commissioned new plants in Andhra Pradesh and Maharashtra to enhance capacity for both decorative and industrial paints.

- Sustainability Milestones: Announced plans for net-zero operations by 2040, including renewable energy adoption across manufacturing facilities.

- Product Innovation: Launched SmartCare Hydroloc and Royale Health Shield to meet growing demand for hygiene and health-driven solutions.

- Home Décor Integration: Expanded “Beautiful Homes” stores across major metros, strengthening its design-led retail footprint.

- Leadership Transition: Continued focus on operational continuity and innovation under the current management team.

Company valuation insights – Asian Paints Ltd.

Asian Paints currently trades at a TTM P/E of 65.5x, higher than the industry average of 55.5x, with a 1-year return of -8.5% versus the Nifty 50’s 5.4%.

The investment case for Asian Paints rests on its dominant leadership in the decorative paints segment, steady urban demand recovery, and expanding footprint in waterproofing, industrial coatings, and home décor solutions. The company’s backward integration initiatives (white cement and VAM-VAE plants) are set to enhance cost efficiency, while its focus on innovation, premiumization, and regionalization continues to strengthen brand saliency amid intensifying competition. Supported by a debt-free balance sheet, robust cash flows, and sustained pricing discipline, Asian Paints remains well-positioned to capture long-term growth in India’s housing and renovation cycle.

We value Asian Paints at 60x FY27E EPS of ₹52, deriving a 12-month target price of ₹3,120 (20% upside) and a 3-month target price of ₹2,750 (5% upside). Key upside triggers include post-monsoon demand revival, margin support from backward integration, and steady expansion in high-margin segments like waterproofing and décor.

Major risk factors affecting Asian Paints Ltd.

- Raw Material Volatility: Sharp rise in crude or titanium dioxide prices could pressure margins.

- Competitive Intensity: Entry of new players like JSW Paints and expansion by Berger could affect pricing power in select regions.

- Demand Slowdown: Prolonged weakness in rural or real estate activity could impact volume growth.

- Execution Challenges: Scaling non-paint businesses like home décor and modular furniture profitably remains key to diversification success.

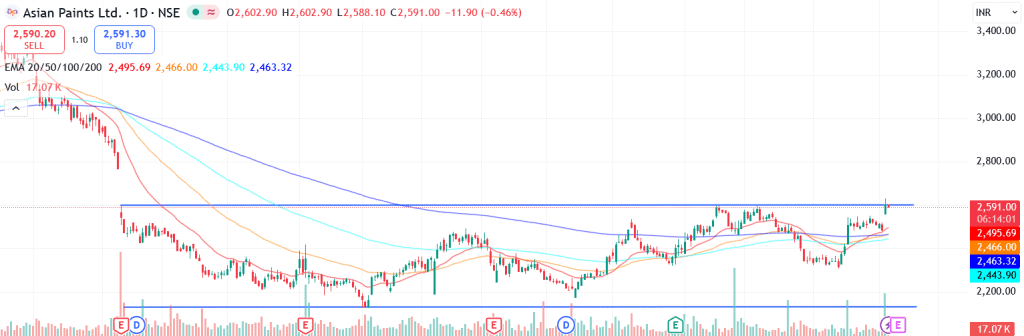

Technical analysis of Asian Paints Ltd. share

Asian Paints has recently broken out of a year-long consolidation phase, signaling the start of a potential upward momentum after a prolonged range-bound move. The breakout is supported by healthy volumes, indicating renewed investor interest and strength in trend reversal.

The stock is currently trading above its 50-day, 100-day, and 200-day EMAs, reinforcing a strong medium- to long-term bullish bias. Sustaining above these moving averages will be crucial to maintain the ongoing uptrend.

Momentum indicators also support the positive setup. The MACD at 36.64 is trading above its signal line, confirming building buying pressure. The RSI at 69.06 reflects robust demand, while relative RSI readings of 0.09 (21-day) and 0.01 (55-day) indicate continued outperformance versus the broader market. The ADX at 29.45 confirms a strengthening directional trend that could accelerate if the stock sustains above near-term resistance.

A decisive breakout above ₹2,750 could open the path toward the ₹3,120 12-month fundamental target, while on the downside, ₹2,350 serves as a key support level. Sustaining above this support will preserve the bullish setup.

- RSI: 69.06 (Strong Buying Interest)

- ADX: 29.45 (Strong Trend)

- MACD: 36.64 (Positive)

- Resistance: ₹2,750

- Support: ₹2,350

Asian Paints Ltd. stock recommendation

Current Stance: Buy, with a 3-month target of ₹2,750 (5% upside) and a 12-month target of ₹3,120 (20% upside) based on 60x FY27E EPS of ₹52.

Why buy now?

Market Leadership: Asian Paints remains the undisputed leader in India’s decorative paints market, with a robust brand recall, deep distribution network (~1.7 lakh outlets), and sustained product innovation.

Urban Recovery & Rural Tailwinds: Early signs of demand revival in urban centers and expectations of a normal monsoon should support volume growth in H2 FY26.

Backward Integration Benefits: Commissioning of the white cement (Q2 FY26) and VAM-VAE (Q1 FY27) plants will enhance cost efficiency and secure raw material supply, improving long-term margins.

Innovation & Premiumization: New product launches (~14% of revenue) and focus on waterproofing, economy emulsions, and décor solutions strengthen its value proposition amid rising competition.

Financial Resilience: A debt-free balance sheet, strong cash flows, and steady RoE (~20%) provide the flexibility to fund expansion and sustain shareholder returns.

Portfolio fit

Asian Paints represents a core consumer discretionary play on India’s housing, renovation, and lifestyle upgrade trends. It combines market dominance, strong pricing power, and strategic diversification into décor and waterproofing, offering investors a steady compounding opportunity in the long-term consumption and urbanization theme.If you found this helpful and want regular stock trade calls, check out my community on StockGro here: https://app.stockgro.club/ui/social/tradeViews/groupFeed/07a7b961-b8ca-42ce-baf3-a9eec781b6ebAsian Paints Ltd.: Budget 2025-26 opportunities

- Housing Boost: Higher allocation to housing and urban schemes to spur decorative paint demand.

- Infra Multiplier: Continued infra and real estate capex to drive coatings and waterproofing volumes.

- Rural Recovery: Increased rural spending to aid demand for economy emulsions and entry-segment paints.

- Make-in-India: Localization and PLI support to strengthen backward integration and cost efficiency.

- Green Push: Focus on green buildings and sustainable materials to benefit Asian Paints’ eco-friendly portfolio.

Final thoughts

Asian Paints is not merely a paint manufacturer; it’s a lifestyle brand shaping India’s evolving housing narrative. From the first stroke of color on new walls to helping homeowners design their dream spaces, the company has embedded itself into every stage of the consumer journey. Its evolution from a paints company to a comprehensive home solutions powerhouse makes it a timeless portfolio compounder, blending innovation, resilience, and emotional connection with Indian households.