As India’s financial inclusion story deepens, small finance banks (SFBs) have emerged as vital players in serving the underserved and untapped segments of the economy. Among them, AU Small Finance Bank stands out – not just as the largest SFB by market cap but as a fully transformed, tech-driven retail bank with a solid operating track record.

But does AU Small Finance offer a compelling case for long-term investors? Let’s delve deeper.

Stock overview

| Ticker | AUBANK |

| Industry/Sector | Financial Services (Banking) |

| CMP | 789.05 |

| Market Cap (₹ Cr.) | 57,217 |

| P/E | 27.18 (Vs Industry P/E of 14.46) |

| 52 W High/Low | 808.00 / 478.35 |

| EPS (TTM) | 28.27 |

| Dividend Yield | 0.13% |

About AU Small Finance

Founded in 1996 as AU Financiers, a vehicle finance-focused NBFC, the company transitioned into a Small Finance Bank in 2017, making it the only NBFC to complete such a successful transformation without legacy issues. Headquartered in Jaipur, AU SFB now offers a full suite of retail banking products – savings, current accounts, deposits, loans, insurance, and digital services – primarily targeting low-to-middle income customers in semi-urban and rural India.

With a market cap of ~₹47,000 crore and expanding footprint across 1,000+ touchpoints in 20+ states, AU SFB has emerged as a formidable force in India’s financial services landscape.

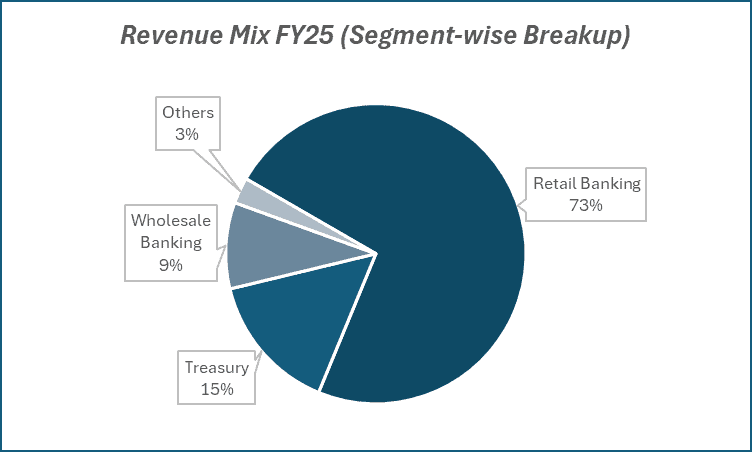

Key business segments

AU Small Finance operates primarily in the following key business segments:

- Retail Asset Lending – Dominated by secured lending to MSMEs, commercial vehicles, and home loans.

- Deposits and CASA – Increasing CASA ratio and focus on building a sticky, granular deposit base.

- Fee-Based Income – Derived from third-party distribution (insurance, mutual funds), digital payments, and other services.

Primary growth factors for AU Small Finance

AU Small Finance key growth drivers:

- Deepening Rural & Semi-Urban Penetration: Expanding branch network in low-competition geographies fuels high-margin growth.

- Digital-First Strategy: AU 0101 app and strategic fintech partnerships are enhancing customer acquisition and retention.

- Granular Loan Book: High focus on secured, small-ticket lending reduces risk concentration and improves NIMs.

- CASA Mobilization: Aggressive push to improve CASA (now over 38%) helps lower cost of funds.

- Cross-Sell and Fee Income: Rising traction in insurance and investment products augments profitability.

Detailed competition analysis for AU Small Finance

Key financial metrics – Q4 FY25

| Company | NII(₹ Cr.) | Net Interest Margin (%) | PAT Margin (%) | Cost of Borrowing (%) | Gross NPA (%) | P/E (TTM) |

| AU Small Finance | 2093.93 | 5,94% | 10.01% | 7.07% | 2.28% | 27.18 |

| Ujjivan Small Finance | 864.31 | 8.30% | 4.52% | 7.60% | 2.18% | 13.03 |

| IDFC First Bank | 4907.61 | 6.10% | 2.61% | 6.51% | 1.87% | 34.69 |

| Bandhan Bank | 2755.90 | 6.70% | 5.18% | 7.20% | 4.71% | 10.28 |

| Karur Vysya Bank | 1089.26 | 4.05% | 16.97% | 5.75% | 0.76% | 10.28 |

Key insights on AU Small Finance

- Strong Growth Track: Median sales growth of 38.1% and profit CAGR of 25.5% reflect consistent financial performance.

- Loan Book Expansion: 23% CAGR in advances over 3 years with a focus on risk-adjusted returns.

- Healthy Asset Quality: Among the lowest GNPA/NNPA in the SFB space, showing disciplined underwriting.

- Digital Push: Over 50% of transactions now through AU 0101, enhancing efficiency and reach.

- Retail-Focused Vision: Tech-led, customer-centric strategy is driving structural gains.

- Sound Governance: Visionary leadership and prudent capital allocation support long-term sustainability.

Recent financial performance of AU Small Finance for Q4 FY25

| Metric | Q4 FY24 | Q3 FY25 | Q4 FY25 | QoQ Growth (%) | YoY Growth (%) |

| NII (₹ Cr.) | 1337.03 | 2022.71 | 2093.93 | 3.52% | 56.61% |

| Operating Income (₹ Cr.) | 649.55 | 1204.90 | 1292.26 | 7.25% | 98.95% |

| Net Interest Margin (%) | 5.45% | 6.00% | 5.94% | -6 bps | 49 bps |

| PAT (₹ Cr.) | 370.74 | 528.45 | 503.70 | -4.68% | 35.86% |

| PAT Margin (%) | 11.00% | 11.17% | 10.01% | -116 bps | -99 bps |

| Adjusted EPS (₹) | 5.54% | 7.10% | 6.77% | -4.65% | 22.20% |

AU Small Finance financial update (Q4 FY25)

Financial performance

- Net Interest Income rose 56.6% YoY to ₹20,939 mn, up 3.5% QoQ as loan yields held firm despite mix shifts.

- Pre‑Provisioning Operating Profit (PPOP) nearly doubled YoY, at ₹12,923 mn (+94.6% YoY, +7.2% QoQ).

- Net Profit came in at ₹5,037 mn, up 35.9% YoY, after elevated provisions of ₹6,351 mn toward unsecured portfolios.

- Asset Quality improved: GNPA steady at 2.3% (vs. 2.3% QoQ), NNPA at 0.7%, and PCR at 67.5%.

Business highlights

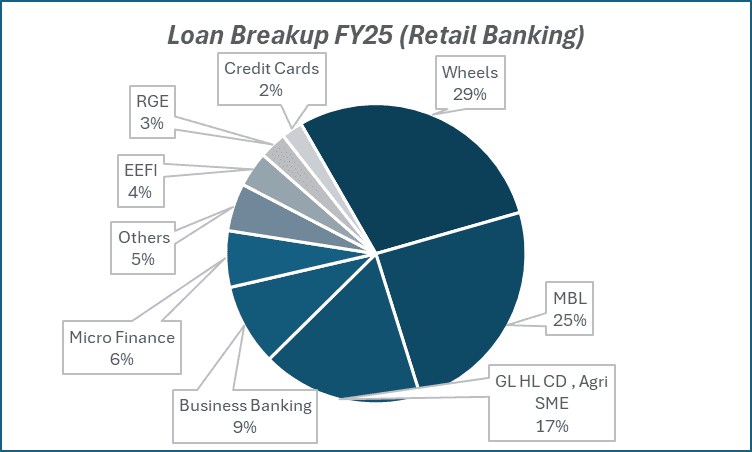

- Loan Book expanded 49.2% YoY to ₹10,70,925 mn, led by vehicle finance (+39.9% YoY) and MSME (+30.2%).

- CASA Ratio moderated to 30.0% from 31.0% QoQ; deposits up 42.5% YoY to ₹12,42,685 mn.

- Cost‑to‑Income held at a lean 54.7%, reflecting calibrated branch expansion and digital efficiencies.

- Branch Network scaled to 2,456 branches (+128.7% YoY), bolstering semi‑urban and rural reach.

- Digital Transactions comprised over 55% of volumes, underlining the success of the AU 0101 app and fintech tie‑ups.

Outlook

- Credit Growth guidance at 20-25% in FY26, to be led by secured lending and gradual MFI/credit‑card recovery.

- NIM expected to stabilise around ~5.7 to 5.8% as ~70% of assets are on fixed rates and recent SA rate cuts cushion near‑term pressures.

- Credit Cost forecast to ease to 75–85 bps in FY26 (FY25: 130 bps) as unsecured portfolios normalize.

- Branch Expansion: Plan to add ~100–120 branches, with deeper focus on Tier 3/4 and top 20 cities.

- Capital Adequacy remains robust (CRAR ~20.1%), supporting growth and digital investments.

Recent Updates on AU Small Finance

- Fresh 52-W High: The stock hit a new 52-week high of ₹808 on June 19.

- Institutional Activity: A block deal (~94 lakh shares) took place on June 2, followed by a bulk deal by TA Associates (~₹714 Cr) on June 10.

- Strong Market Absorption: Despite the heavy institutional selling, the stock has rallied nearly 10%, indicating strong buying interest and bullish sentiment.

Company valuation insights – AU Small Finance

AU Small Finance Bank is trading at a TTM P/B of 3.3x, with a 1‑year return of 15.6% versus the Nifty 50’s 4.9%, reflecting strong investor confidence in its growth and resilience.

The bank’s loan book has expanded nearly 50% YoY – led by secured MSME and vehicle segments – while maintaining GNPA/NNPA at 2.3%/0.7% and a PCR of 67.5%. A healthy NIM of ~5.8%, a lean C/I ratio of 54.7% driven by digital adoption and rapid branch expansion to 2,456 outlets, plus a fortified liability base (42.5% deposit growth, 30% CASA, CRAR ~20%), underpin its robust operating performance.

Valuing the stock at 3.1x FY27E BVPS of ₹305 yields a 12‑month target price of ₹945, implying a 20% upside from current levels, while a 3‑month target of ₹860 offers a 9% near‑term upside.

Major risk factors affecting AU Small Finance

- Geographic Concentration: Still has significant exposure to Rajasthan and neighboring states.

- Rising Competition: As large banks push into similar markets, pressure on spreads and margins may emerge.

- Asset Quality Cycles: While currently stable, any rural stress (e.g., monsoon failures, agri volatility) may affect collections.

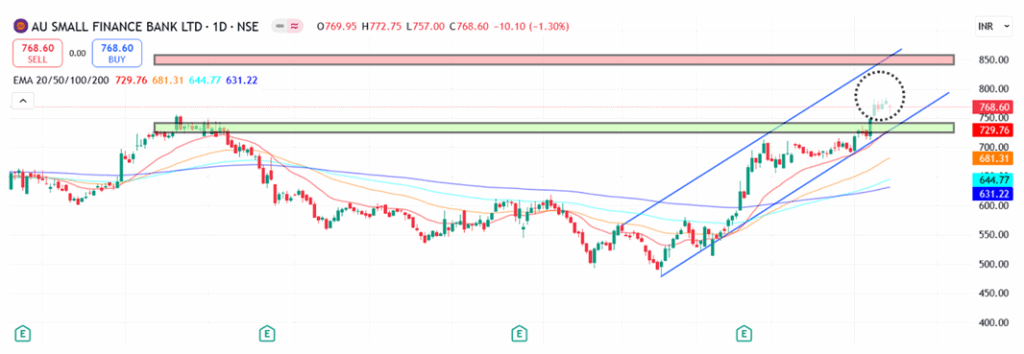

Technical analysis of AU Small Finance share

AU Small Finance Bank is currently trading in a well-defined ascending channel, reinforcing its ongoing uptrend. The stock has seen a strong rally post-Q4 results and is comfortably positioned above its 50-day, 100-day, and 200-day EMAs – a sign of a structurally sound bullish setup.

The MACD stands positive at 28.72, with a recent bullish crossover confirming upward momentum. RSI at 70.67 indicates strong buying interest, while Relative RSI over 21-day and 55-day periods (0.13 and 0.34) suggests sustained outperformance.

A strong ADX reading of 41.95 confirms the strength of the ongoing trend. A breakout above ₹850 could lead to an upside toward ₹945, while ₹740 serves as a key support level.

- RSI: 70.67 (Strong Buying Interest)

- ADX: 41.95 (Strong Trend)

- MACD: 28.72 (Positive)

- Resistance: ₹850

- Support: ₹740

AU Small Finance stock recommendation

Current Stance: Buy with a target price of ₹860 over a 3‑month horizon and ₹945 over a 12‑month horizon. AU Small Finance Bank offers a strong play on India’s financial inclusion theme, driven by rapid secured lending growth, improving margins, and a fortified liability base.

Why buy now?

Loan book up ~50% YoY, led by secured MSME and vehicle finance, underpinning NII momentum.

Asset quality stable (GNPA/NNPA at 2.3%/0.7%) with provisions set to normalize, lowering credit costs.

NIMs held at ~5.8% and C/I ratio of 54.7%, reflecting efficient operations via digital adoption.

Deposits grew 42.5% YoY, CASA at 30% and CRAR ~20%, providing low‑cost funding and growth capital.

Branch network scaled to 2,456 outlets and 55%+ digital transactions, driving customer reach and stickiness.

Portfolio fit

AU SFB brings high‑growth, retail‑focused exposure to portfolios seeking durable compounding. With secured lending leadership, healthy return ratios, and structural tailwinds in semi‑urban and rural India, it complements a growth‑oriented financial allocation while offering defensive resilience through granular assets and a robust liability franchise.If you found this helpful and want regular stock trade calls, check out my community on StockGro here: https://app.stockgro.club/ui/social/tradeViews/groupFeed/07a7b961-b8ca-42ce-baf3-a9eec781b6ebAU Small Finance: Budget 2025-26 opportunities

- Financial Inclusion Incentives: Enhanced refinance and subsidies for priority lending bolster secured MSME and agri loans.

- Digital Payments Push: Budget support for UPI and fintech infrastructure drives digital transaction growth.

- MSME & Agri Credit Schemes: Expanded guarantee programs increase small-ticket secured lending demand.

- Affordable Housing Benefits: New interest subsidies spur home loans in semi‑urban and rural areas.

- SFB Regulatory Relief: Potential capital support and relaxed norms strengthen growth capacity.

Final thoughts

AU Small Finance Bank is not just about small loans – it’s about big ambition. From a regional NBFC to a full-scale bank with aspirations of national scale, AU SFB is scripting one of India’s most exciting retail banking growth stories. Its ability to marry tech, customer-first thinking, and financial prudence makes it a unique play on financial inclusion, formalization, and rural India’s rising aspirations.

As investors hunt for financials that offer both growth and stability, AU Small Finance Bank could well be banking on the future of Bharat.