Bajaj Auto has long been synonymous with two-wheelers in India and beyond. Known for its iconic motorcycles and strong presence across over 70 countries, the company has evolved from a domestic scooter manufacturer into a global two- and three-wheeler powerhouse. As the industry shifts toward premium motorcycles and electric mobility, Bajaj stands poised at the intersection of innovation, brand strength, and international reach, ready to ride the next wave of growth in mobility.

But does Bajaj Auto offer a compelling case for long-term investors? Let’s delve deeper.

Stock overview

| Ticker | BAJAJ-AUTO |

| Industry/Sector | Automobile (Two & Three Wheelers) |

| CMP | 9125.00 |

| Market Cap (₹ Cr.) | 2,54,823 |

| P/E | 33.65 (Vs Industry P/E of 26.96) |

| 52 W High/Low | 11680.00 / 7089.35 |

| EPS (TTM) | 271.91 |

| Dividend Yield | 2.30% |

About Bajaj Auto Ltd.

Established in 1945 and headquartered in Pune, Bajaj Auto Ltd is a flagship company of the Bajaj Group and one of the top three motorcycle manufacturers in the world. The company designs, manufactures, and sells two-wheelers and three-wheelers, with a diversified product portfolio that caters to both mass-market commuters and performance enthusiasts.

Bajaj Auto’s brand philosophy, “The World’s Favourite Indian” , reflects its dominance not just in India but also in key global markets like Africa, Latin America, and Southeast Asia. The company’s strong financial discipline, innovation-led R&D, and global partnerships (like KTM and Triumph) have positioned it as a future-ready mobility leader.

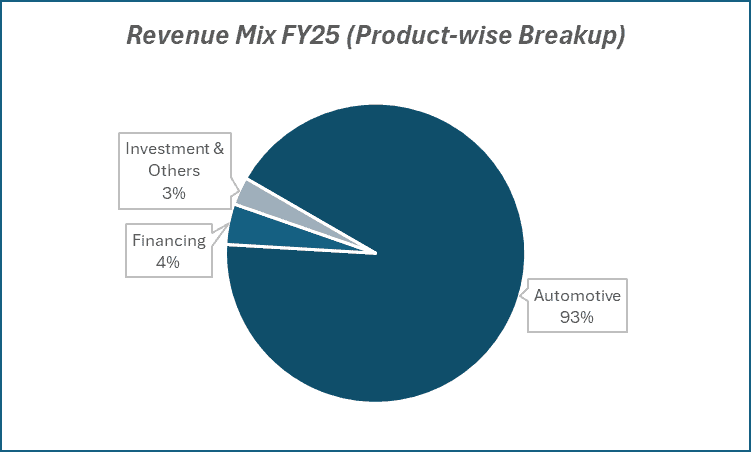

Key business segments

Bajaj Auto Ltd. operates primarily in the following key business segments:

- Motorcycles: The core segment, contributing around 85% of revenues. Product range spans commuter bikes (Platina, CT), mid-segment (Pulsar, Avenger), and premium motorcycles (Dominar, Triumph).

- Three-Wheelers & Qute (Quadricycle): Bajaj remains the global leader in three-wheelers, serving both passenger and cargo mobility markets across developing economies.

- Electric Vehicles (EVs): Under the Chetak brand, Bajaj re-entered the scooter space with its EV line-up, signaling its commitment to clean mobility.

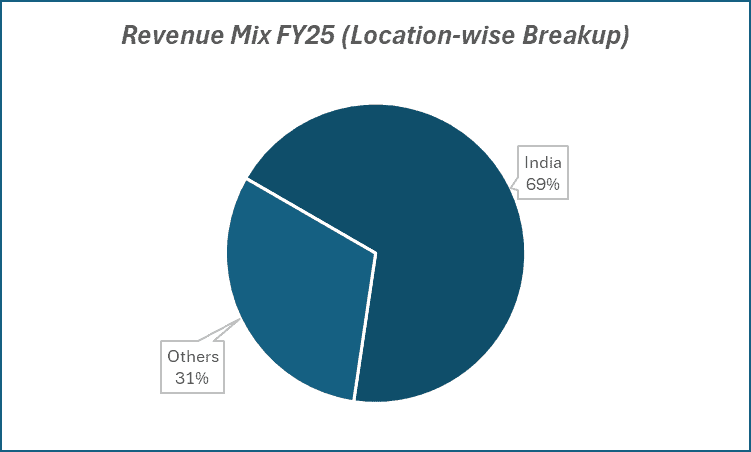

- Exports: Contributes nearly 45% of total volumes, with Africa, LATAM, and ASEAN markets driving demand.

Primary growth factors for Bajaj Auto Ltd.

Bajaj Auto Ltd. key growth drivers:

- Premiumization Trend: Expanding partnership with Triumph and the launch of high-end bikes strengthen Bajaj’s footprint in the premium motorcycle category.

- EV Expansion: The Chetak EV platform continues to gain traction, with expanding distribution and increasing contribution to total volumes.

- Export Leadership: Diversified export mix and brand recall across emerging markets ensure resilience against domestic demand fluctuations.

- Operating Efficiency: Lean manufacturing, backward integration, and cost optimization sustain industry-leading EBITDA margins.

- Collaborative Innovation: Partnerships with KTM and Triumph are driving synergies in R&D and technology transfer for future product launches.

Detailed competition analysis for Bajaj Auto Ltd.

Key financial metrics – TTM

| Company | Revenue(₹ Cr.) | EBITDA (₹ Cr.) | EBITDA Margin (%) | PAT (₹ Cr.) | PAT Margin (%) | P/E (TTM) |

| Bajaj Auto Ltd. | 52195.83 | 10890.23 | 20.86% | 8508.86 | 16.30% | 33.65 |

| Eicher Motors Ltd. | 19519.14 | 4749.38 | 24.33% | 4155.84 | 21.29% | 39.62 |

| TVS Motor Ltd. | 46188.36 | 7040.86 | 15.24% | 2594.05 | 5.62% | 66.97 |

| Hero Motocorp Ltd. | 40440.38 | 5897.46 | 14.58% | 4526.79 | 11.19% | 22.10 |

| Ather Energy | 2255.00 | -580.90 | -25.76% | -812.30 | -36.02% | -32.43 |

Key insights on Bajaj Auto Ltd.

- Bajaj Auto continues to deliver industry-leading operating margins (20%+), supported by a strong product mix and pricing power.

- The company’s cash-rich balance sheet (net cash >₹25,000 crore) offers significant flexibility for investments in EV and global expansion.

- Premium motorcycle sales are steadily increasing, driving margin expansion and brand repositioning.

- The Chetak Electric brand’s expansion into new cities and dealerships marks Bajaj’s growing commitment to sustainable mobility.

- Export markets remain a core strength, helping offset domestic cyclicality in two-wheeler demand.

Recent financial performance of Bajaj Auto Ltd. for Q1 FY26

| Metric | Q1 FY25 | Q4 FY25 | Q1 FY26 | QoQ Growth (%) | YoY Growth (%) |

| Revenue (₹ Cr.) | 11932.07 | 12646.32 | 13133.35 | 3.85% | 10.07% |

| EBITDA (₹ Cr.) | 2370.44 | 2692.93 | 2792.94 | 3.71% | 17.82% |

| EBITDA Margin (%) | 19.87% | 21.29% | 21.27% | -2 bps | 140 bps |

| PAT (₹ Cr.) | 1941.79 | 2137.03 | 2210.44 | 3.44% | 13.84% |

| PAT Margin (%) | 16.27% | 16.90% | 16.83% | -7 bps | 56 bps |

| Adjusted EPS (₹) | 69.55 | 64.52 | 79.15 | 22.68% | 13.80% |

Bajaj Auto Ltd. financial update (Q1 FY26)

Financial performance

- Revenue: ₹13,133 crore (+10% YoY), led by strong exports and premium segment growth.

- EBITDA: ₹2,793 crore (21% margin), stable QoQ despite cost pressures.

- PAT: ₹2,210 crore (+14% YoY).

- Free Cash Flow: ₹1,200 crore added; surplus cash near ₹17,000 crore, underscoring strong financial health.

Business highlights

- Exports: Volumes up 16% YoY; highest-ever retail sales outside Nigeria and record CV exports. Bajaj outpaced industry growth (27% vs 17%); export realization topped $500 million.

- Domestic Motorcycles: 125cc+ segment share rose to ~15% (↑3 ppts QoQ); entry-level segment underweighted due to low margins.

- 3-Wheelers: Maintained leadership — 75% share in ICE, 35%+ in EV; 100,000+ unit run rate for 8 quarters. E-rickshaw launch due mid-August.

- Chetak EV: Volumes doubled; market share up to 21% (vs 12% YoY). New Chetak 35 launched; temporary supply issues persist.

- Probiking: KTM & Triumph volumes up 20% YoY; new Scrambler 400 XC and Enduro 390 R launched; KTM exports resumed post restructuring.

- BACL: 40%+ penetration; ₹12,000 crore AUM; PAT ₹102 crore; cumulative investment ₹2,700 crore.

Outlook

- Margins to stay firm despite input pressures; exports and premium mix to drive near-term performance.

- Long-term growth visibility remains strong with brand strength, global scale, and solid cash generation.

Recent Updates on Bajaj Auto Ltd.

- Bajaj Auto announced plans to spin off its EV business into a separate subsidiary, aimed at sharper strategic focus and partnerships.

- The company inaugurated a new EV manufacturing facility in Akurdi, Pune, to ramp up Chetak’s production capacity.

- Continued collaboration with Triumph, with the Speed 400 and Scrambler 400X models receiving a strong market response.

- Strengthening export partnerships in Africa and South America, with new distribution channels under development.

Company valuation insights – Bajaj Auto Ltd.

Bajaj Auto is currently trading at a TTM P/E of 33.7x, above the industry average of 27.0x, with a 1-year return of -9.7% versus the Nifty 50’s +3.7%.

The investment case rests on Bajaj’s strong export franchise, expanding EV portfolio, and premiumization strategy in motorcycles and 3-wheelers. Export volumes are expected to grow 15–20% annually, led by robust traction across LATAM and Asia, capacity expansion in Brazil, and premium launches like Triumph and KTM. In the domestic market, a stronger 125cc+ mix, Chetak upgrades, and upcoming e-rickshaw launch will support volume and margin resilience. Operating leverage, favorable forex, and the maturing EV portfolio are likely to sustain EBITDA margins near 20%.

We value Bajaj Auto at 29x FY27E EPS of ₹380, arriving at a 12-month target price of ₹11,020 (20% upside from current levels). For the short term, we assign a 3-month target of ₹9,800 (~7% upside).

Key upside triggers include sustained export growth, margin improvement from EV scale-up, and continued leadership across ICE and EV 3-wheelers.

Major risk factors affecting Bajaj Auto Ltd.

- Export Headwinds: Currency depreciation or economic instability in key export markets could impact volumes.

- EV Transition Challenges: Gradual adoption pace and competitive intensity from startups and incumbents may delay profitability in EVs.

- Commodity Price Volatility: Rising metal and energy costs could pressure margins.

- Regulatory Risks: Emission norms or EV subsidy changes can affect product economics and demand patterns.

Technical analysis of Bajaj Auto Ltd. share

Bajaj Auto is currently in a gradual uptrend, indicating a continuation of upward momentum. The stock is trading above its 50-day, 100-day, and 200-day EMAs, confirming that the broader trend remains firmly positive. A sustained move above these averages would further strengthen the medium- to long-term bullish outlook.

Momentum indicators validate this setup. The MACD at 62.00 is positive, with the line positioned above the signal line, suggesting a strong momentum build-up. The RSI at 61.00 signals healthy buying interest, while relative RSI scores of 0.01 (21-day) and 0.09 (55-day) indicate steady outperformance versus the market. The ADX at 18.55 reflects that the trend is gradually gaining strength.

A breakout above ₹9,800 could pave the way for a rally toward ₹11,020 (12-month fundamental target). On the downside, ₹8,470 serves as a critical support; maintaining levels above this will be essential to preserve the bullish structure.

- RSI: 61.00 (Strong Buying Interest)

- ADX: 18.55 (Trend Gaining Strength)

- MACD: 62.00 (Positive)

- Resistance: ₹9,800

- Support: ₹8,470

Bajaj Auto Ltd. stock recommendation

Current Stance: Buy, with a 3-month target of ₹9,800 (~7% upside) and a 12-month target of ₹11,020 (~20% upside).

Why buy now?

Export leadership: Sustained double-digit export growth (15–20% YoY) led by strong traction across LATAM and Asia, with capacity expansion in Brazil.

Premiumization drive: Strong positioning in 125cc+ motorcycles, expanding Triumph & KTM range, and leadership in 3W ICE (75% share) and EV (35%+ share).

EV momentum: Chetak volumes doubled YoY; new launches and network expansion to drive scale and profitability.

Margin resilience: Stable 20%+ EBITDA margin supported by operating leverage, favorable forex, and improving EV economics.

Cash-rich balance sheet: Surplus cash near ₹17,000 crore enables reinvestment in growth and consistent shareholder payouts.

Portfolio fit

Bajaj Auto combines strong cash flows, premium brand equity, and global diversification with an expanding EV franchise. It offers a balanced mix of cyclical recovery and structural growth, a high-quality core holding in the Indian auto space.If you found this helpful and want regular stock trade calls, check out my community on StockGro here: https://app.stockgro.club/ui/social/tradeViews/groupFeed/07a7b961-b8ca-42ce-baf3-a9eec781b6ebBajaj Auto Ltd.: Budget 2025-26 opportunities

- Manufacturing & Mobility Push: Higher infrastructure and rural spending to boost two- and three-wheeler demand.

- Export Incentives: Trade facilitation and logistics upgrades strengthen Bajaj’s global market reach.

- EV Support: FAME-II extension and new PLI incentives to accelerate Chetak EV and e-3W adoption.

- Rural Demand Revival: Income support and rural capex to aid 100–125cc motorcycle sales.

- R&D & Localization: Tax benefits and Make-in-India focus to enhance innovation and cost efficiency.

Final thoughts

Bajaj Auto is more than just a motorcycle company, it’s a story of resilience, innovation, and global ambition. From dominating the mass commuter segment to leading in exports and now accelerating into EVs, Bajaj continues to adapt and thrive. For investors, it offers a balanced play on traditional strength and future readiness, underpinned by high margins, brand depth, and strong cash flows.