Stock overview

| Ticker | BERGEPAINT |

| Sector | Paints |

| Market Cap | ₹ 62,800 Cr |

| CMP (Current Market Price) | ₹ 539 |

| 52-Week High/Low | ₹ 630/ ₹ 438 |

| P/E Ratio | 53x |

About Berger Paints

Berger Paints makes and sells paints and coatings for two broad markets:

- Decorative/Consumer paints : wall paints, enamels, wood finishes, putties, waterproofing etc. (sold through dealers, retail stores and ecommerce).

- Industrial coatings : powder coatings, protective coatings, automotive and industrial paints sold to factories, infrastructure and OEMs.

It also provides painting services and solutions for large projects (commercial buildings, infrastructure). It is one of the top paint brands in India, with a large dealer network and strong brand recall.

- The paint sector is a high-frequency, repeat purchase category for consumers (home repainting, maintenance), which gives predictable demand.

- Industrial coatings act as a growth diversifier and provide higher-margin businesses tied to manufacturing, infrastructure and export segments.

Growth factors for Berger Paints

- Home ownership & urbanisation: more houses, more repaint cycles.

- Rural penetration: lower-tier towns still have low per-house paint usage which can be a big upside.

- Premium products: demand for durable, aesthetic, eco-friendly paints is rising.

- Infrastructure & commercial projects: offices, hotels, malls need large volumes and industrial coatings.

- Export & organised shift: consolidation of small local players into organised branded players.

- New product innovation: textured finishes, anti-bacterial, low-smell, and waterproofing categories.

- Distribution expansion & digital sales: omnichannel reach increases conversion and repeat purchases.

Detailed competition analysis for Berger Paints

| Company | Market Cap | Revenue | P/E Multiple | RoCE |

| Berger Paints | 62,800 Cr | ₹ 3,200 cr | 53x | 25% |

| Asian Paints | 2,47,000 Cr | ₹ 8,900 cr | 64x | 25% |

| Kansai Nerolac | 19,600 cr | ₹ 2,162 cr | 30x | 13% |

| Akzo Nobel | 15,400 cr | ₹ 995 cr | 38x | 41% |

Main domestic competitors: Asian Paints (market leader), Nerolac, JK Lakshmi group paints / Kansai, Shalimar Paints and various regional players. Asian Paints leads on scale and margins; Berger competes strongly in several regional markets and industrial coatings. The sector has a mix of large national players and local/regional companies.

Company valuation insights: Berger Paints

As per the Discounted Cash Flow analysis:

It estimates the intrinsic value of Berger Paints shares based on expected future cash flows:

- Intrinsic Value Estimate: ₹600 per share

- Upside Potential: 10%

- WACC: 11,7%

- Terminal Growth Rate: 3.8%

Major risk factors affecting Berger Paints

- Raw Material Price Volatility

- A large part of paint cost comes from crude oil derivatives (resins, solvents, additives).

- If crude prices shoot up, Berger’s input costs rise immediately, while price increases to customers often take time.

- This squeezes margins and makes quarterly performance volatile.

- Competitive Intensity

- The Indian paints industry is highly competitive, led by Asian Paints and other big players like Nerolac, AkzoNobel, Indigo and many regional brands.

- Price wars, higher trade discounts, or aggressive marketing campaigns can hurt Berger’s pricing power and dealer loyalty.

- Dependence on Decorative Segment

- While industrial paints are growing, Berger still relies heavily on decorative paints (~75–80% of sales).

- Any slowdown in housing demand, government real-estate regulations, or weak consumer sentiment directly impacts volumes.

- Currency & Import Risk

- Some raw materials are imported. A sharp depreciation of the rupee increases costs and may not be fully recoverable through price hikes.

- Seasonality & Weather

- Demand dips during monsoon months when exterior painting slows down.

- Extreme weather or unseasonal rains also delay projects and impact sales cycles.

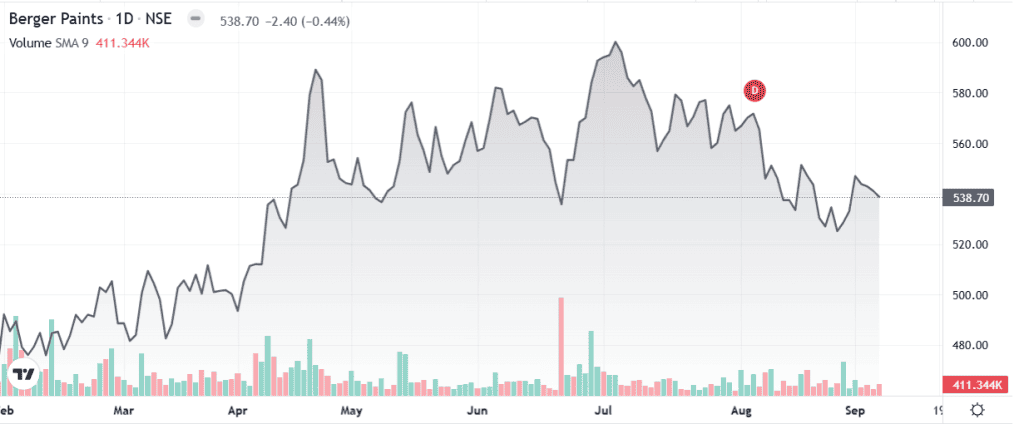

Technical analysis of Berger Paints

- Resistance: ₹565

- Support: ₹525

- Momentum: Slightly Bullish

- RSI (Relative Strength Index): 49 (Neutral)

- 50-Day Moving Average: ₹525

- 200-Day Moving Average: ₹519

Berger Paints stock recommendation by Ketan Mittal

Accumulate on weakness when margins are normalising and growth outlook intact; focus on total returns over 3–5 years.

Target Price: ₹600 (12 months)If you found this helpful and want regular stock trade calls, check out my StockGro profile here: https://stockgro.onelink.me/vNON/6m6ykj0dConclusion

Berger Paints is a well-known, large paint company with a balanced mix of decorative and industrial businesses. The long-term demand story for paints in India is strong — more homes, more urbanisation, and a shift to premium products. Berger benefits from brand strength, distribution reach and product variety. The main headwinds are raw-material price swings, tough competition and occasional seasonal dips. For long-term investors, Berger looks like a solid business to own through cycles — but watch margins and working capital closely, and prefer buying on sensible dips.