India’s defence landscape is undergoing a structural shift, from import dependence to indigenous capability building. At the heart of this transformation stands Bharat Dynamics Ltd (BDL), a critical player in India’s missile and ammunition ecosystem. As defence spending rises and indigenisation accelerates, BDL is emerging as a long-term beneficiary of sustained government focus on strategic self-reliance.

But does Bharat Dynamics Ltd. offer a compelling case for long-term investors? Let’s delve deeper.

Stock overview

| Ticker | BDL |

| Industry/Sector | Capital Goods |

| CMP | 1384.00 |

| Market Cap (₹ Cr.) | 50,512 |

| P/E | 86.14 (Vs Industry P/E of 51.93) |

| 52 W High/Low | 2096.60 / 907.00 |

| EPS (TTM) | 17.85 |

| Dividend Yield | 0.30% |

About Bharat Dynamics Ltd.

Bharat Dynamics Ltd is a Government of India enterprise under the Ministry of Defence, primarily engaged in the manufacture of guided missiles, missile systems, torpedoes, and allied defence equipment. BDL works closely with DRDO and the Indian Armed Forces, playing a vital role in translating indigenous R&D into deployable weapon systems. Its operations are deeply embedded in India’s strategic defence infrastructure, giving it high entry barriers and long-term relevance.

Key business segments

Bharat Dynamics Ltd. operates primarily in the following key business segments:

- Missile Systems: Manufacturing of surface-to-air, air-to-air, anti-tank, and strategic missile systems developed with DRDO.

- Underwater Weapons: Torpedoes and countermeasure systems for naval applications.

- Ammunition & Defence Equipment: Launchers, test equipment, and allied defence electronics.

- Life-Cycle Support: Refurbishment, upgrades, spares, and maintenance for deployed missile systems.

Primary growth factors for Bharat Dynamics Ltd.

Bharat Dynamics Ltd. key growth drivers:

- Defence Indigenisation: Strong push under Make in India and Atmanirbhar Bharat for domestic procurement.

- Rising Defence Budget: Higher capital outlay focused on missiles, air defence, and naval platforms.

- Export Opportunities: Growing global demand for cost-effective missile systems from friendly nations.

- DRDO Pipeline: Steady flow of indigenous missile programs transitioning from development to production.

- High Entry Barriers: Strategic nature of products limits competition and ensures order continuity.

Detailed competition analysis for Bharat Dynamics Ltd.

Key financial metrics – TTM;

| Company | Sales (₹ Cr.) | EBITDA (₹ Cr.) | EBITDA Margin (%) | PAT (₹ Cr.) | PAT Margin (%) | P/E |

| Bharat Dynamics Ltd. | 3738.56 | 467.09 | 12.49% | 579.93 | 15.51% | 86.14 |

| Data Patterns Ltd. | 920.04 | 304.08 | 33.05% | 233.43 | 25.37% | 64.05 |

| Zen Technologies Ltd. | 834.59 | 334.22 | 40.05% | 285.36 | 34.19% | 47.07 |

| Paras Defence & Space Ltd. | 413.49 | 106.15 | 25.67% | 71.41 | 17.27% | 80.43 |

| Axiscades Technologies Ltd. | 1089.15 | 162.90 | 14.96% | 90.27 | 8.29% | 57.92 |

Key insights on Bharat Dynamics Ltd.

- Order Book Visibility: Long-gestation defence orders provide multi-year revenue clarity.

- Strategic Monopoly: Limited domestic manufacturers in missile systems enhance BDL’s relevance.

- Policy Backing: Strong alignment with national security and defence preparedness priorities.

- Operating Leverage: Scale-up in production improves margins over time.

- Low Demand Cyclicality: Defence spending remains resilient across economic cycles.

Recent financial performance of Bharat Dynamics Ltd. for Q3 FY26

| Metric | Q3 FY25 | Q2 FY26 | Q3 FY26 | QoQ Growth (%) | YoY Growth (%) |

| Sales (₹ Cr.) | 832.14 | 1147.03 | 566.63 | -50.60% | -31.91% |

| EBITDA (₹ Cr.) | 126.87 | 187.51 | 25.99 | -86.14% | -79.51% |

| EBITDA Margin (%) | 15.25% | 16.35% | 4.59% | -1176 bps | -1066 bps |

| PAT (₹ Cr.) | 147.13 | 215.88 | 72.92 | -66.22% | -50.44% |

| PAT Margin (%) | 17.68% | 18.82% | 12.87% | -595 bps | -481 bps |

| Adjusted EPS (₹) | 4.01 | 5.89 | 1.99 | -66.21% | -50.37% |

Bharat Dynamics Ltd. financial update (Q3 FY26)

Financial performance

- Revenue down 32% YoY in Q3 FY26; PAT declined 50% YoY, indicating earnings stress.

- 9M FY26 revenue fell 40% YoY, reflecting sustained execution weakness.

- Margins compressed, with profits falling faster than revenues despite lower costs.

- ₹83 Cr of non-moving inventory (>5 years) flagged by auditors, raising asset-quality concerns.

- Near-term earnings visibility remains weak, with elevated volatility risks.

Business highlights

- Defence order execution: The defence segment remained the core growth engine, with BDL delivering on major contracts for guided missiles and strategic programmes aligned with India’s defence modernisation agenda. Higher execution volumes were the primary driver of revenue expansion.

- Order pipeline: The company continues to benefit from a strong, multi-year order book, which supports sustained revenue visibility, while selective focus on high-value systems helps maintain an attractive margin profile.

- Inventory & working capital: A portion of older inventory remains on the books, linked to short-closed contracts, but advances received against these mitigate immediate provisioning needs as noted in the regulatory filings.

- Dividend discipline: Maintaining a consistent dividend policy reflects confidence in cash flow generation and signals financial stability even amid quarterly earnings volatility.

Outlook

- Strong revenue visibility supported by a robust, multi-year defence order book and sustained execution of key missile and strategic programs.

- Continued tailwinds from defence indigenisation and rising capital allocation towards domestic weapon systems.

- Operating leverage benefits expected as execution intensity improves and production scales up across core missile platforms.

- Margins likely to remain stable to mildly improve over the medium term, aided by better mix, execution efficiencies, and cost discipline.

- Working capital expected to remain manageable, supported by milestone-based billing and advance payments on defence contracts.

- Capex to remain calibrated, focused on capacity enhancement and technology upgrades without stressing the balance sheet.

- Strong balance sheet and healthy cash flows provide flexibility for dividends, growth investments, and earnings stability over FY26–27.

Recent Updates on Bharat Dynamics Ltd.

- New Missile Orders: Continued inflow of orders for next-generation indigenous missile platforms.

- Export Engagements: Discussions and agreements with friendly foreign nations for missile exports.

- Capacity Expansion: Investments to enhance manufacturing capabilities and throughput.

- Product Induction: Progress in productionisation of newer DRDO-developed weapon systems.

- Strategic Collaborations: Deeper integration with DRDO and armed forces for future programs.

Company valuation insights – Bharat Dynamics Ltd.

Bharat Dynamics Limited (BDL) is currently trading at a TTM P/E of 86.1x, at a premium to the industry average of 51.9x. Over the last one year, the stock has delivered a 17.8% return, outperforming the NIFTY 50’s 7.7% gain. While the headline multiple appears optically expensive, the valuation premium reflects BDL’s strategic positioning in India’s defence ecosystem, strong order visibility, and its role as a key beneficiary of the government’s indigenisation and missile modernisation programs.

The investment case for BDL is anchored in structural growth in India’s defence spending and BDL’s dominant position in guided missiles and strategic weapon systems. The company enjoys a robust, multi-year order book, largely backed by sovereign clients, providing high revenue visibility and limited demand risk. Increasing localisation, scale benefits from higher production throughput, and operating leverage from execution of large missile programs are expected to support margin expansion over the medium term. As highlighted in sell-side commentary, the transition towards higher-value systems, improved execution timelines, and steady inflow of repeat orders from the Indian armed forces underpin a sustained earnings trajectory. Additionally, a strong balance sheet with minimal leverage provides flexibility to fund capex and working capital needs without straining returns.

From a valuation standpoint, applying a 50x multiple to FY27E EPS of ₹34, we arrive at a 12-month target price of ₹1,700, implying an upside of 24% from current levels. Over the near term, we assign a 3-month target price of ₹1,470, indicating a 6% upside, supported by continued order execution, stable margins, and sustained momentum in defence-led revenues.

Major risk factors affecting Bharat Dynamics Ltd.

- Order Execution Delays: Defence procurement timelines can shift due to administrative or geopolitical factors.

- Client Concentration: Heavy dependence on the Indian government as the primary customer.

- Policy Changes: Shifts in defence procurement priorities or budget allocations.

- Technology Transition Risk: Delays in transitioning R&D programs into mass production.

- Working Capital Intensity: Long receivable cycles inherent in defence contracts.

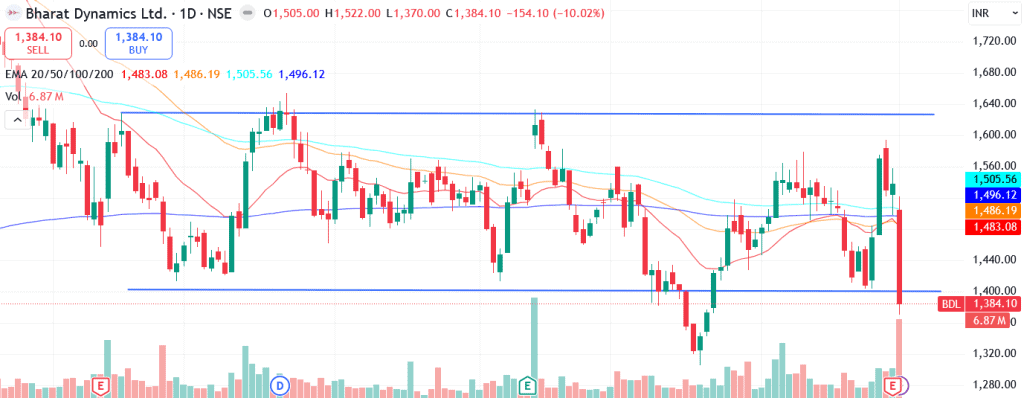

Technical analysis of Bharat Dynamics Ltd. share

Bharat Dynamics Limited (BDL) is currently trading in a sideways consolidation, with prices hovering near the lower end of the established range, offering a relatively favourable risk–reward setup for fresh entries. This phase suggests supply exhaustion at lower levels, with the stock building a base for a potential directional move.

The stock is trading below its 20-, 50-, 100- and 200-day EMAs, indicating that the broader trend remains neutral to mildly weak. However, a sustained crossover above the 20-day EMA could act as an early trigger for a short-term up move, improving sentiment and attracting incremental buying interest. Further strength beyond this level would be required to confirm a broader trend reversal.

Momentum indicators are gradually improving. MACD at -4.63 remains negative and marginally below the signal line; a bullish crossover would act as a clear buy signal and confirm improving momentum. RSI at 56.29 reflects healthy buying interest, comfortably away from overbought territory, allowing room for further upside. ADX at 15.81 suggests a developing trend, with directional strength slowly building but yet to fully mature.

A decisive move above ₹1,470 could open the path towards ₹1,700 (12-month target). On the downside, ₹1,290 remains a key support level; holding above this zone keeps the emerging bullish structure intact and limits downside risk.

- RSI: 56.29 (Decent buying momentum)

- ADX: 15.81 (Developing trend strength)

- MACD: -4.63 (Negative; signal line crossover awaited)

- Resistance: ₹1,470

- Support: ₹1,290

Bharat Dynamics Ltd. stock recommendation

Current Stance: Buy, with a 3-month target of ₹1,470 (6% upside) and a 12-month target of ₹1,700 (24% upside), based on 50x FY27E EPS of ₹34.

Why buy now?

Structural defence growth tailwinds: Bharat Dynamics Limited is a key beneficiary of India’s rising defence capital outlay and indigenisation drive, with a dominant position in guided missiles and strategic weapon systems ensuring sustained demand visibility.

Strong execution and order visibility: A robust, multi-year order book, largely backed by sovereign clients, provides high revenue certainty and underpins earnings scalability over the medium term.

Operating leverage from scale-up: Higher execution intensity across missile programs and improved production throughput are expected to drive operating leverage, supporting earnings growth despite near-term margin fluctuations.

Balance sheet resilience: A strong, low-leverage balance sheet and healthy cash flows provide financial flexibility to fund capex, manage working capital, and sustain shareholder returns without stressing return ratios.

Portfolio fit

Bharat Dynamics Limited offers direct exposure to India’s defence indigenisation and missile modernisation theme, combining long-duration order visibility with structural earnings growth. With sovereign-backed demand, execution-led scalability, and balance sheet strength, the stock fits well in portfolios seeking defence-led growth stories, high-visibility earnings compounders, and strategic allocations alongside core large-cap holdings.If you found this helpful and want regular stock trade calls, check out my community on StockGro here: https://app.stockgro.club/ui/social/tradeViews/groupFeed/07a7b961-b8ca-42ce-baf3-a9eec781b6ebBharat Dynamics Ltd.: Budget 2026-27 opportunities

- Higher Defence Capex: Increased allocation for missiles, air defence, and naval systems.

- Export Promotion: Government support for defence exports and strategic partnerships.

- Indigenous Manufacturing Incentives: Continued policy thrust on domestic defence production.

- Border Security Focus: Demand for precision and missile-based deterrence systems.

- R&D to Production Push: Faster movement of DRDO programs into commercial manufacturing.

Final thoughts

Bharat Dynamics Ltd is not just a defence PSU, it is a strategic enabler of India’s national security architecture. With rising defence allocations, strong indigenisation momentum, and expanding export opportunities, BDL offers investors exposure to a rare segment where demand visibility, policy support, and technological depth converge. For long-term portfolios seeking stability, strategic relevance, and participation in India’s defence modernisation journey, BDL represents a compelling structural opportunity.