India’s equity markets have been witnessing a structural transformation, with rising retail participation, growing institutional flows, and robust derivatives activity. At the heart of this evolution stands BSE Ltd., Asia’s oldest stock exchange and one of the fastest-growing financial market infrastructure providers. With its expanding suite of products and technology-driven platforms, BSE is emerging as a key beneficiary of India’s deepening capital markets, making it an interesting investment story.

But does BSE offer a compelling case for long-term investors? Let’s delve deeper.

Stock overview

| Ticker | BSE |

| Industry/Sector | Financial Services |

| CMP | 2099.00 |

| Market Cap (₹ Cr.) | 85,369 |

| P/E | 55.29 (Vs Industry P/E of 52.40) |

| 52 W High/Low | 3,030.00 / 900.03 |

| EPS (TTM) | 39.40 |

About BSE Ltd

Founded in 1875, the Bombay Stock Exchange (BSE) is the world’s fastest stock exchange platform with a median trade speed of 6 microseconds. It offers a broad ecosystem of services including equity trading, derivatives, mutual fund distribution, SME listings, commodities, debt instruments, and clearing services. Beyond its historical legacy, BSE has embraced innovation and digital transformation to remain relevant in an increasingly competitive and technology-driven market.

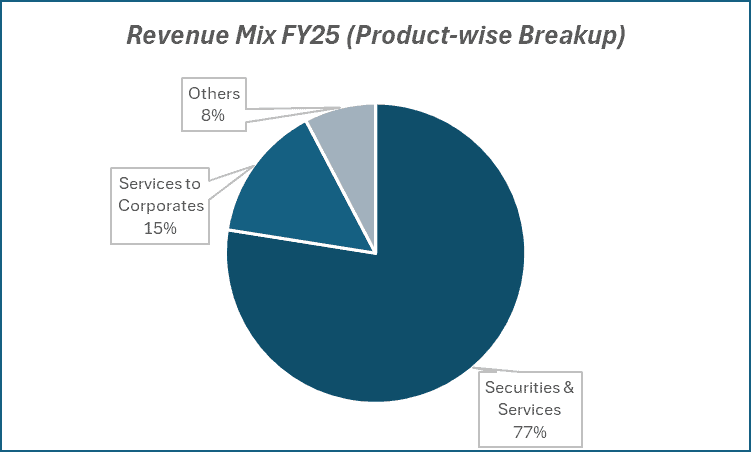

Key business segments

BSE Ltd. operates primarily in the following key business segments:

- Equity & Derivatives Trading – Cash equities, equity derivatives, and commodity derivatives.

- Clearing & Settlement Services – Provided through Indian Clearing Corporation Ltd. (ICCL).

- Mutual Fund Distribution – BSE StAR MF is India’s largest mutual fund transaction platform.

- SME & Startup Listings – Market leader in SME IPO listings, supporting India’s entrepreneurial ecosystem.

- Debt & Corporate Bonds – Trading and listing platform for fixed-income securities.

- Other Services – Index services, data dissemination, and technology platforms.

Primary growth factors for BSE

BSE key growth drivers:

- Retail Participation Boom – Rising demat accounts and mutual fund inflows.

- Derivatives Expansion – Strong growth in options and commodities trading volumes.

- BSE StAR MF Platform – Market leadership in MF distribution with consistent double-digit growth in transactions.

- SME & Startup Listings – Growing traction in SME capital raising.

- Regulatory Push for Transparency – Structural demand for exchange-based trading across asset classes.

- New Product Launches – Focus on innovative indices, ETFs, and commodities.

Detailed competition analysis for BSE

Key financial metrics – TTM;

| Company | Revenue(₹ Cr.) | EBITDA (₹ Cr.) | EBITDA Margin (%) | PAT (₹ Cr.) | PAT Margin (%) | P/E (TTM) |

| BSE Ltd. | 3234.89 | 1844.84 | 55.49% | 1507.47 | 45.34% | 55.29 |

| 360 One Ltd | 3354.82 | 1989.35 | 59.30% | 1056.23 | 31.48% | 39.93 |

| Anand Rathi Wealth | 975.50 | 429.79 | 44.06% | 321.26 | 32.93% | 71.71 |

| Nuvama Wealth | 4325.63 | 2329.11 | 53.84% | 1022.68 | 23.64% | 22.95 |

Key insights on BSE

- BSE has transitioned from a legacy cash-equity exchange into a diversified financial market infrastructure company.

- Its mutual fund distribution arm (BSE StAR MF) is a strong value driver, with consistent growth in transaction volumes and industry leadership.

- SME platform dominance positions BSE uniquely in capturing India’s entrepreneurial wave.

- While NSE continues to dominate equity and index derivatives, BSE is gaining share in select product segments, improving revenue diversity.

- Strong focus on technology, speed, and data monetization is helping drive non-trading revenues.

Recent financial performance of BSE for Q1 FY26

| Metric | Q1 FY25 | Q4 FY25 | Q1 FY26 | QoQ Growth (%) | YoY Growth (%) |

| Revenue (₹ Cr.) | 601.87 | 846.64 | 958.39 | 13.20% | 59.24% |

| EBITDA (₹ Cr.) | 282.42 | 593.57 | 625.93 | 5.45% | 121.63% |

| EBITDA Margin (%) | 46.92% | 70.11% | 65.31% | -480 bps | 1839 bps |

| PAT (₹ Cr.) | 239.68 | 477.41 | 509.93 | 6.81% | 112.75% |

| PAT Margin (%) | 39.82% | 56.39% | 53.21% | -318 bps | 1339 bps |

| Adjusted EPS (₹) | 6.53 | 12.18 | 13.26 | 8.87% | 103.06% |

BSE financial update (Q1 FY26)

Financial performance

- Revenue from operations stood at ₹958 crore (up 59.2% YoY), driven primarily by robust growth in transaction charges.

- PAT more than doubled to ₹510 crore (up 112.8% YoY).

- EBITDA margin expanded strongly to 65% in Q1 FY26, while PAT margin improved to 53%.

- Transaction charges revenue surged ~84% YoY to ₹737 crore, led by equity derivatives and mutual funds; however, cash segment revenue declined 27.8% YoY due to lower turnover.

- Other operating revenues, including data dissemination and training, rose 57.2% YoY to ₹70 crore.

Business highlights

- BSE continued to deliver strong operating leverage with margins expanding on higher derivatives volumes.

- Fundraising activity remained buoyant, with ~₹7.6 lakh crore raised through the BSE platform across equity, bonds, and commercial paper.

- 21 new listings in Q1 FY26 raised ~₹14,237 crore, reflecting the vibrant IPO market.

- The BSE StAR MF platform scaled new highs, processing ~18.3 crore transactions in Q1 FY26 (up 30% YoY), averaging 6.1 crore per month.

- The equity derivatives business showed robust traction, with revenue of ₹598 crore (up sharply YoY); average daily premium turnover grew 111% YoY.

- Cash segment revenue fell due to heightened market volatility, with ADT down 20.2% YoY.

Outlook

- Management aims to deepen product offerings, expand market participation, and invest further in data centers and connectivity infrastructure.

- The successful implementation of the common contract note (June 2025) is expected to improve institutional trading experience and participation across venues.

- With strong traction in derivatives and mutual fund platforms, coupled with buoyant primary markets, BSE is well positioned to sustain high growth momentum in FY26.

- Rebranding of Asia Index Pvt Ltd. to BSE Index Services Pvt Ltd. aligns with its strategy to enhance brand recall in index-related businesses.

Recent Updates on BSE

- BSE StAR MF crossed new transaction volume milestones, reaffirming its leadership in the MF distribution space.

- The exchange announced initiatives to further strengthen SME and startup listings, aiming to expand its ecosystem beyond large-cap equities.

- Expansion of partnerships for ESG indices and new ETF launches in collaboration with asset managers.

- Regulatory focus on exchange interoperability and new product approvals continues to shape its competitive positioning.

Company valuation insights – BSE

BSE is currently trading at a TTM P/E of 55.3, slightly above the industry average of 52.4, with a stellar 1-year return of 123.9% versus Nifty 50’s -2.9%.

The exchange has emerged as a key beneficiary of rising retail and institutional participation in equity derivatives, robust traction in its mutual fund distribution platform (StAR MF), and a buoyant primary issuance market. Its strong operating leverage, diversified revenue streams, and technology investments position it well to sustain growth momentum. Expanding product offerings, improving liquidity in derivatives, and consistent market share gains underpin a solid medium-term outlook.

We value BSE at 45x FY27E EPS of ₹58 to arrive at a 12-month target price of ₹2,610, implying a 24% upside from current levels. A short-term target of ₹2,300 suggests a 10% upside over 3 months, supported by continued traction in derivatives volumes, vibrant IPO pipeline, and scale benefits from StAR MF.

Major risk factors affecting BSE

- Competitive Pressure – NSE dominance in equity and derivatives remains a structural challenge.

- Regulatory Risks – Changes in SEBI policies or taxation can impact trading volumes.

- Market Volatility – Earnings are sensitive to capital market activity and investor sentiment.

- Technology Risks – Any system downtime or cybersecurity threats could disrupt operations.

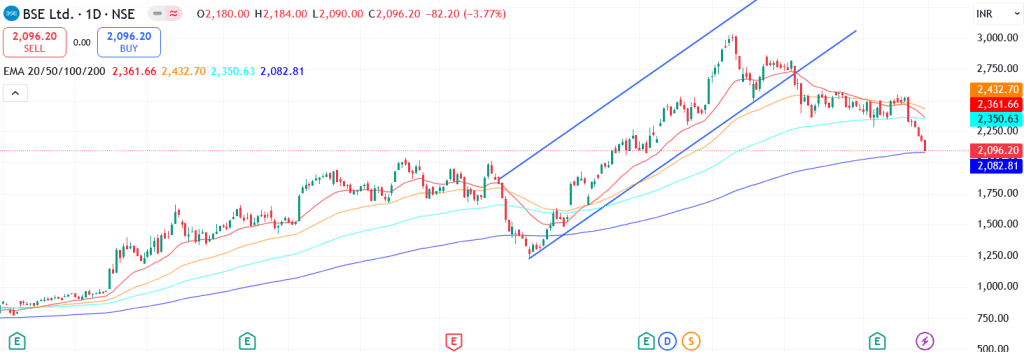

Technical analysis of BSE share

BSE was trading in a long-term ascending channel and delivered over 100% gains in the last year. However, the stock has recently broken below the channel’s lower trendline, signaling a pause in the strong uptrend and reflecting short-term weakness.

The stock currently trades below its 50-day, 100-day, and 200-day EMAs, underscoring bearish momentum. That said, it is hovering around the 20-day EMA, which could act as a strong support. A sustained rebound from this level may provide an early entry opportunity.

Momentum indicators also reflect weakness. The MACD is negative at -80.43, with the MACD line below the signal line, though a bullish crossover here could signal renewed upside momentum. The RSI at 27.89 indicates oversold conditions, suggesting selling pressure may be overextended. Relative RSI scores of -0.14 (21-day) and -0.25 (55-day) highlight underperformance versus the broader market.

The ADX at 28.39 points to a strong downward trend, though this could weaken if the stock stabilizes at current support.

A breakout above ₹2,300 could open the path toward ₹2,610, in line with the 12-month fundamental target. On the downside, ₹1,960 remains a crucial support; holding above it is key to reversing the current bearish structure.

- RSI: 27.89 (Oversold Range)

- ADX: 28.39 (Strong Downward Trend)

- MACD: -80.43 (Negative)

- Resistance: ₹2,300

- Support: ₹1,960

BSE stock recommendation

Current Stance: Buy, with a 3-month target of ₹2,300 (~10% upside) and a 12-month target of ₹2,610 (~24% upside).

Why buy now?

Derivatives growth: Strong traction with ₹598 crore revenue in Q1 FY26 and rising client participation.

StAR MF scale: 30% YoY growth, reinforcing its leadership in mutual fund distribution.

Capital market momentum: Robust fund-raising (~₹7.6 lakh crore) and 21 IPOs highlight BSE’s platform strength.

Operating leverage: Margins expanded sharply (EBITDA 65%, PAT 55%) on a higher scale.

Innovation edge: Ongoing tech upgrades and product initiatives enhance competitiveness.

Portfolio fit

BSE is India’s oldest stock exchange and has successfully reinvented itself into a high-growth, technology-driven marketplace. With leadership in mutual fund distribution, accelerating traction in equity derivatives, and a vibrant primary issuance platform, BSE offers investors diversified exposure across India’s capital markets ecosystem. Its strong operating leverage, robust profitability, and focus on innovation make it a compelling play on India’s deepening financial market participation.If you found this helpful and want regular stock trade calls, check out my community on StockGro here: https://app.stockgro.club/ui/social/tradeViews/groupFeed/07a7b961-b8ca-42ce-baf3-a9eec781b6ebBSE: Budget 2025-26 opportunities

- Capital Market Deepening: Higher government disinvestment targets and PSU stake sales to boost equity market activity and listing opportunities on BSE.

- SME & Startup Support: Increased incentives and easier listing norms for SMEs and startups to strengthen BSE’s SME exchange pipeline.

- Debt Market Development: Policy push for corporate bond market and municipal bond issuances to drive fund-raising activity on the exchange.

- Mutual Fund Penetration: Tax benefits and digital adoption incentives to expand retail participation, supporting growth in the StAR MF platform.

- Technology & Infrastructure Upgrades: Government push for financial market digitization and data infrastructure to enhance BSE’s trading, clearing, and settlement capabilities.

Final thoughts

BSE stands at the intersection of India’s capital market deepening and financialization of savings. With StAR MF scaling new highs, SME listings expanding, and new products enhancing its portfolio, the exchange is well-poised for sustainable growth. While competition from NSE remains intense, BSE’s diversified approach ensures multiple revenue levers. For investors looking to capture the structural India financial markets growth story, BSE offers a differentiated play with strong scalability and improving earnings visibility.