While large pharma names often dominate investor attention, Caplin Point Laboratories has quietly built a high-margin, debt-free business model focused on underserved and high-growth markets. With a unique positioning in the Latin American region, consistent operational efficiency, and expanding US exposure, Caplin offers a differentiated play in the Indian pharmaceutical space.

But does Caplin Point Laboratories offer a compelling case for long-term investors? Let’s delve deeper.

Stock overview

| Ticker | CAPLIPOINT |

| Industry/Sector | Healthcare (Pharmaceuticals & Drugs) |

| CMP | 2090.00 |

| Market Cap (₹ Cr.) | 16,300 |

| P/E | 29.60 (Vs Industry P/E of 35.58) |

| 52 W High/Low | 2,641.00 / 1452.00 |

| EPS (TTM) | 70.56 |

| Dividend Yield | 0.14% |

About Caplin Point Laboratories

Founded in 1990, Caplin Point Laboratories Ltd. is a Chennai-based pharmaceutical company catering primarily to emerging markets. It has built a stronghold in Latin America, the Caribbean, and select African and Southeast Asian countries. The company manufactures a wide range of products including oral solids, injectables, topical formulations, and IV fluids.

Key business segments

Caplin Point Laboratories operates primarily in the following key business segments:

- Branded Generics in Latin America – Key revenue driver; presence in over 10 countries.

- Institutional Business in Africa and Asia – Tenders and government supply contracts.

- US Generic Injectables – Fast-growing vertical with ANDA approvals ramping up.

- CRAMS & Exports – Steady contributor, especially in sterile injectables.

Primary growth factors for Caplin Point Laboratories

Caplin Point Laboratories key growth drivers:

- USFDA Approval & Injectables Expansion: The company has built a USFDA-approved facility (Caplin Steriles) to target the regulated injectable markets.

- Strong Latin America Presence: Long-standing relationships and first-mover advantage in underserved regions.

- Backward Integration: Control over APIs and manufacturing ensures cost competitiveness and supply stability.

- Debt-Free Balance Sheet: Enables self-funded growth, R&D investments, and margin stability.

- Capacity Expansion: Upcoming facilities and increasing US filings to scale regulated market share.

Detailed competition analysis for Caplin Point Laboratories

Key financial metrics – TTM;

| Company | Revenue(₹ Cr.) | EBITDA (₹ Cr.) | EBITDA Margin (%) | PAT (₹ Cr.) | PAT Margin (%) | P/E (TTM) |

| Caplin Point Ltd. | 1937.47 | 646.93 | 33.39% | 541.10 | 27.93% | 29.60 |

| Natco Pharma Ltd. | 4429.50 | 2196.00 | 49.58% | 1883.40 | 42.52% | 9.11 |

| Sai Life Sciences | 1694.57 | 405.66 | 23.94% | 170.13 | 10.04% | 101.85 |

| Neuland Laboratories | 1476.84 | 323.26 | 21.89% | 260.11 | 17.61% | 68.31 |

| Jubilant Pharmova | 7403.50 | 1211.80 | 16.37% | 457.60 | 6.18% | 39.96 |

Key insights on Caplin Point Laboratories

- Over 60% of revenues come from branded markets, unlike many peers dependent on generics.

- R&D intensity is increasing, with 20+ ANDAs filed and many more planned.

- The company consistently maintains EBITDA margins of 25%+, supported by its integrated operations and geographic moat.

- A recent JV with European partners in injectables enhances its global footprint.

Recent financial performance of Caplin Point Laboratories for Q4 FY25

| Metric | Q4 FY24 | Q3 FY25 | Q4 FY25 | QoQ Growth (%) | YoY Growth (%) |

| Revenue (₹ Cr.) | 453.22 | 492.96 | 502.45 | 1.93% | 10.86% |

| EBITDA (₹ Cr.) | 145.23 | 162.29 | 168.06 | 3.56% | 15.72% |

| EBITDA Margin (%) | 32.04% | 32.92% | 33.45% | 53 bps | 141 bps |

| PAT (₹ Cr.) | 121.17 | 140.08 | 145.20 | 3.66% | 19.83% |

| PAT Margin (%) | 26.74% | 28.42% | 28.90% | 48 bps | 216 bps |

| Adjusted EPS (₹) | 16.01 | 18.28 | 18.76 | 2.63% | 17.18% |

Caplin Point Laboratories financial update (Q4 FY25)

Financial performance

- Revenue rose 10.9% YoY to ₹502 crore in Q4 FY25, driven by growth across key geographies and product categories.

- EBITDA stood at ₹168 crore in Q4, with EBITDA margin at 33.5%, aided by product mix and cost efficiencies.

- Net Profit increased 19.8% YoY to ₹145 crore in Q4 FY25, reflecting operational leverage and milestone income.

- For FY25, revenue grew 14.4% YoY to ₹1,937 crore, and PAT improved 17.3% YoY to ₹541 crore.

- Free Cash Flow improved to ₹241 crore in FY25 (vs. ₹172 crore last year); Cash flow from operations stood at ₹432 crore.

- Net cash position remains strong with free cash reserves of ₹1,180 crore and liquid assets of ₹2,148 crore as of March 2025.

Business highlights

- Sales Geography: Emerging markets contributed 82% of revenue (LATAM 76%, Africa 6%), US accounted for 18%.

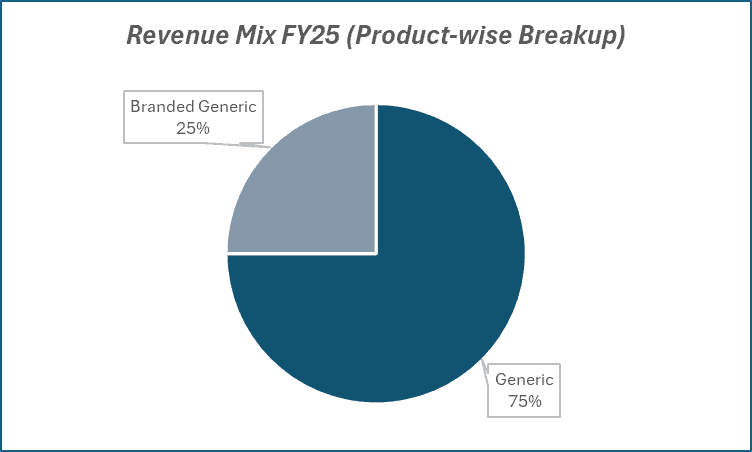

- Product Mix: Generics formed 75% of sales, branded generics 25%; strong growth in Softgels, Injectables, Oncology.

- Revenue Channels: Wholesalers 45%, direct-to-retail 35%, institutional 20%.

- Shift to asset-light outsourcing model in India and China to boost margins and scalability.

Outlook

- Strong growth expected from regulated markets – Canada, Australia, MENA, Russia.

- Strategic focus on expansion into Brazil and Mexico, and on scaling GLP-1 and biosimilar pipelines.

- US business remains a key growth driver, with expectations of 10–12 new approvals in FY26 and expansion in front-end operations.

Recent Updates on Caplin Point Laboratories

- Received USFDA approval for Haloperidol Decanoate and other injectables; cleared recent USFDA inspection with zero observations.

- Acquired Triwin Pharma in Mexico and launched warehouse operations in Chile to strengthen its Latin American footprint.

- Reported 10.9% YoY revenue growth and 17.3% PAT growth in Q4 FY25; strong margins and over $2.5M initial US sales under own label.

Company valuation insights – Caplin Point Laboratories

Caplin Point Laboratories is currently trading at a TTM P/E of 29.6x, which is at a discount to the industry average of 35.6x, despite delivering a strong 1-year return of 33% vs Nifty 50’s -0.4%.

The stock’s performance has been driven by robust growth in both topline and bottomline, supported by healthy margins (FY25 EBITDA margin at 36.5%) and a resilient business model. The company continues to scale up its presence in the US and other regulated markets, while further strengthening its leadership in emerging markets like Latin America. Its front-end US operations are gaining traction with 22 launches and $2.5 million in revenue already, and a strong pipeline of 60+ filings positions the company well for sustainable growth. The ongoing backward integration, asset-light manufacturing model, and disciplined capital allocation (capex fully funded via internal accruals) add to its long-term value creation potential.

We value Caplin Point at 25x FY27E EPS of ₹100 to arrive at a 12-month target price of ₹2,500, implying a 20% upside from current levels. A short-term target of ₹2,250 implies an 8% upside over 3 months, supported by continued operating momentum, steady approvals, and improving visibility across regulated and semi-regulated markets.

Major risk factors affecting Caplin Point Laboratories

- Geopolitical Risks: Heavy dependence on Latin America exposes the company to currency and political volatility.

- US Market Execution: Scaling injectables in a competitive US market requires flawless execution.

- Limited Analyst Coverage: May lead to under-valuation or delayed price discovery.

Technical analysis of Caplin Point Laboratories share

Caplin Point Laboratories is exhibiting a bullish setup, currently in the process of forming a classic cup and handle pattern. The cup formation is complete, and the stock is now hovering around the handle neckline. A successful breakout above this neckline could signal the start of a fresh upward leg.

The stock trades comfortably above its 50-day, 100-day, and 200-day EMAs, reflecting solid medium-term strength and investor conviction.

Momentum indicators also support the positive outlook. The MACD remains positive at 9.57, with the MACD line above the signal line, suggesting ongoing upward momentum. The RSI at 59.74 indicates healthy buying interest, while relative RSI scores of 0.10 (21-day) and 0.06 (55-day) suggest consistent outperformance versus the broader market.

While the ADX at 13.35 reflects a currently moderate trend, it has the potential to strengthen if the stock breaks out above the neckline.

A breakout above ₹2,250 could trigger a rally toward ₹2,500, in line with the 12-month fundamental target. On the downside, ₹1,950 is a critical support level, holding above it will be key to maintaining the bullish structure.

- RSI: 59.74 (Strong Buying Interest)

- ADX: 13.35 (Moderate Trend)

- MACD: 9.57 (Positive Momentum)

- Resistance: ₹2,250

- Support: ₹1,950

Caplin Point Laboratories stock recommendation

Current Stance: Buy, with a 3-month target of ₹2,250 (~8% upside) and a 12-month target of ₹2,500 (~20% upside).

Why buy now?

Multi-market growth: Strong traction in both emerging and regulated markets, backed by product launches and expanding global footprint.

High margins, cash-rich: EBITDA margin at ~36.5%, ₹241 crore FCF in FY25, and net cash despite ₹1,000 crore capex plan.

Robust pipeline: Over 60 filings lined up; backward integration and consistent ANDA approvals ensure long-term scalability.

Portfolio fit

Caplin Point is a high-quality mid-cap pharmaceutical play offering a rare blend of consistent profitability, deep emerging market reach, and growing exposure to regulated markets. With low balance sheet risk, strong return ratios, and scalable operating model, it fits well for investors seeking structurally growing healthcare exposure with strong fundamentals and visibility.If you found this helpful and want regular stock trade calls, check out my community on StockGro here: https://app.stockgro.club/ui/social/tradeViews/groupFeed/07a7b961-b8ca-42ce-baf3-a9eec781b6ebCaplin Point Laboratories: Budget 2025-26 opportunities

- PLI & Export Boost: Continued support for APIs and formulations under the PLI scheme enhances Caplin’s backward integration and global scale-up.

- Healthcare Access Push: Higher public health spending in emerging markets improves demand visibility for branded generics and institutional supplies.

- R&D Incentives: Increased allocation for pharmaceutical innovation supports Caplin’s expansion in injectables, biosimilars, and complex generics.

- Trade & Regulatory Reforms: Simplified export norms and bilateral pharma agreements aid faster product approvals and market access in Latin America and the US.

Final thoughts

Caplin Point Laboratories is not a high-decibel pharma name, but its quiet consistency is what makes it compelling. The company combines cost efficiency, niche market dominance, and a rising play in regulated markets to deliver solid fundamentals with high predictability. For long-term investors looking beyond the usual pharma giants, Caplin Point presents an under-the-radar opportunity worth considering.