Stock overview

| Ticker | Dabur India |

| Sector | FMCG |

| Market Cap | ₹ 87,300 Cr |

| CMP (Current Market Price) | ₹ 492 |

| 52-Week High/Low | ₹ 581/420 |

| P/E Ratio | 49x |

About Dabur India

Dabur India Ltd., founded in 1884, is one of India’s oldest and most trusted consumer goods companies. It operates across multiple categories with a strong focus on health and wellness through Ayurveda-based products.

Key Business Segments:

- Healthcare: Chyawanprash, honey, digestive tablets, and herbal supplements.

- Personal Care: Hair oils, shampoos, oral care, and skin care products.

- Home Care: Cleaners, mosquito repellents, and sanitizers.

- Foods & Beverages: Juices, health drinks, and packaged foods.

Dabur’s strength lies in its deep distribution network reaching over 7 million retail outlets and its strong brand equity across both rural and urban India.

Primary growth factors for Dabur India

1. Rising Health & Wellness Awareness:

Consumers are increasingly choosing natural and preventive products. Dabur’s Ayurvedic heritage puts it in a strong position to benefit from this shift.

2. Rural Market Expansion:

Rural contribution is nearly half of Dabur’s India business. The company continues to add smaller distributors, local outlets, and affordable pack sizes to deepen penetration.

3. Product Innovation:

Over the past few years, Dabur has launched several new products in honey, herbal toothpastes, juices, and immunity boosters. These launches have helped it attract younger consumers while maintaining traditional credibility.

4. Focus on Premium Products:

Premium variants in hair care, skin care, and health supplements are seeing higher traction, supporting margin growth.

5. Synergies from Acquisitions:

The planned merger of Sesa Care is expected to strengthen Dabur’s position in hair care and personal wellness, bringing new brands and distribution synergies.

Detailed competition analysis for Dabur India India

| Company | Market Cap | Revenue | P/E Multiple | RoCE |

| Dabur India | ₹ 87,300 cr | ₹ 3,404 cr | 49 x | 20% |

| Godrej Consumer | ₹ 1,17,800 cr | ₹ 3,661 cr | 62 x | 19% |

| Colgate Palmolive | ₹ 60.800 cr | ₹ 1,434 cr | 43 x | 105% |

| P&G Hygiene | ₹ 46,300 cr | ₹ 937 cr | 56 x | 103% |

Company valuation insights: Dabur India India

As per the Discounted Cash Flow analysis:

It estimates the intrinsic value of Dabur India shares based on expected future cash flows:

- Intrinsic Value Estimate: ₹550 per share

- Upside Potential: 14%

- WACC: 10.6%

- Terminal Growth Rate: 1.7%

Major risk factors affecting Dabur India India

1. Intense Competition:

Dabur faces stiff competition from both large FMCG players (like HUL, ITC, and Nestlé) and newer herbal brands (like Patanjali and regional players).

2. Input Cost Volatility:

Prices of honey, herbs, packaging materials, and freight can fluctuate, impacting margins if price hikes are delayed.

3. Regulatory Oversight:

FSSAI and advertising authorities are increasingly scrutinizing claims related to “100% natural” or “herbal” products. Any negative findings can affect consumer trust.

4. Slow Rural Recovery:

While urban demand remains steady, rural markets have shown inconsistent growth due to inflation and monsoon patterns.

5. Execution Risks in Acquisitions:

Integrating new acquisitions like Sesa Care will require disciplined cost management and brand alignment to avoid dilution of focus.

Sectoral & Macro Tailwinds

- Growing demand for immunity-boosting and Ayurvedic products.

- Consumers moving towards trusted, heritage brands for daily essentials.

- Improved supply chains and digitization boosting rural accessibility.

- Inflation moderation could aid demand recovery in the coming quarters.

Outlook for FY26

Dabur is likely to post mid-single to high-single-digit revenue growth, with gradual margin expansion. Health care and personal care segments are expected to lead growth, supported by premium product launches. The food business may recover with stable input costs.

Urban markets will continue to perform well, while rural growth could accelerate if monsoon and agri incomes improve.

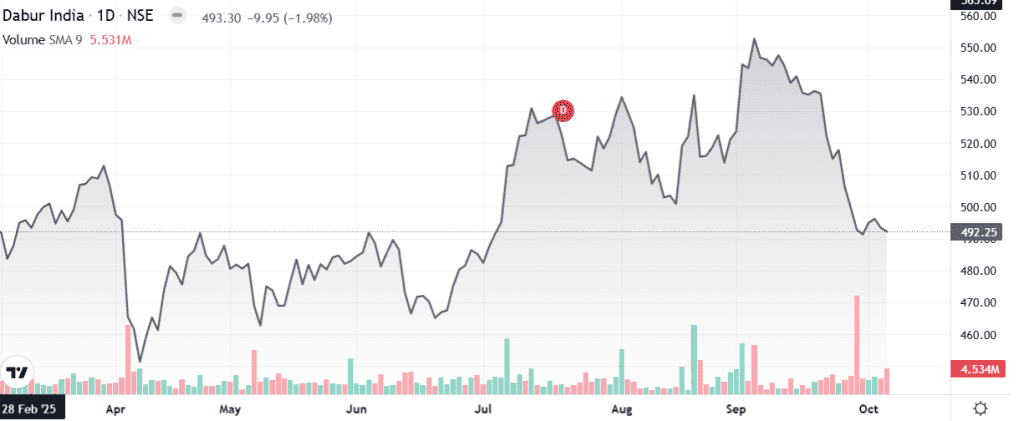

Technical analysis of Dabur India India

- Resistance: ₹510

- Support: ₹375

- Momentum: Neutral

- RSI (Relative Strength Index): 41 (Neutral)

Dabur India stock recommendation by Ketan Mittal

Recommendation: Long-term accumulate

Target Price: ₹550 (12-month horizon)

Investment Horizon: 2–4 years for stable returnsIf you found this helpful and want regular stock trade calls, check out my StockGro profile here: https://stockgro.onelink.me/vNON/6m6ykj0dConclusion

Dabur India remains one of the most trusted and resilient FMCG players in the country. Its strong brand portfolio, deep rural network, and Ayurvedic positioning offer steady long-term potential. While short-term growth has been modest, the company’s focus on innovation, premiumization, and cost control provides a solid foundation for sustainable growth.

For long-term investors seeking stability, brand strength, and consistent dividends, Dabur continues to be a dependable choice in the Indian consumer space.