In India’s evolving chemicals and agri-inputs space, Deepak Fertilisers & Petrochemicals Corporation Ltd. (DFPCL) has steadily built a strong presence as a diversified player. With operations spanning industrial chemicals, mining chemicals, and crop nutrition, the company stands at the intersection of agriculture and industry, two key pillars of India’s growth story. As the government continues to push for self-reliance in chemicals and fertilizers, DFPCL is positioning itself for the next growth phase.

But does Deepak Fertilisers offer a compelling case for long-term investors? Let’s delve deeper.

Stock overview

| Ticker | DEEPAKFERT |

| Industry/Sector | Chemicals |

| CMP | 1525.00 |

| Market Cap (₹ Cr.) | 19,251 |

| P/E | 19.69 (Vs Industry P/E of 43.58) |

| 52 W High/Low | 1,778.60 / 888.90 |

| EPS (TTM) | 77.73 |

| Dividend Yield | 0.65% |

About Deepak Fertilisers

Founded in 1979 and headquartered in Pune, Deepak Fertilisers is one of India’s leading producers of fertilizers and industrial chemicals. It has a strong foothold in ammonia, nitric acid, technical ammonium nitrate (TAN), and crop nutrition products, serving diverse industries such as mining, pharmaceuticals, construction, and agriculture.

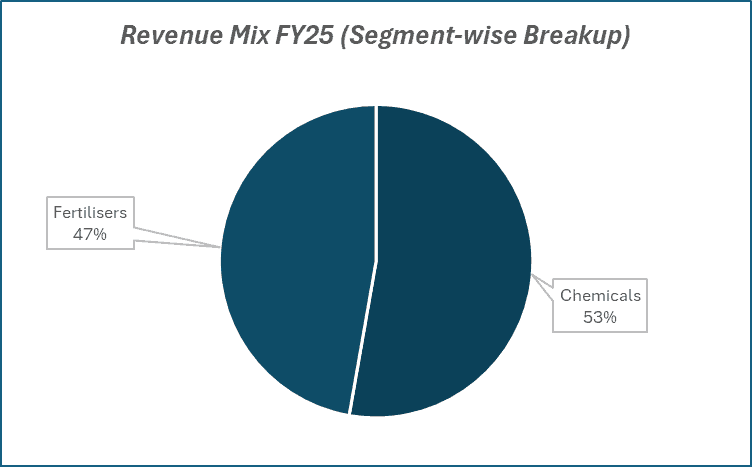

Key business segments

Deepak Fertilisers operates primarily in the following key business segments:

- Chemicals (Industrial & Mining): Production of nitric acid, ammonia, methanol, and TAN—widely used in mining and industrial applications.

- Crop Nutrition: Fertilizers, specialty nutrients, and water-soluble products under the brand Mahadhan.

- Value-Added Agri Solutions: Customized crop solutions and advisory services to boost farm productivity.

Primary growth factors for Deepak Fertilisers

Deepak Fertilisers key growth drivers:

- Mining & Infra Push: Rising demand for TAN due to growing mining and infrastructure activity.

- Agri Modernisation: Increased adoption of specialty fertilizers and water-soluble nutrients in Indian farming.

- Import Substitution: Strategic focus on backward integration in ammonia and nitric acid to reduce dependence on imports.

- Government Reforms: Supportive fertilizer subsidies and policies promoting self-sufficiency.

- Exports Opportunity: Rising global demand for chemicals creates room for export growth.

Detailed competition analysis for Deepak Fertilisers

Key financial metrics – TTM;

| Company | Revenue(₹ Cr.) | EBITDA (₹ Cr.) | EBITDA Margin (%) | PAT (₹ Cr.) | PAT Margin (%) | P/E (TTM) |

| Deepak Fertilisers | 10651.84 | 1973.32 | 18.53% | 988.88 | 9.28% | 19.69 |

| BASF India Ltd. | 15167.64 | 634.97 | 4.19% | 395.89 | 2.61% | 49.42 |

| Navin Fluorine | 2551.10 | 640.16 | 25.09% | 354.57 | 13.90% | 66.07 |

| Vinati Organics | 2265.43 | 616.20 | 27.20% | 425.29 | 18.77% | 41.89 |

| Atul Ltd. | 5739.30 | 925.23 | 16.12% | 509.23 | 8.87% | 35.57 |

Key insights on Deepak Fertilisers

- Strong integrated operations with captive ammonia and nitric acid capacity provide cost efficiency.

- The company is a market leader in TAN, a critical mining chemical, with robust demand visibility.

- Branded crop nutrition portfolio (Mahadhan) enjoys strong recall in western and southern India.

- Strategic focus on high-margin specialty fertilizers and customized agri-solutions enhances profitability.

- Investments in R&D and partnerships with global players support technological strength.

Recent financial performance of Deepak Fertilisers for Q1 FY26

| Metric | Q1 FY25 | Q4 FY25 | Q1 FY26 | QoQ Growth (%) | YoY Growth (%) |

| Revenue (₹ Cr.) | 2281.33 | 2667.35 | 2658.75 | -0.32% | 16.54% |

| EBITDA (₹ Cr.) | 464.42 | 479.99 | 513.02 | 6.88% | 10.46% |

| EBITDA Margin (%) | 20.36% | 18.00% | 19.30% | 130 bps | -106 bps |

| PAT (₹ Cr.) | 199.65 | 277.86 | 243.86 | -12.24% | 22.14% |

| PAT Margin (%) | 8.75% | 10.42% | 9.17% | -125 bps | 42 bps |

| Adjusted EPS (₹) | 15.49 | 21.96 | 19.26 | -12.30% | 24.34% |

Deepak Fertilisers financial update (Q1 FY26)

Financial performance

- Consolidated revenue up 17% YoY to ₹2,659 crore, supported by broad-based growth.

- EBITDA grew 10% YoY to ₹513 crore, margin improved 130 bps QoQ to 19.3%.

- Net profit up 22% YoY to ₹244 crore, PAT margin at 9.2%.

- Net debt reduced by ₹225 crore; net debt-to-EBITDA at 1.5x.

- Fertilizer segment surged 125% YoY, while chemical segment profit fell 9%.

Business highlights

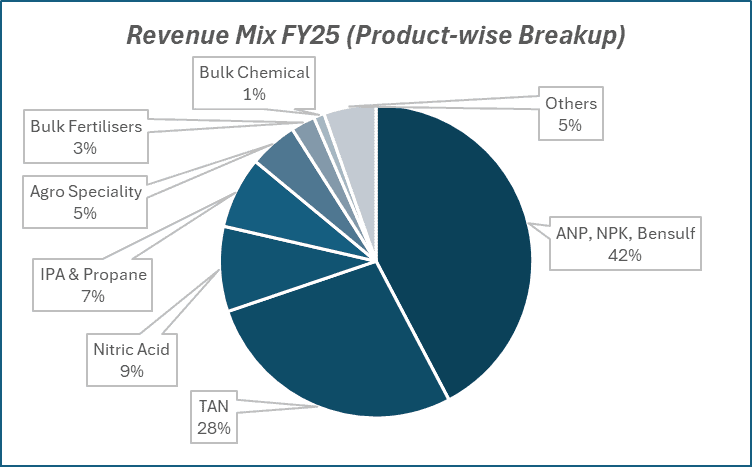

- Specialty portfolio: ~25% of revenue, with 15–40% pricing premiums; crop nutrition contributed 45% of revenue. Croptek sales up 73% YoY; specialty fertilizers +21% YoY.

- Mining chemicals: Volumes up 7% YoY; LDAN down 15% YoY on early monsoon; B2C TAN share at 16% of revenue.

- Industrial chemicals: Nitric acid volume up 15% YoY; IPA volumes surged 27% YoY and 51% QoQ post plant upgrade, though pricing softness weighed on margins.

- Projects: Gopalpur TAN 80% complete, Dahej nitric acid 57% complete; both slated for commissioning in Q4 FY26 (₹4,661 crore investment).

- International: Raised stake in Australian subsidiary (Platinum Blasting) to 85%, revenues ~₹600 crore, with future TAN exports planned from Gopalpur.

Outlook

- Kharif 2025 to see strong momentum on favorable monsoon and adoption of high-value agri solutions.

- Short-term pricing pressure expected in IPA and nitric acid, offset by specialty mix.

- New projects expected to run at ~70% utilization in the first year, boosting growth and margins.

- Strategic focus on B2C TAN expansion, specialty fertilizers, and global mining solutions to drive long-term value creation.

Recent Updates on Deepak Fertilisers

- Commissioned new nitric acid and TAN capacity expansions to meet rising domestic demand.

- Entered into strategic alliances with global players for technology and raw material security.

- Focused on sustainability initiatives, including green ammonia and renewable energy integration.

- Expanding specialty fertilizer portfolio to strengthen presence in high-value segments.

Company valuation insights – Deepak Fertilisers

Deepak Fertilisers is currently trading at a TTM P/E of 19.7x, at a steep discount to the industry average of 43.6x, while delivering a strong 43% 1-year return versus the Nifty 50’s -4.5%.

The stock’s attractiveness stems from its specialty-led portfolio shift, resilient fertilizer and mining chemicals businesses, and upcoming capacity additions. Specialty products now contribute ~25% of revenue with healthy pricing premiums, while Croptek sales grew 73% YoY, underscoring farmer adoption of differentiated solutions. Mining chemicals volumes rose 7% YoY despite seasonal weakness, with the B2C TAN segment scaling to 16% of revenue. Industrial chemicals growth was supported by a 27% YoY surge in IPA volumes, though pricing softness capped margins. Strategic projects like the ₹4,661 crore Gopalpur TAN and Dahej nitric acid plants are on track for Q4 FY26 commissioning, expected to lift utilization and profitability from FY27.

With net debt reduced, expanding specialty mix, and global mining presence through its Australian subsidiary, Deepak Fertilisers is positioned for multi-year growth. Using a SoTP approach, we set a 12-month target price of ₹1,850 (≈21% upside) and a 3-month target of ₹1,650 (≈8% upside), supported by robust specialty traction, project execution, and steady cash flow generation.

Major risk factors affecting Deepak Fertilisers

- Commodity Price Volatility: Fluctuations in ammonia and natural gas can impact margins.

- Regulatory Dependence: Fertilizer subsidy policies and mining regulations may influence demand.

- Global Competition: Rising imports and global pricing pressure in chemicals.

- Execution Risks: Timely ramp-up of new capacities critical for sustaining growth.

Technical analysis of Deepak Fertilisers share

Deepak Fertilisers was trading in a descending channel but has recently broken out above the upper trendline with a 5% cumulative up-move, signaling a potential shift toward upward momentum. The stock is trading well above its 50-day, 100-day, and 200-day EMAs, reinforcing that the broader trend remains positive, and a sustained move higher could establish a medium- to long-term uptrend.

Momentum indicators further support the bullish outlook. The MACD is positive at 13.94, with the MACD line above the signal line, confirming upward momentum. The RSI at 58.61 reflects strong buying interest, while relative RSI scores of 0.07 (21-day) and 0.02 (55-day) indicate outperformance versus the broader market. The ADX at 20.30 suggests that a trend is building, with room for strengthening on a breakout.

A breakout above ₹1,650 could pave the way for a rally toward ₹1,850, in line with the 12-month fundamental target. On the downside, ₹1,400 is a crucial support level, and sustaining above it will be key to maintaining bullish momentum.

- RSI: 58.61 (Strong Buying Interest)

- ADX: 20.30 (Moderate Trend)

- MACD: 13.94 (Positive)

- Resistance: ₹1,650

- Support: ₹1,400

Deepak Fertilisers stock recommendation

Current Stance: Buy, with a 3-month target of ₹1,650 (~8% upside) and a 12-month target of ₹1,850 (~21% upside).

Why buy now?

Specialty shift: Specialty products now contribute ~25% of revenue with 15–40% pricing premiums; Croptek sales surged 73% YoY, driving margin resilience.

Agri & mining momentum: Fertiliser business grew 125% YoY, while mining chemicals volumes rose 7% YoY; B2C TAN now contributes 16% of revenue, enhancing margins.

Industrial chemicals growth: IPA volumes up 27% YoY and 51% QoQ post plant upgrade, supporting expansion despite pricing softness.

Strategic capex: Gopalpur TAN and Dahej nitric acid projects (₹4,661 cr capex) are ~80%/57% complete, set for Q4 FY26 commissioning, with ~70% utilization expected in the first year.

Global presence: Stake in Australian subsidiary (Platinum Blasting, revenues ~₹600 cr) expanded to 85%, providing mining solutions expertise and future export opportunities.

Portfolio fit

Deepak Fertilisers offers a unique specialty chemicals and fertilizers play with exposure across agri, mining, and industrial chemicals. Supported by project-led capacity growth, rising specialty mix, and global expansion, it provides investors with a multi-year growth story at attractive valuations.If you found this helpful and want regular stock trade calls, check out my community on StockGro here: https://app.stockgro.club/ui/social/tradeViews/groupFeed/07a7b961-b8ca-42ce-baf3-a9eec781b6ebDeepak Fertilisers: Budget 2025-26 opportunities

- Agri & Rural Push: Higher budget allocation for agriculture, rural infra, and irrigation to drive fertilizer demand and adoption of high-value crop nutrition solutions.

- Mining & Infra Development: Increased infrastructure and mining activity to boost demand for TAN and mining chemicals, supporting volume growth.

- Specialty Fertiliser Incentives: Policy support for sustainable and specialty agri-inputs to accelerate farmer adoption of differentiated products like Croptek and water-soluble grades.

- Industrial Growth & Import Substitution: PLI schemes and capex incentives for chemicals to enhance competitiveness in nitric acid, IPA, and other industrial chemical segments.

- Export & Global Expansion: Trade facilitation and higher export quotas create opportunities to scale exports of fertilizers and TAN, including synergies with the Australian subsidiary.

Final thoughts

Deepak Fertilisers represents a diversified growth story, benefiting from India’s mining and infra boom, while also serving as a play on agricultural productivity through specialty fertilizers. For investors seeking exposure to both chemicals and agri-inputs, the stock provides a unique dual benefit. With strategic expansions, cost efficiency, and a pivot toward value-added products, DFPCL could continue its transformation into a stronger chemicals-led growth story in the years ahead.