As India’s consumption economy deepens, the spotlight is turning toward non-traditional sectors delivering high-volume, high-frequency products to an expanding base of value-conscious and brand-aware consumers. DOMS Industries Ltd., a leading player in stationery and art supplies, is one such silent compounder, riding India’s education, creativity, and office supply growth themes. With its recent IPO and expanding product suite, DOMS is gearing up to transform from a classroom favorite into a diversified, pan-India consumer brand.

But does DOMS Industries offer a compelling case for long-term investors? Let’s delve deeper.

Stock overview

| Ticker | DOMS |

| Industry/Sector | FMCG (Printing & Stationery) |

| CMP | 2502.50 |

| Market Cap (₹ Cr.) | 15,187 |

| P/E | 74.93 (Vs Industry P/E of 37.10) |

| 52 W High/Low | 3,115.00 / 1,970.00 |

| EPS (TTM) | 33.34 |

| Dividend Yield | 0.13% |

About DOMS Industries

DOMS Industries Ltd. is a prominent Indian stationery and art products company, best known for its flagship DOMS brand of pencils, erasers, sharpeners, and drawing tools. Over the years, it has built a strong distribution network across India and abroad, offering over 2,000 SKUs across multiple price points.

With a sharp focus on brand-building, product innovation, and efficient manufacturing, DOMS has grown rapidly in an otherwise fragmented industry. The company also exports to over 45 countries and has positioned itself as a value-premium player in the mass-market stationery segment.

Key business segments

DOMS Industries operates primarily in the following key business segments:

- Writing Instruments – Pencils, pens, sharpeners, erasers, and scales form the core of the portfolio.

- Art Materials – Crayons, watercolors, sketch pens, and coloring kits catering to students and artists.

- Stationery & Office Supplies – Notebooks, geometry boxes, files, and other academic/office essentials.

- Exports – Sale of products to institutional and retail customers in international markets.

Primary growth factors for DOMS Industries

DOMS Industries key growth drivers:

- Expanding School-age Population: India’s large base of school-going children ensures a consistent demand pipeline.

- Organized Market Shift: Growing preference for branded, safe, and quality-certified stationery products over unbranded local alternatives.

- Distribution Expansion: Rapid scale-up across Tier 2/3 cities and deeper rural penetration.

- Premiumization & Gifting: Gifting-oriented art and coloring sets are gaining traction among urban middle-class buyers.

- Exports & Global Tie-ups: Strategic international alliances and OEM supply agreements offer global growth visibility.

Detailed competition analysis for DOMS Industries

Key financial metrics – FY25;

| Company | Revenue(₹ Cr.) | EBITDA (₹ Cr.) | EBITDA Margin (%) | PAT (₹ Cr.) | PAT Margin (%) | P/E (TTM) |

| DOMS Industries | 1912.63 | 348.45 | 18.22% | 213.53 | 11.16% | 74.93 |

| Flair Writing | 1079.86 | 184.74 | 17.11% | 119.08 | 11.03% | 23.05 |

| Kokuyo Camlin Ltd. | 762.53 | 33.82 | 4.44% | 5.83 | 0.76% | 229.48 |

| Linc Ltd. | 543.48 | 64.40 | 11.85% | 37.98 | 6.99% | 22.95 |

| Sundaram Multi Pap | 127.43 | 1.62 | 1.27% | -5.12 | -4.02% | -19.36 |

Key insights on DOMS Industries

- DOMS has clocked an impressive 24% revenue CAGR over the last 5 years, with a strategic shift toward higher-margin products like markers, colors, and premium art kits driving future growth.

- The company has maintained double-digit volume growth, while margins have expanded meaningfully post-IPO, benefiting from operating leverage and scale efficiencies.

- Profit growth has been stellar, with a 41.2% CAGR over the last 5 years—reflecting both strong execution and rising consumer demand.

- DOMS commands category leadership in pencils and sharpeners, with a 30%+ market share, backed by wide distribution and product innovation.

- Its capital-efficient, integrated manufacturing setup provides strong cost control and ensures consistent product quality, enabling a sustainable advantage.

- With a solid 3-year ROE of 25.4%, the company demonstrates high capital productivity – rare in traditional manufacturing setups.

- Aggressive advertising and school-focused outreach have created strong brand recall among children, building long-term consumer loyalty from a young age.

Recent financial performance of DOMS Industries for Q4 FY25

| Metric | Q4 FY24 | Q3 FY25 | Q4 FY25 | QoQ Growth (%) | YoY Growth (%) |

| Revenue (₹ Cr.) | 403.74 | 501.11 | 508.73 | 1.52% | 26.00% |

| EBITDA (₹ Cr.) | 75.93 | 87.86 | 88.26 | 0.46% | 16.24% |

| EBITDA Margin (%) | 18.81% | 17.53% | 17.35% | -18 bps | -146 bps |

| PAT (₹ Cr.) | 46.87 | 54.28 | 51.28 | -5.53% | 9.41% |

| PAT Margin (%) | 11.61% | 10.83% | 10.08% | -75 bps | -153 bps |

| Adjusted EPS (₹) | 7.44 | 8.36 | 7.98 | -4.55% | 7.26% |

DOMS Industries financial update (Q4 FY25)

Financial performance

- Q4 FY25: Revenue stood at ₹5,087 mn, up 26.0% YoY and 1.5% QoQ; EBITDA was ₹883 mn, up 16.2% YoY and 0.5% QoQ, with margin at 17.3% (–146 bps YoY, –18 bps QoQ); PAT came in at ₹484 mn, up 9.4% YoY and –5.5% QoQ.

- FY25: Revenue was ₹19,126 mn, up 24.4% YoY; EBITDA at ₹3,484 mn, up 27.8% YoY with margin expanding to 18.2%; PAT at ₹2,046 mn, up 33.6% YoY.

Business highlights

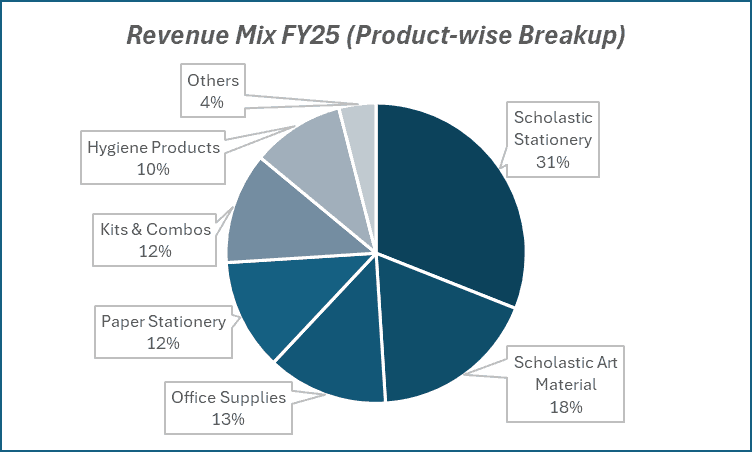

- Stationery segment: Revenue of ₹4,607 mn, up 14.1% YoY, contributing 90.6% of sales with 19.3% EBITDA margin.

- Hygiene segment: Revenue of ₹481 mn (9.4% of sales) with 8.2% EBITDA margin.

- Channel and geography: Retail outlets rose to 135,000; SKUs at 4,300; exports formed 13% of Q4 sales; general trade remained 75% of mix.

- Operations: Working capital at ~61 days (impacted by Uniclan receivables); FY25 capex of ₹2,098 mn, largely on Umbergaon expansion and core capacity ramp‐up.

Outlook

- Growth guidance: FY26E revenue growth expected at 18–20%; EBITDA margin guidance of 16.5–17.5% and PAT margin ~10%.

- Capex & expansion: FY26E–FY27E capex of ₹2.3–2.5 bn p.a., funded via internal accruals/IPO proceeds; first building at 44-acre Umbergaon site on track for Q3 FY26E, with production from Q4 FY26E.

- Capacity enhancements: Pencil capacity to rise from 5.5 mn to 8 mn pieces/day; paper stationery via Super Treads acquisition (+30% capacity); hygiene wipes at 17 mn packs p.a.

Recent Updates on DOMS Industries

- Strategic acquisition: On May 18, 2025, DOMS Industries agreed to acquire a 51% stake in Super Treads Private Limited for ₹61.2 million, bolstering its paper stationery capacity and product diversification.

- Uniclan Healthcare Deal & “DOMS Wowper” Launch: Earlier in February 2025, DOMS completed the acquisition of Uniclan Healthcare, launching the “DOMS Wowper” co-branded diaper range and adding a third diaper line – strengthening its entry into the hygiene segment and setting up in-house wet-wipe manufacturing for Q4 FY26.

Company valuation insights – DOMS Industries

DOMS Industries is trading at a TTM P/E of 74.9× – well above the industry average of 37.1× – despite delivering a solid 1-year return of 25.5% versus the Nifty 50’s 5.8%. This premium valuation reflects the market’s confidence in DOMS’s robust volume-led growth, higher-margin product mix (markers, premium kits), integrated and capital-efficient manufacturing footprint, and category leadership with sustained double-digit margin expansion.

Backed by strong ROI (3-year ROE of 25.4%), successful forays into hygiene products (Uniclan/“DOMS Wowper”) and expanding export and trade channels, DOMS is well-positioned to extend its market dominance.

Applying a 60× multiple to our FY27E EPS of ₹50 yields a 12-month target of ₹3,000 (≈20% upside) and a 3-month target of ₹2,800 (≈11% upside), offering a compelling risk-reward profile given the company’s visibility in earnings growth and operating leverage.

Major risk factors affecting DOMS Industries

- Raw Material Sensitivity: Input costs like plastic, wood, and pigments are volatile and may impact margins.

- Channel Dependence: Over-reliance on general trade; delay in modern retail or e-commerce scale-up could hurt future growth.

- Seasonality & Academic Cycles: Business is skewed toward academic calendars, impacting quarterly performance.

Technical analysis of DOMS Industries share

DOMS Industries has been trading within a sideways channel since August 2024 and has recently rebounded from the lower band, indicating a potential upside move. The stock has crossed above its 20-day and 50-day EMAs, signaling a trend reversal, though it remains just below its 100-day and 200-day EMAs. A sustained breakout above these levels could confirm a medium-term uptrend.

The MACD, while still negative at –33.32, has shown a bullish crossover, supported by rising green histograms – indicating a shift in momentum. The RSI at 52.40 suggests emerging buying interest, and a 21-day Relative RSI of 0.03 shows mild outperformance versus the market. The ADX reading of 25.16 indicates a strong trend formation, adding conviction to the potential breakout.

A decisive move above the ₹2,800 resistance could trigger a rally toward ₹3,000, while ₹2,400 remains the key support to watch for trend confirmation.

- RSI: 52.40 (Decent Buying Interest)

- ADX: 25.16 (Strong Trend)

- MACD: –33.32 (Negative, Bullish Crossover)

- Resistance: ₹2,800

- Support: ₹2,400

DOMS Industries stock recommendation

Current Stance: Buy, with a 3-month target of ₹2,800 (~11% upside) and a 12-month target of ₹3,000 (~20% upside) based on 60× our FY27E EPS estimate of ₹50.

Why buy now?

Strong growth: 26% YoY revenue growth in Q4 FY25 with consistent volume and margin performance.

Premiumization: Shift toward high-margin products and hygiene expansion via Uniclan boosts profitability.

Market leadership: 30%+ share in pencils/sharpeners, wide retail reach, and growing exports support sustained growth.

Portfolio fit

DOMS Industries is a high-growth, branded consumption play with strong return ratios (3-year ROE: 25.4%) and a capital-efficient manufacturing base. Its dominant positioning in the stationery segment, expansion into adjacent categories, and consistent execution make it a suitable mid-cap core holding for investors seeking scalable growth with improving margins and premium valuations.If you found this helpful and want regular stock trade calls, check out my community on StockGro here: https://app.stockgro.club/ui/social/tradeViews/groupFeed/07a7b961-b8ca-42ce-baf3-a9eec781b6ebDOMS Industries: Budget 2025-26 opportunities

- School Infra Boost: Increased education spend to drive stationery demand.

- FLN Focus: Literacy programs to support core product volumes.

- PLI & MSME Support: Incentives to lower costs for domestic manufacturing.

- Digital Learning: Hybrid education to sustain demand for creative supplies.

- Export Incentives: Trade support to aid growing international business.

Final thoughts

DOMS Industries is a rare example of a B2C brand in a high-frequency, low-ticket product space that has managed to build scale, recall, and premium perception. From school bags to office desks, its products are part of daily routines – but its brand equity is anything but ordinary.

For investors seeking exposure to India’s aspirational, youth-driven consumption story, with the comfort of low cyclicality and strong moats, DOMS presents a compelling long-term play. It’s not just writing pencils – it’s writing the script for organized growth in India’s stationery ecosystem.